1. What is the projected Compound Annual Growth Rate (CAGR) of the Photographic Film?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Photographic Film

Photographic FilmPhotographic Film by Type (Wide Photographic Film, Narrow Photographic Film), by Application (Online Sales, Offline Sales), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

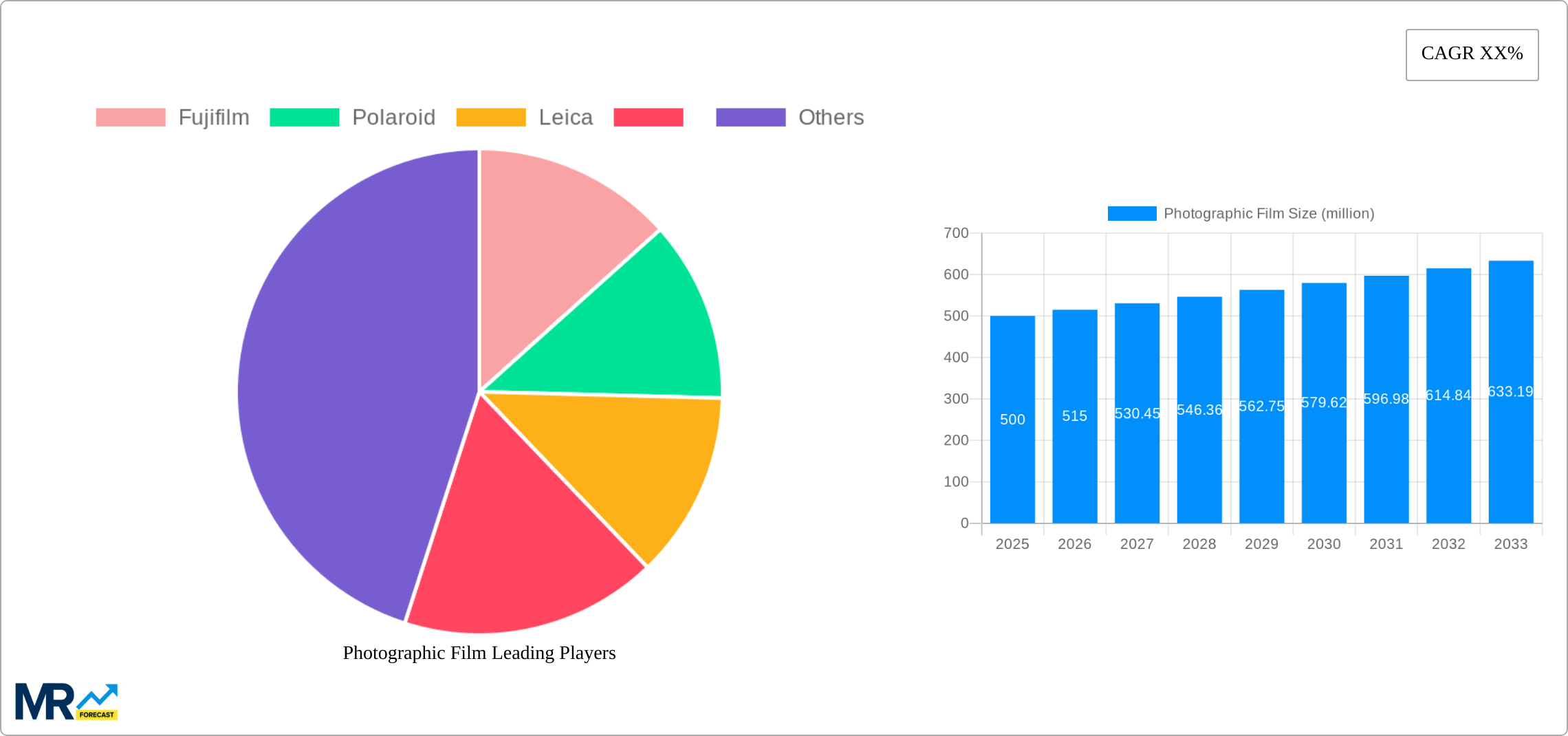

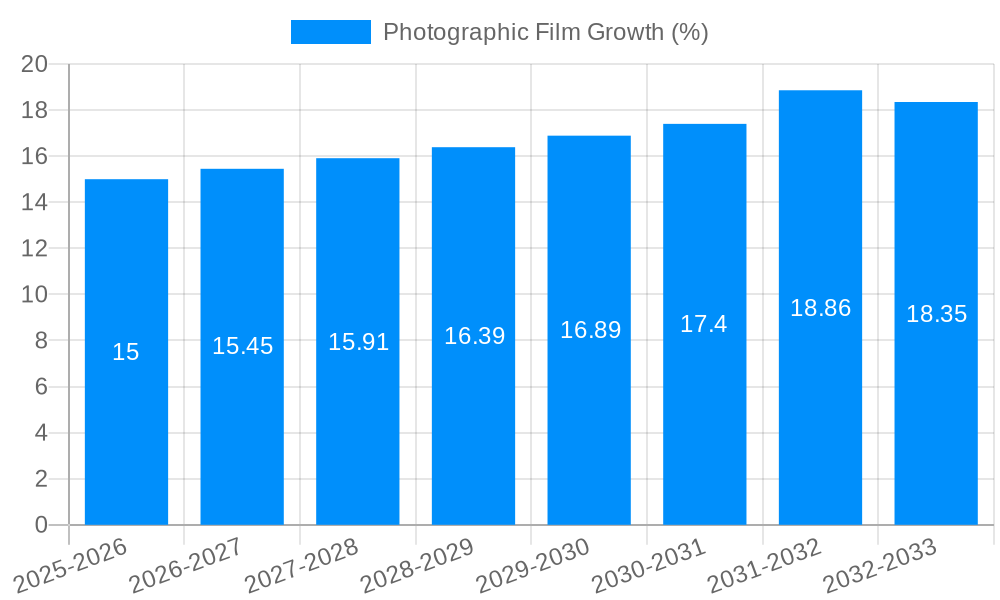

The global photographic film market, while facing the persistent challenge of digital photography's dominance, exhibits surprising resilience and niche growth potential. The market, estimated at $500 million in 2025, is projected to experience a compound annual growth rate (CAGR) of 3% from 2025 to 2033, driven by several key factors. A resurgence in interest in analog photography among younger demographics, fueled by a desire for unique aesthetics and tangible memories, contributes significantly to this growth. The rise of specialty film types catering to diverse artistic expressions further fuels market expansion. Moreover, the increasing popularity of instant photography, spearheaded by brands like Polaroid, contributes to overall market value, despite lower unit prices. Online sales channels are witnessing robust growth, providing access to a wider customer base and facilitating the discovery of niche film types. However, the market continues to face limitations, including high production costs compared to digital alternatives, and the limited availability of processing facilities in certain regions. Despite these restraints, continued innovation within film technology, especially in areas like improved emulsion formulas and environmentally friendly processing methods, is expected to attract and retain loyal customers, ensuring the market’s sustained development.

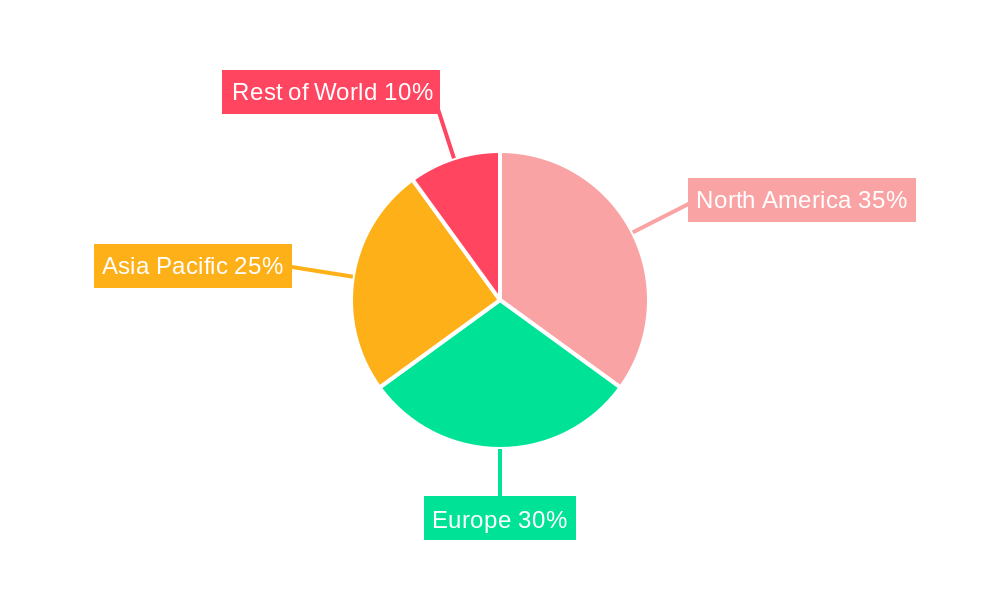

The geographic distribution of the market reveals a varied landscape. North America and Europe retain significant market shares due to established analog photography communities and robust distribution networks. However, Asia-Pacific regions, particularly China and Japan, show promising growth potential due to increasing disposable income and a rising appreciation for analog photography's artistic appeal. Strategic partnerships between film manufacturers and online retailers are enhancing the market's reach and accessibility, while brand loyalty plays a significant role in driving sales. The segmentation reveals significant market share for wide photographic film, reflecting a preference for traditional formats, with niche segments like narrow film and instant film experiencing faster growth rates. The continued evolution of film photography, balancing tradition with modern accessibility, will shape the market's trajectory in the coming years.

The global photographic film market, while seemingly niche in the digital age, exhibits surprising resilience and even pockets of growth. The study period from 2019 to 2033 reveals a complex narrative, with the historical period (2019-2024) showing a decline in overall consumption value, largely attributed to the continued dominance of digital photography. However, the estimated year (2025) and the forecast period (2025-2033) suggest a stabilization and even a potential modest upswing. This resurgence is fueled by several factors, including a growing appreciation for the unique aesthetic qualities of film photography amongst younger generations, the rise of analog photography as a counter-cultural movement, and a renewed interest in tangible, physical forms of media. The market is segmented by film type (wide and narrow), sales channels (online and offline), and applications, each demonstrating varying growth trajectories. While offline sales currently hold a larger market share, online sales are experiencing faster growth, reflecting the changing nature of consumer behavior. Furthermore, the market is witnessing innovation in film technology itself, with new emulsions and formats being introduced to cater to evolving artistic preferences. Key players like Fujifilm, Polaroid, and Leica are actively navigating this dynamic landscape, leveraging their brand heritage and investing in research and development to cater to the evolving demands of this resilient market segment. The global photographic film consumption value, measured in millions of units, is expected to fluctuate but show overall stability during the forecast period, driven by the niche but passionate community embracing analog photography. The market size, although smaller compared to digital photography, exhibits a unique value proposition and should continue its niche existence within the larger imaging market.

The resurgence of photographic film is not simply a nostalgic trend; it's a confluence of factors creating sustained demand. Firstly, the unique aesthetic qualities of film—its grain, its subtle color palettes, its inherent imperfections—are actively sought after by a growing number of photographers, particularly those seeking a distinct artistic style. This aesthetic appeal transcends generational boundaries, attracting both seasoned professionals and young, burgeoning artists. Secondly, the tangible nature of film photography offers a tactile experience missing in the digital realm. The ritual of shooting, developing, and printing film fosters a deeper connection with the creative process, promoting mindfulness and appreciation for the craft. This contrasts with the immediacy and often fleeting nature of digital photography. Thirdly, the rise of analog photography as a counter-cultural movement is undeniable. In a digitally saturated world, film photography represents a deliberate rejection of instant gratification and a return to a more considered and deliberate approach to image-making. Finally, the improved availability of affordable film cameras and developing supplies, along with online communities dedicated to film photography, have contributed to lowering the barriers to entry and fostering a supportive ecosystem for enthusiasts. These interconnected factors contribute to a positive feedback loop, driving continued growth and sustaining the photographic film market's unexpected resilience.

Despite the renewed interest, the photographic film market faces significant headwinds. The primary challenge remains the entrenched dominance of digital photography. Digital technology offers immediate feedback, ease of editing, and cost-effectiveness in terms of capturing and sharing images. This makes it difficult for film photography to compete in terms of convenience and accessibility. Further, the production and distribution costs associated with film remain relatively high compared to digital equivalents. The price of film itself, along with developing and printing services, can be a barrier to entry for many aspiring photographers. Moreover, the reliance on specialized equipment and knowledge, including darkrooms for processing, can be daunting for beginners. Environmental concerns regarding the chemical processes involved in film development also pose a challenge, requiring sustainable and eco-friendly alternatives to gain wider acceptance. Finally, the potential for supply chain disruptions and fluctuating raw material costs (silver, for example) can impact the market stability and pricing. These factors must be addressed to ensure long-term growth and broader adoption of this unique medium.

The global photographic film market shows diverse growth patterns across regions and segments. While a definitive "dominant" region is hard to pinpoint due to the niche nature of the market, specific segments exhibit stronger potential.

Online Sales: This segment demonstrates faster growth than offline sales, reflecting a shift in consumer behavior. The ease of access, broader product selection, and convenience of online purchasing cater to the global reach of the film photography community. The potential for global expansion through targeted online marketing and e-commerce platforms suggests this channel holds considerable future promise.

Narrow Photographic Film: This segment, often used in cameras with a specific aesthetic appeal (e.g., 35mm), enjoys consistent popularity. This is due in part to the wide availability of 35mm cameras both new and vintage, providing a cost-effective entry point for enthusiasts. Its broad appeal across age demographics and photography styles contributes to its market resilience.

Market Dominance by Region: While precise market share data varies, regions with established photography communities and a strong appreciation for analog aesthetics, such as North America and parts of Europe, currently show greater market activity. However, the online sales channel is quickly bridging geographic divides and fostering global engagement.

The paragraph summarizing this information: While geographical dominance remains diffuse, online sales present the most robust growth, fueled by a global network of photographers and enthusiasts. The narrow film segment, particularly the ubiquitous 35mm format, exhibits consistent demand due to its accessibility and aesthetic appeal. These elements, however, are likely to vary over the forecast period.

The ongoing growth in the photographic film industry is spurred by the increasing demand for unique artistic expressions and a move away from the instant gratification and perceived impersonality of digital photography. The rise of online communities, offering tutorials and fostering a supportive environment, plays a key role. Additionally, improved film stock availability and innovation in film types cater to the diversifying needs of photographers, further fueling market expansion.

This report offers a detailed analysis of the photographic film market, examining trends, drivers, challenges, and key players from 2019 to 2033. It provides insights into consumption value, market segmentation by type and application, sales channels, and significant developments. The focus is on understanding the dynamic nature of this niche market, its resilience despite the dominance of digital photography, and its potential for future growth.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Fujifilm, Polaroid, Leica, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Photographic Film," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Photographic Film, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.