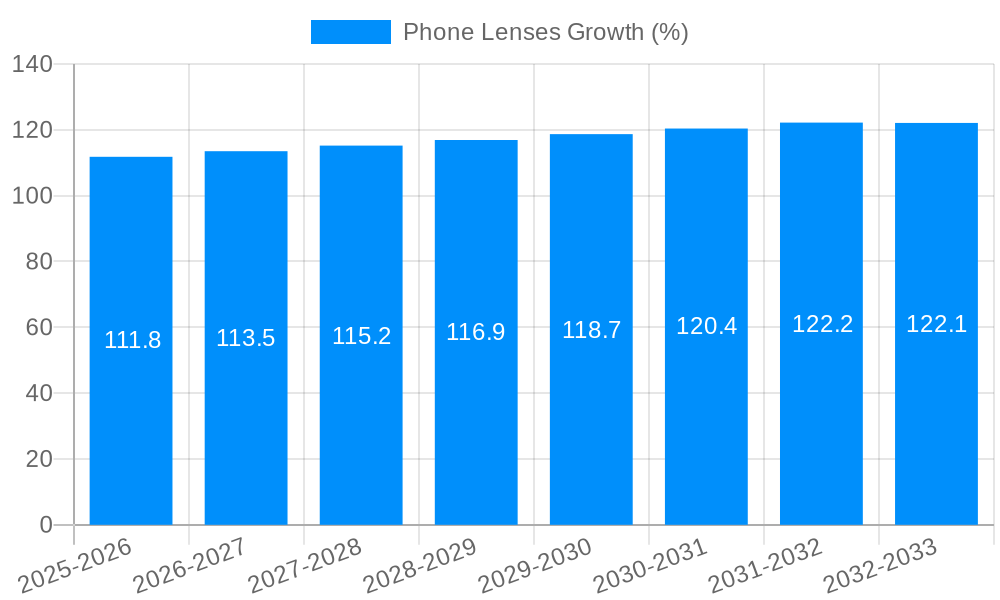

1. What is the projected Compound Annual Growth Rate (CAGR) of the Phone Lenses?

The projected CAGR is approximately 2.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Phone Lenses

Phone LensesPhone Lenses by Type (2-in-1 Lens Kit, 3-in-1 Lens Kit, 4-in-1 Lens Kit, Others), by Application (Online Sales, Offline Sales), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

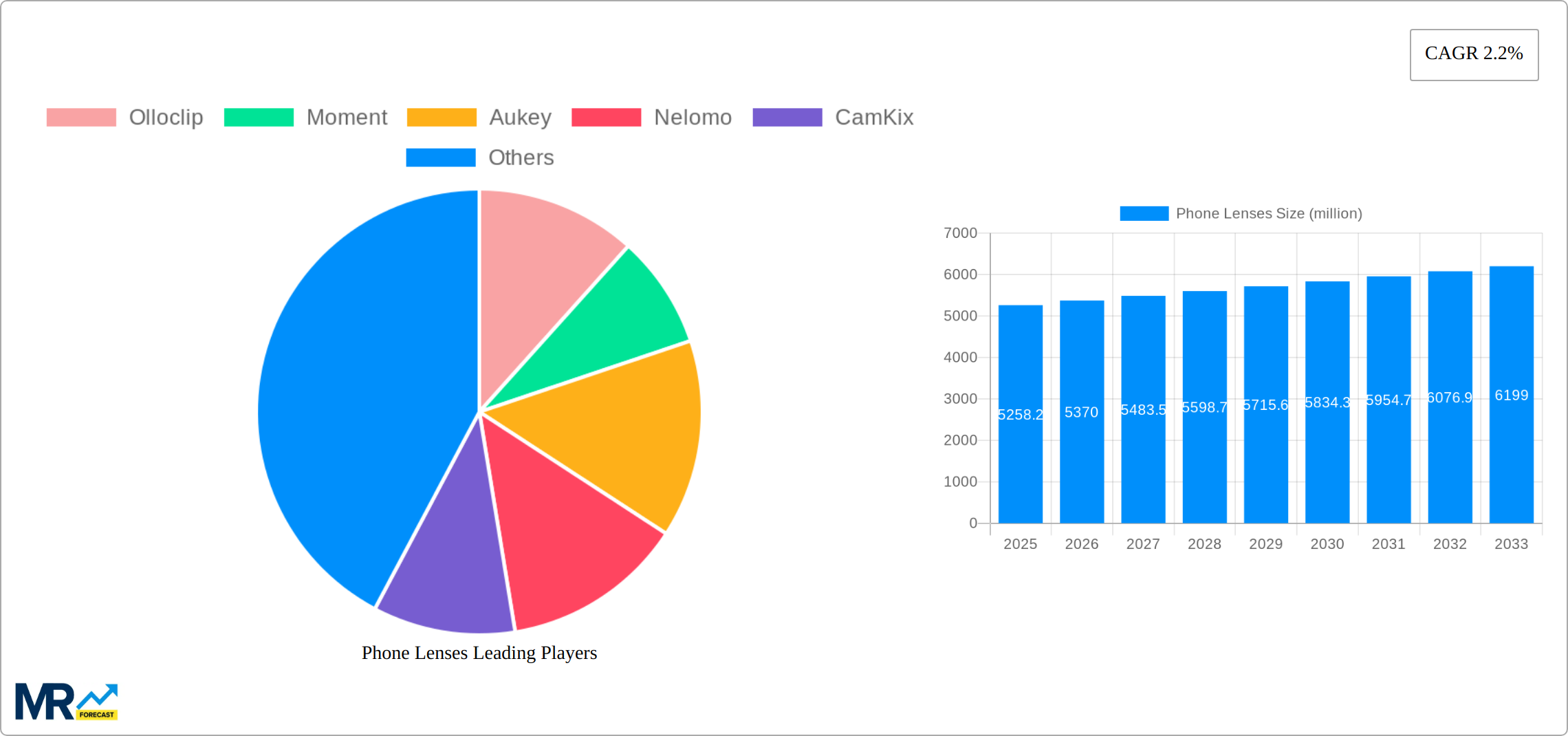

The phone lens attachment market, valued at $5,258.2 million in 2025, is projected to experience steady growth, driven by several key factors. The increasing popularity of mobile photography, coupled with the desire for enhanced image quality and creative capabilities beyond the limitations of built-in phone cameras, fuels demand for these accessories. Consumers are seeking high-quality lenses offering features like macro photography, wide-angle shots, and telephoto zoom, all accessible through their smartphones. This trend is amplified by the rise of social media platforms, where high-quality images are crucial for engagement. Technological advancements, such as improved lens designs and more sophisticated smartphone camera integration, contribute to market expansion. A 2.2% CAGR suggests a relatively stable, yet consistent growth trajectory through 2033. Competition among numerous brands, including Olloclip, Moment, and others, is driving innovation and affordability, making these accessories accessible to a broader consumer base.

However, certain restraints exist. The overall market's growth is moderated by factors such as the increasing capabilities of built-in smartphone cameras, which increasingly incorporate features previously exclusive to external lenses. The price sensitivity of some consumers might limit adoption, especially for high-end lens attachments. Despite these factors, the market continues to demonstrate resilience, benefiting from the ongoing preference for convenient and high-quality mobile photography. The continued rise of smartphone photography trends and technological advancements in the lens industry suggest the market will maintain a slow and steady trajectory. The diversity of brands and price points ensures market accessibility and continued growth.

The global phone lenses market is experiencing robust growth, projected to reach multi-million unit sales by 2033. The study period from 2019 to 2033 reveals a fascinating evolution, with the historical period (2019-2024) setting the stage for the exponential growth anticipated in the forecast period (2025-2033). By the estimated year of 2025, the market will have consolidated its position, showcasing a clear trajectory of increasing adoption. Key market insights point towards a consumer base increasingly demanding higher-quality mobile photography, pushing the demand for versatile and affordable phone lenses. This demand is further fueled by the rise of social media, where high-quality images are crucial for engagement. Furthermore, the declining cost of manufacturing and the increasing availability of sophisticated lens technologies have made these accessories more accessible to a wider audience. The market is witnessing a shift from basic macro and wide-angle lenses towards more specialized options, including telephoto lenses, fisheye lenses, and even specialized lenses for astrophotography. This increasing sophistication reflects the growing expertise and demand from amateur and professional mobile photographers. The competition among various manufacturers is also driving innovation and pushing prices down, making high-quality phone lenses a realistic accessory for the average smartphone user. This creates a positive feedback loop, where increased affordability fuels higher demand, driving further innovation and ultimately benefitting consumers. The market is showing clear signs of maturity, with established players like Olloclip and Moment facing increasing competition from a wider range of manufacturers, each striving to offer unique features and price points to capture market share. This competitive landscape is ultimately beneficial for consumers, offering a diverse range of choices in terms of quality, features, and price.

Several factors are propelling the phenomenal growth of the phone lenses market. The primary driver is the ever-increasing demand for enhanced mobile photography capabilities. Smartphones have become the primary photography tool for many, and users are constantly seeking ways to improve image quality and versatility beyond the limitations of built-in smartphone cameras. The rise of social media platforms, where visually appealing content is paramount, further intensifies this demand. Furthermore, advancements in lens technology, miniaturization, and manufacturing processes have made it possible to produce high-quality lenses at increasingly affordable prices. This affordability is crucial in driving mass adoption, making these accessories accessible to a broader consumer base. The increasing popularity of mobile photography as a hobby and even a profession is also a key factor. Amateurs and professionals alike are using smartphones with enhanced lenses to capture high-quality images and videos for various purposes, from social media content to professional portfolios. Finally, the convenient and portable nature of phone lenses is a major attraction. Unlike bulky DSLR cameras and lenses, phone lenses are easily attached and carried, making them perfect for capturing spontaneous moments and diverse photographic situations.

Despite the market's impressive growth, several challenges and restraints exist. One major challenge is ensuring compatibility across the vast array of smartphone models available on the market. Different phone designs and camera configurations can create compatibility issues, requiring manufacturers to develop lenses compatible with a wide range of devices. This significantly increases development costs and complexity. Another challenge is maintaining consistent image quality across various lens types. Ensuring that each lens performs optimally, without introducing significant distortion or other image flaws, is a critical aspect of quality control. Furthermore, the increasing competition within the market creates price pressures, forcing manufacturers to optimize production costs without compromising quality. This requires constant innovation and efficiency improvements in manufacturing processes. Finally, the reliance on smartphone technology itself poses a challenge. New smartphone models are constantly released, rendering older lenses incompatible. Manufacturers must constantly adapt their product lines to maintain relevance and market share, adding another layer of complexity and potential cost.

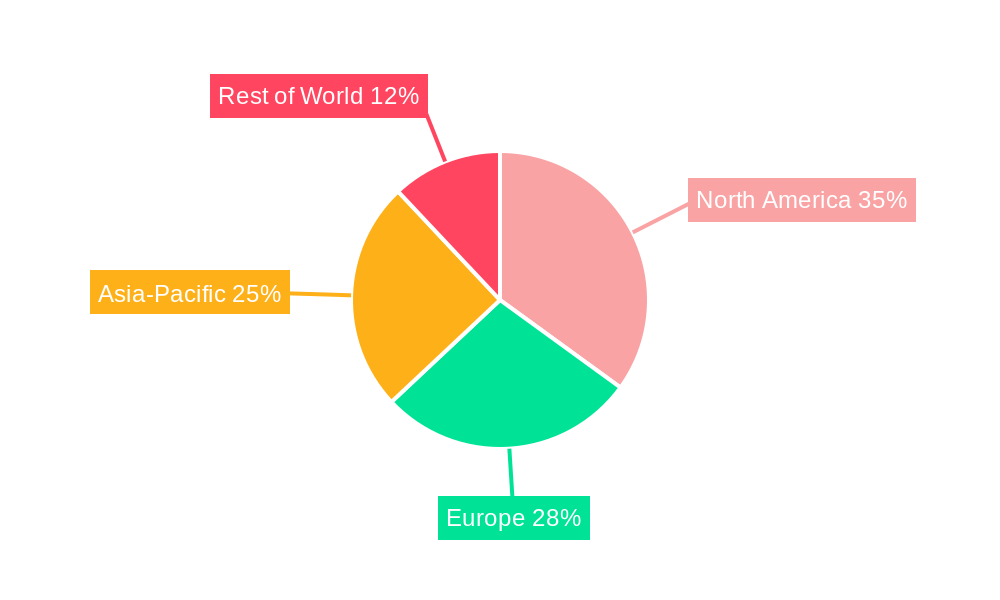

The phone lenses market is geographically diverse, with several regions showcasing significant growth. However, North America and Europe are projected to maintain a leading position throughout the forecast period due to high smartphone penetration and strong consumer demand for high-quality mobile photography. Within these regions, the United States and major European countries like Germany, the UK, and France are anticipated to be key growth drivers. The Asia-Pacific region, especially countries like China and India, is also experiencing rapid growth, fueled by a burgeoning middle class with increasing disposable income and a rising interest in mobile photography. As for market segments, the wide-angle lens segment consistently demonstrates strong performance due to its versatility in capturing broader landscapes and group photos. The macro lens segment also experiences considerable growth, reflecting the consumer desire to capture close-up shots with exceptional detail. These two segments, along with the emerging telephoto lens market, are key drivers of overall market expansion. In terms of specific consumer groups, young adults and photography enthusiasts represent the largest market share, reflecting the lifestyle-oriented nature of mobile photography and the ease of use of the accessories.

The phone lenses market's growth is primarily fueled by increasing smartphone penetration globally, the rising demand for enhanced mobile photography capabilities, and the affordability of these accessories due to technological advancements and economies of scale in manufacturing. The increasing popularity of social media platforms, where high-quality images are crucial, also plays a major role. The continued miniaturization and improvement of lens technology contribute to better image quality and broader consumer appeal.

This report provides a comprehensive overview of the phone lenses market, analyzing key trends, driving forces, challenges, and growth opportunities from 2019 to 2033. It includes detailed market segmentation, regional analysis, competitive landscape assessment, and profiles of leading players in the industry. The report is a valuable resource for companies seeking to enter or expand within this dynamic and rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.2% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 2.2%.

Key companies in the market include Olloclip, Moment, Aukey, Nelomo, CamKix, Bamoer, Apexel, AMIR, Xenvo, DOFLY, Zeso, ClipityPix, .

The market segments include Type, Application.

The market size is estimated to be USD 5258.2 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Phone Lenses," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Phone Lenses, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.