1. What is the projected Compound Annual Growth Rate (CAGR) of the Platinum-Group Metals?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Platinum-Group Metals

Platinum-Group MetalsPlatinum-Group Metals by Type (Iridium Metal, Rhodium Metal, Palladium Metal, Platinum Metal, Osmium Metal, Ruthenium Metal, World Platinum-Group Metals Production ), by Application (Catalyst, Glass Fiber Crucible, Optical Glass, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

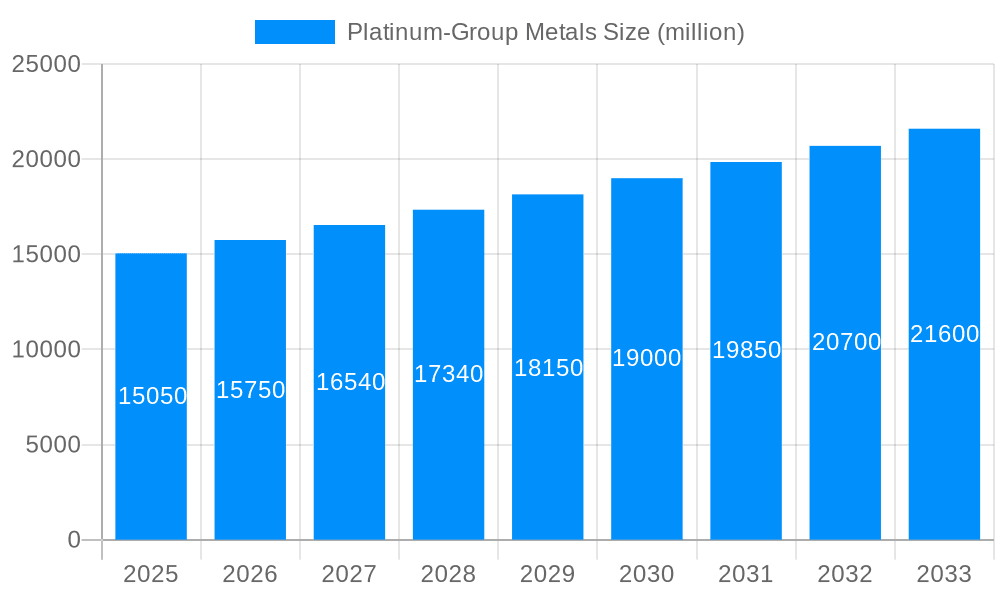

The platinum-group metals (PGMs) market, valued at approximately $15,050 million in 2025, is projected to experience significant growth over the forecast period (2025-2033). While the precise Compound Annual Growth Rate (CAGR) is unavailable, considering the inherent volatility and cyclical nature of the PGM market, coupled with factors like increasing demand from the automotive (catalytic converters) and jewelry sectors, a conservative estimate of a 5% CAGR seems plausible. Key drivers include the growing demand for electric vehicles (EVs), albeit with a slower growth rate initially compared to the internal combustion engine (ICE) market. Furthermore, increased industrial applications in fuel cells and chemical processes continue to fuel demand. Emerging trends indicate a shift towards sustainable mining practices and increased focus on responsible sourcing, influencing investor preferences and regulatory frameworks. However, constraints such as price volatility, supply chain disruptions, and geopolitical factors pose challenges to consistent market expansion. The market segmentation, though not detailed, likely includes various PGM types (platinum, palladium, rhodium, etc.) and applications.

The competitive landscape is dominated by major players like Anglo American, Impala, Lonmin, and Norilsk Nickel, who collectively control a substantial portion of global PGM production and distribution. However, the market also features a range of smaller producers, including those focused on niche applications or regional markets. The interplay between established players and emerging companies is likely to shape the market’s evolution. Successful companies will need to adapt to shifts in demand, regulatory changes relating to environmental sustainability, and fluctuating global economic conditions to maintain market share and profitability. The forecast period's growth is expected to be driven by ongoing technological advancements in various industries, leading to broader application of PGMs. The market's future performance remains interconnected with global economic health and the transition towards more sustainable energy solutions.

The platinum-group metals (PGMs) market, encompassing platinum, palladium, rhodium, ruthenium, iridium, and osmium, exhibited dynamic trends between 2019 and 2024. The historical period (2019-2024) saw fluctuating prices driven by a complex interplay of factors including automotive demand (primarily for catalytic converters), jewelry consumption, industrial applications (electronics, chemical processes), and investment flows. The base year 2025 marks a pivotal point, with estimations suggesting a significant shift in market dynamics. The forecast period (2025-2033) anticipates continued growth, albeit at varying rates for different PGMs. Palladium, for example, experienced a surge in demand due to its use in gasoline-powered vehicles, while platinum's demand has been influenced by the growing adoption of diesel vehicles and its applications in fuel cells and jewelry. Rhodium, known for its high price volatility, remains a critical component in automotive catalytic converters, its market heavily influenced by the global automotive production landscape. The overall market size is projected to reach several billion USD by 2033, indicating a substantial expansion from the 2025 estimated value. This growth is not uniformly distributed, with some PGMs demonstrating stronger growth trajectories than others. This variance is largely attributable to differences in end-use applications and technological advancements impacting their demand. The study period (2019-2033) reveals a clear evolution in the PGM landscape, from periods of relative stability to periods of intense volatility, influenced by macro-economic factors, technological breakthroughs, and geopolitical events. This report provides a detailed analysis of these trends, offering valuable insights for stakeholders across the value chain. The market's complexity stems from diverse applications, varying supply sources, and a cyclical nature influenced by global economic conditions.

Several key factors propel the growth of the platinum-group metals market. The automotive industry remains a dominant driver, with PGMs crucial in catalytic converters to reduce harmful emissions. The shift towards cleaner vehicles, while impacting the demand for specific PGMs, overall boosts the sector. Growth in the electronics industry, particularly in areas like fuel cells for portable electronics and data centers, fuels the demand for platinum and palladium. The burgeoning green energy sector is another significant driver, with PGMs vital components in hydrogen fuel cells and various renewable energy technologies. Investment demand contributes to price fluctuations and market volatility, with PGMs often considered safe-haven assets. Industrial applications, ranging from chemical catalysis to glass manufacturing, also sustain demand for various PGMs. Finally, jewelry demand, particularly for platinum, contributes a steady stream of consumption, with changing fashion trends and consumer preferences impacting demand levels. The interplay of these drivers results in a dynamic and often unpredictable market, making thorough analysis crucial for informed decision-making.

Despite promising growth prospects, the platinum-group metals market faces several challenges. Price volatility, heavily influenced by supply-demand imbalances and geopolitical factors, poses a significant risk to market players. Supply chain disruptions, including mining challenges, processing bottlenecks, and political instability in major producing regions, can severely impact availability and prices. The increasing use of alternative materials in catalytic converters, driven by the push for cost reduction in the automotive industry, presents a threat to PGM demand. Environmental concerns related to mining and processing of PGMs, leading to stricter regulations and increased operational costs, add another layer of complexity. Economic downturns, particularly impacting the automotive industry, can significantly dampen demand, resulting in market corrections. Furthermore, technological advancements leading to more efficient catalytic converter designs could potentially decrease the PGM content needed per vehicle, thus lowering overall demand. Successfully navigating these challenges requires a strong understanding of the intricate dynamics of the PGM market and a proactive approach to mitigating potential risks.

South Africa: A significant portion of global PGM production originates from South Africa, making it a dominant player in the market. Its rich reserves and established mining infrastructure contribute to its pivotal role. Challenges include operational complexities, cost pressures, and labor relations within the mining sector.

Russia: Russia is another major PGM producer, primarily through Norilsk Nickel, a leading global player. Its output significantly influences the global supply-demand balance. Geopolitical factors and potential sanctions can, however, impact production and trade.

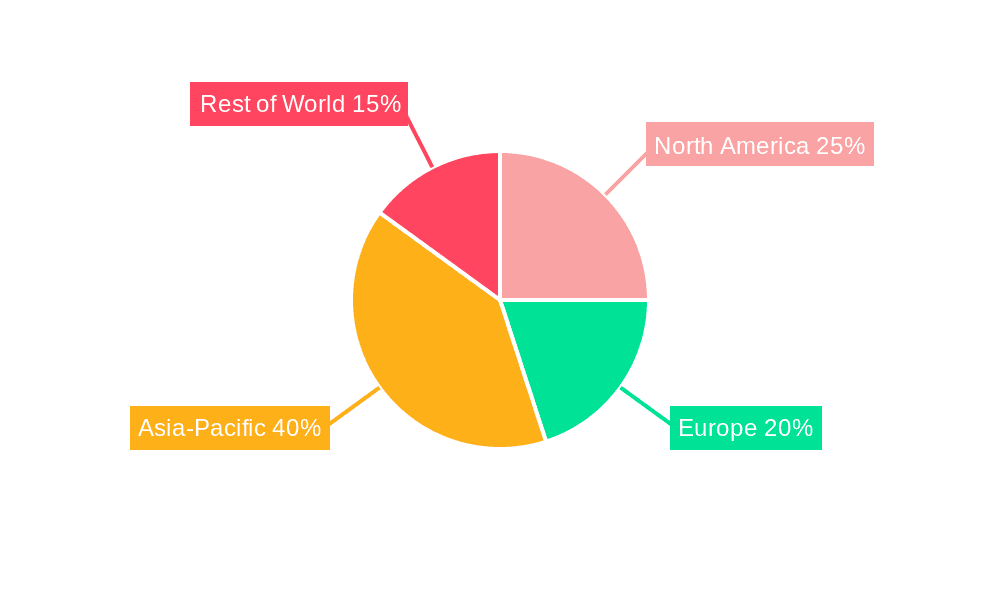

North America: While not a major producer, North America presents significant demand for PGMs, primarily driven by its automotive and industrial sectors. The region’s robust economy and advanced technologies contribute to high PGM consumption.

Automotive: The automotive industry remains the dominant consumer of PGMs, with catalytic converters in gasoline and diesel vehicles representing the most significant application. Future trends, such as the adoption of electric vehicles, will continue to shape the sector's impact on the PGM market.

Jewelry: Platinum's usage in jewelry adds stability to the demand side, although fashion trends and economic factors play a role in the market's evolution.

Electronics: Growing use in electronics, particularly in fuel cells for portable devices, is a notable growth area for platinum and palladium. Technological advancements and increasing demand for smaller, more efficient devices will continue to drive this trend.

The market's dominance stems from a combination of factors including established mining operations, robust industrial sectors driving demand, and economic strength within these regions.

The PGM industry's growth is fueled by several key catalysts. The increasing focus on reducing emissions from vehicles and industrial processes is boosting demand, especially for catalytic converter applications. The growing adoption of hydrogen fuel cells, particularly in renewable energy solutions and transportation, further fuels demand for PGMs. Technological advancements leading to new and diverse PGM applications across various sectors, ranging from electronics to medicine, contribute to sustained growth. Increased investment in PGM exploration and mining operations, particularly in new and prospective regions, expands the available supply and market potential.

This report provides a comprehensive overview of the platinum-group metals market, encompassing historical trends, current market dynamics, future forecasts, key players, and significant developments. The detailed analysis offers valuable insights into the factors driving market growth, challenges faced by industry players, and emerging opportunities. The report is an essential resource for investors, industry professionals, and anyone seeking a deep understanding of the PGM market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Anglo American, Impala, Lonmin, Norilsk Nickel, Platina, Aquarius, Wesizwe, Zimplats, Sedibelo, Northam, Incwala, Royal Bafokeng, Eastplats, Platinum Group Metals, Sino-platinum, Jinchuan, Caisson Laboratories, .

The market segments include Type, Application.

The market size is estimated to be USD 15050 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Platinum-Group Metals," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Platinum-Group Metals, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.