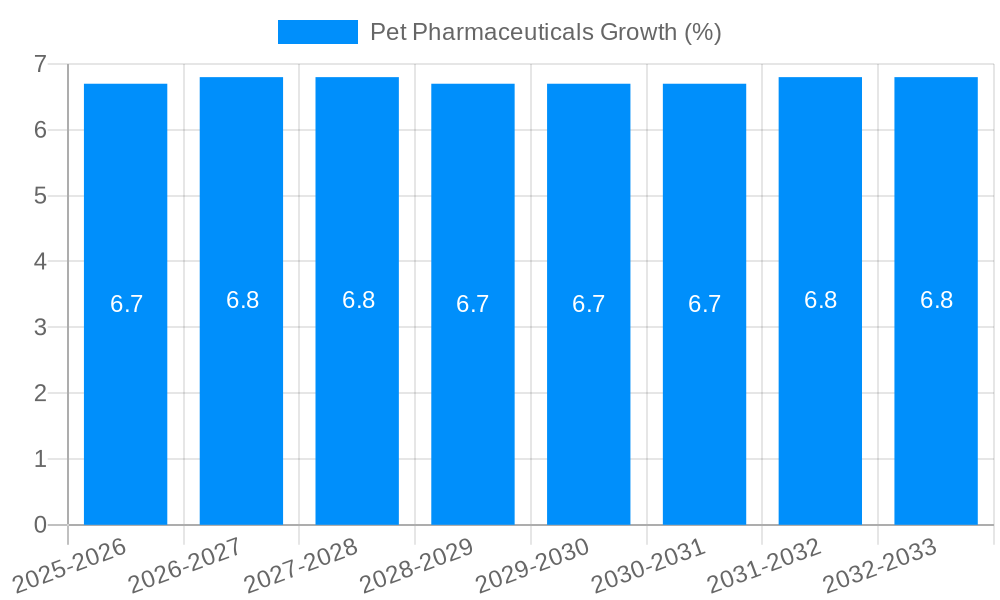

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pet Pharmaceuticals?

The projected CAGR is approximately 6.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Pet Pharmaceuticals

Pet PharmaceuticalsPet Pharmaceuticals by Type (Antiparasitic, Biological Products, Antibacterial, Others), by Application (Prevention, Treatment), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

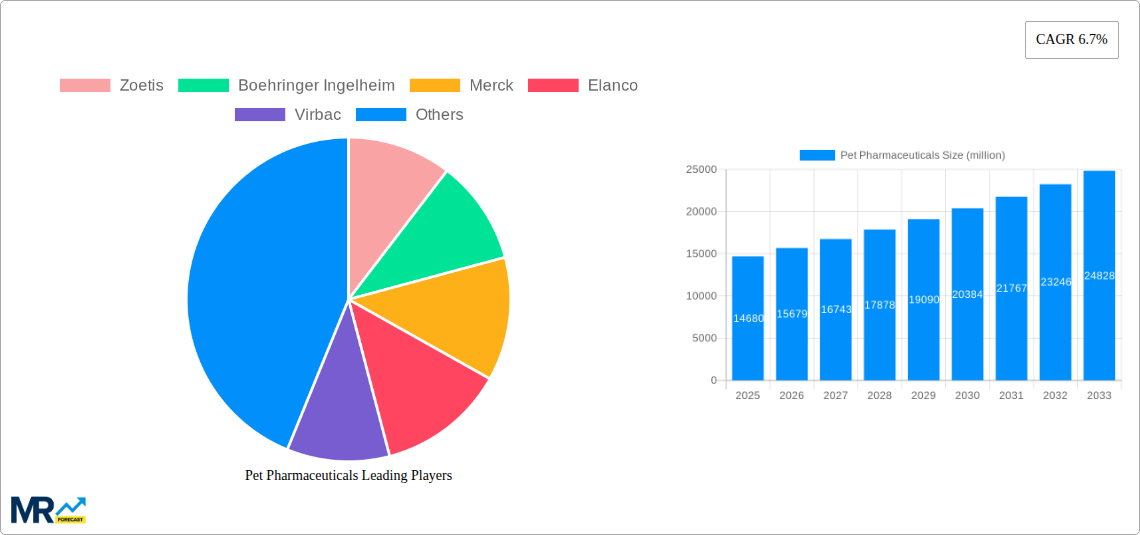

The global Pet Pharmaceuticals market is poised for substantial growth, projected to reach a market size of $14,680 million by 2025, expanding at a robust Compound Annual Growth Rate (CAGR) of 6.7% throughout the forecast period of 2025-2033. This upward trajectory is fueled by a confluence of factors, most notably the increasing humanization of pets, leading owners to invest more in their animals' health and well-being. A growing awareness of zoonotic diseases and the subsequent emphasis on preventative care are also significant drivers, boosting the demand for antiparasitic, antibacterial, and other pharmaceutical solutions. Furthermore, advancements in veterinary medicine, including the development of novel biologics and targeted therapies, are expanding treatment options and contributing to market expansion. The market's segmentation reveals a strong demand across both prevention and treatment applications, indicating a holistic approach to pet healthcare. Key players like Zoetis, Boehringer Ingelheim, and Merck are at the forefront of innovation, continuously introducing new products and expanding their market reach.

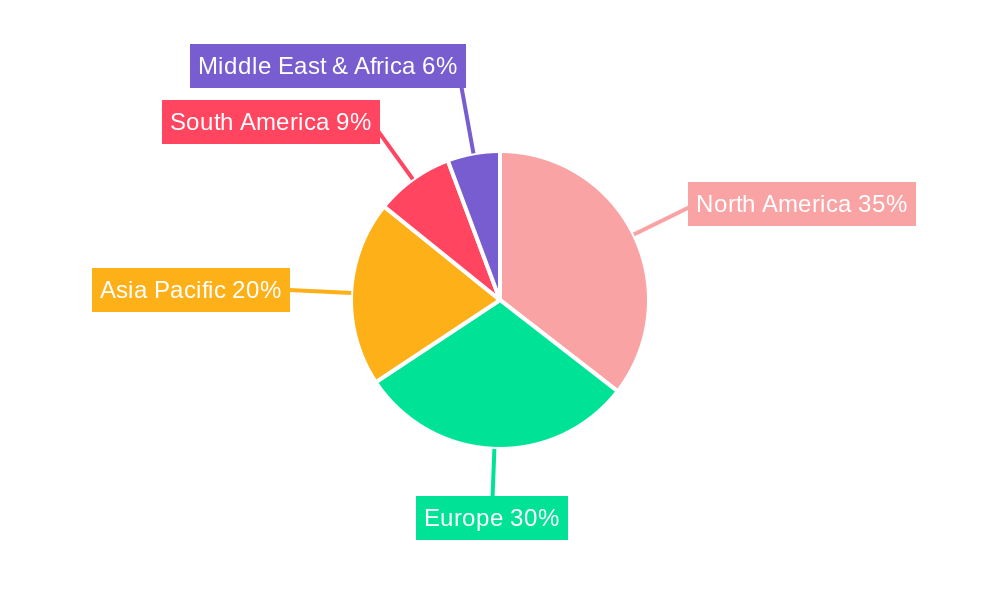

Geographically, North America and Europe currently dominate the pet pharmaceuticals landscape, owing to high pet ownership rates, advanced veterinary infrastructure, and significant disposable income allocated to pet care. However, the Asia Pacific region, particularly China and India, presents a rapidly emerging market with immense growth potential, driven by increasing pet ownership and a burgeoning middle class with a growing inclination towards premium pet products and services. Restraints such as stringent regulatory approvals for veterinary drugs and the rising cost of advanced treatments may temper growth in certain segments, but the overarching trend towards proactive pet health management and the continuous innovation within the industry are expected to overcome these challenges. The market's ability to adapt to evolving consumer needs and technological advancements will be crucial for sustained success.

The global pet pharmaceuticals market is poised for substantial growth, driven by a confluence of factors that are fundamentally reshaping how pet owners approach animal healthcare. From 2019 to 2033, the market is projected to witness a significant expansion, with the base year of 2025 serving as a crucial benchmark for future projections. This trend is underpinned by a rising humanization of pets, where companion animals are increasingly viewed as integral family members, leading to a greater willingness among owners to invest in their well-being. This elevated sentiment translates directly into increased demand for advanced veterinary medicines, including a burgeoning interest in preventive care and sophisticated treatment options for a range of ailments.

Within the Type segment, Antiparasitic products are expected to maintain a dominant position, fueled by the pervasive threat of fleas, ticks, and internal parasites across diverse geographic locations. The continuous need for effective and long-lasting solutions in this category ensures sustained market traction. Simultaneously, Biological Products, encompassing vaccines and novel biologics, are experiencing rapid acceleration. Advancements in biotechnology are enabling the development of more targeted and efficacious biological therapies, addressing complex diseases and improving overall animal health outcomes. This segment is poised for remarkable growth as research and development efforts yield new innovations.

In terms of Application, the Prevention segment is emerging as a significant growth driver. Proactive healthcare, including regular vaccinations and prophylactic treatments, is gaining prominence as pet owners recognize the long-term benefits of preventing diseases rather than treating them. This shift in mindset, coupled with the availability of innovative preventive solutions, is contributing to the robust expansion of this segment. The Treatment segment, while historically strong, will continue to evolve with the introduction of advanced therapeutics for chronic conditions, infectious diseases, and age-related ailments, further solidifying the market's upward trajectory. Industry developments, such as the integration of digital health solutions for better pet monitoring and the increasing focus on sustainable and environmentally friendly pharmaceutical production, are also shaping the market landscape and contributing to its dynamic evolution.

The pet pharmaceuticals market is experiencing an unprecedented surge in demand, largely propelled by the profound emotional bond between humans and their animal companions. This humanization of pets phenomenon has fundamentally altered consumer behavior, transforming pets from mere animals into cherished family members. Consequently, pet owners are demonstrating an increased willingness and financial capacity to invest in their pets' health and well-being, mirroring the healthcare standards they expect for themselves. This paradigm shift is a primary driver, encouraging greater expenditure on veterinary care, diagnostics, and, crucially, pharmaceuticals.

Furthermore, advancements in veterinary medicine and research are consistently introducing novel and more effective therapeutic solutions. The development of targeted treatments for complex diseases, innovative vaccines, and advanced antiparasitic and antibacterial agents are expanding the scope of treatable conditions and improving prognoses. This innovation directly fuels market growth by addressing unmet medical needs and offering owners better options for their pets' care. The increasing awareness among pet owners regarding the importance of preventive healthcare, including regular check-ups and vaccinations, also plays a vital role. This proactive approach to pet health not only enhances animal longevity and quality of life but also drives demand for a wide range of preventive pharmaceuticals. The availability of advanced formulations, such as long-acting injectables and palatable oral medications, further enhances owner compliance and treatment efficacy, thereby contributing to the market's upward trajectory.

Despite the optimistic growth trajectory, the pet pharmaceuticals market is not without its hurdles. A significant challenge lies in the high cost of advanced veterinary medicines. While owners are willing to invest, exorbitant prices for some specialized treatments or innovative drugs can create accessibility barriers, particularly for owners with limited financial resources. This price sensitivity can restrain the adoption of premium products and potentially limit market penetration in certain demographics or regions.

Another considerable restraint is the regulatory landscape and approval processes. Gaining regulatory approval for new pet pharmaceuticals can be a lengthy, complex, and expensive undertaking. The stringent requirements for efficacy, safety, and quality assurance, while essential, can slow down the introduction of innovative products to the market. This extended timeline for approval can also impact the return on investment for pharmaceutical companies, potentially discouraging investment in certain research and development areas. Furthermore, the prevalence of counterfeit and substandard drugs remains a persistent concern. The availability of fake or low-quality pet medications can not only compromise animal health and safety but also erode consumer trust in legitimate pharmaceutical products. Addressing this issue requires robust supply chain management, stringent quality control measures, and increased consumer awareness. Finally, limited veterinary infrastructure and expertise in some developing regions can hinder the effective diagnosis, treatment, and prescription of pet pharmaceuticals, thereby acting as a restraint on overall market expansion.

The North America region is projected to maintain its dominance in the global pet pharmaceuticals market throughout the study period (2019-2033), with United States as a key contributor. This sustained leadership is attributed to a combination of robust economic factors, a deeply ingrained pet ownership culture, and a high level of pet humanization. Pet owners in North America exhibit a strong willingness to invest significantly in their pets' health, viewing them as integral family members. This sentiment translates into a high demand for premium veterinary care and pharmaceuticals, including advanced treatments and preventive solutions. The region boasts a well-developed veterinary infrastructure, with a high density of veterinary clinics and highly qualified professionals, facilitating access to and adoption of sophisticated pet healthcare products.

Within this dominant region, the Antiparasitic segment is expected to continue its strong performance, driven by the persistent need to manage common and potentially life-threatening parasitic infections in pets. The widespread availability of diverse and effective antiparasitic medications, coupled with ongoing public awareness campaigns about parasite prevention, ensures sustained demand. Complementing this, the Biological Products segment is poised for exceptional growth. This surge is fueled by advancements in vaccine technology, leading to the development of more comprehensive and specialized vaccines against a wider range of diseases. Furthermore, the increasing research and development in biologics for managing chronic conditions and autoimmune disorders in pets are opening up new therapeutic avenues and driving market expansion. The Prevention application segment will also play a pivotal role in North America's market dominance. The proactive approach to pet health, emphasizing regular vaccinations and prophylactic treatments to avert diseases, is a deeply ingrained practice among North American pet owners. This focus on preventive care directly translates into a higher consumption of pharmaceuticals aimed at disease prevention. The region's strong regulatory framework, which ensures the safety and efficacy of veterinary drugs, further bolsters confidence among consumers and veterinarians, thereby reinforcing its leading position in the market.

In parallel, Europe is anticipated to exhibit significant growth and emerge as a strong contender. Similar to North America, the strong emotional connection between owners and pets, coupled with rising disposable incomes, is a major growth driver. The increasing adoption of preventive healthcare measures and a growing demand for treatments for chronic and age-related diseases in pets are contributing to the market's expansion in this region. The segment of Treatment applications is particularly strong in Europe, as owners seek advanced solutions for an aging pet population and for conditions like arthritis, cancer, and cardiovascular diseases. The focus on improving the quality of life for senior pets is a significant trend. The Biological Products segment is also gaining traction in Europe, with an increasing interest in immunotherapy and personalized medicine for pets. The region's commitment to animal welfare and stringent regulatory standards ensure a market for high-quality and innovative pharmaceuticals.

The pet pharmaceuticals industry is being propelled by several key growth catalysts. The escalating humanization of pets, transforming them into family members, significantly increases owner willingness to spend on advanced healthcare. This is complemented by continuous innovation and R&D, leading to the development of novel treatments for a broader range of diseases and improved drug formulations. Increased pet owner awareness regarding preventive healthcare and the benefits of early intervention further drives demand for vaccinations and prophylactic medications.

This comprehensive report on the Pet Pharmaceuticals market provides an in-depth analysis of the industry's current landscape and future trajectory from 2019 to 2033. It meticulously examines key market insights, exploring the driving forces behind market expansion, such as the growing humanization of pets and continuous technological innovation. The report also addresses the challenges and restraints impacting growth, including regulatory hurdles and cost considerations. A detailed regional analysis highlights dominant markets and emerging trends, with a specific focus on key segments like antiparasitics and biological products. The report further identifies pivotal growth catalysts and provides an exhaustive list of leading industry players. Significant developments and future forecasts are presented to offer a holistic understanding of the market's evolution and its potential impact on global animal health.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.7% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.7%.

Key companies in the market include Zoetis, Boehringer Ingelheim, Merck, Elanco, Virbac, Dechra Veterinary Products, Ceva, Vetoquinol, Ouro Fino Saude, Norbrook, Jindun, Chopperlvya Animal Health, CAHIC, .

The market segments include Type, Application.

The market size is estimated to be USD 14680 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Pet Pharmaceuticals," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pet Pharmaceuticals, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.