1. What is the projected Compound Annual Growth Rate (CAGR) of the Photocatalytic Membranes for Building?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Photocatalytic Membranes for Building

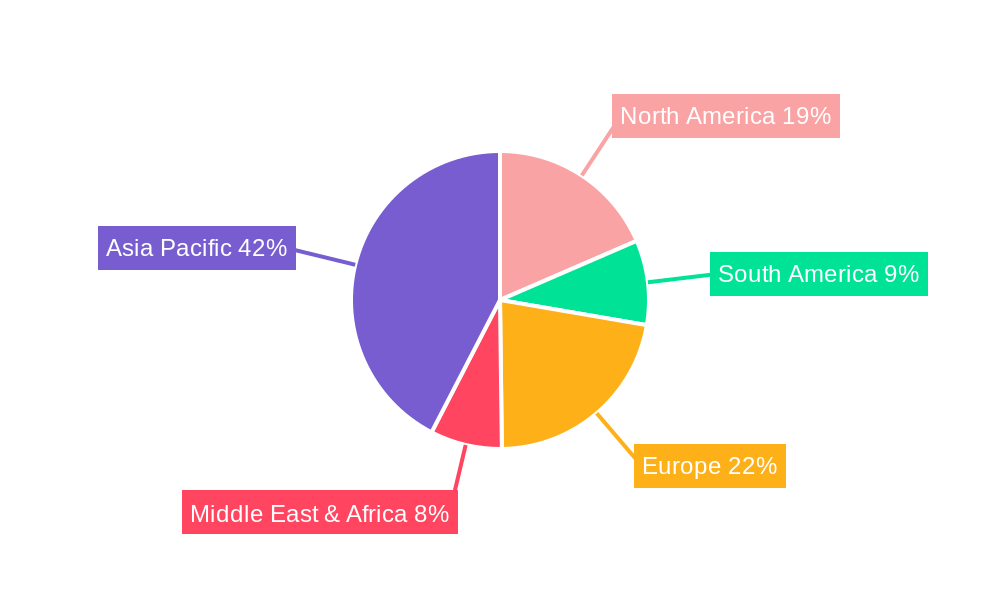

Photocatalytic Membranes for BuildingPhotocatalytic Membranes for Building by Type (0.6mm Thickness, 0.8mm Thickness), by Application (Industrial Building, Agricultural Building, Commercial Building, Private Building, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

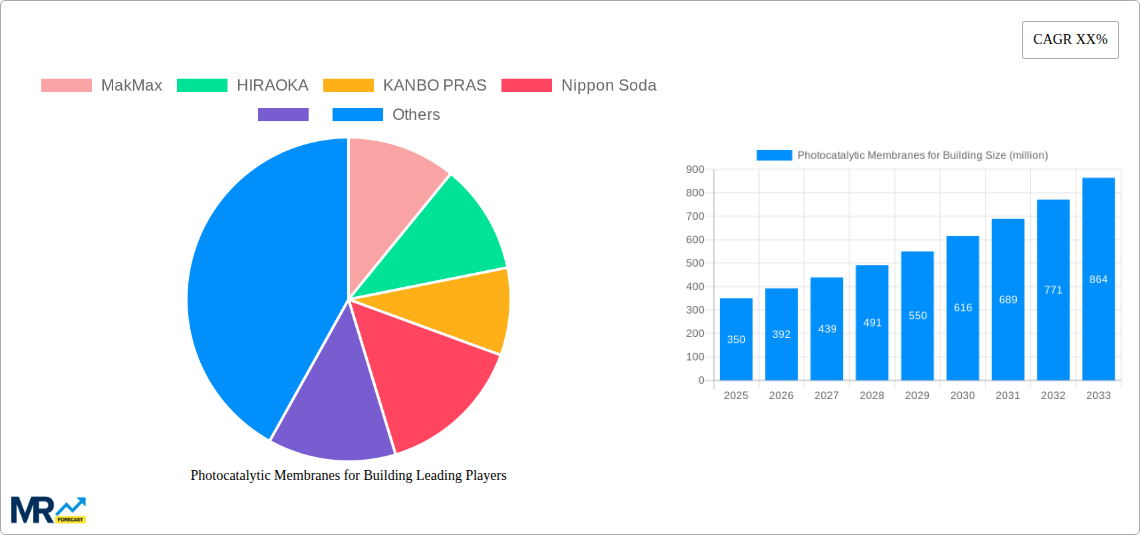

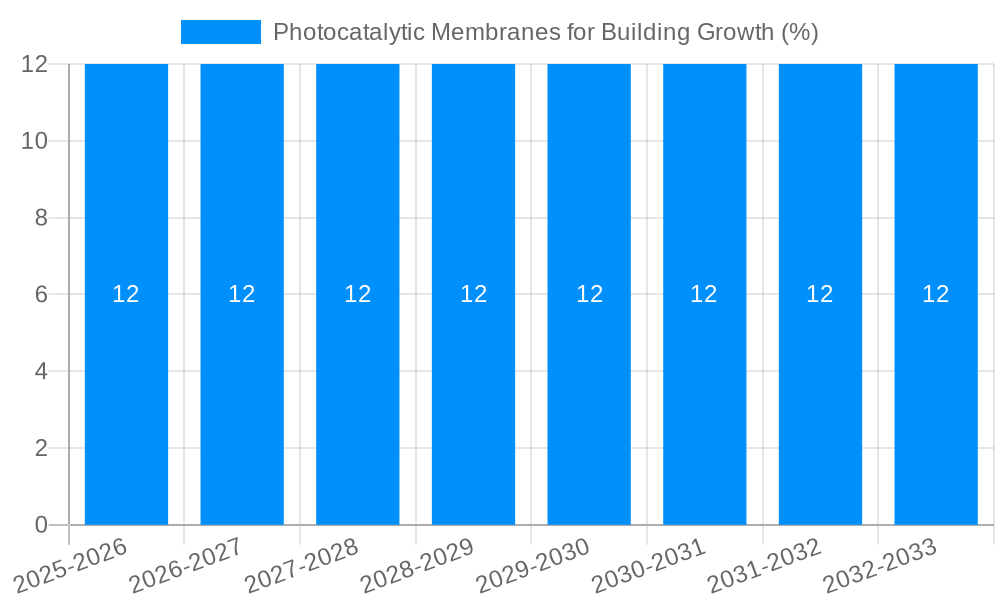

The global market for Photocatalytic Membranes for Building is poised for significant expansion, driven by a burgeoning demand for sustainable and advanced building materials. With an estimated market size of approximately USD 350 million in 2025, the sector is projected to witness a robust Compound Annual Growth Rate (CAGR) of around 12% through 2033. This growth is primarily fueled by the increasing awareness and adoption of photocatalytic technologies that offer self-cleaning, air purification, and pollution reduction capabilities for building facades and interiors. The market's expansion is also supported by stringent environmental regulations and growing consumer preference for eco-friendly construction solutions. Key applications, including industrial and agricultural buildings, are leading the adoption curve due to their larger surface areas and the direct benefits of improved air quality and reduced maintenance.

The market is characterized by innovative advancements in membrane types, with 0.6mm and 0.8mm thickness variations catering to diverse architectural and structural needs. While the "Industrial Building" and "Agricultural Building" segments currently dominate, the "Commercial Building" and "Private Building" sectors are expected to show accelerated growth as the benefits of photocatalytic membranes become more widely recognized and integrated into architectural designs. Restraints such as initial installation costs and the need for specialized application expertise are being mitigated by ongoing research and development efforts aimed at cost reduction and ease of use. Prominent players like MakMax, HIRAOKA, KANBO PRAS, and Nippon Soda are actively investing in R&D and expanding their production capacities to meet the escalating global demand, particularly in the rapidly developing Asia Pacific region. The trend towards smart cities and sustainable urban development further underpins the long-term positive outlook for photocatalytic membranes in the construction industry.

Here is a unique report description for Photocatalytic Membranes for Building, incorporating your specified elements:

This comprehensive report delves into the burgeoning market for photocatalytic membranes in the building sector, offering a detailed analysis of trends, drivers, challenges, and future projections. The study period spans from 2019 to 2033, with a base year and estimated year of 2025, and a forecast period from 2025 to 2033. The historical period analyzed is 2019-2024, providing a robust foundation for understanding market evolution.

The global market for photocatalytic membranes for building is poised for significant expansion, driven by an increasing awareness of environmental sustainability and the demand for advanced building materials that offer multiple functional benefits. These innovative membranes, leveraging the power of photocatalysis, are transforming conventional building envelopes into active components that can purify air, self-clean surfaces, and even contribute to energy efficiency. The market is projected to witness a Compound Annual Growth Rate (CAGR) of over 10% during the forecast period, with an estimated market size reaching USD 550 million by 2033.

The adoption of photocatalytic membranes is being propelled by a confluence of factors, including stringent environmental regulations, a growing preference for green building certifications, and the inherent advantages these materials offer in terms of reduced maintenance costs and improved indoor air quality. As urban populations continue to grow and the focus on sustainable development intensifies, the demand for building solutions that actively contribute to a healthier and more environmentally responsible built environment will undoubtedly surge.

However, the market is not without its hurdles. The initial higher cost of implementation compared to conventional building materials, coupled with the need for greater consumer education and skilled installation expertise, presents significant challenges. Furthermore, the long-term performance validation and standardization of photocatalytic membrane technologies require further research and development.

The photocatalytic membranes for building market is currently experiencing a significant uplift, transitioning from a niche application to a more mainstream building solution. The core trend revolves around the enhanced functionality these membranes bring to conventional building structures. Beyond mere aesthetics and weather protection, these membranes now actively participate in improving the building's environment. A key insight is the growing demand for self-cleaning and air-purifying facades. This trend is driven by the dual benefits of reduced cleaning and maintenance costs, which can be substantial over the lifespan of a building, and the significant improvement in urban air quality. Consider the cumulative impact of millions of square meters of building surfaces actively breaking down pollutants like nitrogen oxides (NOx) and volatile organic compounds (VOCs). The market size for such solutions, which was a modest USD 180 million in the historical period of 2019-2024, is now projected to grow exponentially. Another prominent trend is the integration of these membranes into high-performance building envelopes that offer enhanced durability and UV resistance, thereby extending the lifespan of the building and reducing the need for frequent replacements. The visual appeal is also evolving, with manufacturers developing membranes that offer a wider range of aesthetic options, seamlessly blending functionality with architectural design. The emphasis is shifting towards creating intelligent building skins that are not only protective but also contribute positively to the surrounding environment and the well-being of occupants. The market is also seeing increased innovation in the types of photocatalysts used, with a focus on more efficient and environmentally friendly options, moving away from traditional titanium dioxide towards novel nanomaterials. The development of specialized photocatalytic coatings for different climatic conditions and pollution levels is also gaining traction. This dynamic market is witnessing rapid advancements, with an estimated market valuation of USD 300 million in the base year of 2025, underscoring its accelerating trajectory. The increasing adoption in commercial and industrial sectors, driven by corporate social responsibility initiatives and the desire for premium building performance, further solidifies these trends.

The photocatalytic membranes for building market is experiencing robust growth, primarily fueled by an escalating global consciousness towards environmental sustainability and the pressing need for healthier urban environments. Governments worldwide are implementing stricter regulations on air pollution and promoting green building practices, which directly benefits the adoption of technologies like photocatalytic membranes. These membranes, through their ability to break down harmful pollutants such as NOx and VOCs, offer a tangible solution to combat urban smog and improve indoor air quality, thereby enhancing occupant health and well-being. The economic advantages, although sometimes masked by initial investment costs, are a significant driver. Reduced maintenance requirements due to self-cleaning properties translate into substantial savings over the building's lifecycle. Furthermore, the growing trend towards sustainable architecture and the increasing demand for LEED and BREEAM certifications are pushing developers and architects to incorporate advanced, eco-friendly materials. The innovation in material science, leading to more efficient, durable, and aesthetically pleasing photocatalytic membranes, is also a key propellant. As these membranes become more accessible and their benefits better understood, their integration into diverse construction projects, from residential complexes to large-scale infrastructure, is set to accelerate. The estimated market growth to USD 550 million by 2033 signifies the powerful combination of these driving forces.

Despite the promising outlook, the photocatalytic membranes for building market faces several significant challenges that temper its growth trajectory. The primary restraint is the higher upfront cost of these advanced membranes compared to traditional building materials. This perceived economic barrier can deter budget-conscious developers and contractors, even when the long-term cost savings are substantial. Another critical challenge is the lack of widespread awareness and understanding among end-users, architects, and builders regarding the specific benefits and technical nuances of photocatalytic technology. This knowledge gap often leads to skepticism and hesitation in adoption. Furthermore, the installation and maintenance expertise for these specialized membranes are not yet as widespread as for conventional materials, requiring investment in training and development for the construction workforce. The performance standardization and long-term durability validation of photocatalytic membranes under diverse environmental conditions are still evolving areas. Manufacturers need to provide more robust, independently verified data on lifespan and efficacy to build greater market confidence. Finally, the regulatory landscape and certification processes for advanced building materials are still catching up, which can create hurdles for market entry and product approval. Overcoming these challenges is crucial for unlocking the full potential of this innovative sector.

The global market for photocatalytic membranes for building is poised for significant growth, with certain regions and segments exhibiting a stronger propensity for adoption and market dominance.

Dominant Segments:

Application: Commercial Building: This segment is expected to lead the market due to several compelling factors.

Type: 0.8mm Thickness: While both 0.6mm and 0.8mm thickness membranes are gaining traction, the 0.8mm thickness is anticipated to hold a larger market share, particularly in commercial and industrial applications.

Dominant Regions:

The growth of the photocatalytic membranes for building industry is being significantly catalyzed by a confluence of factors. Foremost among these is the escalating global imperative for sustainable urban development and the increasing regulatory push for cleaner air. As cities grapple with pollution challenges, the demand for building materials that actively contribute to environmental remediation is surging. Furthermore, advancements in material science are continuously yielding more efficient, durable, and cost-effective photocatalytic materials, making them more attractive to developers. The growing preference for smart and healthy buildings, coupled with the economic advantages of reduced maintenance and improved indoor air quality, are also powerful growth catalysts.

This comprehensive report offers an in-depth exploration of the photocatalytic membranes for building market, providing actionable insights for stakeholders. It meticulously analyzes market dynamics, including trends, drivers, and challenges, with a strong emphasis on the evolving regulatory landscape and consumer preferences for sustainable construction. The report presents detailed market segmentation by type (e.g., 0.6mm Thickness, 0.8mm Thickness) and application (e.g., Industrial Building, Agricultural Building, Commercial Building, Private Building, Others), offering a granular understanding of segment-specific growth opportunities. Projections are underpinned by robust data analysis covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033), with an estimated market size of USD 550 million by 2033. It also profiles key industry players and highlights significant developments, providing a holistic view of this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include MakMax, HIRAOKA, KANBO PRAS, Nippon Soda, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Photocatalytic Membranes for Building," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Photocatalytic Membranes for Building, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.