1. What is the projected Compound Annual Growth Rate (CAGR) of the Pocket Cameras?

The projected CAGR is approximately XX%.

Pocket Cameras

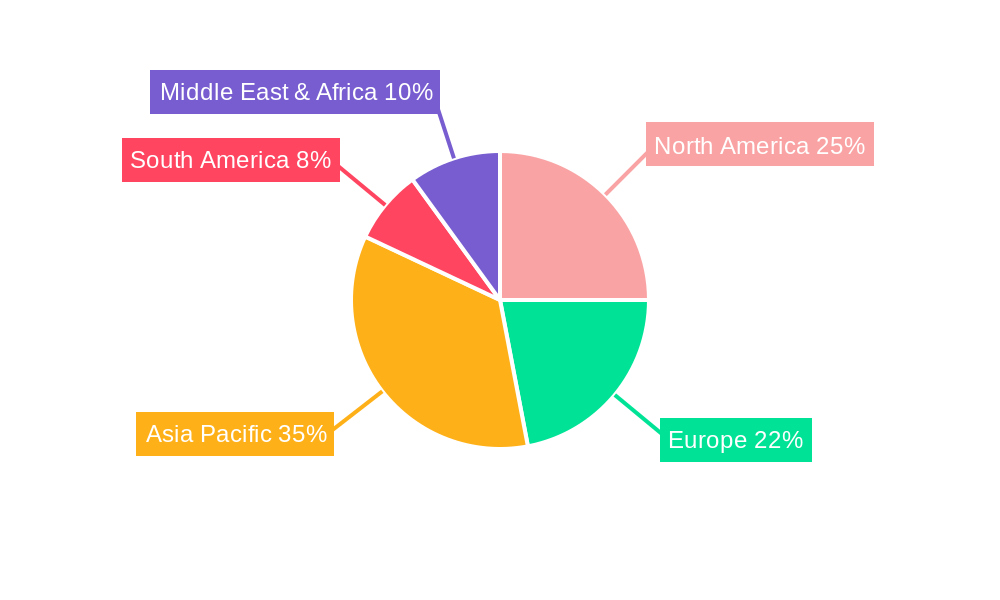

Pocket CamerasPocket Cameras by Type (Film Type, No Film Type, World Pocket Cameras Production ), by Application (Entertainment, Commercial, World Pocket Cameras Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

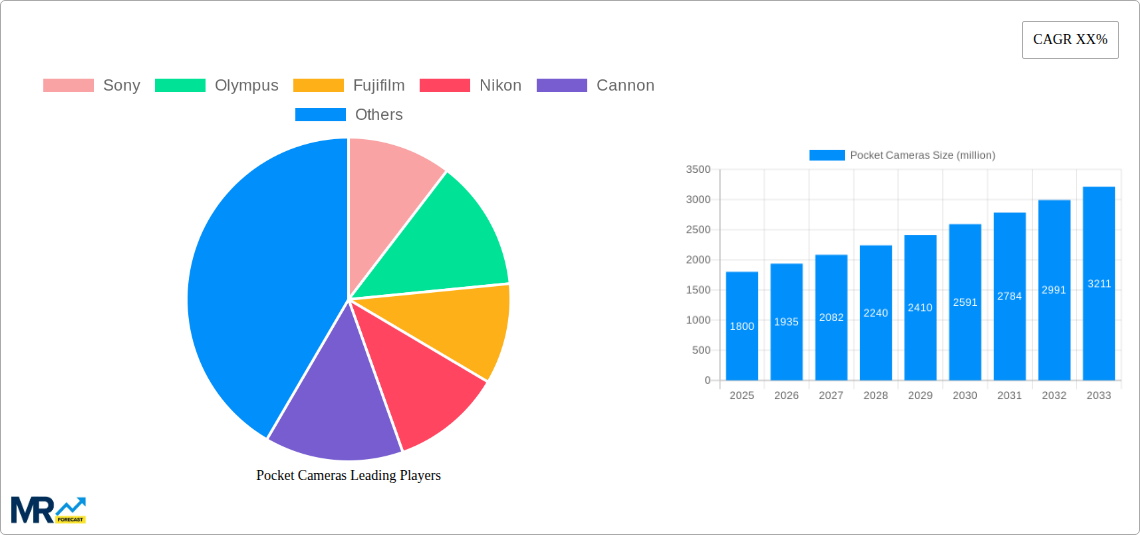

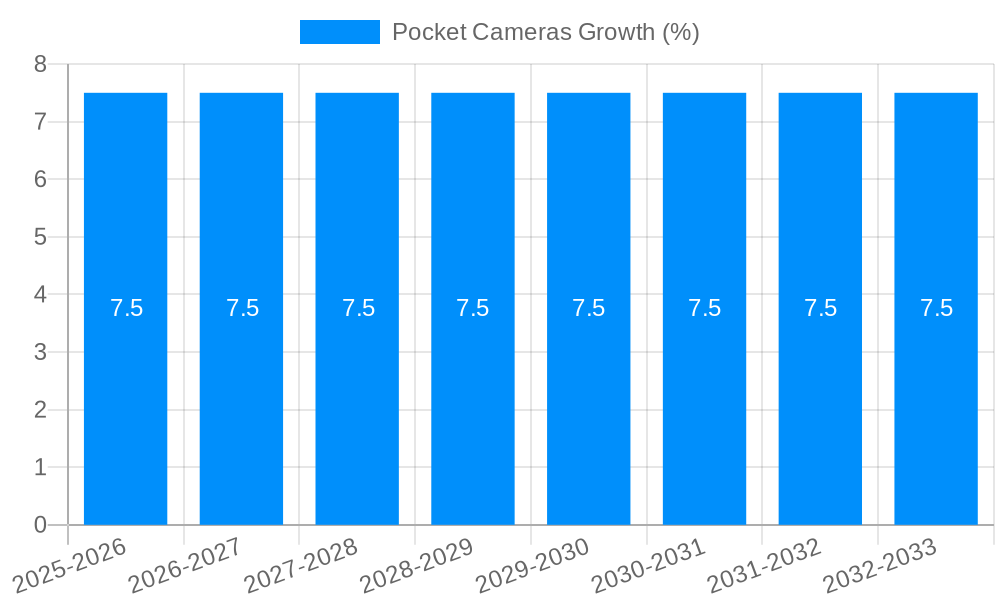

The global pocket camera market is poised for significant expansion, driven by a burgeoning demand for high-quality, portable imaging solutions. With a projected market size of approximately USD 1.8 billion in 2025, the industry is expected to witness robust growth, escalating at a Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This upward trajectory is fueled by several key drivers, including the increasing adoption of advanced imaging technologies such as AI-powered scene recognition and superior low-light performance, making these devices more appealing to both amateur enthusiasts and professional users seeking discreet yet powerful capture capabilities. The persistent trend towards miniaturization, coupled with enhanced connectivity features like seamless smartphone integration and direct cloud uploading, further bolsters market appeal. Furthermore, the growing influence of social media platforms and the desire for instant, high-fidelity content sharing continue to sustain demand for devices that deliver professional-grade results in a compact form factor.

Despite the overall positive outlook, certain restraints may temper the pace of growth. The ubiquitous presence of high-quality smartphone cameras, increasingly equipped with sophisticated optical zoom and computational photography, presents a significant competitive challenge. The perceived overlap in functionality and the convenience of carrying a single device often lead consumers to prioritize smartphones over dedicated pocket cameras for casual photography. Additionally, the high initial cost of premium pocket camera models and the relatively niche market for specialized applications could limit broader adoption. However, the market is actively adapting. The "Film Type" segment, catering to a resurgence in analog aesthetics and tactile photography experiences, is emerging as a distinct and growing niche. Conversely, the "No Film Type" segment, encompassing advanced digital pocket cameras, continues to innovate with features like advanced video recording capabilities and enhanced durability, appealing to a wider spectrum of users, from content creators to travelers. The primary applications in entertainment and commercial sectors are expected to remain strong, with burgeoning opportunities in vlogging, street photography, and niche commercial imaging.

This comprehensive report delves into the dynamic and evolving world of pocket cameras, offering an in-depth analysis of market trends, driving forces, challenges, and future projections. Spanning a study period from 2019 to 2033, with a base year of 2025, this report utilizes historical data from 2019-2024 and provides precise estimations for the forecast period of 2025-2033. We will examine global production figures in the millions of units, dissecting the market by various segments including Type (Film Type, No Film Type) and Application (Entertainment, Commercial). Key industry developments and strategic insights into the leading players will also be thoroughly investigated to equip stakeholders with the knowledge necessary for informed decision-making in this competitive landscape.

XXX The pocket camera market, once a cornerstone of personal photography, is navigating a period of significant transformation, marked by a fascinating dichotomy of decline in traditional segments and a resurgence fueled by niche innovations and evolving consumer preferences. Throughout the historical period of 2019-2024, we witnessed a steady erosion of the high-volume, point-and-shoot, no-film-type pocket cameras, largely due to the pervasive integration of sophisticated camera technology within smartphones. This technological convergence has dramatically impacted the production of these devices, leading to a decline in unit shipments. However, this narrative is not one of outright obsolescence. The "Film Type" segment, representing a nostalgic yet increasingly popular retro trend, has shown remarkable resilience and even growth. This segment appeals to a dedicated user base seeking a tangible, deliberate photographic experience, fostering a unique artisanal appeal. Furthermore, the "Entertainment" application segment, which previously encompassed a broad spectrum of consumer use, is now being redefined. While casual entertainment photography has shifted to mobile devices, pocket cameras are finding new avenues within this sector, such as dedicated vlogging cameras and compact action cameras designed for content creation. The "Commercial" application segment also presents an interesting dynamic, with specialized pocket cameras being adopted for discreet surveillance, professional content creation requiring portability, and specific industrial inspection tasks where larger equipment is impractical. Global pocket camera production, while significantly reduced from its peak, is stabilizing as manufacturers focus on these high-value, niche segments rather than mass-market appeal. The base year of 2025 serves as a crucial pivot point, indicating a market that has largely shed its non-performing segments and is poised for strategic growth within its redefined scope. The forecast period (2025-2033) anticipates a more focused market, driven by specific technological advancements in sensor technology for improved image quality in compact form factors, battery life enhancements for extended usage, and the integration of advanced connectivity features for seamless content sharing and editing. The ongoing exploration of AI-powered image processing within these devices further promises to enhance their appeal in both entertainment and specialized commercial applications, ensuring their continued relevance in a technologically saturated world.

The pocket camera market, despite facing considerable headwinds from smartphone proliferation, is being propelled by several distinct and potent driving forces that are reshaping its trajectory. Foremost among these is the resurgent interest in analog photography, fueling the demand for "Film Type" pocket cameras. This retro trend is not merely about nostalgia; it represents a conscious choice for a more deliberate and tactile photographic process, where the tangible nature of film and the anticipation of development offer a unique artistic satisfaction. This segment has carved out a dedicated and growing niche, attracting a demographic that values the craft and aesthetic of film. Concurrently, advancements in miniaturization and sensor technology are enabling the creation of highly capable "No Film Type" pocket cameras that offer distinct advantages over smartphones for specific applications. These include enhanced optical zoom capabilities, superior low-light performance, and robust build quality, making them ideal for dedicated content creators, vloggers, and travelers who prioritize image quality and versatility in a compact form factor. The "Entertainment" application segment is also evolving, with pocket cameras finding renewed purpose in specialized areas such as action cameras for adventure sports and compact cameras designed for high-quality video recording for social media platforms. These devices offer features like image stabilization, weatherproofing, and intuitive user interfaces that are optimized for capturing dynamic and engaging content. Furthermore, the increasing accessibility of editing software and platforms has democratized content creation, further incentivizing individuals to invest in dedicated pocket cameras that can deliver superior results, thereby bolstering the commercial viability of these devices within the entertainment sphere.

The pocket camera market is confronted by a formidable set of challenges and restraints that significantly influence its growth potential. The most pervasive and impactful restraint remains the relentless advancement of smartphone camera technology. Modern smartphones boast increasingly sophisticated multi-lens systems, AI-powered image processing, and computational photography capabilities that often rival or surpass entry-level pocket cameras in terms of convenience and perceived image quality for everyday use. This has led to a significant cannibalization of the market, particularly for basic point-and-shoot "No Film Type" cameras, which have seen their demand plummet. The decline in global pocket camera production, largely driven by this factor, necessitates a strategic pivot towards niche markets and specialized functionalities. Furthermore, the perception of pocket cameras as a redundant technology by a broad consumer base acts as a significant barrier to entry for new users. Educating consumers about the unique advantages and distinct experiences offered by film and advanced digital pocket cameras is a continuous challenge. The "Film Type" segment, while growing, is inherently limited by the cost and availability of film and processing, as well as the learning curve associated with analog techniques, which can deter a wider adoption. In the "Commercial" application segment, stringent data privacy regulations and the need for highly specialized features can increase development costs and limit the widespread adoption of generic pocket cameras for certain applications. Price sensitivity also plays a role; while high-end niche cameras can command premium prices, the mass market is increasingly price-averse, especially when considering the perceived overlap in functionality with smartphones.

The global pocket camera market, by 2025, is poised for a significant shift in dominance, with the "No Film Type" segment and the Asia-Pacific region emerging as the primary drivers of market activity. This dominance is not a monolithic continuation of past trends but a nuanced evolution shaped by technological adoption, economic development, and specific consumer behaviors.

Segment Dominance: "No Film Type" Pocket Cameras

Regional Dominance: Asia-Pacific

Several key growth catalysts are poised to invigorate the pocket camera industry. The escalating demand for content creation, particularly for social media and vlogging, is a primary driver, pushing the need for compact, high-quality imaging devices that excel beyond smartphone capabilities. Advancements in miniaturized sensor technology and image stabilization are enabling the development of increasingly sophisticated digital pocket cameras with superior performance. Simultaneously, the persistent resurgence of analog photography is fueling the "Film Type" segment, attracting a dedicated user base seeking a unique, tactile experience. Furthermore, the exploration of specialized commercial applications, such as industrial inspection and discreet surveillance, is opening up new revenue streams and market segments for robust and adaptable pocket cameras.

This report provides a holistic view of the pocket camera market, meticulously dissecting its past, present, and future. It offers detailed insights into the evolving consumer preferences, technological advancements, and market dynamics that shape this sector. With a strategic focus on the millions of units produced, the report delves into the competitive landscape, identifying key players and their market strategies. The analysis extends to crucial segments like "Film Type" and "No Film Type" cameras, and their applications in "Entertainment" and "Commercial" spheres, providing a granular understanding of market performance and potential. Furthermore, the report extrapolates on industry developments and future projections, offering valuable intelligence for stakeholders to navigate the complexities and capitalize on the emerging opportunities within the pocket camera industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Sony, Olympus, Fujifilm, Nikon, Cannon, Panasonic Lumix, Leica, Samsung, Hasselblad, Sigma.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Pocket Cameras," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pocket Cameras, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.