1. What is the projected Compound Annual Growth Rate (CAGR) of the Plant-based-protein Meat?

The projected CAGR is approximately 4.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Plant-based-protein Meat

Plant-based-protein MeatPlant-based-protein Meat by Type (Meat Products, Meat), by Application (Food, Retail, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

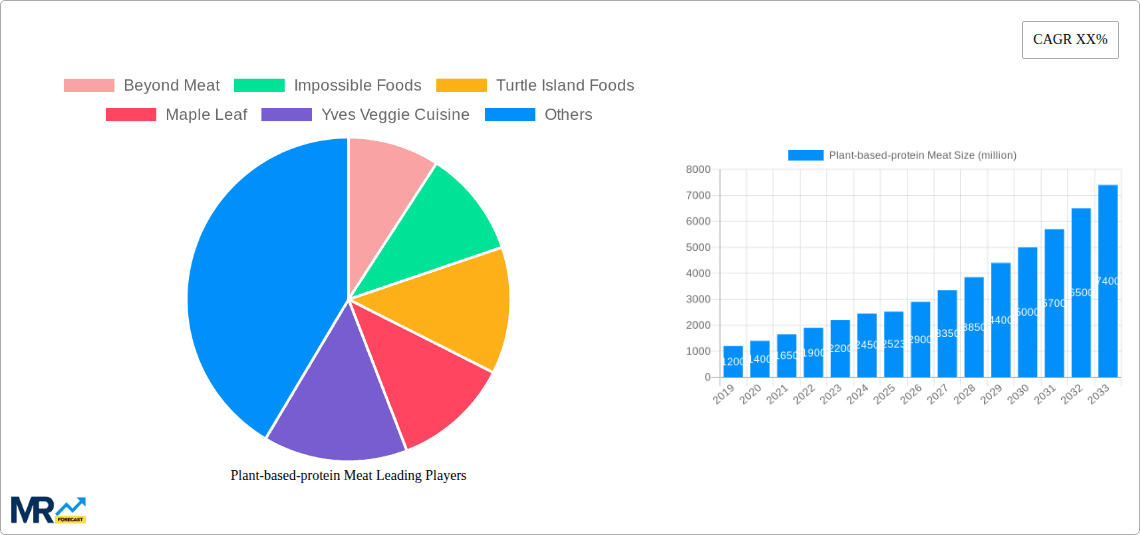

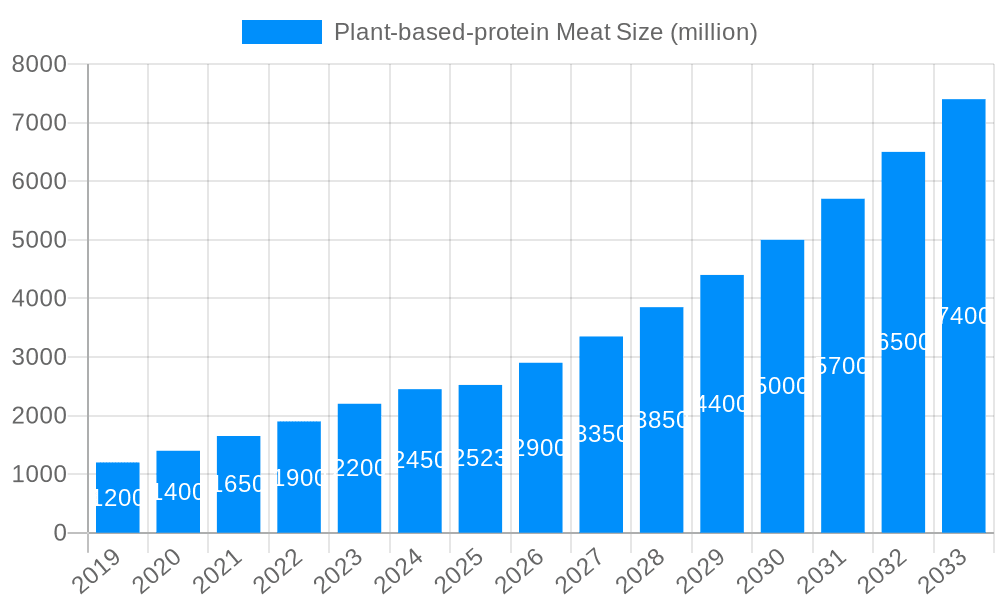

The plant-based protein meat market is experiencing robust growth, projected to reach a substantial size. While the provided data states a 2025 market size of $2523 million and a CAGR of 4.6%, a comprehensive analysis requires deeper regional and segment-specific information. However, considering the increasing consumer demand driven by health consciousness, environmental concerns, and ethical considerations regarding animal agriculture, this CAGR is likely conservative. Key drivers include the rising popularity of vegan and vegetarian diets, increased awareness of the environmental impact of meat production, and the continuous innovation in plant-based protein technologies resulting in improved taste, texture, and nutritional profiles. Furthermore, the market is witnessing significant investments from both established food companies and startups, further fueling its expansion. Major players like Beyond Meat and Impossible Foods are leading the charge in developing and marketing innovative products, while smaller companies are focusing on niche segments and regional markets. Despite the substantial growth, challenges remain, including consumer perception, price competitiveness with traditional meat products, and the need for consistent supply chain management to meet growing demand. Future growth will hinge on addressing these challenges while further innovating to create products that satisfy diverse consumer preferences and price points. Expansion into emerging markets and diversification of product offerings will play crucial roles in achieving sustained market expansion beyond the forecast period.

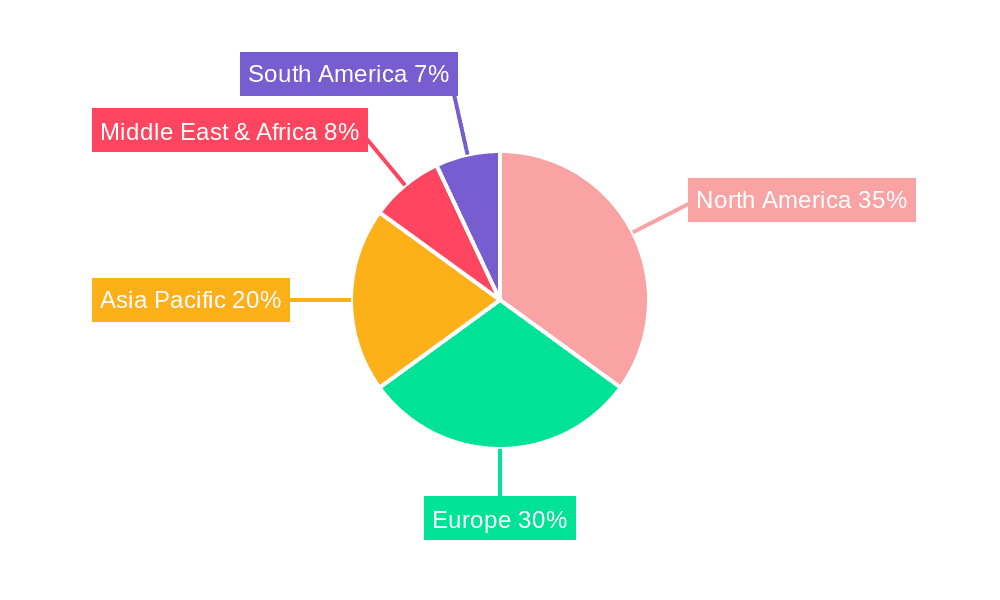

The plant-based protein meat market's segmentation is pivotal for understanding its dynamics. While specific segment details are absent, it's reasonable to assume segmentation by product type (burgers, sausages, ground meat alternatives, etc.), distribution channel (retail, food service), and protein source (soy, pea, mycoprotein, etc.). Regional variations are also significant, with developed markets like North America and Europe expected to show strong growth, followed by increasing adoption in Asia-Pacific and other regions. The competitive landscape is dynamic, characterized by both established food giants and agile startups. The entry of major players like Nestle and Unilever indicates the market's attractiveness and signifies a potential shift towards increased market consolidation. The long-term success of the plant-based meat industry hinges on continued innovation in product development, effective marketing and branding strategies that address consumer concerns, and the creation of a sustainable and scalable supply chain.

The plant-based protein meat market is experiencing explosive growth, driven by shifting consumer preferences and technological advancements. Over the study period (2019-2033), we project a substantial expansion, with the market reaching several billion dollars by 2033. Key insights reveal a strong correlation between increased consumer awareness of health and environmental concerns and the adoption of plant-based alternatives. The historical period (2019-2024) witnessed a significant surge in popularity, particularly amongst younger demographics, demonstrating a growing preference for sustainable and ethical food choices. The estimated year (2025) showcases a market already exceeding several hundred million units, poised for further expansion during the forecast period (2025-2033). This growth isn't solely limited to developed nations; emerging markets are also embracing plant-based proteins, driven by factors such as rising disposable incomes and increasing urbanization. The market's dynamism is further fueled by continuous product innovation, with companies focusing on improving taste, texture, and nutritional profiles to better mimic traditional meat products. This intense competition, coupled with the rising demand, ensures the market remains dynamic and innovative, with new players entering the market and established companies continually expanding their product lines. This report provides a comprehensive analysis of these trends and their implications for the future of the plant-based meat industry. The increasing availability of plant-based meats in mainstream supermarkets and restaurants contributes significantly to its expanding reach and consumer acceptance. The rising awareness regarding the environmental impact of traditional meat production further strengthens the market's positive trajectory.

Several key factors are driving the remarkable growth of the plant-based protein meat market. Firstly, the escalating global awareness of health and wellness is pushing consumers towards plant-based diets, perceived as healthier and lower in saturated fat and cholesterol compared to animal-based proteins. Secondly, environmental concerns regarding animal agriculture's carbon footprint and land use are compelling environmentally conscious consumers to opt for sustainable alternatives. The growing popularity of veganism and vegetarianism globally contributes significantly to market expansion. Technological advancements are also crucial, as companies continuously refine their processes to improve the taste, texture, and overall palatability of plant-based meats, mimicking the experience of consuming animal-based products. Furthermore, increasing disposable incomes, especially in emerging economies, allow consumers to explore and afford more diverse food options, including premium plant-based alternatives. Government initiatives and policies promoting sustainable food systems and reducing carbon emissions further bolster the market's growth trajectory. Finally, the relentless efforts of major food companies to introduce innovative and widely accessible plant-based products are expanding the market's reach and appeal.

Despite the impressive growth, the plant-based meat market faces significant challenges. One key hurdle is the perception of taste and texture. While advancements have been substantial, many consumers still find plant-based meats inferior in taste and texture compared to traditional meat. High production costs can also limit accessibility and affordability, particularly for consumers in lower-income brackets. This price differential compared to conventional meats serves as a significant barrier to wider market penetration. Furthermore, concerns regarding the nutritional content of some plant-based meats, specifically regarding the lack of certain nutrients found in animal-based protein, remain a concern for some consumers. The industry also faces challenges related to consumer education and marketing. Effectively conveying the benefits of plant-based proteins while addressing common misconceptions requires sustained and targeted communication efforts. The lack of well-established regulatory frameworks and labeling standards in some regions also presents a significant challenge for manufacturers and consumers alike, causing some confusion about ingredient sourcing, manufacturing processes and nutritional value claims. Finally, competition from established meat producers who are also developing plant-based options is increasing, creating a highly competitive and rapidly changing market landscape.

The plant-based meat market is witnessing robust growth across various regions and segments. While North America and Europe currently hold significant market shares, Asia-Pacific is projected to experience the fastest growth rate in the forecast period. This is driven by population growth and the rising middle class, who are increasingly adopting western dietary habits and exploring alternative protein sources.

North America: High consumer awareness of health and sustainability, coupled with a strong presence of established and innovative companies, contributes to its leading position.

Europe: Increasing demand for environmentally friendly foods and the growing acceptance of vegetarian/vegan lifestyles boost market growth.

Asia-Pacific: This region is experiencing rapid growth due to rising disposable incomes, burgeoning populations, and increased adoption of Westernized diets.

Segments:

Burgers: This remains the largest segment, due to its wide acceptance and resemblance to a traditional meat-based product. Innovation is concentrated on improving taste, texture and producing plant-based burgers comparable to beef in both nutritional value and consumer experience.

Meatballs and Sausages: These processed options provide readily adaptable products, offering a convenient and versatile alternative within meals. The market shows continued progress in terms of improving texture, mouth-feel and overall product appeal.

Other Products: This includes a variety of alternative meat products, such as plant-based bacon, chicken, and fish, which are gradually gaining traction as the market matures and the technology improves. Increased diversification in product offering supports the growth of this segment.

The continued development of new products and technologies, combined with expanding consumer acceptance and the increasing focus on sustainability, will continue to propel growth within all segments of the plant-based protein meat market. This dynamic market offers significant opportunities for companies committed to innovation and consumer engagement.

The plant-based meat industry's growth is significantly boosted by the convergence of several factors. Rising consumer awareness of health and environmental impacts related to traditional meat consumption fuels the demand for sustainable alternatives. Technological advancements are continuously improving the taste, texture, and nutritional value of plant-based meats, making them increasingly appealing to a broader consumer base. Furthermore, the increasing availability of plant-based meat products in mainstream retail channels and restaurants expands their accessibility and market penetration. The expanding support from governments and organizations promoting sustainable food systems adds momentum to this market trend.

This report provides a thorough analysis of the plant-based protein meat market, offering a comprehensive overview of market trends, driving factors, challenges, and key players. It encompasses historical data, current market estimations, and future projections, providing valuable insights for stakeholders across the industry. The report delves into regional market specifics, segment-wise analysis, and provides a detailed competitive landscape review. It concludes by identifying significant growth opportunities and suggesting strategic recommendations for both established players and new entrants.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.6%.

Key companies in the market include Beyond Meat, Impossible Foods, Turtle Island Foods, Maple Leaf, Yves Veggie Cuisine, Nestle, Kellanova, Monde Nissin, Fry Group Foods, Heather Mills, Cargill, Unilever, Omnipork, Qishan Foods, Hongchang Food, Sulian Food, Starfield, PFI Foods, Shuanghui, Douduoqi, Qishuang Group, Weilong Delicious, Zuming Bean Products.

The market segments include Type, Application.

The market size is estimated to be USD 2523 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Plant-based-protein Meat," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Plant-based-protein Meat, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.