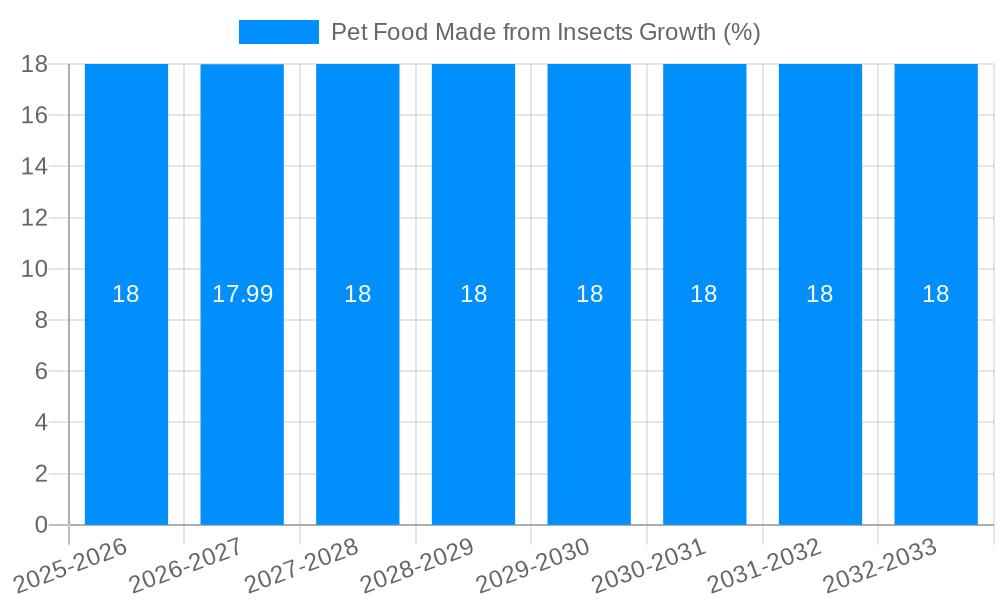

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pet Food Made from Insects?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Pet Food Made from Insects

Pet Food Made from InsectsPet Food Made from Insects by Type (Crickets, Mealworms, Black Soldier Flies, Others, World Pet Food Made from Insects Production ), by Application (Cat, Dog, Others, World Pet Food Made from Insects Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

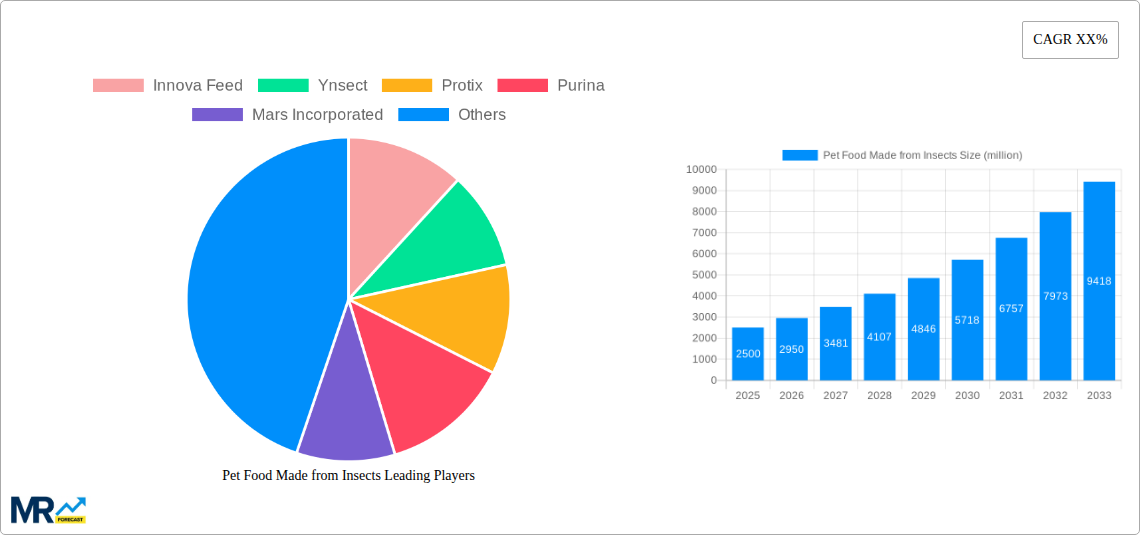

The global pet food market is experiencing a significant shift towards sustainable and novel protein sources, with insect-based pet food emerging as a key player. Driven by growing consumer awareness of environmental sustainability and the search for hypoallergenic and nutritious pet food options, this market is poised for substantial growth. Insect protein, sourced from crickets, mealworms, black soldier flies, and other insects, offers a highly efficient and environmentally friendly alternative to traditional protein sources like beef and poultry. The market is segmented by insect type, with crickets and mealworms currently dominating due to established production processes and consumer familiarity. However, black soldier flies are gaining traction due to their high protein content and ease of cultivation. Application-wise, the market is primarily driven by cat and dog food, although the "others" segment presents opportunities for expansion into specialized pet diets and treats. Key players like Innova Feed, Ynsect, and Protix are leading the innovation in insect farming and processing technologies, while established pet food giants like Purina and Mars Incorporated are increasingly integrating insect-based ingredients into their product lines. This signifies a growing acceptance and integration of insect-based pet food within the mainstream market.

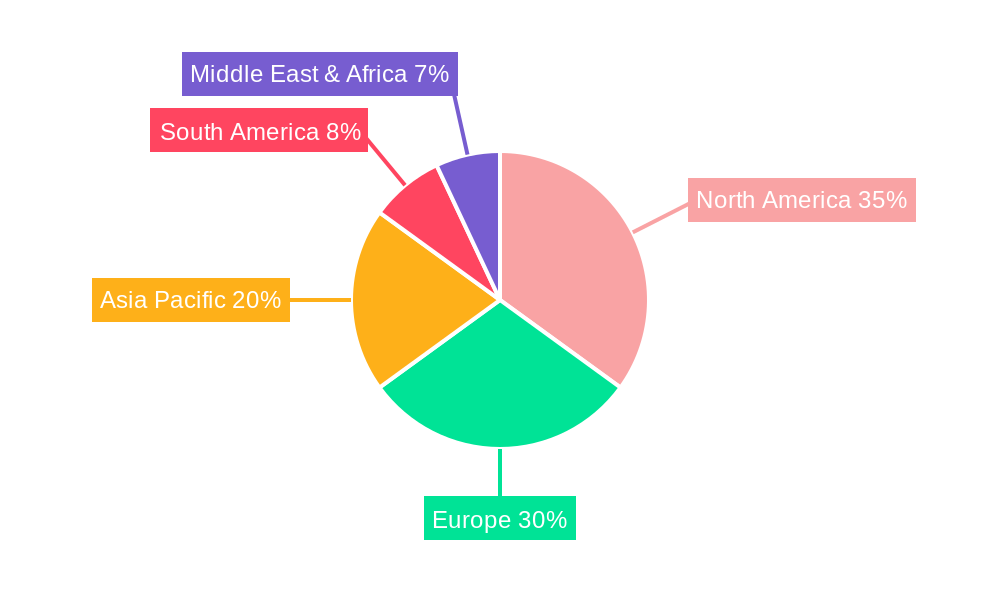

The market's growth is further fueled by several factors, including increasing concerns about the environmental impact of conventional animal agriculture, rising pet ownership globally, and advancements in insect farming technologies that enhance efficiency and scalability. While challenges remain, including overcoming consumer perception barriers and establishing robust regulatory frameworks, the overall market outlook is positive. The projected Compound Annual Growth Rate (CAGR) suggests a considerable expansion over the forecast period (2025-2033), with significant regional variations based on consumer preferences, regulatory landscapes, and the availability of insect-farming infrastructure. North America and Europe are expected to lead the market initially, followed by a rapid rise in Asia-Pacific, driven by increasing pet ownership and growing consumer interest in sustainable food options. The continued development of innovative products and the strengthening of supply chains will be crucial to sustaining this market's growth trajectory.

The pet food market is experiencing a significant shift towards sustainable and innovative ingredients, with insect-based pet food emerging as a prominent trend. Driven by increasing consumer awareness of environmental concerns and the search for healthier pet nutrition, the demand for insect-based pet food is experiencing exponential growth. Over the study period (2019-2033), the market has witnessed a substantial rise in production, with projections indicating continued expansion. The estimated market value in 2025 stands at several hundred million units (exact figures require further market data), demonstrating strong investor interest and market acceptance. This growth is fueled by several factors, including the high protein content and nutritional value of insects compared to traditional protein sources like beef or poultry. Insects also offer a significantly lower environmental impact, requiring less land, water, and feed than conventional livestock farming. Furthermore, consumer preferences are shifting towards novel protein sources, contributing to the market's expansion. While challenges remain, such as regulatory hurdles and consumer perception, the overall trajectory of the insect-based pet food market points towards sustained growth and increasing market share within the broader pet food sector. The historical period (2019-2024) showed a steady incline, setting the stage for the robust forecast period (2025-2033). The base year of 2025 provides a crucial benchmark for assessing future growth trajectories. Key players are strategically investing in research and development, improving production processes, and expanding their product lines to cater to the growing demand and diverse pet owner needs. The market's dynamism lies in its ability to cater to both the environmental and health concerns of pet owners, creating a unique selling proposition in a highly competitive landscape. This trend is expected to continue, reshaping the pet food industry towards greater sustainability and innovation.

Several key factors are propelling the growth of the insect-based pet food market. Firstly, the increasing awareness of the environmental impact of traditional livestock farming is driving consumers towards more sustainable alternatives. Insects are a highly efficient protein source, requiring significantly less land, water, and feed than conventional livestock, making them an attractive option for environmentally conscious pet owners. Secondly, insects offer a high-quality protein source with a rich nutritional profile, comparable to or even surpassing that of traditional protein sources. This nutritional advantage is a significant draw for pet owners seeking to improve their pets' health and well-being. Thirdly, advancements in insect farming technology have made it possible to produce insects on a large scale, ensuring a consistent supply to meet the growing demand. Furthermore, rising disposable incomes, particularly in developing countries, are increasing pet ownership and spending on premium pet food, creating a favorable market environment for insect-based products. Finally, positive media coverage and increased consumer education about the benefits of insect-based pet food are contributing to a more favorable perception of this novel protein source, overcoming initial skepticism and encouraging greater adoption. This convergence of environmental consciousness, nutritional benefits, technological advancements, and increased consumer spending is driving the rapid expansion of this innovative market segment.

Despite its considerable growth potential, the insect-based pet food market faces several challenges. One significant hurdle is the regulatory landscape, which varies significantly across different countries. The lack of clear and consistent regulations regarding the use of insects in pet food can create uncertainty for businesses and hinder market expansion. Consumer perception also remains a key challenge. Many consumers are still unfamiliar with insect-based pet food and may harbor negative perceptions or concerns about its palatability and safety for their pets. Overcoming these misconceptions through education and marketing efforts is crucial for market growth. Furthermore, the production and processing of insects for pet food require specialized infrastructure and technology, which can represent a significant initial investment for companies entering the market. Scaling up production to meet the growing demand while maintaining quality and affordability presents a further challenge. Finally, competition from established pet food brands with conventional protein sources remains intense, requiring insect-based companies to effectively communicate their unique selling propositions and build strong brand awareness. Addressing these challenges is essential for the sustained and widespread adoption of insect-based pet food.

The insect-based pet food market is expected to experience significant growth across various regions and segments. However, specific regions are likely to be more dominant due to factors such as existing pet ownership rates, consumer attitudes toward novel food sources, regulatory environments, and established insect farming infrastructure.

North America and Europe: These regions are projected to dominate the market due to high pet ownership rates, increasing consumer awareness of sustainable food options, and relatively well-developed regulatory frameworks. The presence of several key players in these regions also contributes to their dominant position.

Asia-Pacific: This region is poised for significant growth, driven by rising disposable incomes, increasing pet ownership, and a growing demand for premium pet food. However, regulatory hurdles and consumer acceptance might present challenges for achieving the same market penetration as North America and Europe.

Black Soldier Fly: Among the insect types, black soldier flies are likely to dominate due to their high protein content, ease of mass production, and efficient feed conversion ratio. Their versatility in terms of feed sources and suitability for various pet food formulations also contribute to their market dominance.

Dog Food: The dog food segment is expected to hold the largest market share due to the higher number of dog owners compared to cat owners globally and the greater willingness to experiment with novel protein sources in canine diets.

In paragraph form: While the insect-based pet food market will see considerable growth globally, North America and Europe are expected to lead due to higher pet ownership, stronger consumer acceptance, and a more established regulatory landscape for this innovative food category. Among the insect types, Black Soldier Flies are projected to dominate, owing to their efficient production methods, high protein content, and adaptability to various pet food applications. Finally, the dog food segment will likely claim the biggest market share, reflecting the larger dog ownership and openness to new food options among dog owners. While the Asia-Pacific region presents vast growth potential, overcoming regulatory and consumer perception hurdles will be key to achieving market parity with North America and Europe. The forecast period will reveal how effectively these different regions and segments respond to market forces.

Several factors are driving the growth of the insect-based pet food industry. Increased consumer awareness of environmental sustainability is a primary catalyst, pushing demand for eco-friendly pet food alternatives. The superior nutritional profile of insect-based protein, exceeding traditional sources in several aspects, is another crucial factor. Continuous technological advancements in insect farming and processing are improving efficiency and scalability, further accelerating market growth. Finally, strong investment from venture capitalists and large corporations, recognizing the market's potential, is propelling innovation and expansion within the industry.

This report provides a comprehensive overview of the pet food made from insects market, analyzing its current trends, growth drivers, challenges, and future prospects. It offers valuable insights into key market segments, leading players, and significant developments, providing a roadmap for businesses and investors navigating this dynamic and rapidly evolving industry. The report's detailed analysis enables informed decision-making and strategic planning within the insect-based pet food sector, helping to capture opportunities and address potential risks.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Innova Feed, Ynsect, Protix, Purina, Mars Incorporated, Agri Protein Holdings Ltd, Enterra, Endocycle, Beta Hatch, Ennoble, Healy Biotech, Next Protein, Scout & Zoe'S, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Pet Food Made from Insects," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pet Food Made from Insects, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.