1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Aluminum Aerosol Cans?

The projected CAGR is approximately 4.18%.

Pharmaceutical Aluminum Aerosol Cans

Pharmaceutical Aluminum Aerosol CansPharmaceutical Aluminum Aerosol Cans by Type (Metered Dose Inhalers, Nasal Sprays, Topical Sprays, Other), by Application (Respiratory Medications, Allergy Medications, Wound Care, Dermatology, Ophthalmology, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

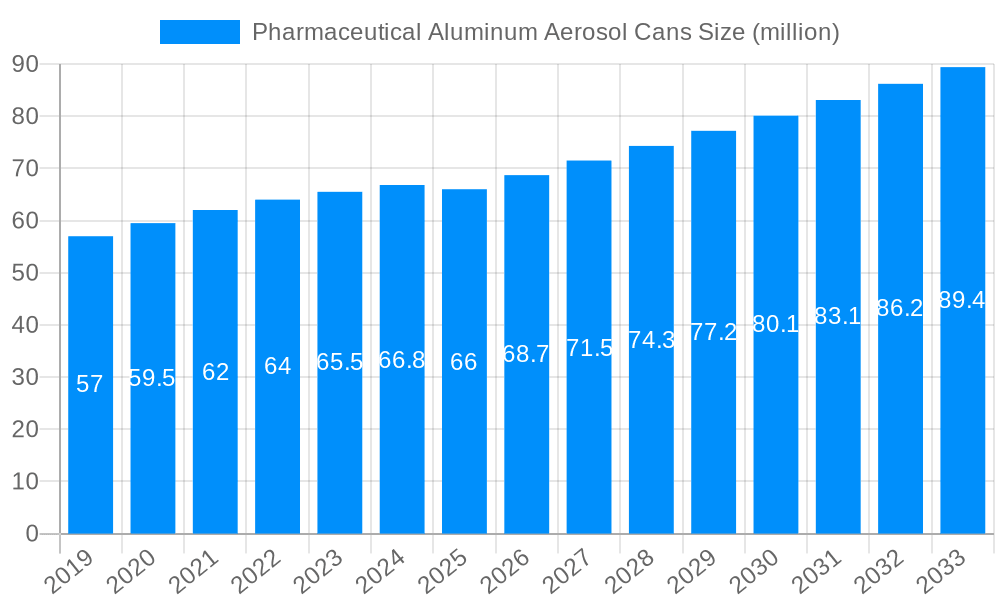

The global Pharmaceutical Aluminum Aerosol Cans market is poised for steady expansion, projected to reach a substantial market size of $66 million by 2025. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of 4.1% through 2033, indicating sustained demand for these critical packaging solutions. The primary drivers for this upward trajectory are the increasing prevalence of respiratory illnesses and allergies worldwide, necessitating the widespread use of metered-dose inhalers and nasal sprays. Furthermore, advancements in drug delivery systems and a growing consumer preference for convenient and effective topical and dermatological treatments are also significantly contributing to market expansion. The pharmaceutical industry's continuous focus on product innovation and the development of new therapeutic applications will further fuel the demand for high-quality, reliable aluminum aerosol cans.

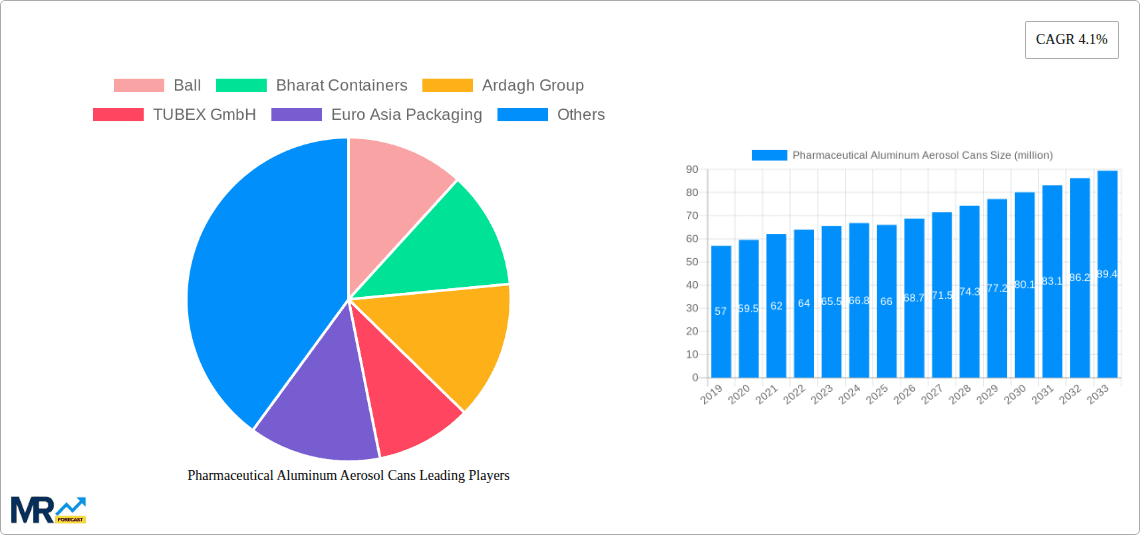

The market is segmented across various applications, with Respiratory Medications and Allergy Medications representing the most dominant segments due to the ongoing global health concerns in these areas. Wound Care and Dermatology applications are also witnessing robust growth, driven by the demand for specialized treatments and the increasing adoption of aerosolized drug delivery for localized therapies. Looking ahead, the market is characterized by key trends such as the growing emphasis on sustainability and the adoption of recyclable packaging materials, where aluminum cans offer a distinct advantage. Innovations in can design, including improved valve systems and enhanced safety features, are also shaping the market. While the market benefits from strong demand, potential restraints include fluctuations in raw material prices, particularly aluminum, and stringent regulatory requirements for pharmaceutical packaging. However, the overall outlook remains positive, with major players like Ball, Ardagh Group, and CCL Container actively investing in expanding their production capacities and developing advanced packaging solutions to meet the evolving needs of the pharmaceutical sector.

Here's a unique report description for Pharmaceutical Aluminum Aerosol Cans, incorporating the provided details:

This comprehensive report delves into the intricate world of Pharmaceutical Aluminum Aerosol Cans, offering a panoramic view of market trends, growth drivers, challenges, and future projections. The study period spans from 2019 to 2033, with a keen focus on the Base Year of 2025 and a detailed Forecast Period from 2025 to 2033, building upon Historical Period data from 2019 to 2024. Our analysis is grounded in a robust understanding of market dynamics, projecting an impressive market size in the millions of units.

The global market for Pharmaceutical Aluminum Aerosol Cans is experiencing a significant evolutionary phase, characterized by increasing demand for advanced drug delivery systems and a growing emphasis on patient convenience and safety. As of 2025, the market stands poised for robust expansion, driven by a confluence of factors including the rising prevalence of chronic respiratory diseases, a surge in allergy-related conditions, and advancements in dermatological and wound care applications. The intrinsic properties of aluminum – its inertness, excellent barrier protection against light and oxygen, and recyclability – make it the material of choice for a wide array of pharmaceutical formulations. Metered Dose Inhalers (MDIs) continue to be a dominant segment, particularly for respiratory medications, as they offer precise dosage delivery and portability. The increasing aging population globally, coupled with a higher incidence of respiratory ailments, directly translates to a sustained demand for MDIs. Furthermore, the growing awareness and diagnosis of allergic rhinitis and other allergic conditions are fueling the demand for nasal sprays, another crucial application segment. Topical sprays are also gaining traction for their ease of application in dermatology and wound care, offering a non-invasive and efficient method of drug administration. The market is witnessing a trend towards innovative valve technologies and propellants, aiming to enhance therapeutic efficacy, reduce environmental impact, and improve patient experience. The shift towards more sustainable packaging solutions also favors aluminum aerosol cans due to their high recyclability rates. The integration of smart technologies for dosage tracking and adherence monitoring within aerosol cans represents a nascent but promising development. Looking ahead, the market is anticipated to witness steady growth, driven by ongoing research and development in drug formulations and delivery mechanisms, further solidifying the indispensable role of aluminum aerosol cans in modern healthcare.

Several powerful forces are collectively propelling the growth of the Pharmaceutical Aluminum Aerosol Cans market. Foremost among these is the escalating global burden of respiratory diseases such as asthma and Chronic Obstructive Pulmonary Disease (COPD). These conditions necessitate reliable and effective drug delivery systems, with Metered Dose Inhalers (MDIs) serving as a cornerstone of treatment. The aging global population, increasingly susceptible to these ailments, directly fuels the demand for such devices. Concurrently, the pervasive rise in allergies, ranging from seasonal hay fever to more severe reactions, is a significant market influencer. Nasal sprays, a key application within the aluminum aerosol can landscape, offer a convenient and targeted solution for managing allergy symptoms, thus contributing substantially to market expansion. Beyond respiratory and allergic applications, the growing demand for advanced dermatological treatments and improved wound care solutions is also a critical driver. Topical sprays provide a hygienic, easy-to-use, and precise method for applying medications to the skin, catering to the increasing consumer preference for accessible self-care options. Furthermore, the inherent advantages of aluminum as a packaging material – its superior barrier properties, inertness, lightweight nature, and recyclability – align perfectly with the pharmaceutical industry's stringent requirements for product integrity, shelf-life extension, and environmental responsibility. Ongoing innovation in aerosol technology, including the development of advanced valve systems and eco-friendly propellants, further enhances the appeal and functionality of these packaging solutions, ensuring their continued relevance and dominance in pharmaceutical drug delivery.

Despite the promising growth trajectory, the Pharmaceutical Aluminum Aerosol Cans market is not without its inherent challenges and restraints. A primary concern revolves around the environmental impact associated with the production and disposal of aerosols, particularly regarding certain propellants. While efforts are underway to transition to more environmentally benign propellants, the historical legacy and ongoing regulatory scrutiny surrounding their use can pose a hurdle. The high cost of raw materials, especially aluminum, is another significant restraint. Fluctuations in global aluminum prices can directly impact the manufacturing costs of aerosol cans, potentially affecting profit margins for producers and, consequently, pricing for pharmaceutical companies. Stringent regulatory compliance is also a perpetual challenge. Pharmaceutical packaging, by its very nature, is subject to rigorous quality control and approval processes from health authorities worldwide. Any deviation in material composition, manufacturing standards, or product performance can lead to costly delays and recalls. Moreover, the development and adoption of alternative drug delivery systems, such as dry powder inhalers (DPIs) and nebulizers, present a competitive threat. While aluminum aerosol cans offer distinct advantages, these alternative technologies are continually evolving and may gain market share in specific therapeutic areas. The perceived safety concerns associated with the use of pressurized containers, though largely addressed by modern safety features, can still influence consumer and, to some extent, prescriber perception, especially in certain demographics. Finally, the intricate supply chain for specialized components like valves and actuators can be vulnerable to disruptions, impacting production schedules and timely delivery of finished products.

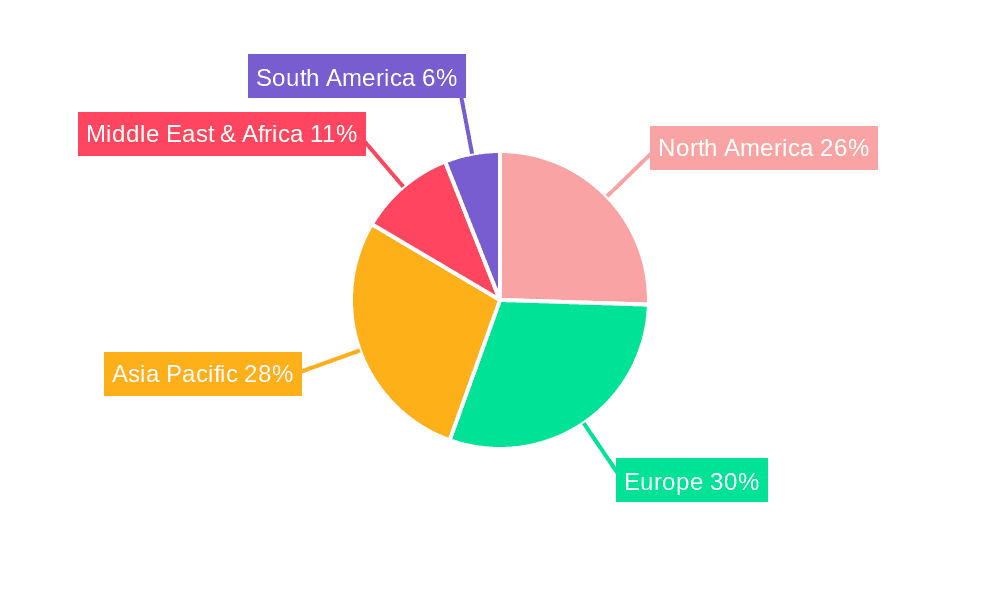

The North America region, particularly the United States, is projected to be a dominant force in the Pharmaceutical Aluminum Aerosol Cans market, driven by a robust healthcare infrastructure, high per capita healthcare spending, and a significant prevalence of respiratory and allergic conditions. This dominance is further amplified by the presence of major pharmaceutical manufacturers actively investing in innovative drug delivery systems. Within this region, Metered Dose Inhalers (MDIs), specifically for Respiratory Medications, are expected to hold a commanding share. The well-established treatment protocols for asthma and COPD in North America, coupled with a preference for convenient and patient-friendly delivery methods, solidify the position of MDIs. The increasing incidence of allergic rhinitis and other allergic disorders also significantly contributes to the demand for nasal sprays within the allergy medication segment, further bolstering North America's market leadership.

The Asia Pacific region, however, is anticipated to witness the fastest growth rate. This surge is fueled by a rapidly expanding middle class, increasing healthcare expenditure, improving access to healthcare services, and a growing awareness of chronic diseases in countries like China, India, and Southeast Asian nations. As these economies mature, the demand for sophisticated pharmaceutical packaging, including aluminum aerosol cans, is set to skyrocket. The prevalence of respiratory ailments is also on the rise in these regions due to factors like industrial pollution and lifestyle changes, creating a substantial market for respiratory medications delivered via MDIs.

Within the segment landscape, Metered Dose Inhalers (MDIs) will continue to be a cornerstone of the market, driven by their efficacy in delivering precise dosages for respiratory conditions. The convenience and portability they offer make them a preferred choice for both patients and healthcare providers, especially in managing chronic diseases that require regular medication.

Following closely, Nasal Sprays will exhibit substantial growth, propelled by the escalating global prevalence of allergic rhinitis and other nasal-related ailments. The ease of application and targeted delivery mechanism of nasal sprays make them an attractive option for managing symptoms associated with allergies and other nasal conditions.

The Dermatology segment, encompassing topical sprays for a range of skin conditions, is also a significant growth area. The increasing demand for advanced skincare products and treatments for various dermatological issues, coupled with the convenience of spray application for hygiene and precise coverage, is expected to drive demand in this segment.

While Respiratory Medications and Allergy Medications will likely remain the primary application drivers for MDIs and nasal sprays respectively, the Wound Care and Dermatology applications for topical sprays are poised for robust expansion, reflecting a broader trend towards accessible and effective self-treatment options.

The Pharmaceutical Aluminum Aerosol Cans industry is invigorated by several potent growth catalysts. The relentless rise in chronic respiratory diseases like asthma and COPD worldwide, demanding effective and precise drug delivery, is a primary driver. Equally significant is the escalating global prevalence of allergic conditions, fueling the demand for nasal sprays. The inherent advantages of aluminum – its barrier properties, inertness, and recyclability – align perfectly with pharmaceutical industry standards and sustainability goals. Innovations in valve technology and propellants are enhancing product performance and environmental profiles, making aluminum aerosol cans even more attractive. Furthermore, the increasing focus on patient convenience and self-administration of medication favors the development and adoption of aerosol-based delivery systems across various therapeutic areas, including dermatology and wound care.

This report offers a holistic examination of the Pharmaceutical Aluminum Aerosol Cans market, providing invaluable insights for stakeholders. Our comprehensive analysis delves into market segmentation by type (Metered Dose Inhalers, Nasal Sprays, Topical Sprays, Other) and application (Respiratory Medications, Allergy Medications, Wound Care, Dermatology, Ophthalmology, Other), alongside a detailed exploration of regional dynamics. We meticulously analyze industry developments, including technological advancements, regulatory shifts, and emerging trends in sustainability. The report forecasts market growth and identifies key growth catalysts, while also acknowledging potential challenges and restraints. Through in-depth interviews with industry experts and thorough secondary research, we equip businesses with the strategic intelligence needed to navigate this dynamic market, optimize their product portfolios, and capitalize on emerging opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.18% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.18%.

Key companies in the market include Ball, Bharat Containers, Ardagh Group, TUBEX GmbH, Euro Asia Packaging, Aryum Aerosol Cans, Casablanca Industries, CCL Container, Trivium Packaging, ALLTUB Group, Alucon, LINHARDT, Tecnocap Group, Nussbaum Matzingen, Montebello Packaging, Perfektüp, Daiwa Can, Shanghai Jia Tian.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Pharmaceutical Aluminum Aerosol Cans," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pharmaceutical Aluminum Aerosol Cans, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.