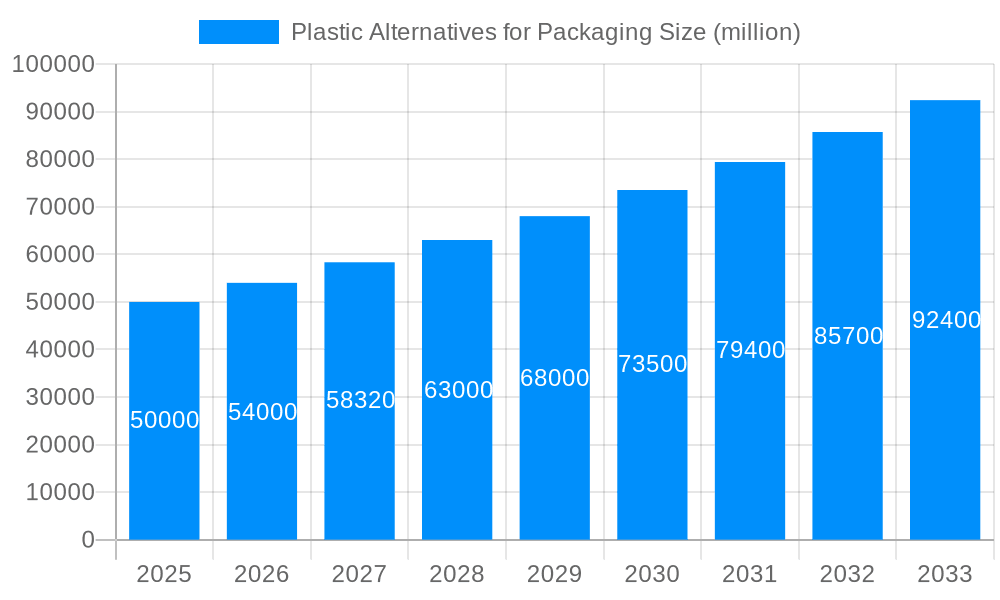

1. What is the projected Compound Annual Growth Rate (CAGR) of the Plastic Alternatives for Packaging?

The projected CAGR is approximately 19.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Plastic Alternatives for Packaging

Plastic Alternatives for PackagingPlastic Alternatives for Packaging by Application (Food and Drinks, Personal Care, Medical Insurance, Other), by Type (Starch Based Plastic, Cellulose-based Plastics, Polylactic Acid(PLA), Polyhydroxyalkanoate (PHA), Other Types, World Plastic Alternatives for Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

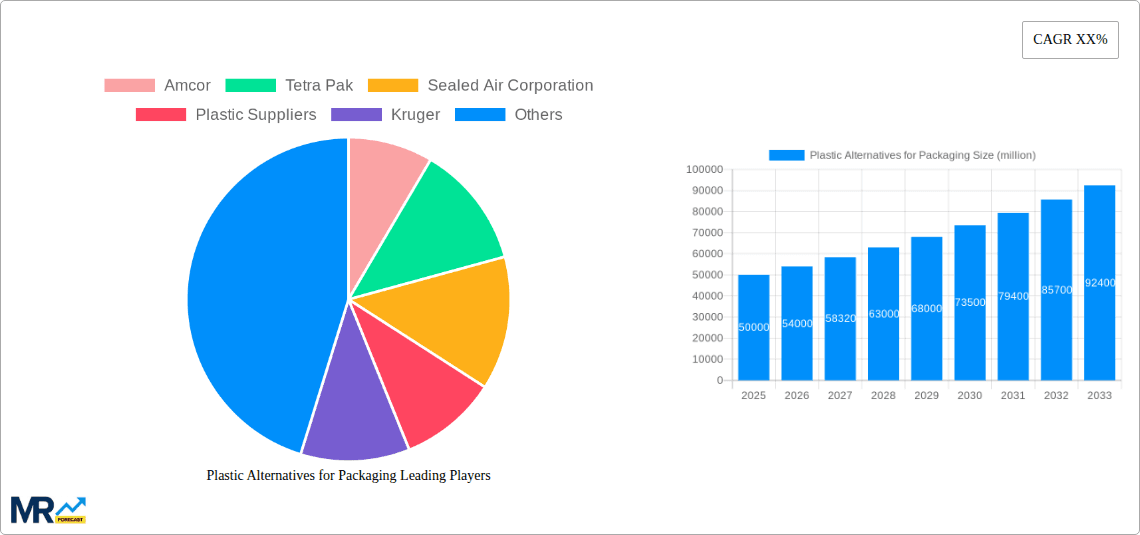

The global plastic alternatives in packaging market is poised for significant expansion, driven by heightened environmental consciousness, robust regulatory frameworks addressing plastic waste, and a discernible consumer shift towards sustainable product choices. This market, valued at $9.1 billion in 2025, is forecast to achieve a Compound Annual Growth Rate (CAGR) of 19.1% from 2025 to 2033, reaching an estimated $9.1 billion by the end of the forecast period. Key growth drivers include the increasing integration of biodegradable and compostable materials such as paper, cardboard, and plant-derived polymers. Furthermore, advancements in material science are enhancing the performance and cost-efficiency of these alternatives, alongside amplified investments in research and development within the packaging sector to foster innovative, eco-friendly solutions. Leading industry participants like Amcor, Tetra Pak, and Smurfit Kappa are instrumental in the development and market introduction of these sustainable alternatives, thereby accelerating their adoption.

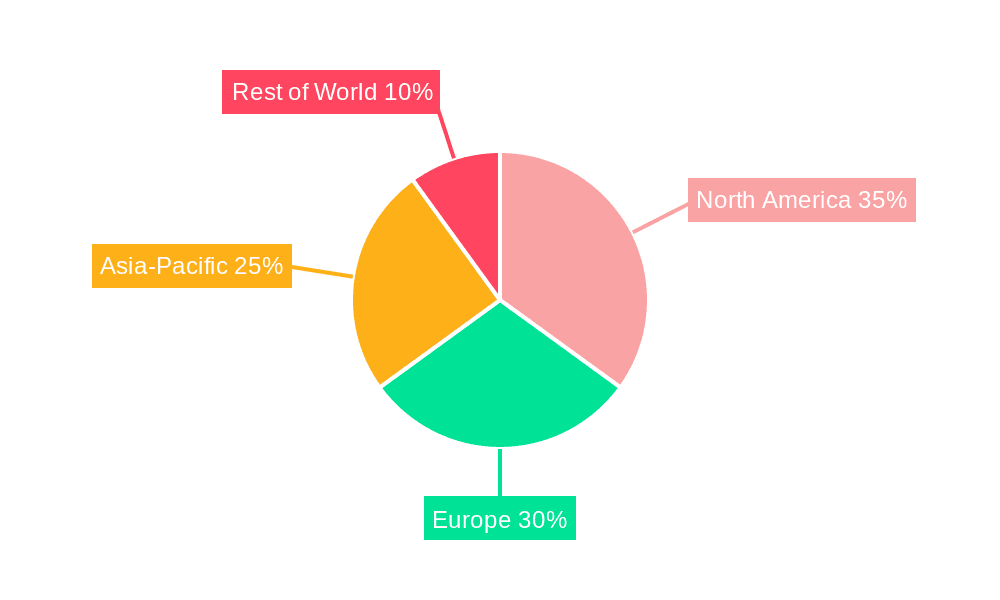

Despite inherent challenges, including the comparatively higher cost of certain alternatives versus traditional plastics and the imperative for enhanced infrastructure for the collection and processing of compostable materials, the long-term trajectory for plastic alternatives in packaging remains overwhelmingly positive. Escalating global awareness regarding the adverse environmental and health impacts of plastic pollution serves as a powerful impetus for this transition. Government initiatives promoting sustainability and circular economy principles are further reinforcing the move towards environmentally responsible packaging solutions. Market segmentation highlights substantial growth across diverse material categories, including paperboard, bioplastics, and other compostable options, each addressing specific packaging requirements and applications. Geographically, North America and Europe currently lead market share, with Asia-Pacific expected to witness accelerated growth in the near future, propelled by increasing demand and evolving environmental regulations in developing economies. This dynamic market landscape presents considerable opportunities for enterprises dedicated to sustainable practices and pioneering solutions.

The global plastic alternatives for packaging market is experiencing a period of significant transformation, driven by escalating environmental concerns and stringent regulations aimed at reducing plastic waste. The study period from 2019-2033 reveals a burgeoning demand for sustainable packaging solutions, with a projected market value exceeding several billion units by 2033. Key market insights indicate a strong preference for biodegradable, compostable, and recyclable materials. The shift is not merely driven by consumer pressure but also by proactive measures taken by brands seeking to enhance their environmental credentials and comply with evolving legislation. This transition involves a complex interplay of factors. Firstly, the development of technologically advanced bio-based polymers and innovative paper-based packaging is accelerating. Secondly, the rising cost of virgin plastic and the instability of fossil fuel prices are making alternative materials increasingly economically viable. Thirdly, advancements in recycling technologies are increasing the recyclability rates of alternative packaging materials, further bolstering their appeal. The estimated year 2025 marks a pivotal point, showing the market is maturing beyond initial adoption and moving towards wider integration across various sectors. The forecast period (2025-2033) points towards sustained growth, fueled by continued innovation and increased consumer awareness. Analyzing the historical period (2019-2024) demonstrates a clear upward trajectory, setting the stage for the anticipated exponential growth in the coming years. The base year of 2025 serves as a strong foundation for future projections, showcasing the market's robustness and potential for further expansion. This report delves into the specifics of this transition, examining the various alternative materials, their applications, and the challenges and opportunities they present.

Several powerful forces are accelerating the adoption of plastic alternatives in the packaging industry. Growing consumer awareness of the devastating environmental impact of plastic pollution is a primary driver. Consumers increasingly demand eco-friendly products and packaging, influencing purchasing decisions and pushing businesses towards sustainability. Simultaneously, governments worldwide are implementing stricter regulations on plastic use, including bans on single-use plastics and extended producer responsibility (EPR) schemes. These regulations create a compelling economic incentive for businesses to transition to more sustainable alternatives. Furthermore, advancements in materials science are leading to the development of innovative and cost-effective alternatives to traditional plastics. Bio-based polymers derived from renewable resources, such as starch and cellulose, are becoming increasingly viable options. Improved recycling technologies are also playing a crucial role, increasing the efficiency and cost-effectiveness of recycling programs and making alternative packaging more attractive. The rising cost of raw materials for conventional plastic packaging, coupled with the fluctuating prices of fossil fuels, further contributes to the economic feasibility of alternative solutions. This confluence of factors – consumer pressure, governmental regulations, technological advancements, and economic considerations – ensures that the shift towards plastic alternatives in packaging is not just a trend but a fundamental and irreversible change within the industry.

Despite the significant growth potential, the transition to plastic alternatives faces several challenges. One major hurdle is the cost-competitiveness of traditional plastics. While the price gap is narrowing, many alternatives remain more expensive to produce, potentially impacting affordability for some products and hindering wider adoption, particularly in price-sensitive markets. Secondly, the performance characteristics of some alternative materials may not always match those of conventional plastics. Concerns regarding barrier properties, durability, and shelf life are prevalent, potentially requiring modifications to existing packaging designs and processes. Furthermore, the scalability of production for some innovative materials is still a significant challenge. The infrastructure for large-scale manufacturing of certain bio-based polymers, for example, may not be fully developed, limiting the supply and driving up costs. Finally, the lack of standardized testing and certification protocols for alternative materials can create uncertainty and hinder market acceptance. Establishing clear and consistent standards for biodegradability, compostability, and recyclability is crucial to ensuring consumer trust and facilitating widespread adoption across the industry. Addressing these challenges requires collaboration between material suppliers, packaging manufacturers, retailers, and policymakers to foster innovation and build a robust and sustainable packaging ecosystem.

The plastic alternatives for packaging market is geographically diverse, with several regions experiencing significant growth. However, North America and Europe are currently leading the charge, driven by stringent environmental regulations, high consumer awareness, and a strong presence of innovative companies. Within these regions, specific countries like the United States, Germany, and the United Kingdom are showing particularly robust growth. The Asia-Pacific region, while currently exhibiting slower growth compared to the West, demonstrates immense potential for the future, given its rapidly expanding consumer base and increasing focus on environmental sustainability.

Segments: The food and beverage sector is a major driver of demand for plastic alternatives, followed by the personal care and cosmetics industries. The growth of e-commerce further fuels the need for sustainable packaging solutions for shipping and delivery.

The dominance of specific segments and regions will continue to evolve, shaped by a variety of factors, including technological advancements, evolving regulatory landscapes, and shifting consumer preferences.

Several factors are acting as catalysts for rapid growth in this sector. First and foremost is the increasing consumer preference for sustainable and eco-friendly products, creating strong market pull. Governmental regulations are acting as significant push factors, incentivizing the transition through bans on certain plastics and financial support for green initiatives. Technological advancements, particularly in bio-based polymers and advanced recycling technologies, are expanding the range of viable and cost-effective alternatives. Finally, collaborative efforts between businesses, researchers, and policymakers are fostering innovation and accelerating the overall pace of market development. These converging forces are propelling the industry toward a future where sustainable packaging is not merely an option but a necessity.

This report offers a detailed and comprehensive analysis of the plastic alternatives for packaging market, providing valuable insights for businesses, investors, and policymakers. It covers key trends, drivers, challenges, market segmentation, regional analysis, and profiles of leading players in the industry. This in-depth study utilizes a robust methodology and incorporates data from both primary and secondary research sources to provide a reliable and accurate view of this dynamic and rapidly evolving market. The information provided is crucial for strategic decision-making in the context of the increasing global shift towards sustainable packaging solutions.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 19.1%.

Key companies in the market include Amcor, Tetra Pak, Sealed Air Corporation, Plastic Suppliers, Kruger, Mondi, International Paper Company, Smurfit Kappa Group, DS Smith, Klabin SA.

The market segments include Application, Type.

The market size is estimated to be USD 9.1 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Plastic Alternatives for Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Plastic Alternatives for Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.