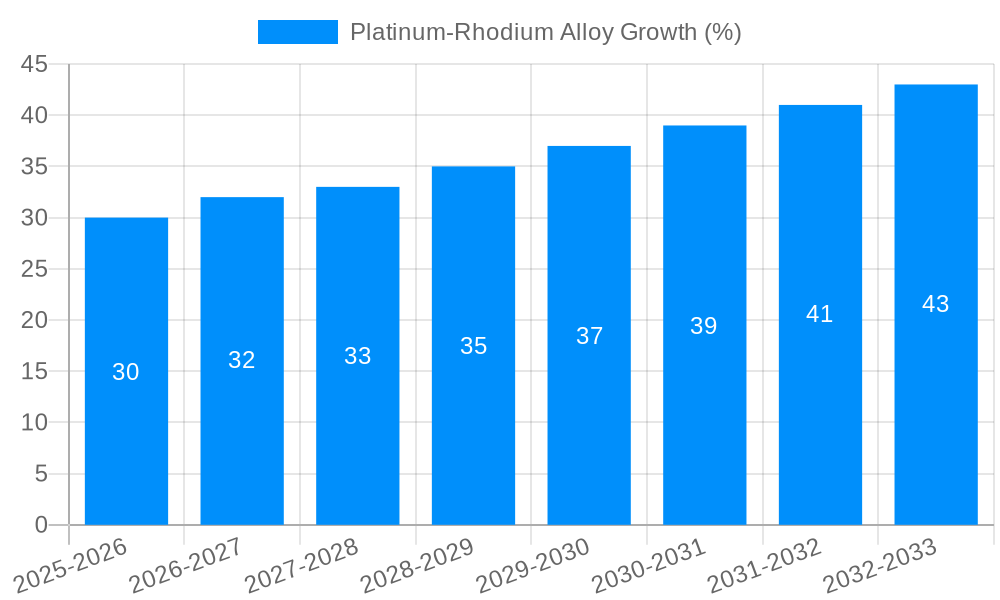

1. What is the projected Compound Annual Growth Rate (CAGR) of the Platinum-Rhodium Alloy?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Platinum-Rhodium Alloy

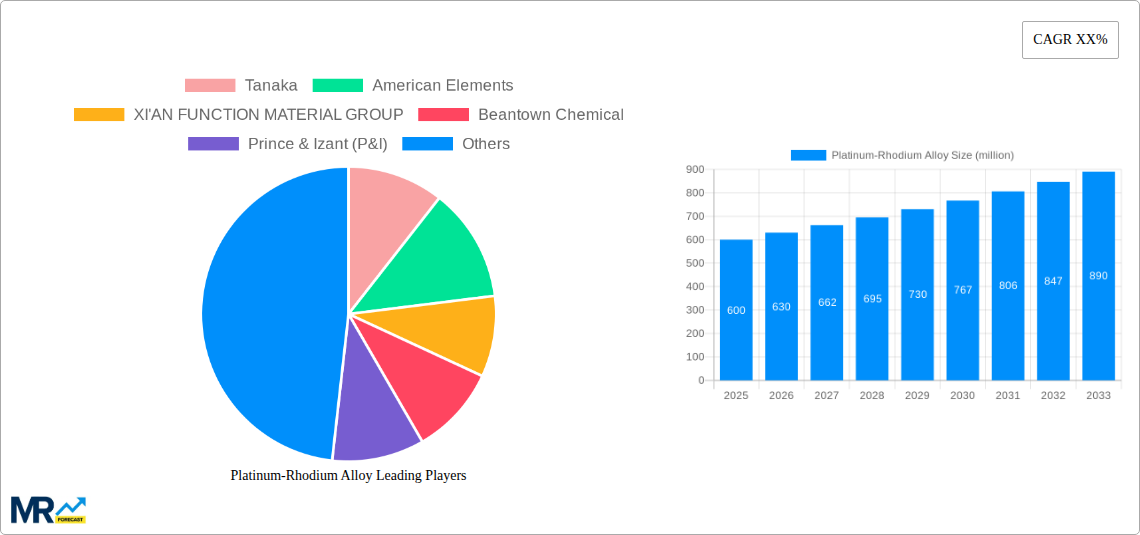

Platinum-Rhodium AlloyPlatinum-Rhodium Alloy by Type (Powder, Silky, Other), by Application (Industry, The Medical, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The Platinum-Rhodium Alloy market is poised for significant expansion, projected to reach a substantial market size of approximately \$1,500 million by 2025. Driven by a robust Compound Annual Growth Rate (CAGR) of 7.5%, the market is anticipated to flourish to an estimated \$2,650 million by 2033. This upward trajectory is primarily fueled by the increasing demand for high-performance materials in critical industrial applications, particularly in the manufacturing of thermocouples and specialized chemical catalysts where their exceptional heat resistance and corrosion properties are indispensable. The medical sector also presents a growing avenue, with the alloy's biocompatibility and inertness making it ideal for implantable devices and surgical instruments. Emerging economies in Asia Pacific are emerging as key growth engines, owing to rapid industrialization and increasing healthcare expenditure, further solidifying the market's positive outlook.

While the market demonstrates strong growth potential, certain restraints warrant attention. The high cost of platinum and rhodium, inherent to these precious metals, can impact price sensitivity for some applications and may encourage the exploration of alternative materials where feasible. Nevertheless, the unique properties of Platinum-Rhodium Alloys continue to make them the preferred choice for demanding environments where performance and reliability are paramount. Technological advancements in refining and alloy production, coupled with a sustained demand from established sectors, are expected to outweigh these challenges, ensuring a dynamic and expanding market landscape. The prevalence of powder and silky forms caters to diverse manufacturing needs, from intricate component fabrication to advanced material synthesis.

This report offers an in-depth analysis of the global Platinum-Rhodium Alloy market, meticulously examining trends, driving forces, challenges, and future projections across a comprehensive study period spanning from 2019 to 2033, with a specific focus on the Base Year 2025. The market is characterized by its niche applications, high material value, and the intricate interplay of supply and demand dynamics. During the historical period (2019-2024), the market experienced steady growth, primarily driven by advancements in catalytic converters for the automotive industry and critical components within the aerospace sector. The estimated market size for Platinum-Rhodium Alloys in 2025 is projected to reach a significant valuation, potentially in the hundreds of millions of US dollars, reflecting its indispensable role in high-performance applications.

The Platinum-Rhodium Alloy Trends are intricately linked to global economic health, technological innovation, and increasingly stringent environmental regulations. In the automotive sector, the demand for Platinum-Rhodium alloys, particularly in catalytic converters, has seen a gradual shift. While traditional internal combustion engines continue to utilize these alloys, the burgeoning growth of electric vehicles presents a dual-edged sword. On one hand, the declining production of ICE vehicles could dampen demand. On the other hand, the exploration of hydrogen fuel cell technology, where Platinum-Rhodium alloys play a crucial role in catalysts, offers a significant potential growth avenue. The medical industry, a consistent consumer, relies on the biocompatibility and inertness of these alloys for crucial implantable devices and surgical instruments. The intrinsic value of platinum and rhodium, often trading in the tens of millions of US dollars per kilogram depending on market fluctuations, also dictates market dynamics, influencing production costs and product pricing. Future trends will likely involve further research into alloy compositions to optimize performance, cost-effectiveness, and sustainability, potentially leading to novel applications in emerging technologies such as advanced sensor development and specialized industrial catalysts. The study period’s extensive scope allows for a nuanced understanding of long-term market trajectories, anticipating shifts in supply chains, technological disruptions, and evolving end-user demands, all contributing to a market that, while specialized, holds substantial economic weight, projected to be in the hundreds of millions of US dollars by the forecast period's end.

The Platinum-Rhodium Alloy market is propelled by a confluence of critical factors, primarily stemming from its unique properties that make it indispensable in high-stakes applications. The most significant driver remains the automotive industry's persistent need for efficient and durable catalytic converters. Despite the rise of electric vehicles, internal combustion engines continue to be a dominant force globally, particularly in developing economies. Platinum-Rhodium alloys excel in converting harmful exhaust emissions into less toxic substances, a function mandated by increasingly stringent environmental regulations worldwide. The value proposition here is clear: improved air quality and compliance with emission standards directly translate to sustained demand for these alloys. Furthermore, the aerospace sector's insatiable appetite for high-performance materials acts as another substantial propeller. The extreme operating conditions experienced by aircraft engines, including soaring temperatures and corrosive environments, necessitate alloys with exceptional thermal stability, oxidation resistance, and mechanical strength. Platinum-Rhodium alloys, with their inherent resilience, are ideally suited for critical components like turbine blades and combustion liners, where failure is not an option and component lifespan is paramount. The ongoing technological advancements in aerospace, leading to more fuel-efficient and powerful engines, further underscore the demand for these advanced materials. The medical field also contributes significantly, leveraging the biocompatibility and inertness of Platinum-Rhodium alloys for life-saving medical devices. From pacemakers and defibrillators to surgical instruments and orthopedic implants, the reliability and safety offered by these alloys are non-negotiable, ensuring patient well-being and driving consistent market demand. The sheer cost of these precious metals, often measured in the tens of millions of US dollars per kilogram, also indirectly fuels demand for efficient recycling and recovery processes, further integrating them into the market cycle.

Despite its critical applications and robust demand drivers, the Platinum-Rhodium Alloy market faces significant challenges and restraints that shape its growth trajectory. The most prominent restraint is the inherent volatility and exceptionally high cost of raw materials. Platinum and rhodium are precious metals with prices that can fluctuate dramatically due to geopolitical factors, mining disruptions, and speculative trading. These price swings directly impact the cost of producing Platinum-Rhodium alloys, making it difficult for manufacturers and end-users to forecast budgets and maintain stable pricing. The cost of raw rhodium alone can reach millions of US dollars per kilogram during periods of scarcity, making it one of the most expensive elements on Earth. This high cost can limit its adoption in price-sensitive applications or drive a concerted effort towards material substitution or reduction in usage. Furthermore, the limited global supply and concentrated mining operations pose a significant risk. The primary sources of platinum and rhodium are concentrated in a few countries, making the supply chain vulnerable to political instability, labor disputes, or environmental regulations in those regions. Any disruption in these key mining areas can lead to immediate and severe price hikes and supply shortages, impacting industries that rely heavily on these alloys. The evolving regulatory landscape, while a driver in some instances, can also act as a restraint. While environmental regulations push for cleaner emissions, leading to increased demand for catalytic converters, the transition to electric vehicles presents a long-term challenge to the dominance of traditional internal combustion engines. As the automotive industry shifts towards electrification, the demand for platinum-based catalytic converters is expected to gradually decline, requiring a strategic pivot in the application focus for Platinum-Rhodium alloys. Additionally, the complex and energy-intensive nature of alloy production and refining adds to the overall cost and environmental footprint, potentially leading to pressure for more sustainable manufacturing processes. The sheer value of these materials also makes them targets for theft, adding another layer of logistical and security challenges for companies involved in their handling and production.

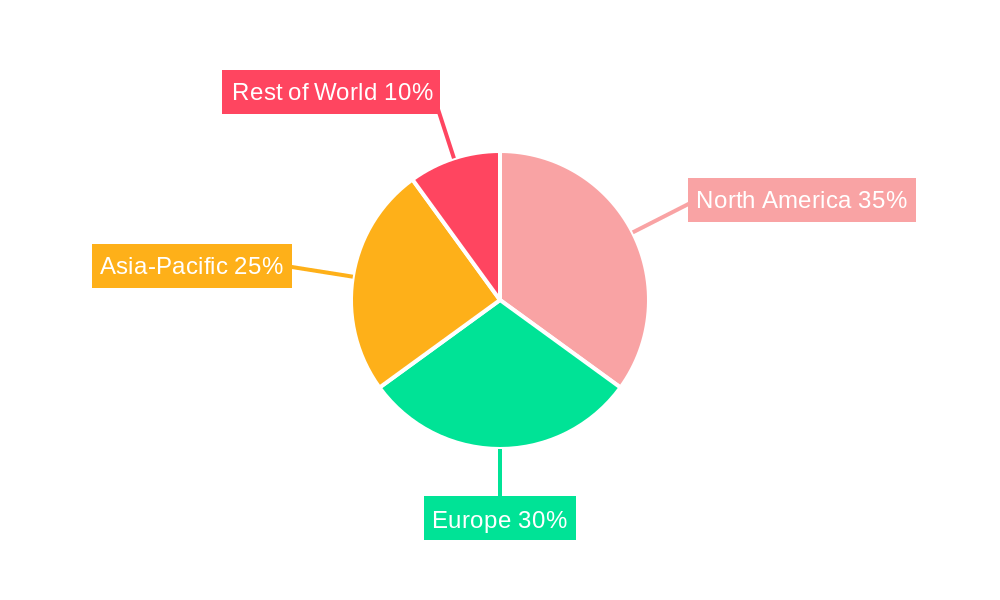

The dominance of specific regions and segments within the Platinum-Rhodium Alloy market is dictated by a confluence of factors including industrialization, technological prowess, regulatory frameworks, and the presence of key end-user industries.

Key Regions/Countries Dominating the Market:

Asia-Pacific (APAC): This region, particularly China, is emerging as a dominant force. Its massive manufacturing base, especially in the automotive sector, fuels a significant demand for Platinum-Rhodium alloys in catalytic converters. As China continues to upgrade its emission standards, the need for advanced catalytic technologies will only grow. Furthermore, the expanding aerospace and medical device manufacturing capabilities within APAC countries are contributing to this dominance. The sheer scale of its industrial output and the increasing disposable income of its population translate into substantial consumption of goods that utilize these high-performance alloys. The market size for Platinum-Rhodium Alloys within the APAC region is projected to be in the hundreds of millions of US dollars throughout the forecast period.

North America: The United States remains a crucial market, driven by its established automotive industry, its leadership in aerospace technology, and its advanced healthcare sector. The strict emission regulations enforced in North America necessitate the use of efficient catalytic converters, ensuring a steady demand. The country's pioneering role in developing and adopting new technologies also fuels demand for Platinum-Rhodium alloys in research and development, as well as in specialized industrial applications. The robust healthcare infrastructure and the continuous innovation in medical devices further solidify North America's position.

Europe: Similar to North America, Europe boasts a strong automotive manufacturing sector with stringent environmental regulations, particularly in countries like Germany and France. The European aerospace industry is also a significant consumer, and the advanced medical device sector contributes substantially to the demand. The focus on sustainable technologies and the drive towards cleaner energy solutions, including hydrogen fuel cells, presents a growing opportunity for Platinum-Rhodium alloys in this region.

Dominating Segment: Application - Industry (Catalytic Converters)

The Industry segment, specifically the application within catalytic converters for internal combustion engines, is unequivocally the dominant force driving the Platinum-Rhodium Alloy market. This segment alone accounts for a substantial portion of the global demand, estimated to be in the hundreds of millions of US dollars annually. The continuous evolution of emission standards worldwide, mandating stricter control over pollutants like nitrogen oxides (NOx), carbon monoxide (CO), and unburnt hydrocarbons (HC), necessitates the use of highly efficient catalytic converters. Platinum and rhodium are critical components in these converters due to their exceptional catalytic properties, enabling the chemical reactions that neutralize these harmful gases.

Automotive Catalytic Converters: The vast global fleet of internal combustion engine vehicles, coupled with ongoing production, ensures a consistent demand for Platinum-Rhodium alloys in catalytic converters. Even with the rise of electric vehicles, the lifespan of existing ICE vehicles and the continued production in many parts of the world will maintain this demand for the foreseeable future. The increasing stringency of emissions regulations globally, requiring more complex and effective catalytic systems, further bolsters this segment. The value of rhodium alone, often in the millions of US dollars per kilogram, makes this a high-value segment within the broader industrial application.

Industrial Catalysis: Beyond automotive applications, Platinum-Rhodium alloys find crucial roles in various industrial catalytic processes, including the production of nitric acid, the refining of petroleum, and the synthesis of various chemicals. These processes often require catalysts that can withstand high temperatures and corrosive environments, a characteristic that Platinum-Rhodium alloys possess in abundance. The continuous need for efficient and cost-effective industrial production mechanisms ensures a steady demand from this sub-segment.

The Type: Powder within the industrial application segment also holds significant importance. Platinum-Rhodium alloy powders are highly favored for their surface area and reactivity, making them ideal for impregnation onto catalytic substrates in converters and other industrial catalytic applications. The ability to control particle size and morphology allows manufacturers to optimize catalytic performance and efficiency. The market for Platinum-Rhodium alloy in powder form is estimated to be a substantial portion of the overall industrial segment, likely in the tens of millions of US dollars.

The Platinum-Rhodium Alloy industry is poised for growth, catalyzed by several key factors. The relentless pursuit of cleaner air globally, leading to increasingly stringent emission regulations for vehicles and industrial processes, directly fuels demand for efficient catalytic converters and industrial catalysts. Advancements in aerospace technology, requiring materials that can withstand extreme conditions, also provide a consistent growth avenue. Furthermore, the burgeoning interest and development in hydrogen fuel cell technology present a significant opportunity, as Platinum-Rhodium alloys are critical catalysts in these systems. Emerging applications in specialized sensors and electronic components, where their unique conductive and resistant properties are leveraged, also contribute to future growth.

This comprehensive report provides a detailed examination of the Platinum-Rhodium Alloy market, encompassing market size, share, trends, and forecasts from 2019 to 2033. It delves into the driving forces and challenges that shape the industry, offering strategic insights for stakeholders. The report also highlights key regions and dominant segments, with a particular focus on the indispensable role of Platinum-Rhodium alloys in industrial applications like catalytic converters, and the significant demand for its powder form. Leading players, significant developments, and future growth catalysts are meticulously analyzed, offering a holistic view of this high-value market. The report is designed to empower businesses with the information necessary to navigate this complex landscape, capitalize on emerging opportunities, and make informed strategic decisions within the Platinum-Rhodium Alloy sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Tanaka, American Elements, XI'AN FUNCTION MATERIAL GROUP, Beantown Chemical, Prince & Izant (P&I), ESPI, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Platinum-Rhodium Alloy," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Platinum-Rhodium Alloy, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.