1. What is the projected Compound Annual Growth Rate (CAGR) of the Plant-based Vegan Leather?

The projected CAGR is approximately 10.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Plant-based Vegan Leather

Plant-based Vegan LeatherPlant-based Vegan Leather by Type (Grain Leather, Mushroom Leather, Cacti Leather, Pineapple Leather, Others), by Application (Clothing, Leather Shoes, Bags & Cases, Automotive Interior, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

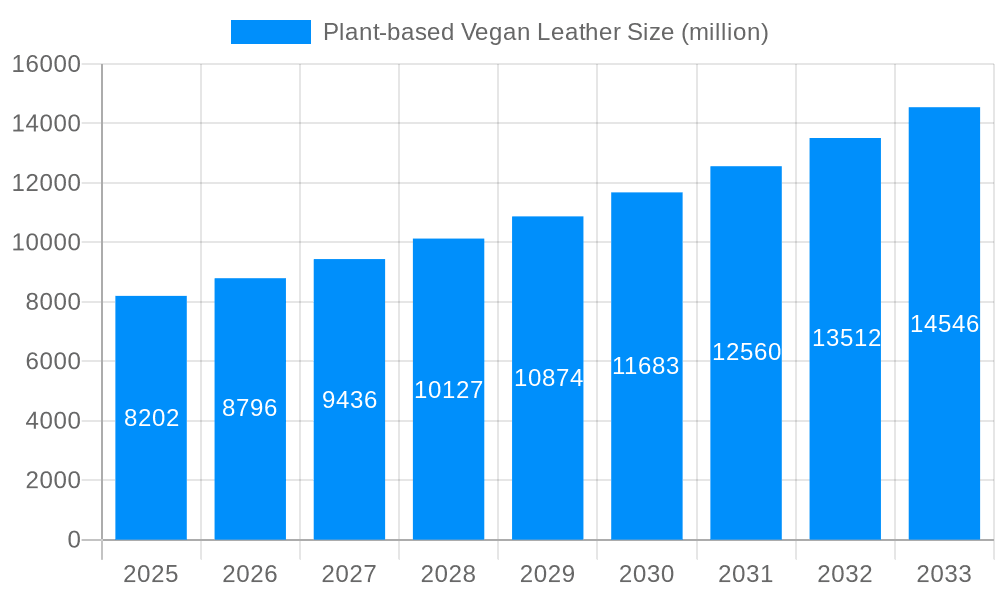

The global plant-based vegan leather market is experiencing robust growth, projected to reach a substantial size driven by increasing consumer demand for sustainable and ethical alternatives to traditional leather. The market, valued at approximately $8.202 billion in 2025, is expected to expand at a Compound Annual Growth Rate (CAGR) of 7.1% from 2025 to 2033. This growth is fueled by several key factors. Firstly, heightened environmental awareness among consumers is pushing a preference for eco-friendly materials, reducing the demand for animal-derived leather with its associated environmental impact. Secondly, the fashion and automotive industries are actively seeking sustainable alternatives to align with their corporate social responsibility initiatives, thus driving significant demand for plant-based leathers. Thirdly, ongoing technological advancements are leading to improved material properties, such as enhanced durability, flexibility, and aesthetic appeal, making plant-based leathers more competitive with traditional options. The diverse range of plant sources, including pineapple, cacti, mushroom, and grain, provides various options catering to different applications and price points.

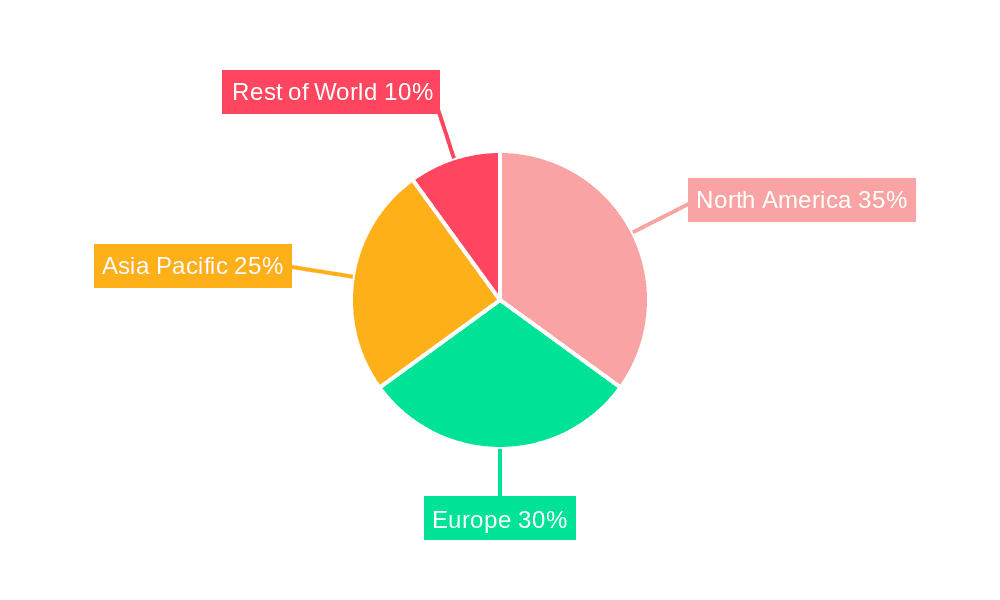

Major market segments include clothing, leather shoes, bags & cases, and automotive interiors. The North American and European markets currently hold significant shares, reflecting high consumer awareness and adoption of sustainable products in these regions. However, Asia-Pacific is poised for significant growth due to its burgeoning middle class and increasing consumer spending on fashion and lifestyle products. Key players in the market are actively innovating and expanding their product portfolios to cater to the rising demand. Competition is likely to intensify as more companies enter the market, leading to further innovation and potential price reductions, making plant-based vegan leather more accessible to a wider consumer base. While challenges remain regarding scaling production to meet the increasing demand and ensuring consistent quality, the long-term outlook for the plant-based vegan leather market remains extremely positive.

The plant-based vegan leather market is experiencing explosive growth, driven by escalating consumer demand for sustainable and ethical alternatives to traditional leather. The global consumption value, which stood at several billion dollars in 2024, is projected to reach tens of billions by 2033. This surge is fueled by a confluence of factors, including heightened environmental awareness, stricter regulations on animal welfare, and advancements in material science resulting in vegan leathers that increasingly rival the quality and durability of their animal-derived counterparts. The market is witnessing a diversification of raw materials beyond the initial pioneers like pineapple and mushroom leather, with companies exploring innovative sources such as cacti and other plant-based byproducts. This innovation is leading to a wider range of textures, colors, and functionalities, catering to the diverse needs of various industries. The shift is not limited to niche markets; major fashion houses and automotive manufacturers are actively integrating plant-based vegan leather into their product lines, signifying a mainstream adoption that further propels market expansion. This trend is further reinforced by the rising popularity of conscious consumerism, with shoppers increasingly prioritizing brands that align with their values of sustainability and ethical production. The market's evolution includes not only material innovation but also the development of more efficient and scalable production processes, contributing to reduced costs and increased accessibility. The forecast suggests that the plant-based vegan leather industry will continue its robust growth trajectory throughout the forecast period (2025-2033), underpinned by consistent technological advancements and increasing consumer adoption. This signifies a significant shift in the leather industry landscape, moving towards a more environmentally and ethically conscious future.

Several key factors are driving the rapid expansion of the plant-based vegan leather market. Firstly, the growing awareness of the environmental impact of traditional leather production is a significant catalyst. Traditional leather manufacturing is resource-intensive, contributing to deforestation, water pollution, and greenhouse gas emissions. Plant-based alternatives offer a substantially lower carbon footprint and reduced environmental burden, appealing to environmentally conscious consumers and brands striving for sustainability. Secondly, the ethical concerns surrounding animal welfare are also playing a crucial role. The demand for cruelty-free products is increasing globally, leading consumers to actively seek out vegan alternatives to leather. This ethical consideration is a powerful driver, particularly among younger generations who are increasingly vocal about their values. Thirdly, technological advancements in material science have resulted in plant-based leathers that are increasingly comparable to, and in some cases superior to, traditional leather in terms of durability, texture, and appearance. This improvement in quality eliminates a major barrier to adoption, making vegan leather a viable and attractive substitute for a wide range of applications. Finally, the increasing support from governments and regulatory bodies through incentives and policies promoting sustainable practices further accelerates the growth of this sector.

Despite the significant growth potential, the plant-based vegan leather market faces several challenges. One key restraint is the higher initial cost of production compared to traditional leather, although this gap is narrowing with economies of scale and technological advancements. The scalability of production remains a hurdle for some innovative materials. Certain plant-based leathers may currently struggle to match the durability and longevity of traditional leather in some applications, particularly in high-stress environments. Maintaining consistent quality and texture across large-scale production can also be difficult, requiring ongoing research and development. Furthermore, consumer perception and acceptance remain a factor; while awareness is growing, some consumers may still harbor misconceptions about the quality or performance of vegan leather. Finally, the establishment of robust supply chains for raw materials and efficient manufacturing processes are essential for sustainable growth and widespread adoption. Overcoming these challenges will require continued innovation, investment in research and development, and effective marketing strategies to build consumer trust and confidence in plant-based alternatives.

The plant-based vegan leather market is experiencing global expansion, but certain regions and segments are poised for more significant growth.

Dominant Segments:

Clothing: The clothing segment is expected to maintain its leading position, driven by the increasing demand for sustainable and ethical fashion. The integration of plant-based leathers into apparel is becoming increasingly mainstream, with major fashion brands incorporating these materials into their collections. The diverse range of textures and colors achievable with different plant-based materials makes them suitable for a wide spectrum of clothing applications, from jackets and coats to handbags and accessories. The market value for plant-based leather in the clothing industry is projected to reach tens of billions of dollars within the forecast period.

Automotive Interior: The automotive industry is showing significant interest in adopting plant-based vegan leather for interior applications. This segment offers substantial growth potential due to the large volume of vehicles produced annually. The shift towards sustainable and eco-friendly automotive interiors aligns with growing consumer awareness and regulatory pressures to reduce the environmental footprint of vehicle manufacturing. Key advantages include reduced volatile organic compound (VOC) emissions compared to traditional leather. The demand is driven by both original equipment manufacturers (OEMs) seeking to improve their environmental credentials and consumers willing to pay a premium for sustainable vehicles.

Mushroom Leather: Mushroom leather, a particularly innovative segment, is rapidly gaining traction due to its unique properties and sustainable production process. It demonstrates exceptional strength, durability, and flexibility, making it a compelling alternative to animal leather in various applications. Furthermore, the growing availability of mushroom biomass and advancements in processing techniques are lowering production costs, increasing its accessibility and market appeal.

Dominant Regions:

North America: The region holds a significant market share due to the high demand for sustainable and ethically produced goods. Growing environmental awareness among consumers and supportive regulatory policies contribute to this strong market presence. The high disposable income and strong adoption of sustainable lifestyles in this region contribute to its dominance in the market.

Europe: Similar to North America, Europe exhibits a high level of consumer awareness of environmental and ethical issues related to traditional leather. Stringent regulations and consumer preference for sustainable products position Europe as another key region in the plant-based vegan leather market.

The above-mentioned segments and regions are predicted to demonstrate robust growth over the forecast period, driven by a combination of increasing consumer demand, technological advancements, and supportive regulatory landscapes. However, the overall market will benefit from expansion in other geographical areas and segments as awareness and production scale increases.

The plant-based vegan leather industry’s growth is fueled by a convergence of factors. Increasing consumer demand for sustainable and ethical products, coupled with continuous innovation leading to improved material quality and reduced production costs, are primary drivers. Government regulations promoting sustainable practices and favorable policies further accelerate market expansion. The growing acceptance of plant-based leathers among major brands in the fashion and automotive sectors signals a broad shift toward sustainable alternatives, solidifying the industry's trajectory for continued growth.

This report offers a comprehensive analysis of the plant-based vegan leather market, encompassing market size estimations, segmental breakdowns, regional performance, competitive landscape analysis, and future market projections. The detailed insights provided are valuable for industry stakeholders seeking a clear understanding of the current market dynamics and future growth prospects, enabling informed decision-making and strategic planning within this rapidly evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.8% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 10.8%.

Key companies in the market include Ananas Anam, Mycel, MycoWorks, Bolt Threads, Ecovative Design, Mycotech Lab, Mykkö, MuSkin, Adriano Di Marti, Kuraray Co. Ltd., H.R. Polycoats Pvt. Ltd., Yantai Wanhua Group Co. Ltd., Alfatex Italia, BASF SE, Dupont, Willow Tex, Anli Group, Ultrafabrics, Desserto, Veja.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Plant-based Vegan Leather," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Plant-based Vegan Leather, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.