1. What is the projected Compound Annual Growth Rate (CAGR) of the Plastic Closures for Food and Beverage?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Plastic Closures for Food and Beverage

Plastic Closures for Food and BeveragePlastic Closures for Food and Beverage by Type (PP Closure, PE Closure, Other), by Application (Food, Beverage), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

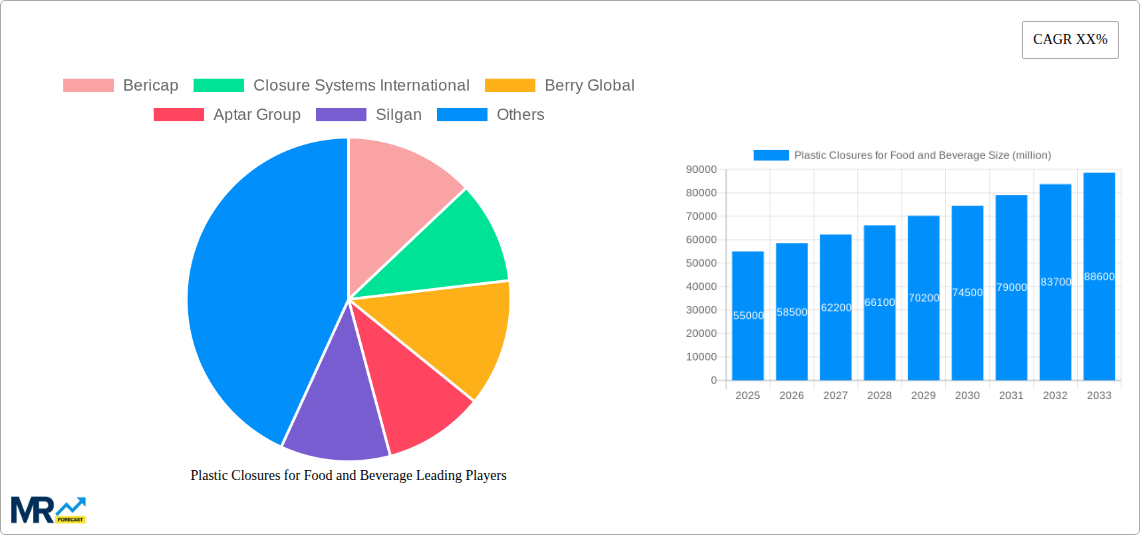

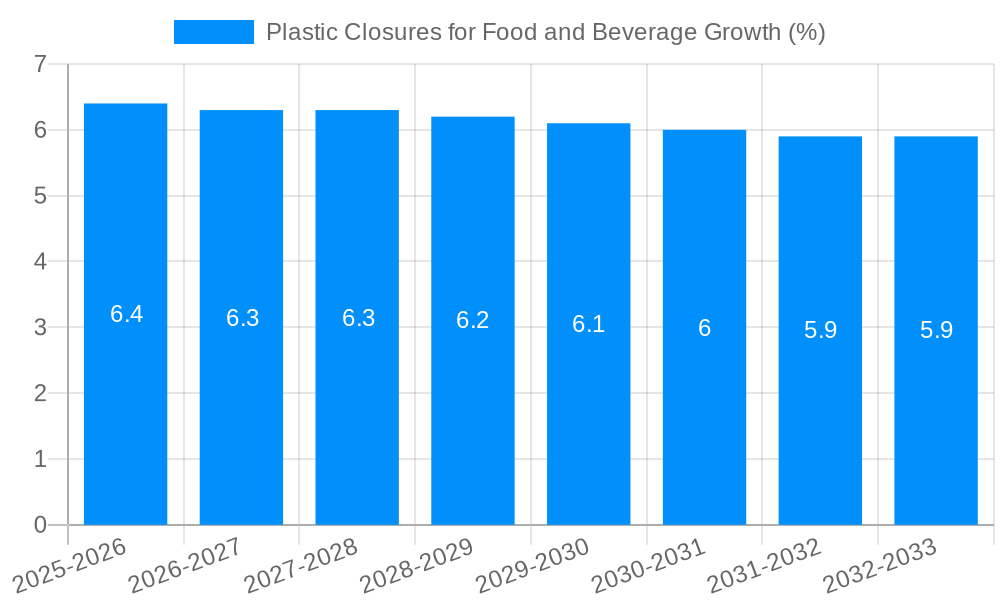

The global plastic closures for food and beverage market is poised for substantial growth, projected to reach an estimated market size of USD 55,000 million by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025-2033. This robust expansion is fueled by a confluence of dynamic drivers, including the ever-increasing global demand for packaged food and beverages, driven by population growth, urbanization, and changing consumer lifestyles that favor convenience. The convenience offered by resealable and tamper-evident plastic closures plays a pivotal role in extending product shelf life, minimizing spoilage, and enhancing consumer safety, thereby solidifying their indispensable position in the supply chain. Furthermore, advancements in material science and manufacturing technologies are enabling the development of innovative and sustainable plastic closure solutions, such as those made from recycled or bio-based plastics, which are gaining traction among environmentally conscious consumers and regulatory bodies. The continuous innovation in closure designs, focusing on ease of use, child-resistance, and enhanced functionality, also contributes significantly to market penetration across diverse applications.

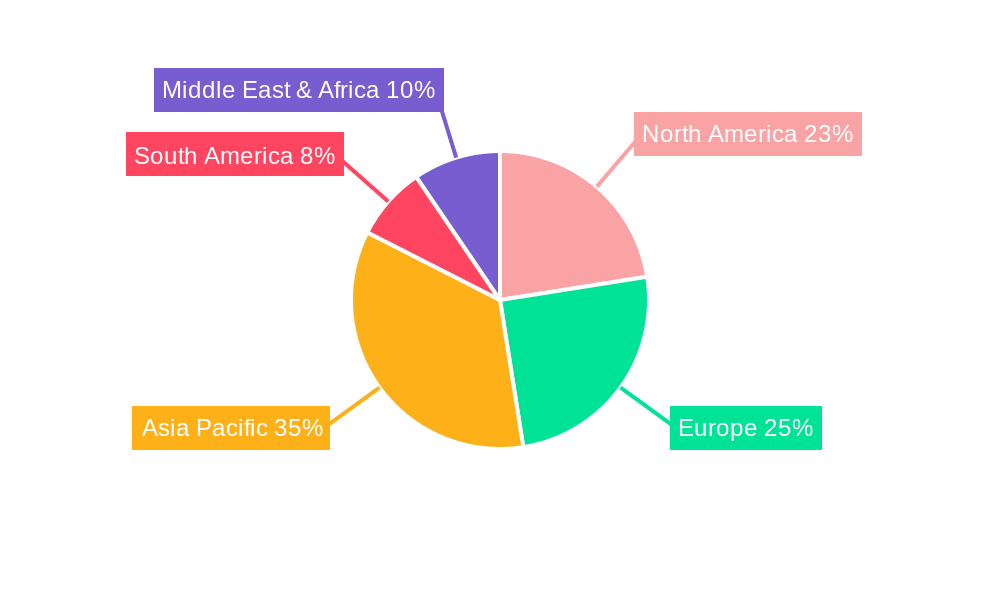

The market segmentation reveals a significant dominance of PE Closures due to their versatility, cost-effectiveness, and excellent sealing properties, making them a preferred choice for a wide array of food and beverage products. Within applications, the Beverage segment commands the largest share, propelled by the immense volume of bottled water, soft drinks, juices, and alcoholic beverages. However, the Food segment is also experiencing considerable growth, driven by the demand for packaged dairy products, sauces, condiments, and edible oils. Geographically, Asia Pacific is emerging as the fastest-growing region, attributed to its burgeoning middle class, increasing disposable incomes, and a rapidly expanding food and beverage industry, particularly in countries like China and India. North America and Europe remain mature but significant markets, characterized by a strong focus on premiumization, sustainability, and technological innovation. While the market demonstrates strong upward momentum, potential restraints such as volatile raw material prices, stringent environmental regulations concerning plastic waste, and the growing consumer preference for alternative packaging solutions could present challenges, necessitating a continued focus on innovation and sustainable practices.

This report provides a comprehensive analysis of the global plastic closures market for food and beverage applications. Covering the historical period from 2019 to 2024, the base year of 2025, and a detailed forecast for the period 2025-2033, this study offers unparalleled insights into market dynamics, key players, and future trajectories. The market is analyzed in terms of volume in million units, providing a granular understanding of demand and supply.

The plastic closures for food and beverage market is experiencing a dynamic evolution, driven by a confluence of consumer preferences, regulatory landscapes, and technological advancements. A key trend is the increasing demand for lightweight yet durable closures that enhance product integrity and shelf life. Consumers, particularly in emerging economies, are showing a strong preference for convenient and tamper-evident packaging solutions, directly impacting the design and functionality of plastic closures. The growing emphasis on sustainability is also a significant shaper of trends. This manifests in the rising adoption of recycled content in closure manufacturing and the development of mono-material solutions that facilitate easier recycling. For instance, the demand for PP closures is projected to witness substantial growth, driven by their excellent chemical resistance, heat stability, and recyclability. Similarly, PE closures continue to hold a strong position due to their flexibility, cost-effectiveness, and wide range of applications. The beverage segment, encompassing everything from carbonated soft drinks and bottled water to juices and dairy beverages, represents the largest application area, demanding a diverse array of closure types to meet specific product requirements, such as secure sealing for carbonated drinks and easy-open features for dairy products. The food industry, while slightly smaller in volume, presents its own set of evolving needs, with a growing focus on closures for ready-to-eat meals, sauces, and spreads, where freshness and portion control are paramount. The market's overall trajectory is characterized by a steady upward trend, with an estimated market size of XXX million units in the base year of 2025, projected to expand significantly by 2033. This growth is underpinned by increasing global food and beverage consumption, coupled with the persistent need for reliable and aesthetically pleasing packaging. Industry developments, such as the introduction of smart closures with enhanced traceability features and innovative dispensing mechanisms, are further contributing to market dynamism, anticipating a market size of XXX million units by 2033.

Several potent forces are propelling the growth of the plastic closures for food and beverage market. Foremost among these is the ever-increasing global population and the subsequent rise in demand for packaged food and beverages. As urbanization accelerates and disposable incomes rise, particularly in developing regions, the consumption of convenience foods and beverages, which heavily rely on secure and user-friendly packaging, escalates. Furthermore, the beverage industry, a primary consumer of plastic closures, continues its robust expansion, fueled by a growing demand for bottled water, juices, and other non-alcoholic drinks, all of which necessitate effective sealing solutions. The inherent advantages of plastic closures, such as their lightweight nature, cost-effectiveness, excellent sealing properties, and resistance to corrosion, make them the preferred choice for a vast majority of food and beverage products. The ongoing innovation in closure design and functionality, including the development of tamper-evident features, child-resistant mechanisms, and dispensing closures, also plays a crucial role in driving market adoption. These advancements not only enhance product safety and consumer convenience but also contribute to brand differentiation and consumer appeal. The shift towards smaller, on-the-go packaging formats, especially for beverages, further amplifies the demand for specialized and efficient plastic closure solutions.

Despite the robust growth, the plastic closures for food and beverage market faces several significant challenges and restraints. The most prominent among these is the mounting pressure from environmental regulations and consumer concerns regarding plastic waste. Governments worldwide are implementing stricter policies aimed at reducing single-use plastics, promoting recycling, and encouraging the use of sustainable alternatives. This has led to increased scrutiny of plastic closures, driving the need for more eco-friendly materials and designs. The fluctuating prices of raw materials, primarily petrochemicals, pose another substantial challenge. Volatility in crude oil prices directly impacts the cost of producing plastic resins, leading to unpredictable manufacturing expenses and potentially affecting profit margins for closure manufacturers. The increasing demand for sustainable packaging also necessitates significant investment in research and development for innovative materials and manufacturing processes, which can be a considerable financial burden for smaller players in the market. Moreover, the development and adoption of alternative packaging materials, such as glass or metal, in certain niche applications, although currently limited, could pose a long-term threat to the market share of plastic closures. Counterfeit products and the associated risks of substandard closures can also damage consumer trust and brand reputation, necessitating stringent quality control measures.

The Asia Pacific region is poised to dominate the plastic closures for food and beverage market, driven by a potent combination of factors, including a massive and growing population, rapid economic development, and increasing per capita consumption of packaged food and beverages. Countries like China and India, with their vast consumer bases and expanding middle class, are at the forefront of this dominance. The increasing urbanization and changing lifestyles in these regions have led to a surge in demand for convenience foods and beverages, which in turn fuels the need for reliable and accessible packaging solutions, including plastic closures. Furthermore, the significant presence of food and beverage manufacturing hubs within the Asia Pacific, coupled with a growing export market for packaged goods, solidifies its leadership position.

Within this dynamic regional landscape, the Beverage application segment is the most dominant force in the plastic closures market. This dominance is attributed to the sheer volume of beverages consumed globally and the critical role of closures in ensuring product integrity, preventing spoilage, and maintaining the effervescence of carbonated drinks. The bottled water industry alone accounts for a substantial portion of beverage consumption, and each bottle requires a closure. Similarly, the burgeoning demand for juices, dairy drinks, and soft drinks across all demographics further amplifies the need for a diverse range of beverage closures.

Delving deeper into the Type segments, the PP Closure segment is expected to witness exceptional growth and a significant market share. Polypropylene (PP) closures offer a compelling blend of properties that make them highly suitable for a wide array of food and beverage applications. Their excellent chemical resistance ensures that they do not react with the contents of the bottle or container, preserving the taste and quality of the product. PP also exhibits superior heat resistance, making it ideal for closures used in hot-fill applications or sterilization processes. Furthermore, PP closures are known for their good mechanical strength, providing a secure and reliable seal against leaks and contamination. The recyclability of PP is a crucial advantage, aligning with the growing global emphasis on sustainable packaging solutions. As manufacturers increasingly seek to reduce their environmental footprint and comply with regulations, the adoption of PP closures, especially those incorporating recycled PP content, is set to accelerate. Their versatility allows them to be used in various closure designs, including screw caps, flip-top caps, and tamper-evident closures, catering to the diverse needs of the food and beverage industry.

Paragraph Form Explanation:

The Asia Pacific region is firmly establishing its leadership in the global plastic closures for food and beverage market. This ascendancy is fueled by the region's colossal population and the accompanying surge in demand for packaged food and drinks. As economies grow and urbanization intensifies, particularly in powerhouses like China and India, consumers are increasingly opting for convenient, ready-to-consume food and beverage options. This dietary shift directly translates into a higher requirement for effective and accessible packaging, with plastic closures playing a pivotal role. Moreover, the Asia Pacific has become a manufacturing powerhouse for the food and beverage industry, serving both its burgeoning domestic markets and significant international export demands, further cementing its dominance in closure consumption.

Within this vast market, the Beverage application segment stands out as the primary driver of closure demand. The global thirst for bottled water, juices, carbonated soft drinks, and dairy beverages means that a colossal number of closures are required annually. The integrity of these seals is paramount for product freshness, preventing leakage, and, in the case of carbonated drinks, preserving essential effervescence. The sheer scale of beverage production and consumption worldwide makes this segment the undisputed leader in the plastic closures market.

Focusing on the Type segments, PP Closures are emerging as a dominant and rapidly growing category. Polypropylene's inherent characteristics—robust chemical resistance, high heat tolerance, and mechanical strength—make it an ideal material for a broad spectrum of food and beverage applications, ensuring product quality and safety. Crucially, PP's recyclability aligns perfectly with the global push towards sustainability. As regulatory pressures mount and consumer demand for eco-conscious products intensifies, the preference for PP closures, especially those incorporating recycled content, is projected to soar. Their adaptability across various closure designs further enhances their appeal, allowing them to meet the diverse and evolving needs of the food and beverage industry.

The growth of the plastic closures for food and beverage industry is significantly catalyzed by the burgeoning demand for packaged goods across emerging economies, driven by rising disposable incomes and urbanization. The continuous innovation in closure technology, focusing on enhanced safety features like tamper-evidence and child resistance, as well as improved functionality for dispensing and resealing, directly contributes to market expansion. The increasing popularity of convenience foods and beverages, requiring reliable and user-friendly packaging, is another key growth accelerator. Furthermore, the ongoing shift towards smaller, single-serving packaging formats, especially in the beverage sector, necessitates a higher volume of closures, thus driving market growth.

This report offers a comprehensive and in-depth analysis of the global plastic closures market for food and beverage applications. It delves into market size, segmentation by type (PP, PE, Other) and application (Food, Beverage), and regional dynamics. The study meticulously examines market trends, driving forces, and challenges, providing a holistic understanding of the industry's landscape. It also identifies growth catalysts and leading players, offering strategic insights for stakeholders. The forecast period (2025-2033) is meticulously analyzed, considering the impact of evolving consumer preferences, regulatory changes, and technological advancements, ensuring that the report provides actionable intelligence for businesses operating within or looking to enter this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Bericap, Closure Systems International, Berry Global, Aptar Group, Silgan, ALPLA, THC, Mold Rite Plastics, Oriental Containers, Zijiang, Jinfu, Zhuhai Zhongfu, Blackhawk Molding, Mocap, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Plastic Closures for Food and Beverage," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Plastic Closures for Food and Beverage, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.