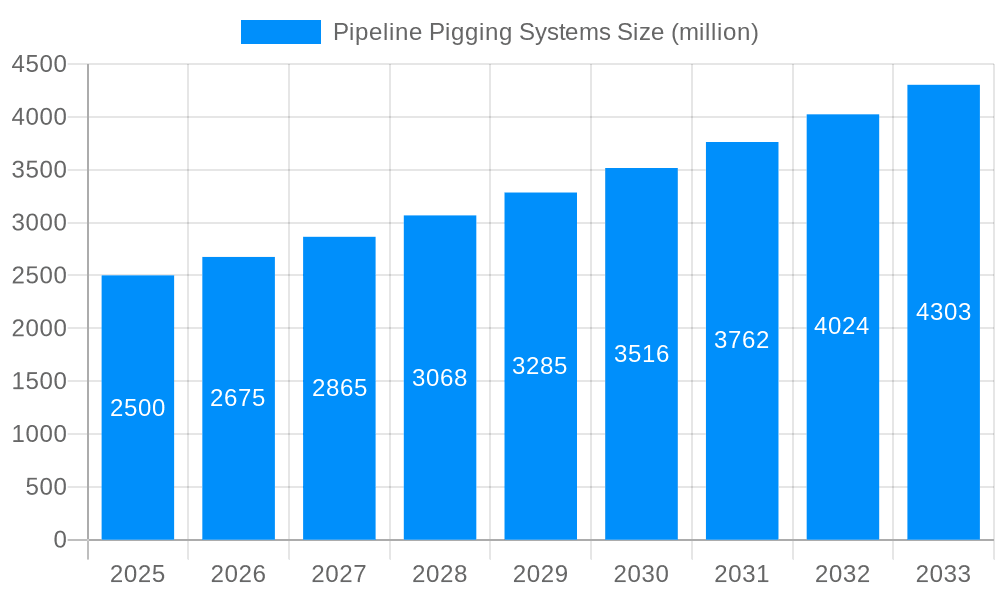

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pipeline Pigging Systems?

The projected CAGR is approximately 11.45%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Pipeline Pigging Systems

Pipeline Pigging SystemsPipeline Pigging Systems by Type (Ultrasonic Pigging (UT), Magnetic Flux Leakage (MFL), Other), by Application (Oil & Gas, Chemicals, Construction, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

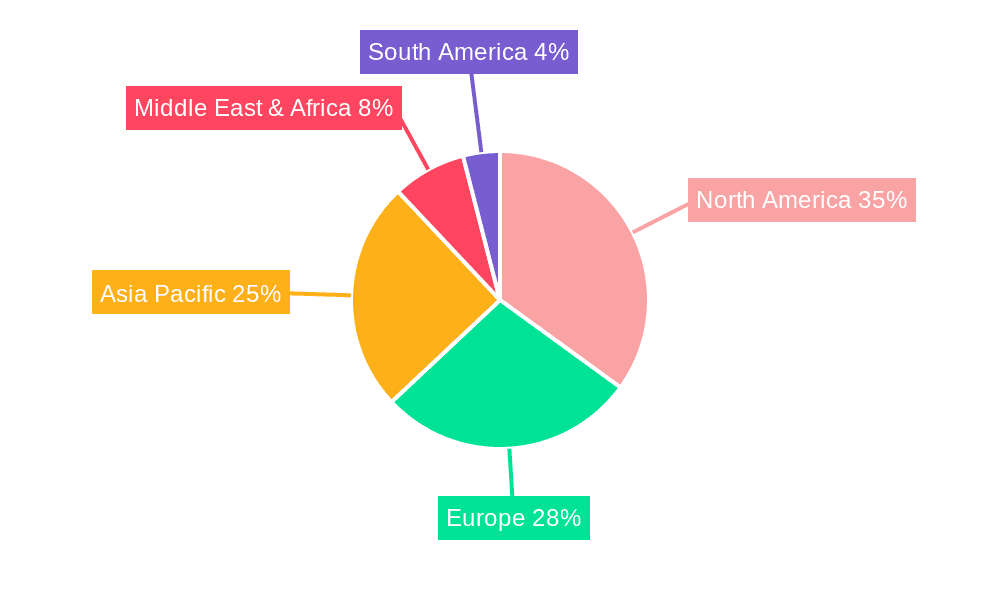

The global pipeline pigging systems market is poised for significant expansion, propelled by the escalating need for effective pipeline integrity management across diverse industries. Increasing pipeline network complexity and length, alongside stringent safety and environmental regulations, mandate routine inspection and maintenance. This demand drives the adoption of advanced technologies like ultrasonic pigging (UT) and magnetic flux leakage (MFL), which provide superior diagnostic capabilities over conventional methods. While the oil and gas sector remains the primary driver, the chemical and construction industries are projected to exhibit substantial growth due to burgeoning global infrastructure development. Although initial capital expenditure for sophisticated systems and the requirement for skilled operators present challenges, ongoing technological innovations and the long-term cost-saving potential are expected to overcome these restraints. The market size is estimated at $11.16 billion for 2025, with a projected compound annual growth rate (CAGR) of 11.45% from 2025 to 2033. Growth is anticipated to be particularly robust in regions with extensive pipeline infrastructure development, including Asia-Pacific and the Middle East & Africa.

The competitive environment features a blend of established global suppliers and specialized niche providers. Key players such as GE (Baker Hughes), Pure Technologies, and T.D. Williamson offer comprehensive solutions and possess extensive market reach. Smaller entities specializing in specific technologies or regional markets are also emerging as notable competitors. The market anticipates increased consolidation via mergers and acquisitions, driven by the pursuit of expanded market share and technological advancement. Continuous innovation in smart pigging systems with real-time data analytics and the development of more resilient and adaptable pigging tools will further influence market dynamics. These advancements will enhance operational efficiency and minimize downtime, reinforcing pipeline pigging as a highly cost-effective solution for pipeline operators.

The global pipeline pigging systems market is experiencing robust growth, projected to reach USD XXX million by 2033, exhibiting a CAGR of XX% during the forecast period (2025-2033). The market's expansion is fueled by the increasing demand for efficient and cost-effective pipeline maintenance and inspection across various industries, primarily oil & gas and chemicals. The historical period (2019-2024) witnessed steady growth, laying a strong foundation for the accelerated expansion anticipated in the coming years. This growth is driven by several factors, including stringent regulations regarding pipeline safety and environmental protection, the rising complexity and length of pipelines globally, and the increasing adoption of advanced pigging technologies offering improved accuracy and efficiency. The shift towards automation and the integration of data analytics in pipeline management systems further contribute to market growth. While the base year (2025) shows a market value of USD XXX million, the estimated year (2025) reflects a similar valuation, indicating a stable yet expanding market. The increasing adoption of sophisticated pigging technologies, including Ultrasonic Pigging (UT) and Magnetic Flux Leakage (MFL), capable of detecting various pipeline defects with higher precision, plays a significant role in this growth trajectory. Furthermore, the growing focus on reducing operational downtime and enhancing pipeline integrity further bolsters market demand. The market is also witnessing a rise in the demand for specialized pigging solutions tailored to specific pipeline applications and materials, leading to diversification within the industry. Competition among key players is intensifying, driving innovation and pushing for more cost-effective and technologically advanced solutions.

Several factors are driving the expansion of the pipeline pigging systems market. Firstly, the stringent regulatory environment emphasizing pipeline safety and environmental protection mandates regular pipeline inspection and maintenance, creating a substantial demand for efficient pigging solutions. Secondly, the global expansion of pipeline networks, particularly in developing economies, necessitates sophisticated pipeline maintenance strategies, thereby increasing the demand for advanced pigging systems. Thirdly, the ever-increasing complexity of pipelines, in terms of size, length, and the nature of transported substances, requires more sophisticated pigging technologies to ensure accurate inspection and efficient cleaning. The cost-effectiveness of pigging compared to other pipeline maintenance methods, such as excavation and replacement, serves as another significant driver. Furthermore, advancements in pigging technology, including the development of smart pigs with enhanced capabilities and data acquisition systems, are improving the efficiency and accuracy of pipeline inspections, thus increasing their adoption. Finally, the growing focus on predictive maintenance and the integration of data analytics in pipeline management are contributing to the market's expansion. These factors collectively create a compelling environment for the sustained growth of the pipeline pigging systems market.

Despite the significant growth potential, the pipeline pigging systems market faces several challenges. The high initial investment required for purchasing advanced pigging equipment can pose a barrier to entry for smaller companies, potentially limiting market penetration. The complexity of operating and maintaining sophisticated pigging systems necessitates specialized training and expertise, which can be costly and time-consuming. Furthermore, the risk of pigging-related incidents, such as pig sticking or damage to pipelines, necessitates stringent safety protocols and skilled personnel, adding to operational costs. Geographic limitations, particularly in remote or challenging terrain, can hinder the efficient deployment of pigging systems. Moreover, the varying types of pipelines and the transported substances require customized pigging solutions, which can increase development costs and complexity. Fluctuations in commodity prices, especially in the oil and gas sector, can impact the demand for pipeline pigging services, creating market uncertainty. Finally, the need for continuous innovation to adapt to evolving pipeline technologies and regulations presents an ongoing challenge for market players.

The Oil & Gas segment is poised to dominate the pipeline pigging systems market throughout the forecast period. This is due to the extensive network of oil and gas pipelines globally and the stringent regulatory requirements for their maintenance and safety. The substantial capital investment in oil and gas infrastructure, alongside ongoing expansion, ensures sustained demand for efficient and reliable pipeline inspection and cleaning services.

The continued expansion of oil and gas pipelines in developing regions, such as the Middle East and Asia-Pacific, further fuels this segment's dominance. The adoption of advanced UT pigging technology, capable of detecting a wider range of defects with higher precision, is further contributing to the market's growth within this segment. Stringent regulatory frameworks in North America and Europe mandate regular pipeline inspections, creating a substantial demand for effective pigging solutions within these regions. The focus on predictive maintenance strategies and the integration of data analytics are also driving growth in the Oil & Gas application segment. The rising adoption of automation in pipeline management is further boosting the demand for intelligent pigging systems capable of data acquisition and analysis, creating a favorable market for technology advancements.

The pipeline pigging systems industry is experiencing robust growth driven by several catalysts. Stringent regulatory compliance mandates regular pipeline inspections, pushing demand for advanced pigging technologies. The escalating complexity and length of global pipeline networks necessitate sophisticated maintenance solutions. Cost-effectiveness compared to traditional methods, such as excavation, makes pigging a preferred choice. Furthermore, technological advancements in pigging technology continuously enhance accuracy and efficiency, driving wider adoption. The rising focus on predictive maintenance and integration of data analytics improves operational efficiency and reduces downtime.

This report provides a comprehensive analysis of the pipeline pigging systems market, encompassing market size estimations, growth forecasts, competitive landscape analysis, and detailed segment-wise breakdowns. It covers various aspects of the market, including technological advancements, regulatory developments, and key growth drivers. The report also examines the challenges and opportunities facing the industry and profiles leading players in the market, providing valuable insights for businesses operating in this sector and investors seeking to capitalize on its growth potential. The detailed analysis allows for informed decision-making regarding market entry, investment strategies, and competitive positioning within the dynamic pipeline pigging systems industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.45% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 11.45%.

Key companies in the market include 3P Services GmbH & Co KG, GE (Baker Hughes), Pigtek Ltd, Dacon Inspection Services, PLL Pipeline Solutions, LIN SCAN, NDT Global Corporate Limited, Aubin Group, CIRCOR Energy, Diamond Edge Services, Pure Technologies, Enduro Pipeline Services, GeoCorr, T.D. Williamson, Pigs Unlimited International, OMV Aktiengesellschaft, .

The market segments include Type, Application.

The market size is estimated to be USD 11.16 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Pipeline Pigging Systems," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pipeline Pigging Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.