1. What is the projected Compound Annual Growth Rate (CAGR) of the Plutonium-239?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Plutonium-239

Plutonium-239Plutonium-239 by Type (Weapons Grade Plutonium, Reactor Grade Plutonium, Fuel Grade plutonium, World Plutonium-239 Production ), by Application (Isotope Battery, Artificial Satellite, Polar Weather Station, World Plutonium-239 Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

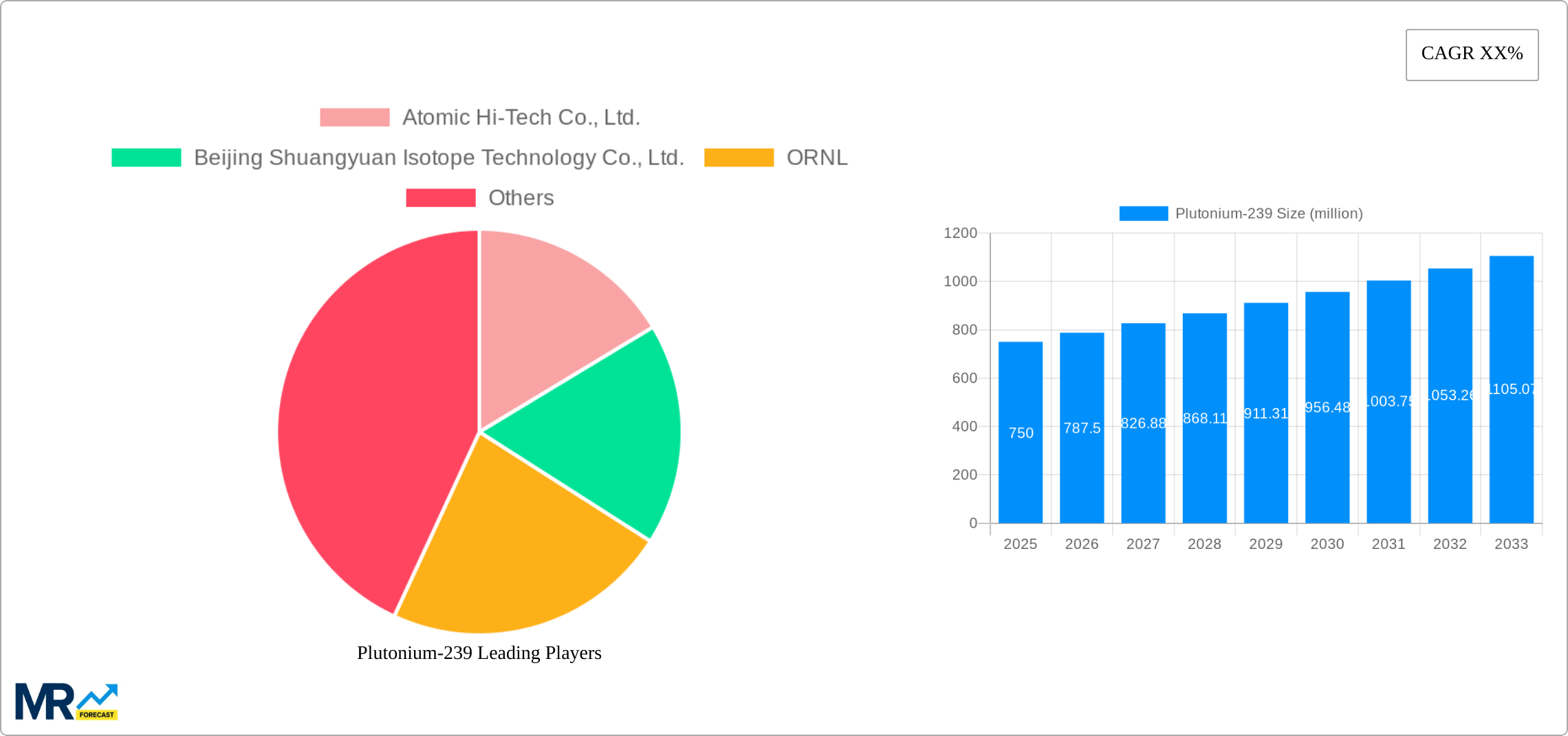

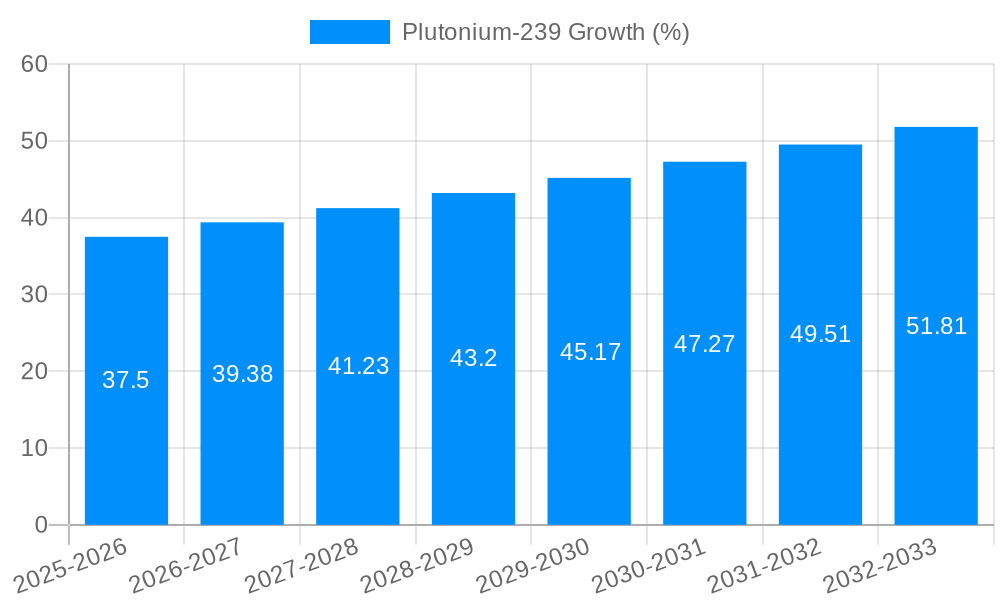

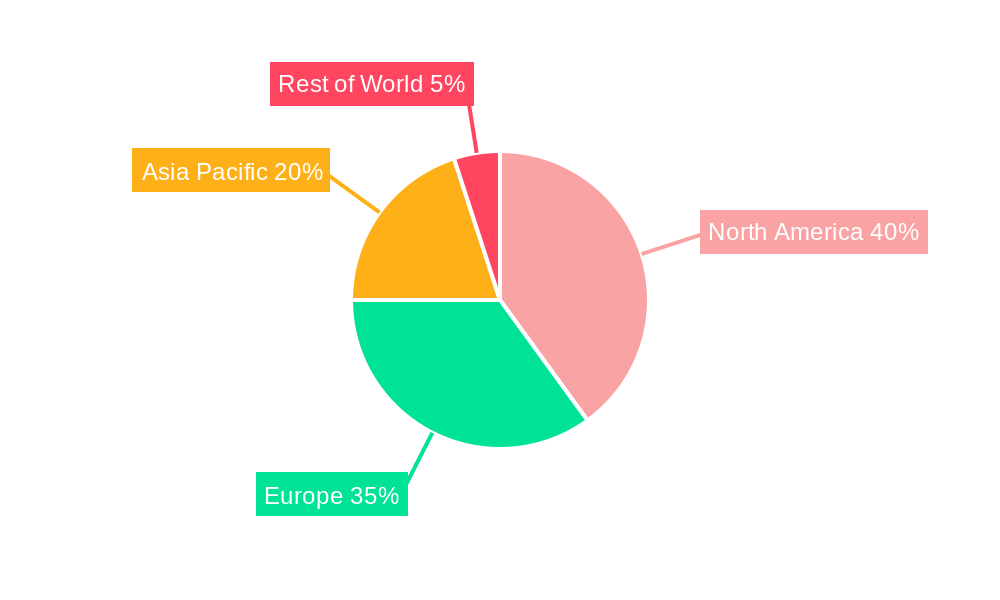

The global Plutonium-239 market is a niche but strategically significant sector, driven by its critical applications in specialized energy sources and scientific research. While precise market sizing data is unavailable, considering the high value and controlled nature of Plutonium-239, a reasonable estimate for the 2025 market size could be in the range of $500 million to $1 billion USD, depending on the inclusion of military applications which are often undisclosed. The market is segmented primarily by grade (weapons-grade, reactor-grade, fuel-grade) and application (isotope batteries, artificial satellites, specialized research facilities such as polar weather stations). Growth is anticipated to be moderate, with a Compound Annual Growth Rate (CAGR) in the 3-5% range over the forecast period (2025-2033), driven primarily by increasing demand for long-life power sources in remote locations and the continued expansion of space exploration. However, stringent regulatory controls on Plutonium-239 production, handling, and distribution represent a significant restraint. This necessitates substantial investment in advanced safety measures and technology throughout the supply chain, which ultimately impacts market expansion. Key players, including Atomic Hi-Tech Co., Ltd., Beijing Shuangyuan Isotope Technology Co., Ltd., and ORNL (Oak Ridge National Laboratory), are likely to focus on technological advancements and securing government contracts to maintain market share. Regional distribution is geographically concentrated, with North America, Europe, and Asia-Pacific accounting for the majority of the market, reflecting established research infrastructure and government programs in these regions.

The competitive landscape is characterized by a small number of specialized producers, often with strong government ties, and therefore exhibits less competition than other markets. Future growth will likely hinge upon technological innovations that improve the efficiency and safety of Plutonium-239 applications, along with international collaborations that ease restrictions on the substance's distribution. The emergence of alternative power sources, however, poses a long-term threat to market growth, although the unique properties of Plutonium-239, particularly its long half-life and high energy density, are likely to ensure a continued, albeit limited, demand for specific niche applications. Further market research would require access to classified data to precisely quantify production and distribution, making accurate market forecasting challenging.

The global Plutonium-239 market, valued at approximately $XXX million in 2025, is projected to experience significant growth during the forecast period (2025-2033). Analysis of the historical period (2019-2024) reveals a fluctuating market influenced by geopolitical factors and advancements in nuclear technology. While the production of weapons-grade Plutonium-239 has remained relatively stable, driven by existing stockpiles and ongoing security concerns, the demand for reactor-grade and fuel-grade Plutonium-239 has exhibited more dynamic trends. The increasing focus on nuclear energy diversification and advanced reactor designs is subtly impacting the demand for reactor-grade material. Furthermore, research and development efforts directed towards safer and more efficient nuclear fuel cycles are gradually shaping the market for fuel-grade Plutonium-239. However, stringent regulations and safety protocols surrounding the handling and transportation of Plutonium-239 continue to impose constraints on market expansion. The application of Plutonium-239 in specialized niche areas like isotope batteries for space exploration and remote power generation presents a less prominent but steadily growing market segment. The overall market trajectory is thus a complex interplay between established uses, emerging applications, regulatory oversight, and geopolitical dynamics.

Several key factors are driving the Plutonium-239 market. Firstly, the sustained need for nuclear weapons, though subject to international treaties and non-proliferation efforts, ensures a baseline demand for weapons-grade Plutonium-239. Secondly, the ongoing exploration and potential resurgence of nuclear power generation, particularly in countries facing energy security challenges or those seeking to decarbonize their energy mix, fuels the demand for reactor-grade Plutonium-239. Advances in reactor technology that aim to improve efficiency and minimize waste also indirectly contribute to this demand. Thirdly, ongoing research into next-generation nuclear fuel cycles, though still in their early stages, presents a long-term potential for increased demand for fuel-grade Plutonium-239. Finally, albeit a smaller segment, the specialized application of Plutonium-239 in long-life power sources for space missions and remote locations offers a niche market with steady growth potential. These factors, considered collectively, ensure that the Plutonium-239 market maintains a consistent, albeit complex and often politically influenced, trajectory.

The Plutonium-239 market faces significant challenges. Firstly, the inherent dangers associated with handling and transporting this highly radioactive material necessitate stringent safety protocols and sophisticated infrastructure, significantly increasing the costs associated with production, storage, and use. Secondly, strict international regulations and non-proliferation agreements place substantial limitations on the production and distribution of Plutonium-239, particularly weapons-grade material. This stringent regulatory environment presents substantial hurdles for market expansion. Thirdly, public perception and concerns regarding nuclear safety and waste disposal consistently impact the acceptance of Plutonium-239-related technologies, particularly in the context of nuclear power generation. Finally, the high cost of Plutonium-239 production and the associated infrastructure needs make it less economically competitive compared to alternative energy sources in some applications. These challenges collectively contribute to a complex and carefully regulated market landscape.

Weapons-Grade Plutonium: While specific production figures are classified, countries with established nuclear arsenals (e.g., the United States, Russia, China) historically represent the largest segment for weapons-grade Plutonium-239 production. This segment's market dynamics are primarily influenced by geopolitical factors and international non-proliferation efforts rather than purely economic drivers.

Reactor-Grade Plutonium: The demand for reactor-grade Plutonium-239 is expected to be driven by countries with existing or developing nuclear power programs. Regions with a high dependence on nuclear energy, or those actively exploring nuclear energy options as a means of reducing carbon emissions are likely to dominate this segment. Examples include certain regions of Europe, Asia, and North America.

Fuel-Grade Plutonium: This segment is closely linked to advancements in advanced nuclear reactor technologies. Countries actively investing in research and development of fast breeder reactors and other advanced nuclear fuel cycles are likely to see increased market share in this area. The dominance will shift as these technologies mature and become more widely adopted.

Application: Isotope Battery: The market for Plutonium-239 isotope batteries is relatively small but displays steady growth. Its application is primarily confined to space exploration and other niche applications where long-life power sources are essential. The key players in this market are likely to be countries and organizations directly involved in space exploration and related activities.

In summary, the dominance within the Plutonium-239 market is a complex interplay between geopolitical influence (weapons-grade), energy policy (reactor-grade), technological advancements (fuel-grade), and specialized applications (isotope batteries). No single region or segment will hold undisputed dominance; instead, the market will be characterized by a diverse landscape of players with varying priorities and capabilities.

Several factors can potentially accelerate growth within the Plutonium-239 industry. Firstly, increased investment in research and development for advanced nuclear reactors and fuel cycles could significantly expand the market for reactor-grade and fuel-grade Plutonium-239. Secondly, the growing global need for reliable and long-lasting energy sources, particularly in remote locations, could stimulate demand for Plutonium-239 isotope batteries. Finally, any relaxation of international regulations (though unlikely in the short-term), could positively, though controversially, influence the market size. These catalysts, acting in conjunction, can potentially reshape the market significantly in the coming years.

This report provides a comprehensive overview of the Plutonium-239 market, examining historical trends, current market conditions, and future projections. It delves into the key drivers and challenges shaping the market, providing detailed insights into the various segments and key players. The report also offers a nuanced perspective on the geopolitical and regulatory factors influencing the Plutonium-239 landscape, presenting valuable information for stakeholders across the nuclear industry and related sectors. The forecast extends to 2033, providing long-term perspectives on market growth and potential developments.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Atomic Hi-Tech Co., Ltd., Beijing Shuangyuan Isotope Technology Co., Ltd., ORNL.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Plutonium-239," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Plutonium-239, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.