1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Butyl Rubber Stoppers?

The projected CAGR is approximately 4.8%.

Pharmaceutical Butyl Rubber Stoppers

Pharmaceutical Butyl Rubber StoppersPharmaceutical Butyl Rubber Stoppers by Type (Bromobutyl Rubber Stoppers, Chlorobutyl Rubber Stoppers), by Application (Big Infusion, Antibiotic, Freeze-Dried), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

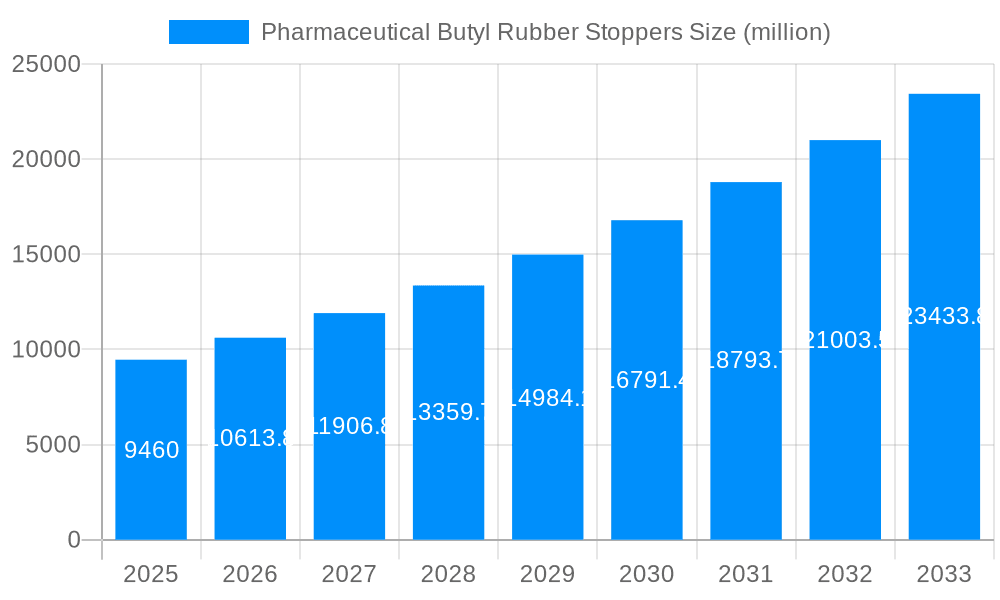

The global Pharmaceutical Butyl Rubber Stoppers market is poised for robust expansion, projected to reach an estimated $9.46 billion by 2025, driven by a compound annual growth rate (CAGR) of 13.15%. This significant surge is underpinned by escalating global healthcare expenditures, an increasing demand for sterile and safe pharmaceutical packaging solutions, and the burgeoning biopharmaceutical sector. The continuous development of novel drug formulations, particularly in areas like oncology and biologics, necessitates advanced stopper technologies that ensure drug integrity and prevent contamination. Furthermore, stringent regulatory requirements worldwide, emphasizing product safety and efficacy, are compelling pharmaceutical manufacturers to adopt high-quality butyl rubber stoppers. The market's growth is also fueled by the rising prevalence of chronic diseases and an aging global population, both of which contribute to a higher demand for injectable drugs and, consequently, their packaging components. Innovations in stopper design, such as enhanced barrier properties and self-sealing capabilities, are further stimulating market adoption.

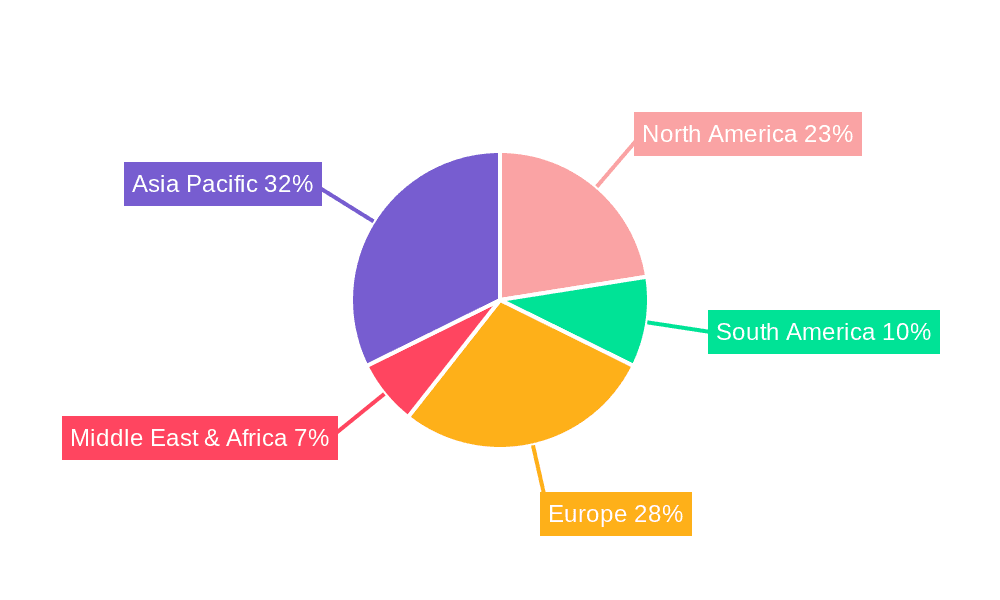

The market segmentation reveals distinct growth avenues. Bromobutyl rubber stoppers are expected to lead due to their superior impermeability to gases and moisture, making them ideal for sensitive drug formulations. Chlorobutyl rubber stoppers will also witness steady demand, particularly for antibiotic applications. In terms of applications, the big infusion segment is a major contributor, driven by the widespread use of large-volume parenteral solutions. The antibiotic and freeze-dried drug segments are also experiencing significant growth, reflecting the expanding pharmaceutical pipeline and the increasing preference for lyophilized formulations due to their extended shelf life and improved stability. Geographically, the Asia Pacific region is anticipated to emerge as a dominant force, propelled by rapid industrialization, a growing domestic pharmaceutical manufacturing base, and increasing investments in healthcare infrastructure in countries like China and India. North America and Europe, with their established pharmaceutical industries and high regulatory standards, will continue to be significant markets. Emerging economies in South America, the Middle East, and Africa present substantial untapped potential for market expansion.

The pharmaceutical butyl rubber stoppers market is a critical yet often overlooked segment within the global healthcare packaging industry, projected to witness substantial growth fueled by an expanding pharmaceutical pipeline and increasing demand for sterile drug delivery solutions. The study period, spanning from 2019 to 2033, with a base and estimated year of 2025, highlights a dynamic landscape shaped by technological advancements, regulatory shifts, and evolving healthcare needs. Historically, the market has seen consistent expansion, with the forecast period (2025-2033) poised to build upon this momentum. The overarching trend points towards an increased reliance on high-quality, inert stoppers that ensure drug stability, prevent contamination, and facilitate aseptic drug administration. This demand is particularly pronounced in the development and production of biologics, vaccines, and complex parenteral formulations, where material compatibility and barrier properties are paramount. The market's value, measured in billions of units, underscores its immense scale and the vital role it plays in ensuring the safety and efficacy of pharmaceutical products worldwide.

Key market insights reveal a growing preference for advanced butyl rubber formulations, such as bromobutyl and chlorobutyl stoppers, owing to their superior chemical resistance and reduced leachables. These specialized stoppers are essential for sensitive drug products that require extended shelf lives and protection from degradation. The application segments are equally dynamic, with a notable surge in demand for stoppers used in big infusion volumes, antibiotic formulations, and freeze-dried products. The increasing prevalence of chronic diseases and the subsequent rise in the number of patients requiring long-term intravenous therapies directly translate to a higher consumption of stoppers for big infusions. Similarly, the ongoing need for effective antibiotic treatments, especially in the face of rising antimicrobial resistance, underpins the sustained demand in this application. The burgeoning biopharmaceutical sector, with its emphasis on stable and potent therapeutic agents, is a significant driver for freeze-dried stoppers, ensuring product integrity during storage and transportation. The market is characterized by a complex interplay of factors, including stringent quality control measures, evolving packaging regulations, and the continuous pursuit of cost-effectiveness without compromising safety and performance. As the global pharmaceutical industry matures and expands its reach, the demand for reliable and high-performance butyl rubber stoppers is set to remain a cornerstone of drug manufacturing and delivery.

The pharmaceutical butyl rubber stoppers market is propelled by a confluence of powerful drivers, each contributing significantly to its upward trajectory. Foremost among these is the relentless growth of the global pharmaceutical industry, characterized by an ever-expanding pipeline of new drug discoveries and an increasing number of generic drug approvals. This surge in pharmaceutical production directly translates to a proportional increase in the demand for essential packaging components like butyl rubber stoppers. Furthermore, the rising global healthcare expenditure, driven by aging populations and the increasing prevalence of chronic diseases, has amplified the need for accessible and effective medications, thereby boosting the consumption of stoppers for various drug delivery systems. The accelerating development and commercialization of biologics and biosimilars represent another pivotal driver. These complex therapeutic agents are often sensitive to environmental factors and require highly inert and reliable stoppers to maintain their stability and efficacy throughout their shelf life. The shift towards pre-filled syringes and vials, which offer convenience and improved dosing accuracy, also contributes to the demand for specialized stoppers designed to fit these primary packaging formats. Finally, stringent regulatory requirements from health authorities worldwide mandate the use of high-quality, safe, and compliant packaging materials, pushing manufacturers to adopt premium butyl rubber stoppers that meet these exacting standards.

Despite its robust growth prospects, the pharmaceutical butyl rubber stoppers market faces several challenges and restraints that could potentially impede its progress. One of the primary concerns is the volatile pricing of raw materials, particularly the natural rubber and synthetic polymers that form the basis of butyl rubber. Fluctuations in the global supply and demand of these commodities can significantly impact the manufacturing costs of stoppers, leading to price instability for end-users. Moreover, the stringent and evolving regulatory landscape surrounding pharmaceutical packaging can present a hurdle. Manufacturers must continually adapt to new guidelines and certifications, which often require substantial investment in research, development, and quality control processes. The emergence of alternative packaging materials, although currently less prevalent for critical applications, poses a potential long-term threat. While butyl rubber offers superior performance, ongoing innovation in areas like advanced polymers and elastomers could lead to competitive solutions. Another significant challenge lies in counterfeiting and the supply of substandard stoppers. The market's reliance on reliable and sterile components means that the introduction of counterfeit or inferior products can have severe consequences for patient safety and brand reputation, necessitating robust supply chain security measures. Furthermore, the manufacturing process for high-quality butyl rubber stoppers is complex and requires specialized expertise and equipment, which can limit the number of new entrants and create supply chain bottlenecks.

The pharmaceutical butyl rubber stoppers market is characterized by a significant dominance of specific regions and segments, driven by a combination of factors including manufacturing capabilities, healthcare infrastructure, regulatory environments, and pharmaceutical production volumes.

Key Dominating Segments:

Key Dominating Regions/Countries:

The interplay between these dominant segments and regions creates a concentrated market landscape where demand for high-quality, specialized butyl rubber stoppers is concentrated. Companies operating in this space must strategically focus on these areas to maximize market penetration and leverage growth opportunities.

The pharmaceutical butyl rubber stoppers industry is experiencing several potent growth catalysts. The relentless expansion of the global pharmaceutical market, driven by an aging population and the increasing burden of chronic diseases, fuels the demand for all types of pharmaceutical packaging. The burgeoning biopharmaceutical sector, with its complex and sensitive drug formulations, necessitates the use of highly inert and reliable stoppers. Advancements in drug delivery systems, such as pre-filled syringes and complex injectable formulations, also contribute to this growth. Furthermore, stringent regulatory mandates for drug safety and product integrity continuously push for the adoption of premium-quality stoppers, which butyl rubber excels at providing.

This comprehensive report on pharmaceutical butyl rubber stoppers offers an in-depth analysis of market dynamics, trends, and opportunities. It meticulously covers the historical period (2019-2024), base and estimated year (2025), and forecast period (2025-2033), providing a robust understanding of market evolution. The report delves into key drivers such as the expanding pharmaceutical industry and the rise of biologics, while also addressing restraints like raw material price volatility. It offers detailed insights into dominant segments like bromobutyl and chlorobutyl stoppers, and applications such as antibiotics and big infusions, along with regional market analyses. Leading players and significant developments are thoroughly documented, equipping stakeholders with strategic intelligence for informed decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.8%.

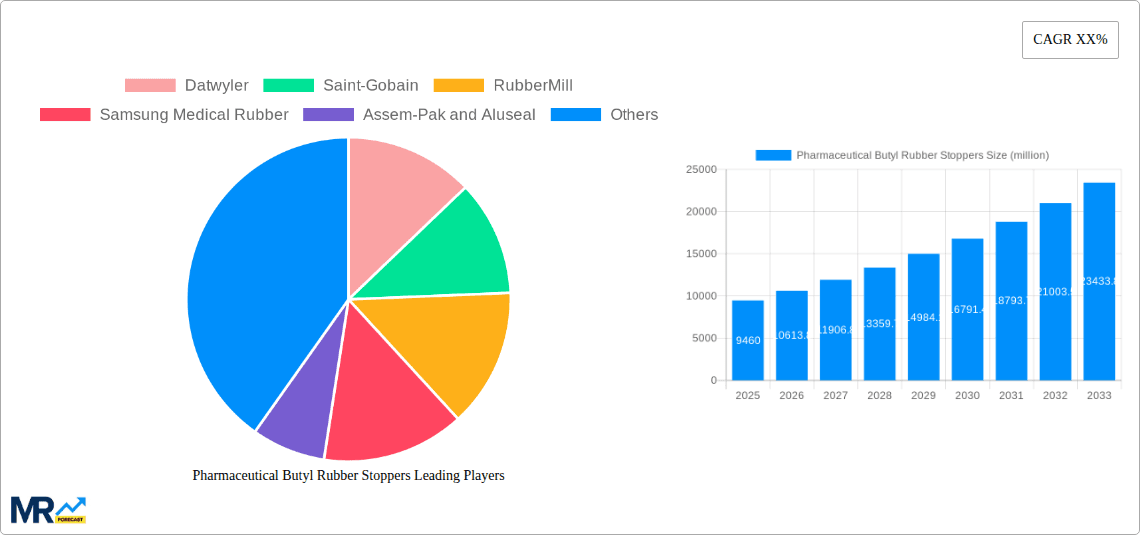

Key companies in the market include Datwyler, Saint-Gobain, RubberMill, Samsung Medical Rubber, Assem-Pak and Aluseal, SumitomoRubber, Aoxiang pharmaceutical packing, Hebei First Rubber Medical Technology, Huaqiang High-Tech, Best New Medical Material, Hualan New Pharmaceutical Material, Shandong Pharmaceutical Glass, Huaneng Medical Rubber Products, Geili Packaging Material, Aido Medicinal Glass, Aobo Glass Products, Shandong Guohui New Material, Huaren Pharmaceutical.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Pharmaceutical Butyl Rubber Stoppers," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pharmaceutical Butyl Rubber Stoppers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.