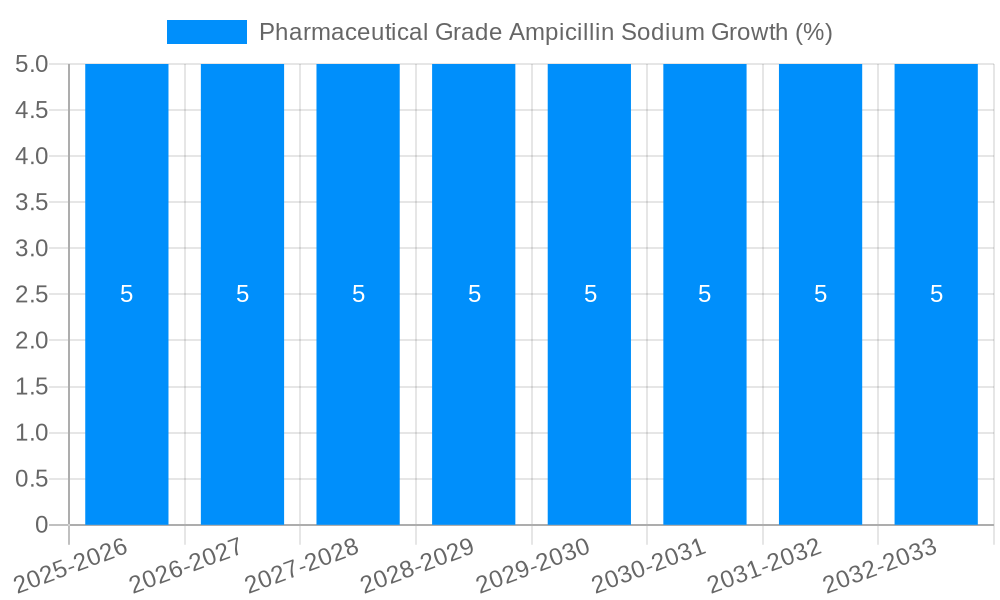

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Grade Ampicillin Sodium?

The projected CAGR is approximately 5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Pharmaceutical Grade Ampicillin Sodium

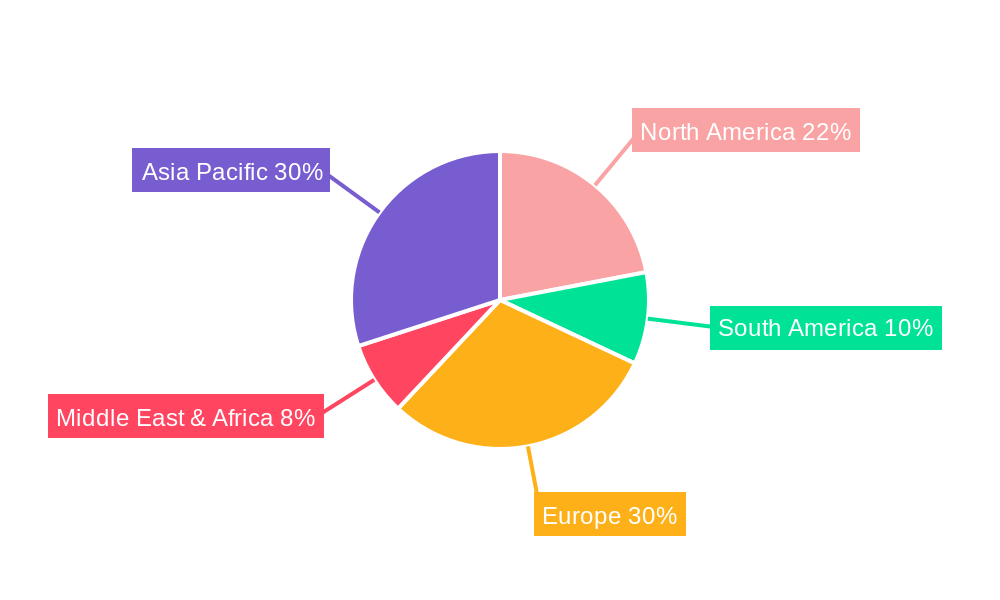

Pharmaceutical Grade Ampicillin SodiumPharmaceutical Grade Ampicillin Sodium by Type (Purity≥99%, Purity, World Pharmaceutical Grade Ampicillin Sodium Production ), by Application (Injection, Sterile Powder for Injection, World Pharmaceutical Grade Ampicillin Sodium Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

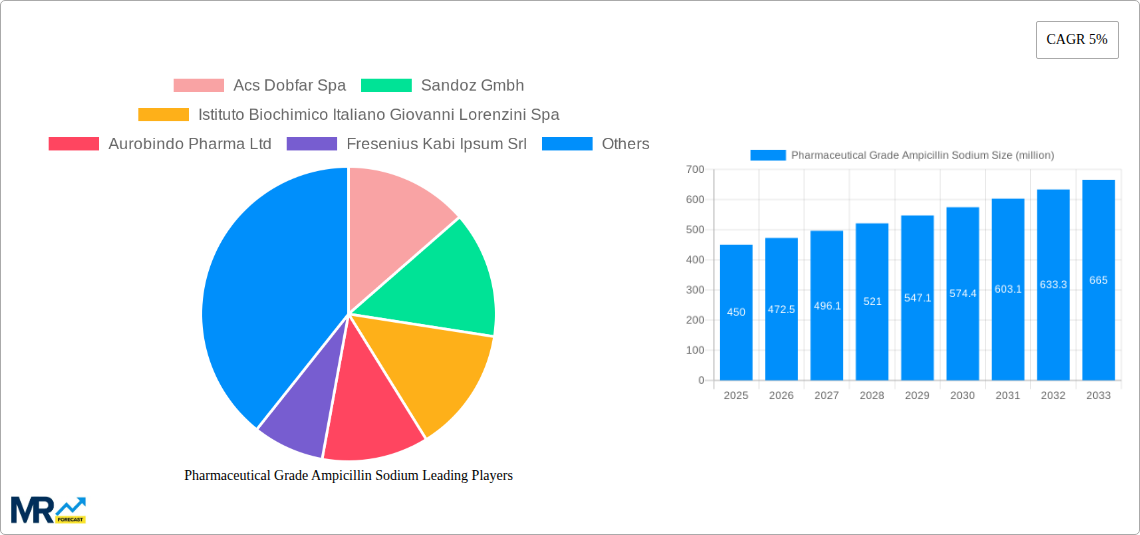

The global market for Pharmaceutical Grade Ampicillin Sodium is projected to witness robust expansion, driven by the sustained demand for effective antibiotic treatments in both human and veterinary medicine. With a market size estimated at approximately USD 450 million in 2025, the sector is poised for steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5% through 2033. Key drivers fueling this growth include the increasing prevalence of bacterial infections, a rising global population, and an expanding healthcare infrastructure, particularly in emerging economies. The pharmaceutical grade segment, characterized by its high purity standards (Purity ≥ 99%), is expected to dominate, catering primarily to the production of injectables and sterile powders for injection. This segment's demand is intrinsically linked to the healthcare industry's need for reliable and potent antimicrobial agents to combat a wide spectrum of infections, from respiratory ailments to serious systemic diseases.

Despite the positive outlook, the market faces certain restraints, notably the growing concerns surrounding antibiotic resistance and the subsequent push for responsible antibiotic stewardship. Regulatory scrutiny regarding the manufacturing processes and quality control of Active Pharmaceutical Ingredients (APIs) also presents a hurdle for some market players. However, ongoing research and development efforts focused on novel delivery systems and combination therapies, alongside the continued importance of ampicillin sodium as a cost-effective and broad-spectrum antibiotic, are expected to mitigate these challenges. The market landscape is characterized by a mix of established global pharmaceutical giants and specialized API manufacturers, with significant production capabilities concentrated in regions like Asia Pacific and Europe. The competitive environment is likely to intensify as companies focus on enhancing production efficiency, ensuring stringent quality compliance, and expanding their distribution networks to cater to the ever-growing global demand for essential antibiotics.

This comprehensive report delves into the global Pharmaceutical Grade Ampicillin Sodium market, offering an in-depth analysis spanning the Study Period: 2019-2033, with the Base Year: 2025 and Estimated Year: 2025. The Forecast Period: 2025-2033 provides critical insights into future market trajectories, building upon the Historical Period: 2019-2024. The report quantifies market dynamics in million units, presenting a granular view of production, consumption, and demand. It meticulously examines the intricate interplay of technological advancements, regulatory landscapes, and evolving healthcare needs that shape the production and application of this vital antibiotic. The research underscores the sustained demand for high-purity Ampicillin Sodium, particularly in sterile formulations, and forecasts robust growth driven by its established efficacy and affordability in combating bacterial infections across diverse patient populations. Furthermore, the report explores emerging trends in manufacturing efficiency and supply chain optimization, essential for meeting escalating global health requirements.

The global Pharmaceutical Grade Ampicillin Sodium market is characterized by a steady and predictable growth trajectory, underpinned by its enduring importance in the fight against bacterial infections. XXX, a key market insight, reveals a consistent demand for Ampicillin Sodium, particularly in developing economies where it remains a cost-effective first-line treatment. The market is witnessing a subtle but significant trend towards higher purity grades, with Purity≥99% becoming the benchmark for injectable formulations, ensuring enhanced safety and efficacy. While overall World Pharmaceutical Grade Ampicillin Sodium Production is projected to increase by approximately 8-10% annually during the forecast period, this growth is not uniform across all segments. The application segment for Sterile Powder for Injection is demonstrating particularly strong momentum, reflecting the ongoing emphasis on sterile manufacturing processes and the need for stable, ready-to-reconstitute antibiotic preparations. This is especially relevant for critical care settings and outpatient treatments requiring precise dosing. Another noteworthy trend is the increasing adoption of advanced manufacturing technologies aimed at improving yields and reducing environmental impact. Companies are investing in process optimization and quality control to meet stringent regulatory standards and maintain competitive pricing. The report also highlights a growing interest in combination therapies, where Ampicillin Sodium might be used in conjunction with other antibiotics or beta-lactamase inhibitors to broaden its spectrum of activity and combat emerging resistance patterns. This diversification of application, while nascent, presents a potential avenue for future market expansion. The market's resilience is also attributed to its established safety profile and decades of clinical experience, making it a trusted choice for healthcare professionals. However, the persistent challenge of antibiotic resistance necessitates continuous monitoring and responsible stewardship, which in turn influences production strategies and the development of newer, more potent agents. Nevertheless, for the foreseeable future, Pharmaceutical Grade Ampicillin Sodium is expected to retain its significant market share due to its indispensable role in managing a wide range of common bacterial infections. The global production of Ampicillin Sodium, estimated to reach around 550 million units in the base year of 2025, is anticipated to grow steadily, with key players actively expanding their capacities to meet this sustained demand.

The sustained demand and projected growth of the Pharmaceutical Grade Ampicillin Sodium market are driven by a confluence of potent factors. Foremost among these is the persistent global burden of bacterial infections. Despite advancements in medicine, conditions such as respiratory tract infections, urinary tract infections, and skin and soft tissue infections remain prevalent, necessitating effective and accessible antibiotic treatments. Ampicillin Sodium, with its broad-spectrum activity against many Gram-positive and Gram-negative bacteria, continues to be a cornerstone therapy for these common ailments. Its established efficacy, backed by decades of clinical research and real-world application, instills confidence in healthcare providers and patients alike. Furthermore, the cost-effectiveness of Ampicillin Sodium is a significant propellant, particularly in low- and middle-income countries where budget constraints often dictate treatment choices. This economic advantage ensures its continued accessibility and widespread use, contributing to its consistent market presence. The continuous emphasis on World Pharmaceutical Grade Ampicillin Sodium Production and its availability as a Sterile Powder for Injection also plays a crucial role. Regulatory bodies worldwide maintain stringent quality standards, and manufacturers are adept at producing high-purity Ampicillin Sodium compliant with these requirements. The sterile powder formulation ensures stability and facilitates administration in various clinical settings, from hospitals to primary care facilities. As populations grow and healthcare access expands, the demand for essential medicines like Ampicillin Sodium is expected to rise in tandem, further fueling market expansion.

Despite its established position, the Pharmaceutical Grade Ampicillin Sodium market is not without its challenges and restraints. The most significant and persistent concern is the escalating global issue of antibiotic resistance. The overuse and misuse of antibiotics, including Ampicillin Sodium, have led to the development of bacterial strains that are less susceptible or entirely resistant to its effects. This necessitates a shift towards more potent or newer generation antibiotics for certain infections, potentially limiting the market share of Ampicillin Sodium in specific therapeutic areas. Regulatory hurdles also present a constant challenge. Stringent quality control measures and evolving regulatory requirements for pharmaceutical manufacturing, particularly for injectable sterile products, demand continuous investment in advanced technologies and robust quality assurance systems from manufacturers. This can increase production costs and create barriers to entry for smaller players. Moreover, the presence of generic competitors in the market often leads to price erosion, putting pressure on profit margins for manufacturers. While affordability is a driving force, intense competition can make it challenging for companies to recoup significant investments in research, development, and production. Supply chain disruptions, as witnessed in recent global events, can also impact the availability and cost of raw materials, affecting production schedules and overall market stability. Finally, the development of novel antibacterial agents with improved efficacy or resistance profiles could, in the long term, displace Ampicillin Sodium in certain applications, although its broad utility and cost-effectiveness make it resilient.

The World Pharmaceutical Grade Ampicillin Sodium Production market is poised for significant growth and regional dominance, with the Application: Sterile Powder for Injection segment and the Asia-Pacific region emerging as key drivers.

Dominant Segment: Sterile Powder for Injection

Dominant Region: Asia-Pacific

The growth of the Pharmaceutical Grade Ampicillin Sodium industry is significantly propelled by the increasing global prevalence of bacterial infections, particularly in developing nations. The drug's cost-effectiveness and well-established efficacy make it a preferred choice for managing common infections where access to newer, more expensive antibiotics is limited. Furthermore, advancements in manufacturing technologies are enabling higher purity and more stable formulations, especially for Sterile Powder for Injection, meeting stringent regulatory demands. The expanding healthcare infrastructure and rising disposable incomes in emerging economies are also contributing to increased demand for essential medicines like Ampicillin Sodium.

The global market for Pharmaceutical Grade Ampicillin Sodium is populated by a number of key manufacturers, including:

This report provides a holistic view of the Pharmaceutical Grade Ampicillin Sodium market, offering comprehensive coverage that extends beyond basic market sizing. It meticulously analyzes the intricate value chain, from raw material sourcing to finished product distribution, identifying key bottlenecks and opportunities for optimization. The report delves into the regulatory landscape, detailing the compliance requirements and standards that govern the production and sale of Ampicillin Sodium in different global regions. Furthermore, it explores the competitive intelligence of leading manufacturers, including their production capacities, market strategies, and investment plans, providing valuable insights for strategic decision-making. The forecast also considers the potential impact of emerging antibiotic resistance patterns and the development of alternative treatments, offering a nuanced perspective on the long-term sustainability of Ampicillin Sodium's market position.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5%.

Key companies in the market include Acs Dobfar Spa, Sandoz Gmbh, Istituto Biochimico Italiano Giovanni Lorenzini Spa, Aurobindo Pharma Ltd, Fresenius Kabi Ipsum Srl, Sterile India Pvt Ltd, Shandong Lukang Pharmaceutical, Sichuan Ren'an Pharmaceutical, Zhuhai United Laboratories, CSPC Zhongnuo Pharmaceutical, Good Doctor Pharmaceutical, Langzhi Group Bokang Pharmaceutical Co., Ltd., Shanghai Shanghai Pharmaceuticals New Asia Pharmaceutical Co., Ltd., Harbin Pharmaceutical Group, North China Pharmaceutical Group Xiantai Pharmaceutical, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Pharmaceutical Grade Ampicillin Sodium," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pharmaceutical Grade Ampicillin Sodium, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.