1. What is the projected Compound Annual Growth Rate (CAGR) of the Personal Accessories?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Personal Accessories

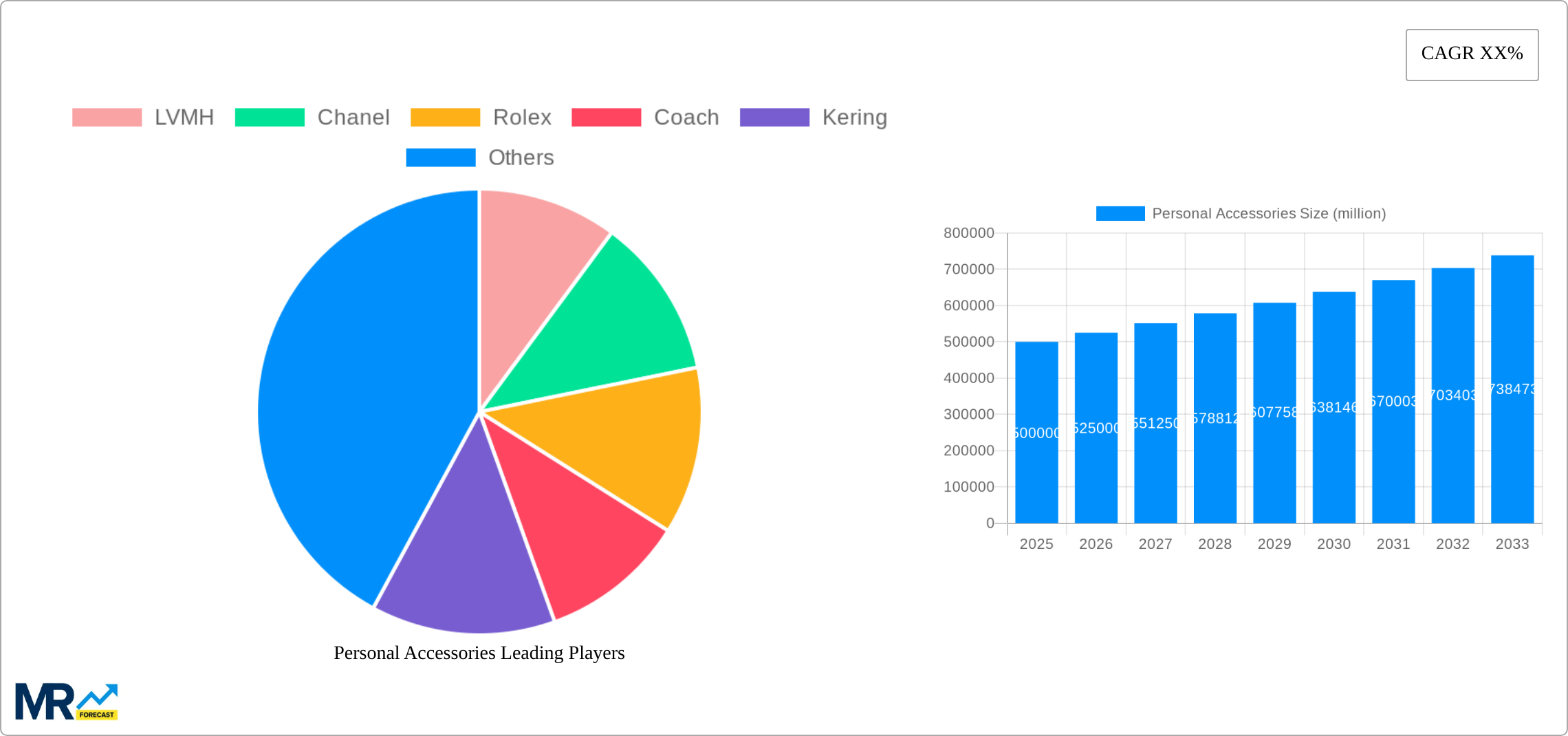

Personal AccessoriesPersonal Accessories by Type (Jewelry, Bags, Watches, Other), by Application (General Consumption, Moderate Consumption, Luxury Goods, World Personal Accessories Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

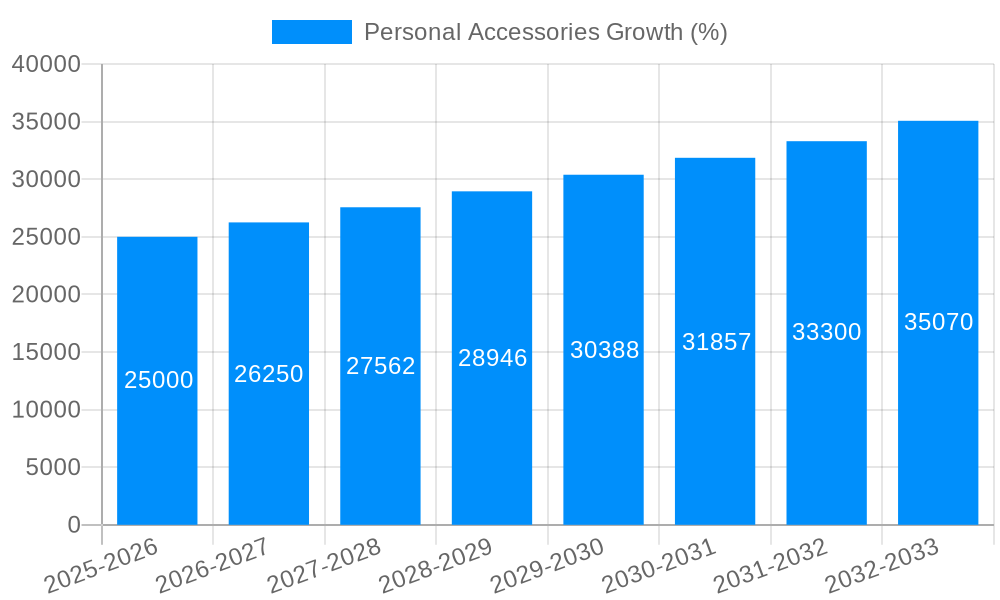

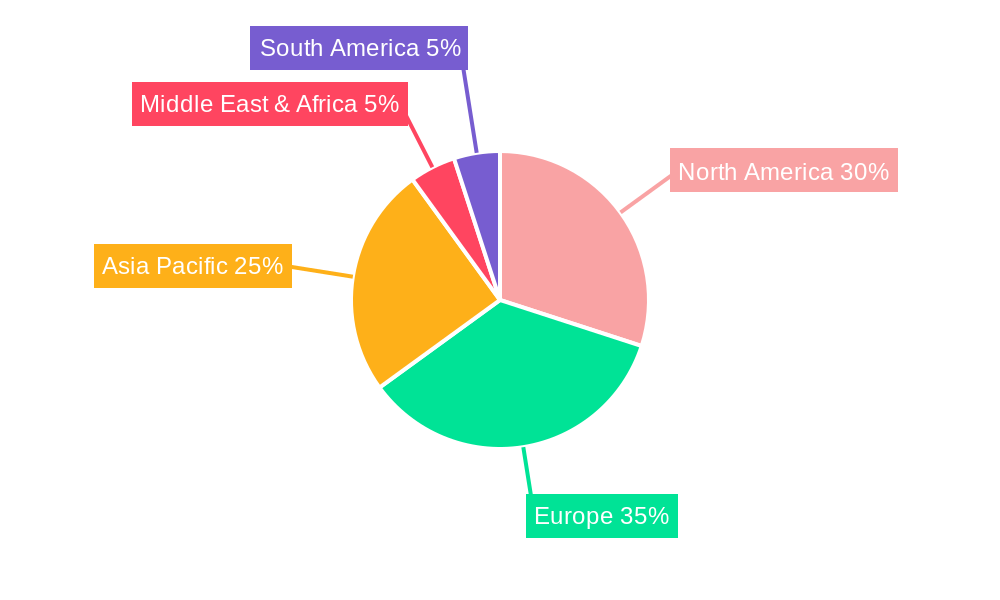

The global personal accessories market, encompassing jewelry, bags, watches, and other items, is a dynamic and expansive sector projected for robust growth. While precise figures for market size and CAGR are unavailable, industry analysis suggests a multi-billion dollar market experiencing a steady Compound Annual Growth Rate (CAGR) likely between 5-7% based on similar luxury goods markets. This growth is fueled by several key drivers: rising disposable incomes in emerging economies, increasing consumer spending on luxury and premium goods, the growing influence of fashion trends and social media, and the expanding e-commerce market providing wider access to a diverse range of products. Significant trends include the rise of sustainable and ethically sourced materials, personalization and customization options, and the integration of technology into accessories like smartwatches and connected jewelry. However, economic downturns, fluctuating raw material prices, and counterfeiting remain significant restraints on market expansion. The market is segmented by product type (jewelry, bags, watches, etc.) and consumer segment (general, moderate, luxury consumption), with the luxury segment exhibiting particularly strong growth potential. Geographical distribution shows strong performances in North America, Europe, and increasingly in Asia-Pacific regions like China and India, driven by rising middle classes and increased purchasing power.

The competitive landscape is dominated by established luxury brands such as LVMH, Chanel, Rolex, and Kering, alongside emerging players catering to diverse consumer preferences. These brands compete based on brand reputation, product quality, design innovation, and marketing strategies. Successful strategies often emphasize brand storytelling, exclusivity, and leveraging social media to cultivate brand loyalty. Further growth will likely be influenced by evolving consumer preferences, technological advancements, and the continued expansion of online retail channels. The market's future trajectory hinges on successfully navigating economic uncertainties, addressing environmental concerns related to production and sourcing, and adapting to rapid changes in consumer tastes and purchasing behavior. Companies will need to invest in research and development, innovative marketing, and sustainable practices to maintain a competitive edge and capitalize on the market's long-term growth prospects.

The global personal accessories market, valued at several billion units in 2024, is experiencing dynamic shifts driven by evolving consumer preferences and technological advancements. The historical period (2019-2024) witnessed a surge in demand for luxury goods, particularly among millennials and Gen Z, fueled by a desire for self-expression and status symbols. This trend is projected to continue throughout the forecast period (2025-2033), with a notable increase in the sales of high-end jewelry, designer handbags, and premium watches. However, the market isn't solely defined by luxury; the general and moderate consumption segments are demonstrating resilience, driven by affordability and accessible fashion trends. The rise of e-commerce has significantly impacted the market, providing increased accessibility to a wider range of brands and styles. This online accessibility has also fostered a growth in personalization options, with consumers increasingly seeking customized accessories that reflect their individual identities. Furthermore, sustainability concerns are gaining traction, influencing consumer choices towards brands with ethical sourcing practices and environmentally friendly materials. This growing awareness is compelling brands to adopt more responsible production methods and transparent supply chains. The integration of technology is also reshaping the industry, with smartwatches and accessories incorporating advanced functionalities impacting the watch and "other" accessories segments, further stimulating innovation and market expansion. The estimated year (2025) marks a critical juncture, representing a baseline for a projected period of sustained growth characterized by evolving consumer behavior, technological advancements, and a greater emphasis on sustainability and ethical consumption. The study period (2019-2033) provides a comprehensive overview of this dynamic transformation.

Several key factors contribute to the growth of the personal accessories market. Firstly, the rising disposable incomes, particularly in developing economies, are expanding the consumer base for personal accessories across all segments. This increased purchasing power allows more individuals to invest in higher-priced items, boosting the luxury goods segment significantly. Secondly, the ever-evolving fashion trends and the desire for self-expression are continuously fueling demand. Consumers are increasingly using accessories to express their personality and individuality, resulting in a high demand for diverse styles and designs. The influence of social media and celebrity endorsements plays a crucial role in shaping consumer preferences and driving sales. Moreover, the convenience and wider reach afforded by online shopping platforms have expanded market accessibility and increased sales. Consumers are no longer limited to local stores, enabling them to browse and purchase items from around the globe. This online accessibility fuels market growth, promoting brand discovery and fostering a broader selection of products. Finally, the continuous innovation in materials, design, and technology, particularly within the watch and "other" accessories segments, attracts a wider range of customers seeking cutting-edge features and styles, sustaining market growth.

Despite its growth potential, the personal accessories market faces several challenges. Economic downturns and fluctuations in currency exchange rates can significantly impact consumer spending, particularly within the luxury segment. Economic instability can decrease consumer confidence, leading to reduced purchases of non-essential items like personal accessories. Furthermore, intense competition among established brands and emerging players creates pressure on pricing and profit margins. The constant need to innovate and adapt to changing consumer preferences adds to this competitive pressure. Counterfeit products pose a considerable threat, undermining brand value and impacting legitimate businesses. Consumers' increasing awareness of ethical concerns regarding labor practices and environmental impact necessitates brands' greater focus on sustainability and ethical sourcing, adding to operational costs. Lastly, shifts in consumer preferences and emerging trends require brands to continuously invest in research and development to remain competitive. Failure to adapt to evolving fashion trends and technological advancements can lead to market share loss.

Luxury Goods Segment: This segment is expected to dominate the market due to increasing disposable incomes in emerging markets and the rising aspiration for luxury goods among millennials and Gen Z. The luxury market shows significant growth potential in regions like Asia-Pacific (particularly China) and North America, where there is a high concentration of high-net-worth individuals. The luxury segment's growth is further propelled by strong brand loyalty and exclusive product offerings.

Jewelry Type: The jewelry segment consistently shows strong performance across various regions, particularly in countries with established jewelry traditions and cultural significance. The increasing preference for personalized and customized jewelry further strengthens this segment. Demand is especially high in countries with significant cultural associations with jewelry, such as India and China.

Key Regions: The Asia-Pacific region is projected to hold a substantial share of the global personal accessories market during the forecast period, driven primarily by the expanding middle class and increasing consumer spending in countries like China and India. North America remains a strong market, characterized by high consumer spending on luxury goods and established brand loyalty. Europe continues to be a significant player, known for its established luxury brands and design heritage.

The combination of the luxury goods segment's appeal, the enduring demand for jewelry, and the strong performance of the Asia-Pacific and North America regions points to a potent synergy driving significant market growth. While other segments and regions also contribute, these factors are predicted to significantly shape the market landscape during the forecast period. The high growth potential in these key areas positions the personal accessories market for continued expansion in the coming years. The interplay between segment preference and regional economic performance forms a critical aspect of market analysis and prediction for the future.

The personal accessories industry's growth is fueled by several key factors, including the rise of e-commerce, enabling broader access to brands and styles, increasing disposable incomes across multiple global regions, and the ongoing trend of personalized and customizable accessories that allow consumers to express their individual identities. Coupled with this is the powerful influence of social media trends and celebrity endorsements in shaping consumer preferences and driving demand. The continued innovation in materials, design, and technology keeps the industry dynamic and appealing to a wider consumer base, fostering growth throughout various segments.

This report offers a comprehensive analysis of the personal accessories market, covering historical data (2019-2024), the estimated year (2025), and a detailed forecast for 2025-2033. It provides key insights into market trends, driving forces, challenges, and growth catalysts, along with a thorough analysis of major players and their strategic initiatives. The report also includes regional breakdowns, segment-specific data, and valuable information for businesses seeking to navigate this dynamic market successfully. The detailed market segmentation and regional analyses enable informed decision-making and strategy development.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include LVMH, Chanel, Rolex, Coach, Kering, Prada Group, Ralph Lauren, Pandora, Dolce & Gabbana, Burberry Group, Giorgio Armani, Tiffany & Company, Compagnie Financiere Richemont, Titan Company, Tory Burch, Giorgio Armani, Hugo Boss, Kalyan Jewellers, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Personal Accessories," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Personal Accessories, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.