1. What is the projected Compound Annual Growth Rate (CAGR) of the Plant-based Protein Alternatives?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Plant-based Protein Alternatives

Plant-based Protein AlternativesPlant-based Protein Alternatives by Type (Soy Protein-based Foods, Wheat Protein-based Foods, Pea Protein-based Foods, Others), by Application (Meat & Seafood, Dairy), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

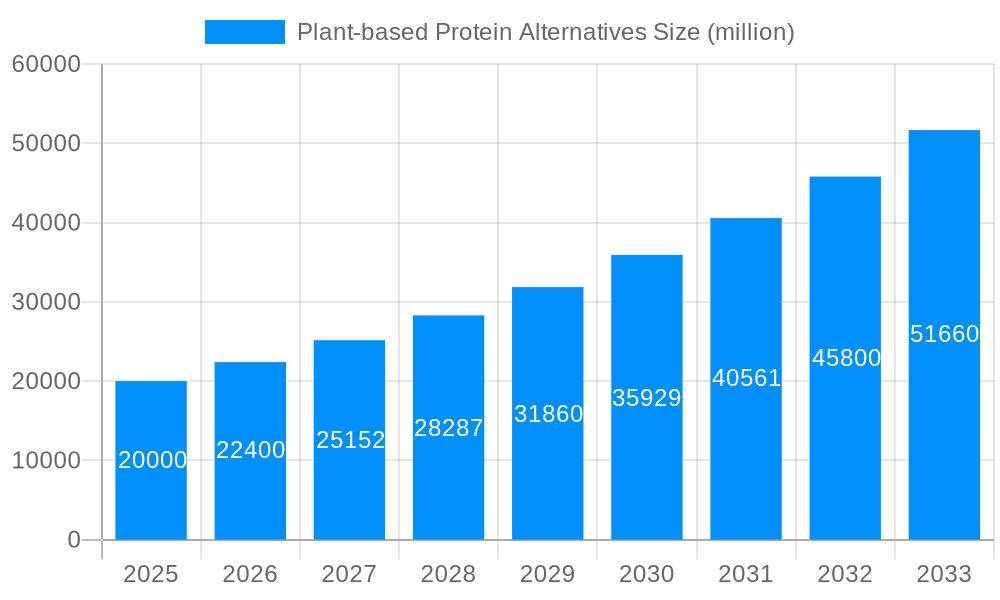

The plant-based protein alternatives market is experiencing robust growth, driven by increasing consumer awareness of health and environmental benefits, coupled with a rising demand for sustainable and ethical food choices. The market, currently valued at approximately $20 billion in 2025, is projected to witness a Compound Annual Growth Rate (CAGR) of 12% from 2025 to 2033, reaching an estimated $65 billion by 2033. This expansion is fueled by several key factors including the increasing prevalence of vegetarianism and veganism, growing concerns about the environmental impact of animal agriculture, and the development of innovative plant-based products that closely mimic the taste and texture of traditional meat and dairy alternatives. Soy protein-based foods currently hold a significant market share, but pea and wheat protein-based alternatives are rapidly gaining traction, driven by their nutritional profiles and functionalities. The meat & seafood application segment dominates the market, reflecting the strong demand for plant-based meat substitutes like burgers, sausages, and fish alternatives. Key players in this competitive landscape include established food companies like Pinnacle Foods, ADM, and Kellogg's alongside innovative startups such as Beyond Meat and Impossible Foods, constantly striving to improve product quality and expand distribution channels. Geographic expansion is another key driver, with North America and Europe currently leading the market, followed by Asia-Pacific, which is experiencing significant growth due to rising disposable incomes and changing dietary preferences.

The market faces some challenges despite its positive outlook. Consumer perception and acceptance of taste and texture are still areas that require constant improvement. Pricing remains a factor, with plant-based alternatives often being more expensive than traditional counterparts, although economies of scale and technological advancements are expected to narrow this gap. Furthermore, the increasing availability of plant-based products also intensifies competition, requiring companies to continuously innovate to maintain a competitive edge. Regulatory frameworks and labeling standards also play a role, requiring continuous monitoring and adaptation. However, the overall market trend indicates a sustained upward trajectory, propelled by expanding consumer demand and continuous advancements in product development and production technologies.

The plant-based protein alternatives market is experiencing explosive growth, driven by a confluence of factors including increasing health consciousness, environmental concerns, and the rising popularity of vegan and vegetarian diets. The market, valued at XXX million units in 2025, is projected to reach XXX million units by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR). This surge is fueled by a growing consumer base seeking healthier, more sustainable food options. Innovation within the sector is also a key driver, with companies constantly developing new products to improve taste, texture, and nutritional profiles to better mimic traditional meat and dairy products. The historical period (2019-2024) witnessed significant market expansion, laying the groundwork for the projected growth during the forecast period (2025-2033). Key trends include the rise of hybrid products combining plant-based proteins with other ingredients for enhanced flavor and functionality, increased focus on sustainability throughout the supply chain, and the expansion into new product categories such as plant-based seafood alternatives and novel protein sources beyond soy and pea. Consumer demand is pushing companies to expand distribution channels, making plant-based options readily available in supermarkets, restaurants, and online retailers. This accessibility coupled with ongoing technological advancements to address challenges around taste and texture continues to accelerate market expansion. The competition is fierce, with established food giants and innovative startups vying for market share, leading to continuous product improvement and increased consumer choice. The market is further segmented by type (soy, pea, wheat, and others) and application (meat alternatives, dairy alternatives), each exhibiting its own growth trajectory influenced by specific consumer preferences and technological breakthroughs. This dynamic market landscape promises continued evolution and expansion throughout the forecast period.

Several key factors are driving the remarkable growth of the plant-based protein alternatives market. Firstly, the increasing awareness of the health benefits associated with plant-based diets is a significant motivator. Consumers are actively seeking alternatives to animal products, recognizing their lower saturated fat content, reduced cholesterol levels, and higher fiber intake. This health-conscious approach is particularly prevalent among younger demographics. Secondly, growing environmental concerns are prompting consumers to reduce their meat consumption due to the significant environmental impact of livestock farming. Plant-based proteins offer a more sustainable alternative, reducing carbon emissions and land usage. Thirdly, the rising popularity of veganism and vegetarianism is substantially expanding the target market for these products. More people are adopting plant-based lifestyles for ethical, environmental, or health reasons, creating a significant demand for alternatives that meet their dietary preferences. Furthermore, the ongoing innovation in the sector, leading to improvements in taste, texture, and overall product quality, is crucial in attracting a broader consumer base who may have previously been hesitant to adopt plant-based options. The continued expansion of distribution channels also plays a vital role, increasing accessibility and making plant-based products readily available to a wider audience. Finally, increasing investment in research and development fuels the creation of novel protein sources and production techniques, furthering the potential of this sector.

Despite the impressive growth trajectory, the plant-based protein alternatives market faces several challenges. One major hurdle is the often-higher price point compared to traditional animal-based products, potentially limiting accessibility for budget-conscious consumers. Overcoming this price barrier is crucial for broader market penetration. Secondly, the taste and texture of certain plant-based products can still fall short of consumer expectations, particularly when trying to replicate the experience of meat or dairy products. Continued research and development are needed to address these sensory shortcomings. Thirdly, concerns regarding the nutritional completeness of certain plant-based alternatives exist. Ensuring adequate levels of essential nutrients, such as iron and vitamin B12, is important for addressing potential nutritional deficiencies among consumers relying heavily on plant-based sources. Additionally, allergen concerns related to certain plant proteins, such as soy and nuts, represent a challenge that requires careful ingredient sourcing and labeling. Finally, the relatively nascent nature of the market leads to fluctuations in supply chains and occasional production limitations. Addressing these challenges through innovation, careful ingredient selection, and improved manufacturing processes is vital for ensuring sustainable and widespread market adoption.

The North American market is anticipated to hold a significant share of the global plant-based protein alternatives market throughout the forecast period. This is driven by increasing health awareness, the presence of key market players, and a significant number of consumers adopting flexitarian or plant-based diets. Within this region, the United States is expected to witness substantial growth.

Dominating Segments:

Pea Protein-based Foods: Pea protein is gaining popularity due to its excellent nutritional profile, hypoallergenic nature, and relatively low environmental impact compared to other protein sources. Its versatility allows for its incorporation into various food products, furthering its market dominance. The increasing availability and affordability of pea protein further contribute to its expanding market share.

Meat & Seafood Alternatives: This segment is experiencing significant growth fueled by the increasing demand for meat substitutes that offer comparable taste, texture, and nutritional benefits. The ongoing innovation in this area results in a variety of products including plant-based burgers, sausages, and even seafood alternatives, catering to a broad range of consumer preferences.

Soy Protein-based Foods: Despite the emergence of newer protein sources, soy-based products continue to retain a significant market share. This is mainly due to established production infrastructure, affordability, and well-established consumer awareness. However, concerns regarding potential allergenicity and environmental impact continue to influence consumer choices.

Other Regions: While North America leads, significant growth is also expected in Europe and Asia-Pacific, driven by similar factors such as growing health consciousness and environmental concerns. However, differing cultural preferences and varying levels of acceptance of plant-based alternatives may impact the growth trajectory in these regions.

Several factors are acting as catalysts for growth within the plant-based protein alternatives industry. Firstly, the continuous improvement in taste, texture, and nutritional profile of plant-based products is attracting a wider range of consumers who may have previously found alternatives unappealing. Secondly, increased availability and affordability of plant-based proteins are making them more accessible to budget-conscious consumers. Thirdly, growing government support and regulations promoting sustainable food systems are encouraging the development and adoption of plant-based alternatives. Finally, the increasing awareness of the health and environmental benefits associated with plant-based diets is continuously broadening the consumer base driving market growth.

This report provides a comprehensive overview of the plant-based protein alternatives market, encompassing market size estimations, detailed segmentation analysis, key trend identification, competitive landscape assessment, and future growth projections. It offers valuable insights for stakeholders across the value chain, helping them make informed decisions about product development, investment strategies, and market entry plans. The report's findings are based on rigorous data analysis, industry expert interviews, and extensive market research, making it a reliable resource for navigating this dynamic and rapidly evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Pinnacle Foods, Turtle Island Foods, ADM (Archer Daniels Midland Company), Amy’s Kitchen, Atlantic Natural Foods, Impossible Foods, The Hain Celestial Group, Beyond Meat, Pacific Foods of Oregon, Monde Nissin Corporation, Kellogg Company, Fry Family Food, Pulmuone Holdings, Hügli Holding, Sweet Earth, VBites Food, Maple Leaf Foods, Kraft Heinz, Schouten Europe, Taifun-Tofu GmbH, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Plant-based Protein Alternatives," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Plant-based Protein Alternatives, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.