1. What is the projected Compound Annual Growth Rate (CAGR) of the Plastic Smartphone Back Cases?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Plastic Smartphone Back Cases

Plastic Smartphone Back CasesPlastic Smartphone Back Cases by Type (Polycarbonate (PC) Plastic, ABS Plastic, Other), by Application (iOS Smartphones, Android Smartphones, Others, World Plastic Smartphone Back Cases Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

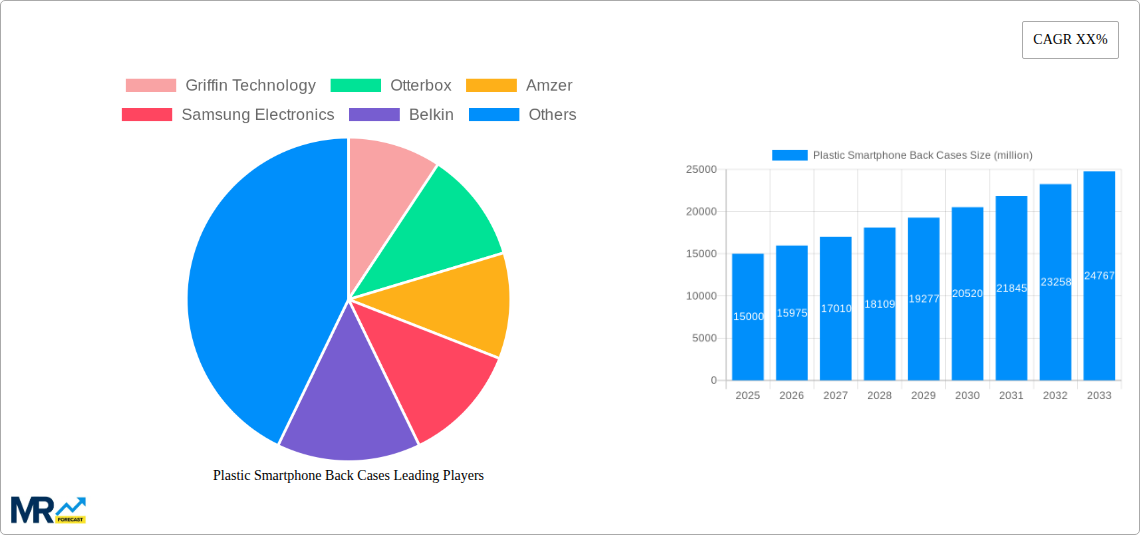

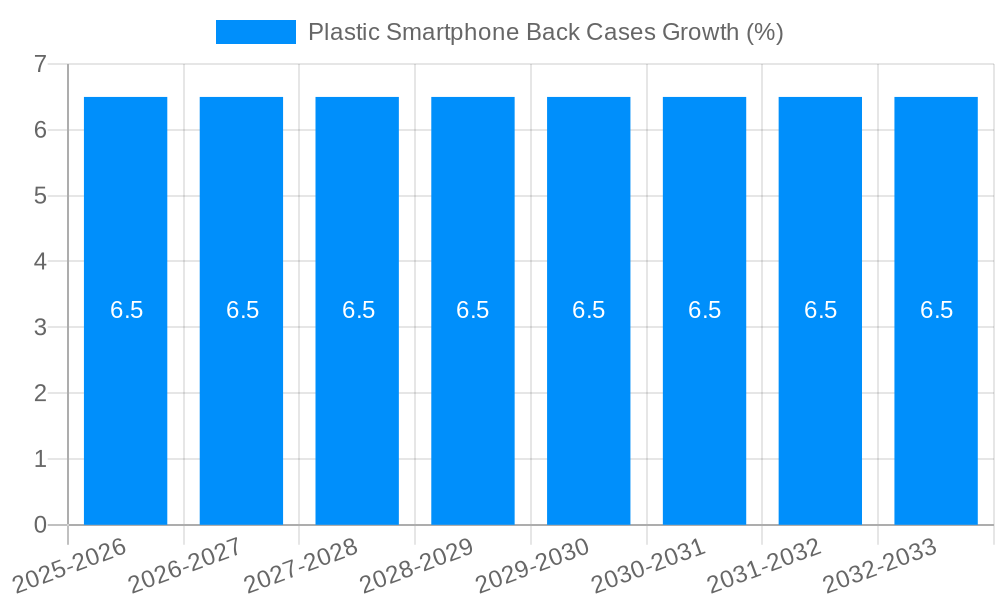

The global market for plastic smartphone back cases is experiencing robust expansion, driven by a burgeoning smartphone user base and the constant demand for device protection and personalization. With an estimated market size projected to reach approximately USD 15,000 million by 2025, the industry is set to witness a Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This growth is fueled by key drivers such as the increasing affordability and accessibility of smartphones across emerging economies, alongside a continuous upgrade cycle driven by technological advancements and new model releases. Consumers increasingly view smartphone back cases not just as protective accessories but as fashion statements, leading to a surge in demand for diverse designs, colors, and material finishes. The widespread adoption of both iOS and Android smartphones, particularly in rapidly developing regions, underpins the significant volume in this market segment. Furthermore, the ongoing innovation in plastic formulations, offering enhanced durability, scratch resistance, and aesthetic appeal, contributes to the sustained market momentum.

The market dynamics are characterized by a competitive landscape featuring both established global players like Otterbox and Griffin Technology, and a growing number of regional manufacturers, particularly from Asia Pacific. The dominance of polycarbonate (PC) and ABS plastics is a testament to their cost-effectiveness, durability, and moldability, allowing for intricate designs. However, emerging trends also point towards a growing interest in eco-friendly and biodegradable plastic alternatives, driven by increasing environmental consciousness. Restraints such as the rising popularity of metal and glass-backed smartphones, particularly in premium segments, and the perceived vulnerability of plastic cases to extreme damage, present challenges. Nevertheless, the sheer volume of smartphone production and the continued consumer preference for affordable, stylish, and functional protection ensure a promising outlook for the plastic smartphone back cases market, with significant opportunities for innovation and market penetration in developing regions.

Here's a unique report description for "Plastic Smartphone Back Cases," incorporating your specified requirements:

This comprehensive report delves into the dynamic global market for plastic smartphone back cases, offering an in-depth analysis of trends, drivers, challenges, and opportunities. Spanning a study period from 2019 to 2033, with a base year of 2025 and a detailed forecast for 2025-2033, this report provides crucial insights for stakeholders across the value chain. We will meticulously examine production volumes, market segmentation by material type and application, and the strategic developments shaping the industry.

The plastic smartphone back case market is characterized by a fascinating interplay of evolving consumer preferences, technological advancements, and shifting manufacturing landscapes. XXX Key market insights reveal a steady and robust demand, driven by the sheer volume of smartphone activations globally. In the historical period (2019-2024), the market saw a significant surge, fueled by the widespread adoption of smartphones across diverse demographics. This trend is projected to continue, with an estimated production volume of over 1,800 million units in the base year 2025, underscoring the market's inherent scale. A critical trend is the increasing demand for thin, lightweight yet durable cases, prompting manufacturers to innovate in material science and design. The aesthetic appeal of cases has also become paramount, with a growing emphasis on diverse color palettes, textures, and customizable options. Furthermore, the integration of smart features, such as MagSafe compatibility and embedded NFC capabilities, is starting to influence design choices, creating niche but rapidly growing segments. The market is also witnessing a push towards more sustainable material options within the plastic category, responding to growing environmental awareness. This includes the exploration of recycled plastics and bioplastics, although traditional ABS and Polycarbonate (PC) plastics continue to dominate due to their cost-effectiveness and established performance. The aftermarket for smartphone cases remains a dominant force, with consumers actively seeking to personalize and protect their devices. This perpetual need for protection and personalization, coupled with the continuous release of new smartphone models, ensures a consistent replenishment cycle for plastic back cases, maintaining a healthy production volume that is expected to approach 2,100 million units by 2033. The report will dissect these trends, providing quantitative data on market growth and qualitative analysis of underlying consumer behaviors and technological influences.

The sustained growth of the plastic smartphone back cases market is underpinned by several powerful driving forces. Foremost among these is the ever-increasing global smartphone penetration rate. As more individuals worldwide acquire smartphones, the demand for protective and decorative accessories like plastic back cases naturally escalates. The sheer volume of active smartphone users, estimated to be in the billions, translates into a consistent and substantial market for these accessories. Furthermore, the frequent release of new smartphone models by major manufacturers acts as a consistent catalyst. Each new device launch necessitates an updated range of compatible cases, creating an ongoing cycle of demand for both OEM and aftermarket manufacturers. Consumers' desire to personalize their devices is another significant driver. Smartphone cases have evolved from purely functional items to fashion statements and expressions of individuality. The vast array of designs, colors, and finishes available in plastic back cases allows consumers to customize their phones to reflect their personal style. The affordability and versatility of plastic materials are also crucial. Compared to other case materials like metal or premium leather, plastics such as Polycarbonate (PC) and ABS offer an excellent balance of durability, protection, and cost-effectiveness, making them accessible to a broad consumer base. The growing disposable income in emerging economies further contributes to market expansion, as more consumers can afford not only smartphones but also accessories to protect and enhance them.

Despite its robust growth, the plastic smartphone back cases market is not without its challenges and restraints. One of the most significant is the increasing durability of smartphones themselves. Newer smartphone models often feature more resilient materials and improved water and dust resistance, potentially reducing the perceived necessity for basic protective cases for some users. This can lead to a slower replacement cycle for cases. Another major challenge is the intense competition and price wars within the market. The relatively low barrier to entry for plastic case manufacturing, especially with the availability of standardized molds and materials, has led to a crowded marketplace. This fierce competition often results in razor-thin profit margins, particularly for generic or unbranded products, and can restrain investment in premium features or innovation. The growing environmental concern and push towards sustainability also pose a restraint. While plastic cases are often cost-effective, consumers and regulatory bodies are increasingly scrutinizing the environmental impact of single-use plastics. Manufacturers are facing pressure to adopt more eco-friendly materials and manufacturing processes, which can involve higher initial investment and potentially alter the cost structure. The rapid pace of technological obsolescence in the smartphone industry also presents a challenge. As new phone models are released with different dimensions and camera cutouts, older case designs can quickly become obsolete, leading to inventory management issues and potential write-offs for manufacturers and retailers.

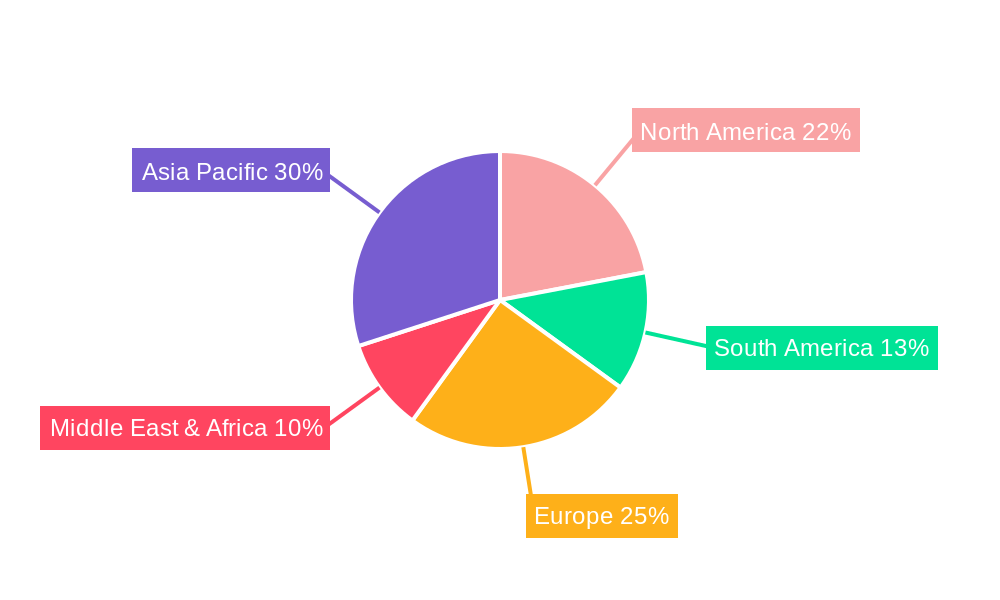

The global plastic smartphone back case market is characterized by significant regional variations and segment dominance. Among the key segments, Android Smartphones are poised to dominate the market in terms of volume and value. With a significantly larger global user base than iOS, the sheer number of Android devices manufactured and in use translates directly into a higher demand for their corresponding back cases. This segment's dominance is further amplified by the diversity of Android device manufacturers and models, each requiring a unique range of case designs, thereby fueling consistent production.

From a regional perspective, Asia Pacific is anticipated to be the dominant force in the plastic smartphone back case market. This dominance stems from several converging factors:

Within the Type segment, Polycarbonate (PC) Plastic is expected to maintain a leading position, especially in the forecast period (2025-2033). PC plastic offers an exceptional blend of impact resistance, clarity, and design flexibility, making it ideal for producing cases that are both protective and aesthetically pleasing. Its inherent strength allows for thinner case profiles, catering to the trend of slim and lightweight accessories. While ABS plastic remains a significant player due to its cost-effectiveness, PC's superior protective qualities and premium feel often make it the preferred choice for mid-range to high-end plastic cases.

In terms of World Plastic Smartphone Back Cases Production, the sheer volume produced is staggering. For the base year 2025, it is estimated that over 1,800 million units of plastic smartphone back cases will be produced globally. This production volume is driven by the consistent demand from the Android Smartphone segment, particularly within the Asia Pacific region. This figure is expected to grow steadily, reaching an estimated 2,100 million units by the end of the forecast period in 2033, showcasing the sustained vitality and scale of this essential market. The report will provide detailed breakdowns of production capacities, regional output, and segment-specific volume estimations.

The plastic smartphone back cases industry is propelled by several key growth catalysts. The relentless pace of innovation in smartphone design, with new models featuring distinct form factors and camera arrangements, necessitates a constant supply of compatible cases. Furthermore, the increasing consumer desire for personalization and self-expression, viewing phone cases as fashion accessories, drives demand for diverse designs and functionalities. The expanding middle class and rising disposable incomes in emerging economies also contribute significantly, making protective and decorative cases more accessible to a larger consumer base.

This report provides an unparalleled and comprehensive analysis of the plastic smartphone back cases market. We go beyond surface-level data to offer deep insights into market dynamics, production volumes reaching over 1,800 million units in 2025, and future projections up to 2,100 million units by 2033. The analysis meticulously dissects market segmentation, including the dominance of Android Smartphones and the regional leadership of Asia Pacific, alongside the prevalent use of Polycarbonate (PC) Plastic. We thoroughly investigate the driving forces, challenges, and growth catalysts, supported by historical data from 2019-2024 and forecasts for 2025-2033. The report also features an in-depth look at leading players and significant market developments, equipping stakeholders with the knowledge necessary for strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Griffin Technology, Otterbox, Amzer, Samsung Electronics, Belkin, NILLKIN, HOSEN(Guangzhou) Plastic Product, Shenzhen Ipaky Electronic Technology.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Plastic Smartphone Back Cases," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Plastic Smartphone Back Cases, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.