1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Business?

The projected CAGR is approximately 5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Pharmaceutical Business

Pharmaceutical BusinessPharmaceutical Business by Application (Medical Institutions, Consumers), by Type (Drugs, Medical Devices, Chemical Reagents, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

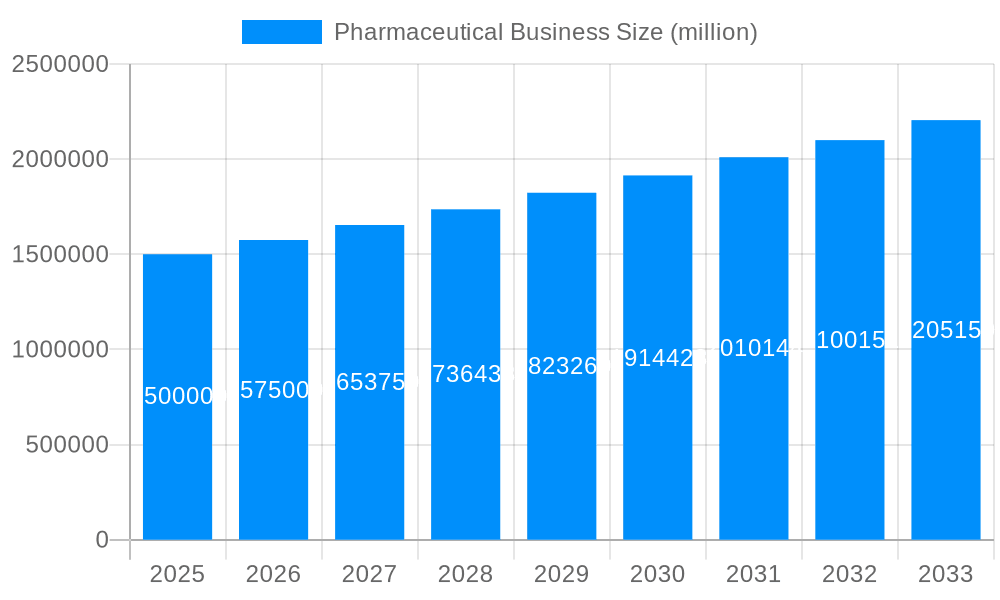

The global pharmaceutical market, a sector characterized by continuous innovation and evolving regulatory landscapes, is projected to experience robust growth. While the exact market size for 2025 is not provided, considering a 5% CAGR from a base year (assumed to be 2019), and referencing publicly available data on pharmaceutical market valuations, a reasonable estimate for the 2025 market size could be in the range of $1.5 trillion. This substantial figure reflects the increasing prevalence of chronic diseases, an aging global population driving demand for medications, and the ongoing development of novel therapies. Key growth drivers include the rising incidence of cancer, cardiovascular diseases, and diabetes, alongside the increasing adoption of personalized medicine and the expansion of healthcare infrastructure in emerging markets. Trends indicate a shift toward biopharmaceuticals, advanced therapies like gene editing and cell therapy, and a greater focus on digital health solutions for patient engagement and drug development. However, the market also faces challenges such as stringent regulatory approvals, high research and development costs, and increasing pressure to reduce drug prices. The segment analysis shows significant contributions from medical institutions, consumers, and diverse product types including drugs, medical devices, and chemical reagents. Competition is fierce, with both large multinational corporations like McKesson and Cardinal Health and regional players contributing to market dynamics.

The geographical distribution of market share reflects established pharmaceutical hubs in North America and Europe, but significant growth is anticipated in Asia-Pacific regions, particularly China and India, driven by rising disposable incomes, improving healthcare access, and burgeoning pharmaceutical manufacturing capabilities. The forecast period (2025-2033) promises continued growth, although the exact CAGR may fluctuate based on economic conditions, technological breakthroughs, and regulatory changes. Understanding these market dynamics and competitive pressures is crucial for stakeholders to effectively navigate the opportunities and challenges presented by this dynamic industry. Market segmentation is key; further analysis by specific therapeutic areas (e.g., oncology, cardiovascular, central nervous system) will reveal even more granular insights into market potential and competitive landscape.

The global pharmaceutical business, valued at $1.5 trillion in 2024, is experiencing dynamic shifts driven by technological advancements, evolving healthcare needs, and geopolitical factors. The historical period (2019-2024) saw significant growth, particularly in specialized therapies like oncology and immunology, fueled by an aging population and increasing prevalence of chronic diseases. However, pricing pressures, regulatory hurdles, and the rise of biosimilars have introduced complexities. The estimated market size for 2025 stands at $1.7 trillion, reflecting continued expansion but at a potentially moderated pace compared to previous years. The forecast period (2025-2033) anticipates steady growth, driven by factors such as the ongoing development of innovative treatments, personalized medicine, and increasing healthcare expenditure in emerging markets. Despite this positive outlook, challenges remain, including patent expirations for blockbuster drugs, the need for greater access to affordable medicines, and the ongoing struggle to balance innovation with cost-effectiveness. The market is increasingly segmented, with a strong focus on specialized therapeutic areas and personalized medicine solutions. This trend is further fueled by the adoption of advanced technologies such as artificial intelligence (AI) and big data analytics, which are transforming drug discovery, development, and market access. Competition is fierce, with both established pharmaceutical giants and innovative biotech companies vying for market share. Strategic alliances, mergers and acquisitions, and a focus on enhancing operational efficiencies are key strategies adopted by players across the value chain. The rising importance of digital health and telehealth is reshaping the industry, with increased adoption of digital platforms for patient engagement, remote monitoring, and drug delivery.

Several key factors are driving the growth of the pharmaceutical business. Firstly, the aging global population is leading to an increased incidence of chronic diseases, creating a greater demand for pharmaceutical products. Secondly, advancements in research and development are continuously leading to the discovery of new and more effective treatments for a wide range of conditions. This includes innovative therapies such as targeted cancer treatments, immunotherapies, and gene therapies, commanding premium pricing. Technological advancements also play a crucial role, facilitating faster and more efficient drug discovery and development processes. Big data analytics and AI are being leveraged to accelerate clinical trials and improve the overall efficacy of drug development. Additionally, the increasing prevalence of infectious diseases, including emerging pandemics, fuels demand for vaccines and antiviral drugs. Government initiatives and policies aimed at improving healthcare access and affordability, along with increased investments in healthcare infrastructure in developing countries, also contribute significantly to the growth of the pharmaceutical market. Finally, the growing awareness among consumers about their health and wellness is leading to increased self-medication and demand for over-the-counter pharmaceutical products.

Despite the substantial growth potential, the pharmaceutical business faces significant challenges. Stringent regulatory requirements and lengthy approval processes can significantly delay the launch of new drugs, impacting profitability. Intense competition among pharmaceutical companies, including the rise of biosimilars and generic drugs, puts pressure on pricing and profit margins. The high cost of research and development, coupled with the risk of drug failure, presents a substantial financial hurdle for pharmaceutical companies. Concerns surrounding drug safety and efficacy, coupled with increasing regulatory scrutiny, necessitate stringent quality control measures and substantial investments in compliance. Patent expirations for blockbuster drugs lead to a decline in sales, prompting pharmaceutical companies to focus on developing innovative drugs with extended patent protection. Fluctuations in exchange rates and geopolitical instability can disrupt global supply chains and impact the profitability of multinational pharmaceutical companies. Finally, ethical considerations regarding drug pricing and access to essential medicines pose significant challenges for the industry, demanding a balance between innovation and affordability.

The global pharmaceutical market is fragmented, with different regions and segments exhibiting varying growth trajectories. However, the Drugs segment is expected to retain its dominant position, accounting for the lion's share of the market throughout the forecast period (2025-2033).

Within the Drugs segment, oncology drugs and immunotherapies are projected to experience the highest growth rates, fueled by increasing cancer incidence and the development of innovative, targeted therapies. Chronic disease medications, including diabetes and cardiovascular drugs, also comprise a substantial and growing segment. The consumer segment will grow at a steady pace due to the growing popularity of over-the-counter medications and increased self-medication practices.

The Medical Institutions application segment will remain the largest in terms of revenue, with hospitals and clinics accounting for a significant portion of drug consumption. However, the increasing emphasis on home healthcare and ambulatory care settings suggests a gradual shift in the share of the market from traditional inpatient settings.

The pharmaceutical business is poised for continued expansion driven by several factors: the ongoing development and launch of innovative new drugs addressing unmet medical needs, technological advancements in drug discovery and delivery systems (e.g., personalized medicine, gene therapy), and increasing investments in research and development by both large pharmaceutical companies and biotech startups. Expansion into emerging markets with growing healthcare budgets is also a significant growth catalyst. The rising adoption of digital health technologies, including telehealth and remote patient monitoring, is transforming healthcare delivery and enhancing patient engagement, presenting opportunities for innovative pharmaceutical companies.

This report provides a comprehensive overview of the pharmaceutical business, covering market trends, driving forces, challenges, key players, and significant developments from 2019 to 2033. The study period encompasses historical data (2019-2024), with 2025 serving as the base and estimated year. The forecast period extends to 2033, offering valuable insights for strategic decision-making within the industry. The detailed analysis across segments (Drugs, Medical Devices, etc.) and applications (Medical Institutions, Consumers, etc.) provides a granular understanding of the market dynamics. The report also highlights key growth catalysts and challenges for companies operating in this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5%.

Key companies in the market include McKesson Corporation, Cardinal Health, AmerisourceBergen Corporation, CVS Health, Walgreens Boots Alliance, Rite Aid, Diplomat Pharmacy, MatsumotoKiyoshi, GoodRx, Tsuruha, Welcia, Sugi, Sundrug, Clicks, Shanghai Pharmaceuticals Holding, Yifeng Pharmacy Chain, China Meheco Group, Jointown Pharmaceutical Group, DaShenLin Pharmaceutical Group, China National Medicines Corporation, LBX Pharmacy Chain Joint Stock Company, Yixintang Pharmaceutical, China National Accord Medicines Corporation, Qingdao Baheal Medical, Shanghai Kai Kai Industry Company Limited, Morris and Dickson, H.D.Smith, Smith Drug, CuraScript Specialty Distribution, Anda Distribution, North Caralina Mutual Wholesale Drug, Rochester Drug Cooperative, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Pharmaceutical Business," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pharmaceutical Business, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.