1. What is the projected Compound Annual Growth Rate (CAGR) of the Plastic Reusable Packaging?

The projected CAGR is approximately 6.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Plastic Reusable Packaging

Plastic Reusable PackagingPlastic Reusable Packaging by Type (Plastic Barrel, Plastic Box, Plastic Bottle), by Application (Food and Beverage, Automotive, FMCG, Retail and Wholesale, Industrial, Healthcare and Pharma, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global plastic reusable packaging market is poised for substantial expansion, driven by the imperative for sustainable and efficient supply chain operations across diverse sectors. A primary catalyst for this growth is the escalating demand for eco-friendly alternatives to single-use plastics, amplified by heightened environmental consciousness. The burgeoning e-commerce landscape and the necessity for expedited, dependable delivery systems further bolster this trend, as reusable packaging offers superior durability and cost efficiencies over disposable options. Market leaders are actively pursuing innovation, developing lighter, more robust, and easily sanitized packaging solutions through advancements in material science, design, and logistics. The integration of circular economy principles is fostering synergistic partnerships among manufacturers, retailers, and logistics providers to establish comprehensive reusable packaging ecosystems. The market is segmented by packaging type (e.g., crates, bins, pallets), end-use industry (e.g., food & beverage, automotive, retail), and geographical regions.

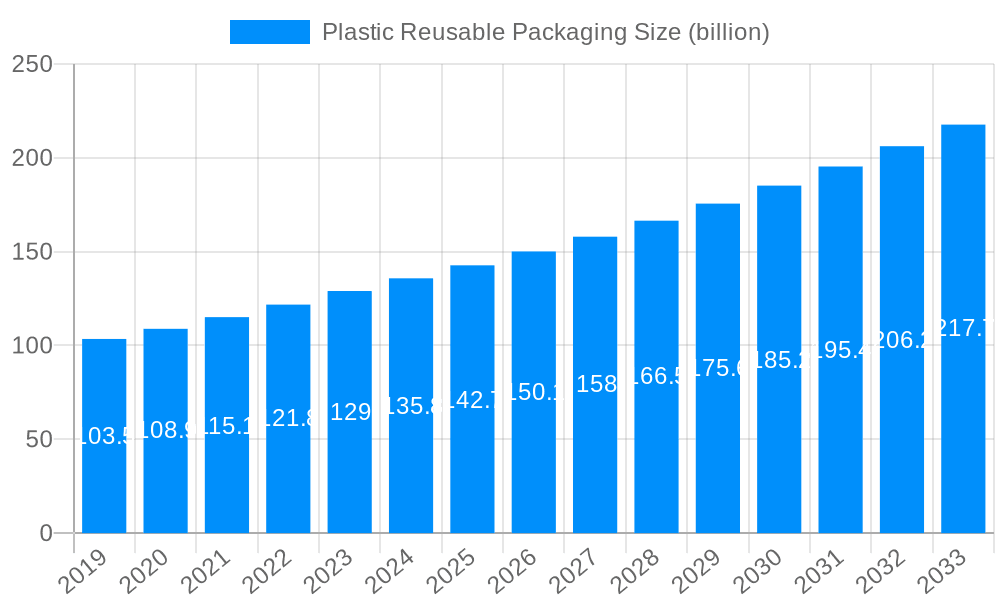

Notwithstanding the upward market trajectory, certain challenges persist. The significant upfront investment required for implementing reusable packaging systems can present a hurdle for smaller enterprises. Moreover, the establishment of effective cleaning and sanitization protocols is paramount for ensuring hygiene and preventing contamination. Stringent regulatory frameworks concerning material safety and recyclability also shape market dynamics. Despite these obstacles, the long-term prognosis for plastic reusable packaging remains exceptionally positive. The intensified focus on sustainability, complemented by technological progress and a growing recognition of the total cost-effectiveness of reusable systems, positions this market for considerable growth in the forthcoming years. We forecast sustained robust expansion, propelled by widespread industry adoption and supportive governmental initiatives advocating for sustainable packaging practices. The market is projected to reach $142.7 billion by 2025, exhibiting a compound annual growth rate (CAGR) of 6.1%.

The global plastic reusable packaging market is experiencing robust growth, driven by increasing environmental concerns and the rising demand for sustainable packaging solutions across various industries. The market, valued at several billion units in 2024, is projected to witness significant expansion during the forecast period (2025-2033), exceeding tens of billions of units by 2033. This surge is fueled by several key factors, including stringent regulations aimed at reducing single-use plastics, the growing adoption of circular economy principles by businesses, and the increasing awareness among consumers about environmentally friendly practices. The shift towards e-commerce and the consequent need for efficient and reliable packaging solutions further contributes to market expansion. The market is witnessing a diversification of product types, with manufacturers focusing on innovative designs that improve durability, hygiene, and ease of handling. Moreover, technological advancements, such as the use of advanced materials and intelligent tracking systems, are enhancing the efficiency and sustainability of reusable packaging systems. Competition is intense, with major players focusing on strategic partnerships, acquisitions, and geographic expansion to gain a larger market share. This report provides an in-depth analysis of the market, covering various segments, key players, and future growth prospects, offering invaluable insights for businesses operating within this dynamic landscape. The historical period (2019-2024) showcased steady growth, with the base year (2025) setting a strong foundation for future expansion. The estimated market value for 2025 is in the multi-billion-unit range, indicating the market's significant scale and potential for further growth.

Several key factors are driving the expansion of the plastic reusable packaging market. The escalating global concern regarding environmental pollution from single-use plastics is a significant catalyst. Governments worldwide are introducing stringent regulations and bans on single-use plastics, incentivizing businesses to adopt more sustainable alternatives. This regulatory pressure is complemented by growing consumer demand for eco-friendly products, putting pressure on companies to demonstrate their commitment to sustainability. The rise of the circular economy, emphasizing resource efficiency and waste reduction, further supports the adoption of reusable packaging. Businesses are increasingly recognizing the cost-effectiveness of reusable packaging in the long run, as it reduces material costs and waste disposal fees. Moreover, the growth of e-commerce has created a demand for robust and efficient packaging solutions capable of withstanding the rigors of transportation and handling. Reusable plastic packaging provides a durable and reliable solution compared to its single-use counterparts, further accelerating its adoption across various industries. The trend toward supply chain optimization also favors reusable packaging, enhancing efficiency and traceability within logistics networks.

Despite the significant growth potential, the plastic reusable packaging market faces certain challenges. High upfront investment costs associated with transitioning to reusable systems can be a barrier for smaller businesses. The need for efficient and reliable cleaning and sanitization processes for reusable containers presents a logistical hurdle. Concerns about the potential for cross-contamination also need to be addressed through robust hygiene protocols. Furthermore, the durability and longevity of reusable plastic packaging may be affected by repeated use and cleaning, potentially reducing their lifespan and overall sustainability benefits. The complexity of establishing efficient reverse logistics systems for collecting and returning used containers poses another challenge. Fluctuations in raw material prices and potential supply chain disruptions can impact the cost-effectiveness of reusable packaging. Finally, consumer behavior and awareness levels regarding the proper use and disposal of reusable packaging can influence market adoption. Overcoming these challenges requires collaboration among stakeholders, including manufacturers, retailers, consumers, and policymakers.

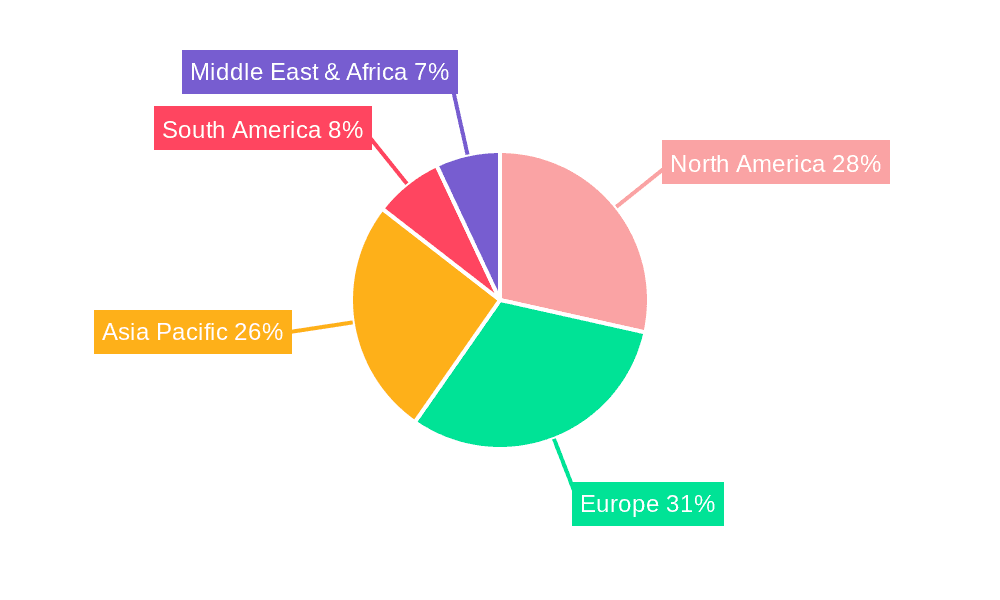

The plastic reusable packaging market exhibits significant regional variations, with North America and Europe currently leading in adoption due to stringent environmental regulations and strong consumer awareness of sustainability issues. However, Asia-Pacific is expected to witness the fastest growth rate in the coming years, driven by rapid economic expansion and increasing industrialization. Within specific segments, the food and beverage industry is a major driver of demand, followed by the retail and e-commerce sectors. The healthcare and pharmaceutical industries are also increasingly adopting reusable packaging solutions to maintain hygiene and product integrity.

These regions and segments are poised for substantial growth due to factors such as increasing regulatory pressure, rising consumer demand for sustainable solutions, and industry-specific requirements for hygienic and durable packaging. The ongoing focus on improving supply chain efficiency and reducing environmental impact will further propel the market in these key areas.

The plastic reusable packaging industry is experiencing a surge due to a confluence of factors. Stringent government regulations promoting sustainability, coupled with heightened consumer awareness of environmental issues, are compelling businesses to shift from single-use to reusable alternatives. The inherent cost-effectiveness of reusable systems in the long run, compared to the continuous expense of single-use packaging, also contributes significantly. Furthermore, advancements in materials science are yielding more durable and easily cleanable plastic containers, extending their lifespan and enhancing their overall sustainability profile.

This report provides a thorough overview of the plastic reusable packaging market, analyzing key trends, drivers, challenges, and growth opportunities. It examines the market across various segments and regions, offering detailed insights into the competitive landscape and future prospects. The report is essential for businesses seeking to understand the market dynamics and make informed strategic decisions related to reusable packaging. It leverages comprehensive data analysis spanning the historical period (2019-2024), the base year (2025), and provides detailed forecasts up to 2033. The report also presents valuable information regarding key players, their market share, and their strategic initiatives.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.1%.

Key companies in the market include Brambles, ORBIS, IFCO, Schoeller Allibert, DS Smith, Schutz, Tosca, Cabka Group, Rehrig Pacific Company, Craemer Group, IPL Plastics, Monoflo International, LOSCAM, Greystone Logistics, HOREN Group, Mpact Limited, Buckhorn, RPP Containers, .

The market segments include Type, Application.

The market size is estimated to be USD 142.7 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Plastic Reusable Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Plastic Reusable Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.