1. What is the projected Compound Annual Growth Rate (CAGR) of the Plant-Based Vitamin?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Plant-Based Vitamin

Plant-Based VitaminPlant-Based Vitamin by Type (Vitamin C, Vitamin A, Vitamin E, Multi-Vitamins, Others), by Application (Online Sales, Offline Sales), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

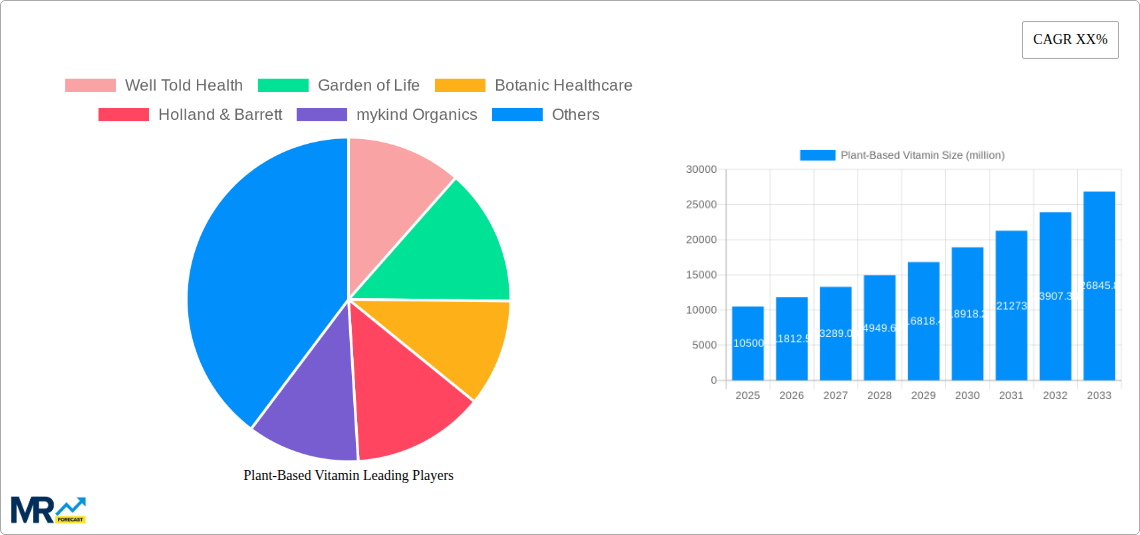

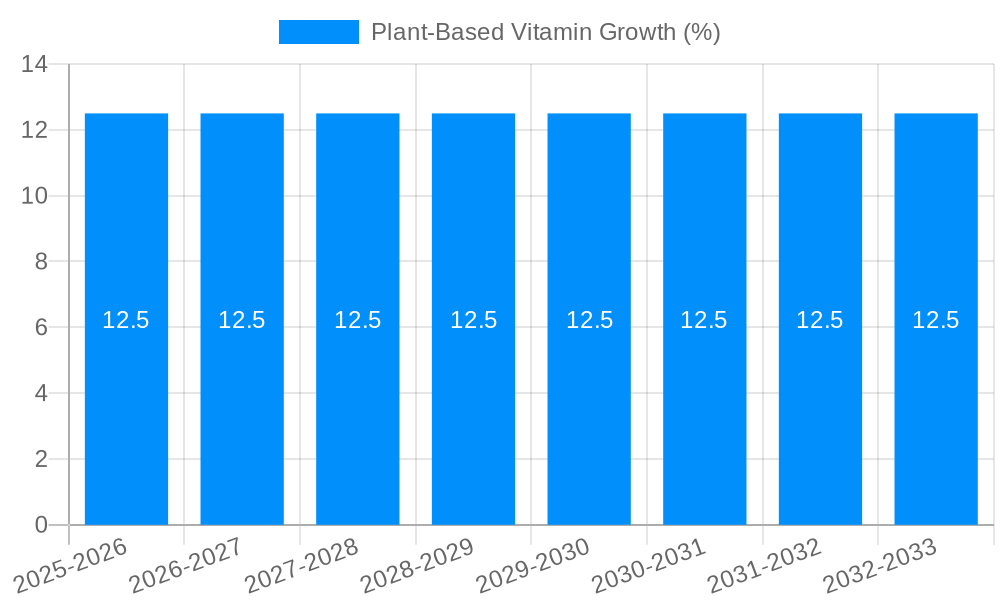

The global plant-based vitamin market is poised for significant expansion, projected to reach an estimated $10,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 12.5% anticipated through 2033. This remarkable growth is primarily fueled by a surging consumer demand for natural and sustainable health solutions. The increasing awareness of the benefits associated with plant-derived nutrients, coupled with a growing prevalence of dietary restrictions and allergies to animal-derived ingredients, are key drivers. Consumers are actively seeking alternatives that align with their ethical and environmental values, making plant-based vitamins a preferred choice. The market's dynamism is further propelled by innovation in product formulations and ingredient sourcing, ensuring efficacy and bioavailability. The "free-from" movement, emphasizing the absence of artificial additives, GMOs, and allergens, is a dominant trend, resonating strongly with health-conscious individuals. This shift towards clean label products solidifies the appeal of plant-based vitamins as a trustworthy and health-promoting option, driving substantial market value.

The market for plant-based vitamins is characterized by a diverse range of product offerings and evolving distribution channels. Key vitamin segments like Vitamin C, Vitamin A, and Vitamin E, alongside multi-vitamins, are experiencing consistent demand, driven by their well-established health benefits. However, the "Others" segment, likely encompassing emerging or specialized plant-derived nutrients, is also demonstrating significant growth potential as research uncovers new applications. While offline sales continue to hold a considerable share, the online sales channel is rapidly gaining traction, offering convenience and a wider selection to consumers. This digital transformation is enabling brands to reach a broader audience and engage directly with customers. Despite the optimistic outlook, certain restraints, such as the perceived higher cost of some plant-based ingredients and the need for greater consumer education on bioavailability, could temper growth in specific niches. Nevertheless, the overarching trend towards holistic wellness and proactive health management, combined with the increasing availability of plant-based options, ensures a dynamic and expanding market landscape for plant-based vitamins in the coming years.

Here is a unique report description on Plant-Based Vitamins, structured as requested, with the inclusion of provided data points and company names:

The global plant-based vitamin market is experiencing a dynamic surge, evolving from a niche segment to a mainstream dietary staple. During the study period of 2019-2033, the market has witnessed substantial growth, with the base year of 2025 projecting significant expansion and the forecast period of 2025-2033 indicating sustained momentum. The historical period of 2019-2024 laid the groundwork for this acceleration, characterized by increasing consumer awareness of health and wellness, coupled with a growing ethical and environmental consciousness. This confluence of factors has fundamentally reshaped dietary supplement preferences, pushing demand towards naturally derived, sustainable, and ethically sourced options. Consumers are actively seeking alternatives to synthetic vitamins, driven by concerns about potential side effects, perceived lower bioavailability, and the environmental impact associated with conventional vitamin production. The rising prevalence of chronic diseases and the desire for preventative health measures further bolster the adoption of plant-based vitamins as a proactive approach to well-being.

The market's evolution is also marked by innovation in formulation and delivery systems. Manufacturers are increasingly focusing on creating comprehensive multi-vitamins derived entirely from plant sources, addressing the demand for complete nutritional support without compromise. Furthermore, specialized single-nutrient vitamins, such as Vitamin C, Vitamin A, and Vitamin E, derived from potent botanical extracts, are gaining traction. The application landscape is similarly diversifying, with Online Sales emerging as a dominant channel due to its convenience, accessibility, and the ability to reach a broader consumer base. However, Offline Sales through pharmacies, health food stores, and supermarkets continue to hold significant ground, especially in regions with established retail infrastructure. The growing interest in personalized nutrition and the development of vegan and vegetarian lifestyle certifications have further validated and propelled the plant-based vitamin category. Industry players are investing heavily in research and development to enhance the efficacy, absorption, and palatability of their products, ensuring they meet the sophisticated demands of health-conscious consumers. This trend indicates a long-term shift in the supplement industry, where sustainability, ethical sourcing, and natural ingredients are no longer add-ons but core expectations.

The plant-based vitamin market is experiencing robust growth, propelled by a multifaceted array of driving forces. Foremost among these is the escalating consumer awareness and adoption of vegan and vegetarian diets, a trend directly translating into a demand for supplements that align with these lifestyle choices. This dietary shift is underpinned by increasing concerns regarding animal welfare, environmental sustainability, and the perceived health benefits of plant-centric eating. Furthermore, the growing apprehension surrounding the potential health implications and synthetic nature of conventionally produced vitamins is a significant catalyst. Consumers are actively seeking out 'clean label' products, prioritizing transparency in ingredients and ethical sourcing. The rising incidence of lifestyle-related chronic diseases and a proactive approach to health management further fuel the demand for supplements that support overall well-being. This includes a focus on immune support, energy levels, and cognitive function, all areas where plant-based vitamins are being marketed as effective solutions. Technological advancements in extraction and formulation are also playing a crucial role, enabling the production of highly bioavailable and potent plant-derived vitamins, thereby overcoming historical limitations and enhancing consumer confidence.

Despite the promising trajectory, the plant-based vitamin market is not without its hurdles. A primary challenge lies in the perceived cost premium associated with plant-based ingredients compared to their synthetic counterparts. The complex extraction processes, sourcing of specific botanical materials, and stringent quality control measures often contribute to higher manufacturing costs, which can be reflected in the retail price, potentially deterring price-sensitive consumers. Another significant restraint is the potential for variability in nutrient content and bioavailability inherent in natural sources. Unlike precisely synthesized vitamins, the concentration of active compounds in plant-based ingredients can fluctuate based on factors like growing conditions, harvest time, and processing methods. Ensuring consistent potency and optimal absorption requires sophisticated formulation and rigorous testing, which adds to the complexity and expense. Furthermore, the limited availability of certain plant-derived nutrients in sufficient quantities to meet widespread demand can pose a supply chain challenge. Educating consumers about the efficacy and equivalence of plant-based vitamins compared to synthetic options remains an ongoing effort. Lastly, regulatory scrutiny and the need for clear, scientifically substantiated claims can also act as a restraint, requiring substantial investment in research and clinical trials to validate product benefits.

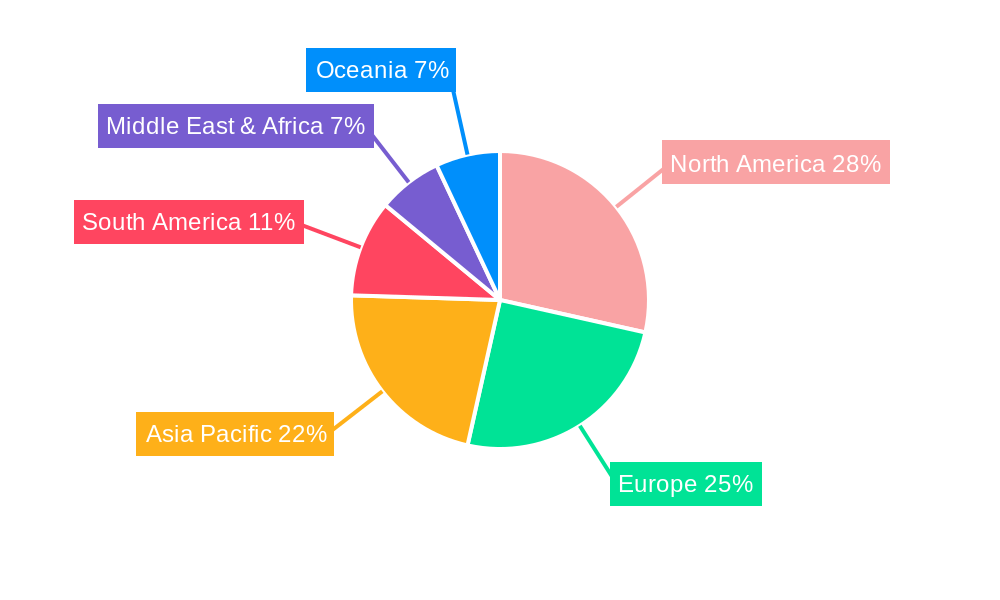

The global plant-based vitamin market is poised for significant growth, with specific regions and product segments expected to lead this expansion. From a regional perspective, North America, particularly the United States, is anticipated to be a dominant force. This leadership is attributed to a mature and health-conscious consumer base with a high awareness of veganism, vegetarianism, and the benefits of natural supplements. The strong presence of key industry players and a well-developed e-commerce infrastructure further solidifies its leading position. Western European countries, including Germany, the United Kingdom, and France, are also projected to exhibit substantial market share. These regions benefit from a growing vegan population, increasing environmental consciousness, and robust regulatory frameworks that support the growth of the health and wellness sector. The strong emphasis on organic and natural products within these markets further amplifies the appeal of plant-based vitamins.

In terms of product segments, Multi-Vitamins are expected to emerge as the most dominant category within the plant-based vitamin market. This dominance stems from the consumer desire for comprehensive nutritional support in a single, convenient product. As awareness of the multifaceted benefits of a plant-based lifestyle grows, individuals are increasingly seeking to ensure they are meeting all their nutritional needs without relying on animal-derived ingredients. Plant-based multi-vitamins offer a holistic solution that caters to this demand, providing a blend of essential vitamins and minerals derived from a variety of botanical sources. The ability of these formulations to address deficiencies often associated with restrictive diets, coupled with their perceived gentleness on the digestive system, makes them highly attractive to a broad consumer base.

The Online Sales application channel is also set to be a significant driver of market dominance. The convenience of purchasing health supplements from the comfort of one's home, coupled with the wider selection available online, makes this channel increasingly popular. E-commerce platforms provide consumers with easy access to a plethora of plant-based vitamin brands and products, often accompanied by detailed product information, customer reviews, and competitive pricing. This digital accessibility allows smaller and niche brands to reach a wider audience, fostering innovation and competition within the market. The increasing penetration of internet access and smartphone usage globally further amplifies the reach and impact of online sales.

Several key factors are acting as potent growth catalysts for the plant-based vitamin industry. The unwavering surge in consumer awareness regarding the health benefits and ethical considerations of plant-based diets is a primary driver. This is complemented by increasing demand for transparent and 'clean label' products, pushing manufacturers towards natural and recognizable ingredients. Furthermore, technological advancements in bioavailability and formulation science are enhancing the efficacy and appeal of plant-derived supplements, overcoming historical reservations. The growing emphasis on preventative healthcare and a holistic approach to wellness is also fueling demand for natural dietary support.

This report provides an exhaustive analysis of the global plant-based vitamin market, meticulously covering the study period of 2019-2033. It offers a deep dive into market dynamics, exploring the key trends, driving forces, and challenges that shape the industry landscape. The report identifies the most promising regions and countries poised for market leadership, alongside an in-depth examination of dominant product segments like Multi-Vitamins and the pivotal role of Online Sales. Furthermore, it highlights significant industry developments and the strategies of leading players such as Well Told Health and Garden of Life. This comprehensive coverage equips stakeholders with actionable insights to navigate the evolving plant-based vitamin sector effectively.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Well Told Health, Garden of Life, Botanic Healthcare, Holland & Barrett, mykind Organics, Future Kind, Abundant Earth Labs, Yuve, MegaFood, NaturesPlus, Rainbow Light, Solgar, NOW Foods, Source Naturals, Vega, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Plant-Based Vitamin," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Plant-Based Vitamin, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.