1. What is the projected Compound Annual Growth Rate (CAGR) of the Plant-Based Creamy Powder?

The projected CAGR is approximately 2.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Plant-Based Creamy Powder

Plant-Based Creamy PowderPlant-Based Creamy Powder by Type (Flavored, Non- Flavored), by Application (Bakery, Beverages, Confectionary, Dairy, Desserts and Ice Cream, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

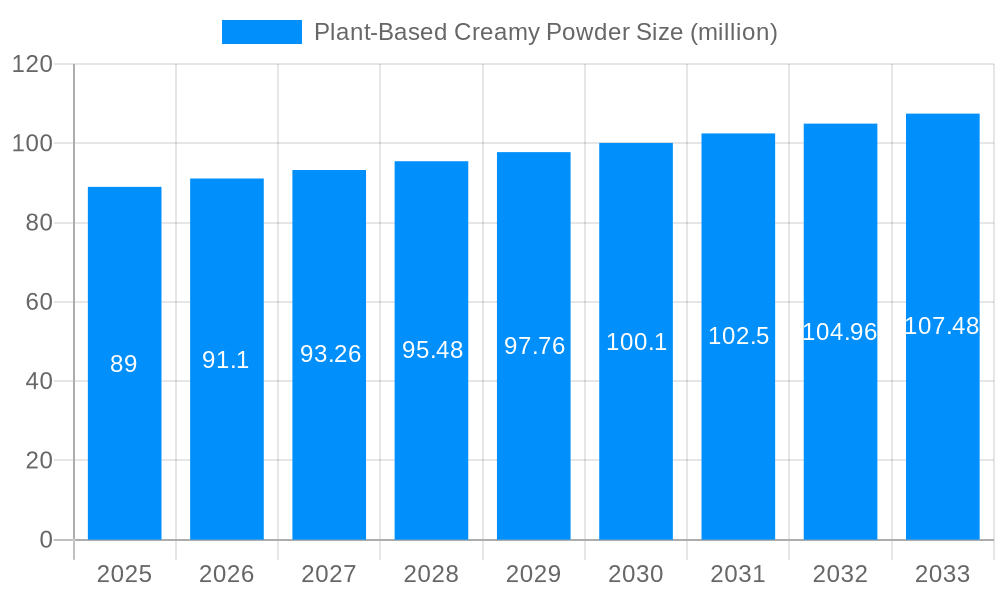

The plant-based creamy powder market, currently valued at $89 million in 2025, exhibits a steady growth trajectory, projected to expand at a compound annual growth rate (CAGR) of 2.1% from 2025 to 2033. This growth is fueled by several key drivers. The increasing consumer preference for plant-based alternatives due to health consciousness, ethical concerns regarding animal welfare, and environmental sustainability is a major catalyst. The versatility of plant-based creamy powders, enabling their incorporation into various food and beverage products like dairy-free alternatives, confectionery, and baked goods, further fuels market expansion. Innovation in product development, with a focus on enhancing taste, texture, and nutritional profiles, is another significant driver. While precise data on regional segmentation is unavailable, it's reasonable to assume a geographically diverse market, with developed regions like North America and Europe holding substantial shares, along with emerging markets in Asia-Pacific showing promising growth potential due to rising disposable incomes and changing dietary habits. However, challenges remain. Price sensitivity among consumers and potential limitations in achieving the same sensory experience as dairy-based products could constrain growth. Furthermore, fluctuating raw material prices and stringent regulatory requirements in certain regions might pose obstacles.

Major players in the market, including Asahi Group Foods, Nestlé, and Kerry Group, are actively involved in research and development to improve product quality and expand their product portfolios to cater to diverse consumer demands. The competitive landscape is dynamic, characterized by both established multinational corporations and emerging regional players. Successful players will leverage their strengths in innovation, supply chain management, and branding to capitalize on the growing consumer preference for plant-based food alternatives and achieve a competitive edge in this expanding market. Future growth will likely depend on the effective communication of health benefits, improved taste profiles, and a widening range of applications to ensure market penetration and maintain consumer interest.

The global plant-based creamy powder market is experiencing robust growth, projected to reach several billion units by 2033. Driven by escalating consumer demand for healthier, more sustainable food alternatives, this market segment shows considerable promise. The historical period (2019-2024) witnessed a steady increase in adoption, fueled by rising awareness of the environmental impact of dairy products and the increasing prevalence of vegan and vegetarian diets. The estimated market value for 2025 signifies a significant milestone, representing millions of units sold and demonstrating substantial market penetration. This growth is further amplified by innovative product development, with manufacturers focusing on enhancing taste, texture, and nutritional profiles to rival traditional dairy-based options. The forecast period (2025-2033) anticipates continued expansion, driven by factors such as technological advancements in plant-based protein extraction and the development of new and improved formulations with enhanced functionality and appeal. Furthermore, the increasing availability of plant-based creamy powders in diverse applications, from beverages and desserts to savory dishes, further contributes to market expansion. This market is not just a niche trend; it represents a significant shift in consumer preferences and a major opportunity for food manufacturers worldwide. The base year of 2025 provides a crucial benchmark for understanding the market's current trajectory and projecting future performance. Key market insights reveal a growing preference for products with clean labels, reduced sugar content, and fortified nutritional benefits. This trend influences product development strategies and presents both challenges and opportunities for manufacturers. The market’s success hinges on balancing consumer demand for affordability, convenience, and premium quality with sustainability and ethical sourcing practices. Successful players will leverage technological advancements, strategic partnerships, and strong marketing campaigns to capitalize on this rapidly expanding market.

Several key factors are driving the phenomenal growth of the plant-based creamy powder market. Firstly, the burgeoning global vegan and vegetarian population is a major catalyst. Consumers increasingly seek alternatives to dairy products for ethical, health, and environmental reasons. Secondly, the rising awareness of the health benefits associated with plant-based diets—lower cholesterol, reduced risk of heart disease, and improved gut health—significantly boosts demand. Thirdly, the increasing concerns about the environmental impact of animal agriculture are prompting consumers to explore more sustainable food choices. Plant-based alternatives offer a lower carbon footprint and reduced water consumption compared to traditional dairy production. The growing availability of plant-based creamy powders in diverse retail channels, from supermarkets and online stores to specialty health food shops, significantly enhances accessibility and consumer reach. Furthermore, continuous innovation in product development is key. Manufacturers are constantly striving to improve taste, texture, and functionality to match or exceed consumer expectations for traditional dairy products. This involves research into new plant-based protein sources, emulsification techniques, and flavoring systems to deliver superior consumer experiences. Finally, proactive marketing campaigns highlighting the health, sustainability, and ethical advantages of plant-based creamy powders further contribute to increasing market awareness and driving consumer adoption.

Despite the significant growth potential, several challenges and restraints impede the market's progress. One primary concern is the relatively higher cost of production compared to conventional dairy-based products. The sourcing of high-quality plant-based ingredients, advanced processing techniques, and quality control measures can contribute to higher prices, potentially limiting accessibility for price-sensitive consumers. Another significant hurdle is achieving comparable taste, texture, and functionality to traditional creamy powders. While significant advancements have been made, replicating the creamy texture and rich flavor profiles of dairy remains a challenge for many manufacturers. Furthermore, maintaining product stability and extending shelf life are crucial for ensuring product quality and minimizing waste. Variations in ingredient quality and processing conditions can affect product consistency and lead to potential quality issues. Consumer perceptions and misconceptions surrounding plant-based alternatives also pose a challenge. Some consumers may harbor skepticism about the nutritional value or taste of these products, requiring targeted education and marketing initiatives to overcome these reservations. Finally, ensuring consistent supply chains and access to sustainable raw materials for manufacturing is essential for the long-term growth of the market. Fluctuations in raw material prices and availability can disrupt production and impact product pricing.

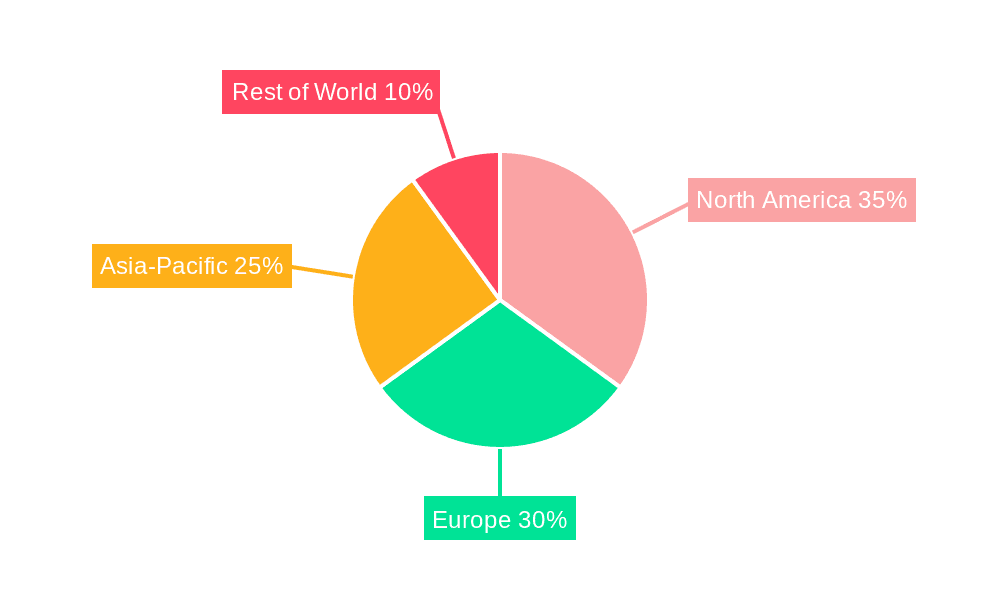

North America & Europe: These regions are expected to dominate the market due to high consumer awareness of health and sustainability issues, a large vegetarian and vegan population, and strong demand for convenient, plant-based food options. The established retail infrastructure and high disposable incomes further contribute to market dominance. These regions have witnessed a rapid adoption of plant-based diets and a willingness to experiment with new food products. Many innovative companies and established food giants are headquartered in these regions, resulting in a significant number of product launches and strong marketing campaigns. The regulatory landscape in these regions is also generally supportive of plant-based food innovation.

Asia-Pacific: This region is experiencing rapid growth, driven by an expanding middle class, rising disposable incomes, and increasing awareness of health benefits associated with plant-based diets. The growing popularity of veganism and vegetarianism, particularly in countries like India and China, is fueling this growth. However, challenges remain in overcoming existing cultural preferences for traditional dairy products and ensuring affordable pricing to reach a broader consumer base.

Segments: The food and beverage segment holds significant market share due to the versatility of plant-based creamy powders in various applications. From coffee creamers and smoothies to soups and sauces, the widespread usability is a crucial driver. The dairy alternative segment is another key area, with consumers actively seeking replacements for traditional dairy-based products. Innovation is continuously occurring within this segment to improve taste, texture, and nutritional value. This includes the expansion of products like plant-based yogurt and ice cream that utilize plant-based creamy powder as a key ingredient.

The plant-based creamy powder industry is fueled by several key growth catalysts. These include increasing consumer demand for healthier and more sustainable food options, ongoing innovation in product development to improve taste and texture, and a wider range of applications in both the food and beverage industries. Growing consumer awareness of the environmental impact of dairy farming further strengthens the market's momentum. Government support for sustainable agriculture and plant-based food production also plays a significant role.

This report provides a comprehensive overview of the plant-based creamy powder market, offering detailed insights into market trends, growth drivers, challenges, and key players. The report covers the historical period (2019-2024), the base year (2025), and projects the market's future trajectory up to 2033. It examines various market segments and regional dynamics to present a holistic understanding of this rapidly expanding market. The analysis includes both quantitative and qualitative data, making it a valuable resource for businesses operating in or considering entry into the plant-based food sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 2.1%.

Key companies in the market include Asahi Group Foods, Nestle, Bay Valley Foods, Thai Foods Product International Co., Ltd., Fujian Jumbo Grand Food Co Ltd., Empire Eagle Food Co., Ltd., Ming Chyi Biotechnology, Drytech, Kerry Group, WhiteWave (International Delight), FrieslandCampina, DEK(Grandos), DMK(TURM, DP Supply), Barry Callebaut (Caprimo), Super Group, Yearrakarn, Custom Food Group, PT. Santos Premium Krimer, PT Aloe Vera, Suzhou Jiahe Foods Industry, Wenhui Food, Bigtree Group, Zhucheng Dongxiao Biotechnology, Jiangxi Weirbao Food Biotechnology, Hubei Hong Yuan Food, Fujian Jumbo Grand Food, Shandong Tianmei Bio, Amrut International, Almer Malaysia, Mokate Ingredients, Lautan Luas, Kornthai, Dong Suh, Meggle, .

The market segments include Type, Application.

The market size is estimated to be USD 89 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Plant-Based Creamy Powder," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Plant-Based Creamy Powder, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.