1. What is the projected Compound Annual Growth Rate (CAGR) of the Polycrystalline Silicon Carbide Substrates?

The projected CAGR is approximately 19%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Polycrystalline Silicon Carbide Substrates

Polycrystalline Silicon Carbide SubstratesPolycrystalline Silicon Carbide Substrates by Type (α-SiC, β-SiC, Others), by Application (Power Electronics, Optoelectronics, Microelectronics, Aerospace, Medical Electronics, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

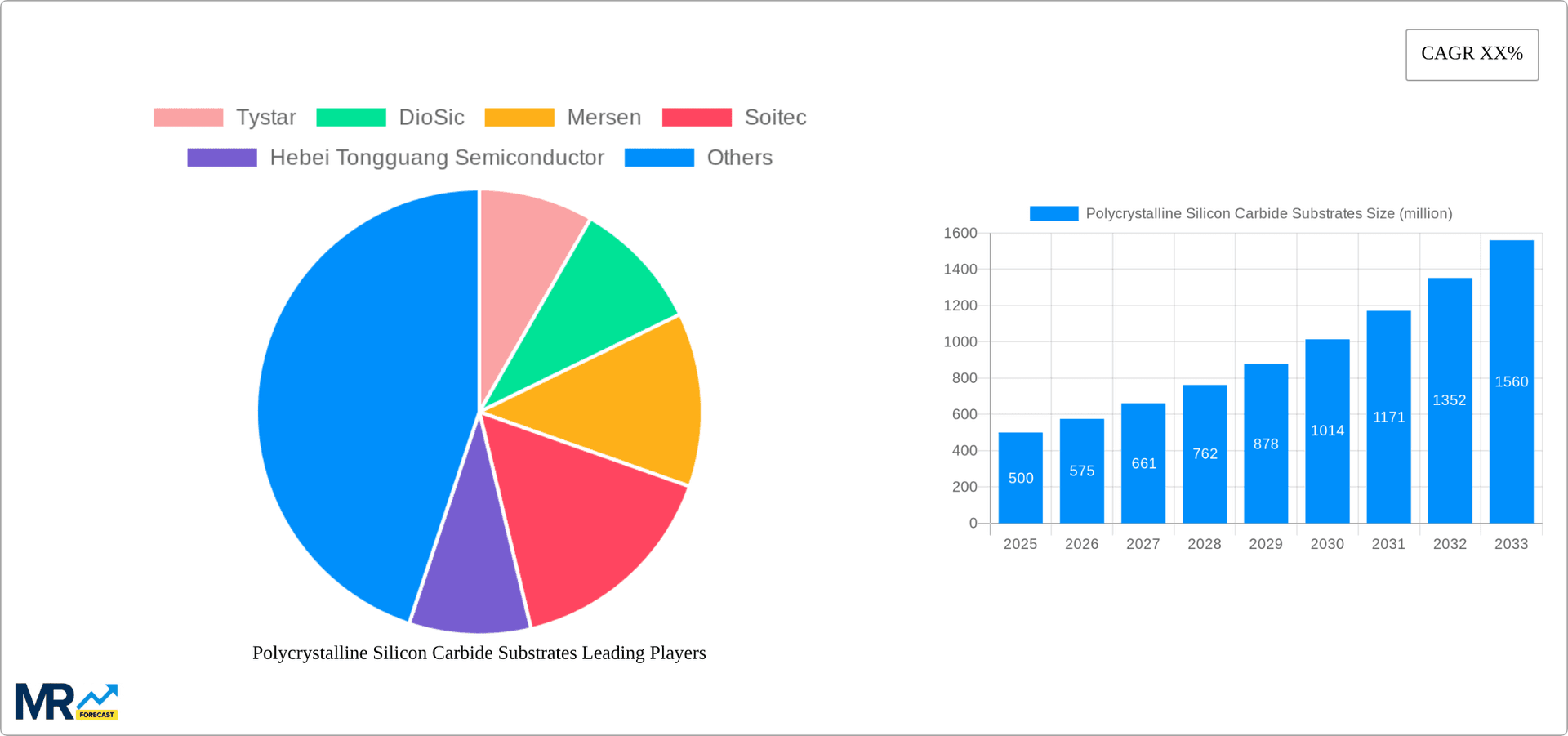

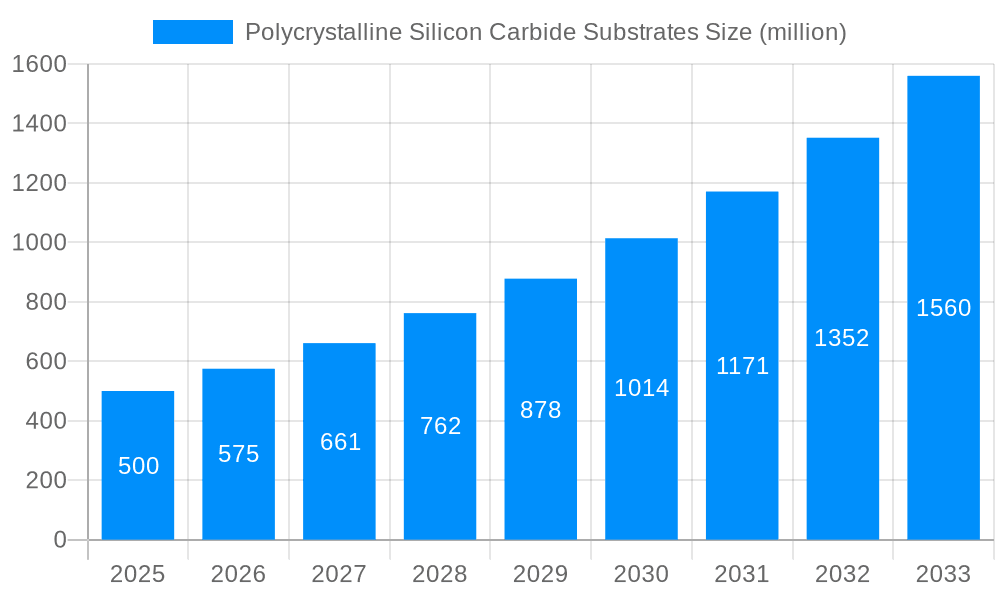

The global polycrystalline silicon carbide (poly SiC) substrates market is experiencing robust growth, driven by the increasing demand for high-power, high-frequency, and high-temperature applications across diverse sectors. The market's expansion is fueled by advancements in power electronics, particularly in electric vehicles (EVs), renewable energy infrastructure (solar inverters and wind turbines), and industrial motor drives. The inherent properties of poly SiC substrates, such as high thermal conductivity, wide bandgap, and superior breakdown strength, make them ideal for these applications, outperforming traditional silicon-based solutions. Furthermore, ongoing research and development efforts are leading to improvements in manufacturing processes, resulting in increased yield and reduced production costs, thereby making poly SiC substrates more commercially viable. We estimate the 2025 market size to be around $500 million, with a CAGR of 15% projected through 2033, indicating a significant market expansion. Key segments driving this growth include power electronics (currently dominating the market share) and optoelectronics, with the aerospace and medical electronics sectors showing promising potential for future expansion. Companies like Tystar, DioSic, Mersen, Soitec, and others are actively engaged in developing and supplying these substrates, fostering competition and innovation within the industry.

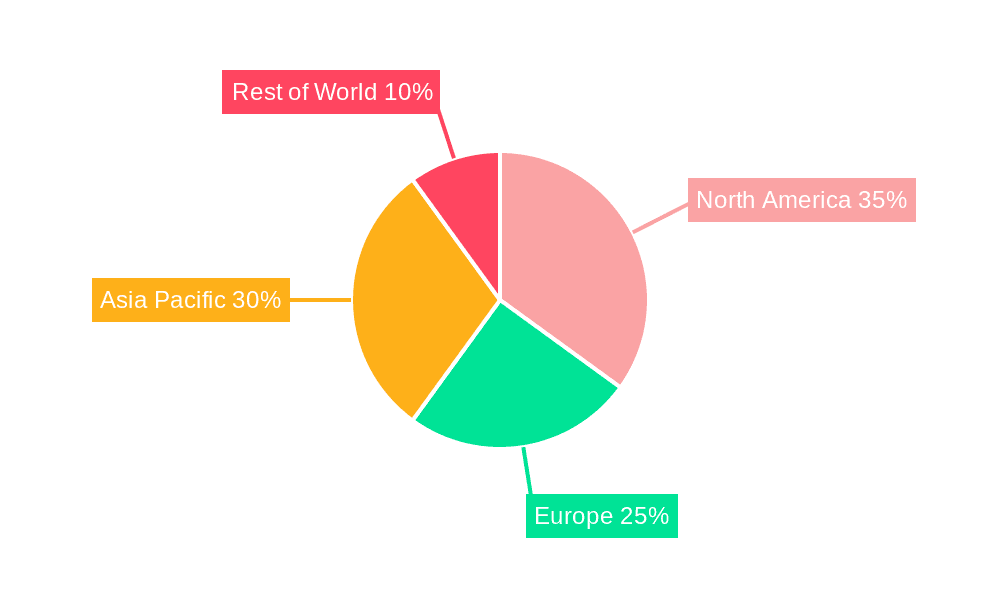

While the market presents significant opportunities, challenges remain. These include the relatively high cost of poly SiC substrates compared to silicon, the complexity of the manufacturing process, and the need for continuous improvement in substrate quality and consistency. Despite these restraints, the long-term growth outlook for the poly SiC substrates market is exceptionally positive, primarily due to the increasing adoption of electric vehicles and renewable energy technologies, as well as the continual demand for miniaturized and high-performance electronic devices. The geographical distribution shows a strong concentration in North America and Asia-Pacific, with China and the United States being major consumers. However, Europe and other regions are anticipated to witness substantial growth in the coming years as the adoption of SiC-based technology expands globally. The market segmentation by material type (α-SiC, β-SiC, and others) reflects the ongoing development and refinement of different substrate varieties, each tailored for specific application requirements.

The global polycrystalline silicon carbide (poly-SiC) substrates market is experiencing robust growth, driven by the increasing demand for high-power, high-frequency, and high-temperature electronic devices. The market, valued at several hundred million USD in 2024, is projected to witness substantial expansion throughout the forecast period (2025-2033). This surge is primarily fueled by the inherent advantages of poly-SiC substrates, including their superior thermal conductivity, high breakdown strength, and wide bandgap, making them ideal for a range of applications. The historical period (2019-2024) showed a steady upward trend, setting the stage for the significant growth anticipated in the coming years. Key market insights reveal a shift towards larger diameter substrates to enhance manufacturing efficiency and reduce costs. Furthermore, ongoing research and development efforts are focused on improving the quality and yield of poly-SiC substrates, leading to cost reductions and wider adoption across various sectors. The estimated market value for 2025 sits at over $XXX million, indicating substantial growth from the previous years, and showcasing a compound annual growth rate (CAGR) expected to be in the double digits during the forecast period. This growth is expected to be driven by the adoption of SiC based power devices in electric vehicles, renewable energy infrastructure, and 5G communication systems, among other applications. Competition amongst key players is intensifying, leading to innovative product offerings and strategic partnerships aimed at capturing larger market share. The market is characterized by a diverse range of players, each with its own strengths in terms of technology, manufacturing capacity, and market reach. The interplay of these factors will shape the future trajectory of the poly-SiC substrates market, promising continued expansion and innovation in the years to come.

The burgeoning demand for high-performance electronic devices across various sectors is the primary driver of the poly-SiC substrates market's expansion. The unique properties of poly-SiC, such as its exceptional thermal conductivity, high breakdown voltage, and wide bandgap, make it an ideal material for applications requiring high power, high frequency, and high-temperature operation. The increasing adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) is significantly boosting demand for SiC-based power electronics, a key application segment. The need for efficient energy conversion and management in renewable energy systems, including solar inverters and wind turbines, is another significant driver. Furthermore, advancements in 5G communication technology are creating a need for high-frequency components, where poly-SiC substrates offer a significant performance advantage. The electronics industry's relentless pursuit of miniaturization and increased functionality further fuels the growth, as poly-SiC enables the development of smaller, faster, and more efficient devices. Finally, government initiatives promoting the adoption of energy-efficient technologies and the expansion of renewable energy infrastructure are providing additional impetus to market growth. These factors collectively create a strong and sustainable demand for poly-SiC substrates, ensuring robust market growth in the coming years.

Despite the significant growth potential, the poly-SiC substrates market faces certain challenges. The high cost of production remains a significant barrier to widespread adoption, particularly compared to traditional silicon substrates. The complex manufacturing process involved in producing high-quality poly-SiC substrates requires specialized equipment and expertise, contributing to the higher cost. Furthermore, the availability of high-quality raw materials and skilled labor can pose constraints on production capacity and scalability. Yield rates in the manufacturing process are another concern, as defects can impact the quality and performance of the final product, leading to increased costs and wastage. Competition from other wide bandgap materials, such as gallium nitride (GaN), also poses a challenge, as GaN offers certain advantages in specific applications. Finally, the inherent brittleness of SiC requires careful handling and processing, adding complexity to the manufacturing process. Addressing these challenges through technological advancements, process optimization, and economies of scale is crucial for the continued growth and wider adoption of poly-SiC substrates.

The Power Electronics segment is poised to dominate the poly-SiC substrates market. This is due to the increasing adoption of SiC-based power devices in electric vehicles, renewable energy systems, and industrial automation applications. The demand for high-efficiency, compact, and reliable power electronic components is driving this segment's growth.

Power Electronics: This segment is projected to account for the largest share of the market due to the substantial demand from the electric vehicle (EV) and renewable energy sectors. The superior performance characteristics of poly-SiC substrates in power electronics applications, such as their high switching frequency and low energy loss, make them highly attractive for use in electric vehicle inverters, solar inverters, and other power conversion systems. The market value for this segment is expected to exceed $XXX million by 2033.

Geographic Dominance: Regions with robust manufacturing capabilities and a high concentration of electronics manufacturers, such as North America (particularly the United States) and Asia (China, Japan, South Korea) are expected to be key drivers of market growth. North America benefits from strong R&D capabilities and a focus on developing advanced semiconductor technologies, while Asia's vast manufacturing base and growing demand for electronic devices contribute significantly to the region's market dominance. The European market is also expected to exhibit significant growth due to strong government support for the electric vehicle and renewable energy sectors.

β-SiC dominance: While both α-SiC and β-SiC are used, β-SiC is anticipated to hold a larger market share due to its lower cost of production and relative ease of processing. However, the higher performance characteristics of α-SiC are expected to drive growth in specific niche applications requiring superior performance capabilities. The difference in market share is expected to be substantial, with β-SiC dominating in the early part of the forecast period, while the gap might narrow later due to technological advances in α-SiC production techniques.

The poly-SiC substrates industry is experiencing accelerated growth fueled by technological advancements, increasing demand in diverse sectors (EVs, renewable energy, 5G), and supportive government policies promoting energy efficiency. Continuous improvements in manufacturing processes lead to higher yields, better substrate quality, and reduced costs, further stimulating market expansion.

This report provides a comprehensive analysis of the polycrystalline silicon carbide substrates market, offering valuable insights into market trends, growth drivers, challenges, and key players. It offers detailed segmentation analysis by type (α-SiC, β-SiC, Others), application (Power Electronics, Optoelectronics, Microelectronics, Aerospace, Medical Electronics, Others), and geography, providing a complete overview of the market landscape. The report also includes forecasts for the market's future growth, enabling businesses to make informed strategic decisions. The detailed competitive landscape analysis helps identify key players and their strategies, providing valuable insights into the market dynamics.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 19%.

Key companies in the market include Tystar, DioSic, Mersen, Soitec, Hebei Tongguang Semiconductor, Fuli Tiansheng Science and Technology.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Polycrystalline Silicon Carbide Substrates," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Polycrystalline Silicon Carbide Substrates, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.