1. What is the projected Compound Annual Growth Rate (CAGR) of the PCIe 4.0 Solid State Drive?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

PCIe 4.0 Solid State Drive

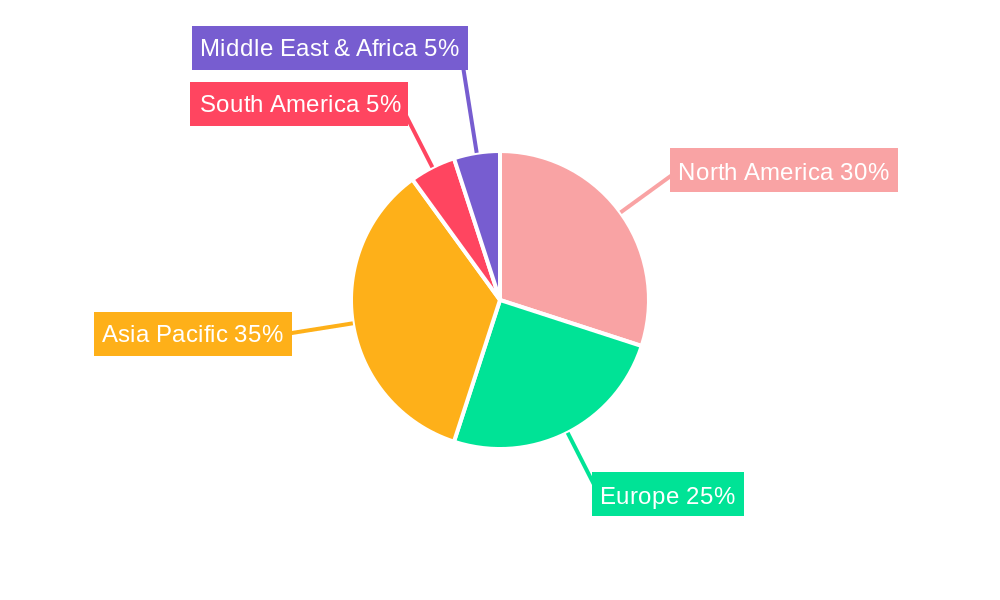

PCIe 4.0 Solid State DrivePCIe 4.0 Solid State Drive by Type (500GB, 1TB, 2TB, 4TB, Others, World PCIe 4.0 Solid State Drive Production ), by Application (Game Field, Scientific Research, Others, World PCIe 4.0 Solid State Drive Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

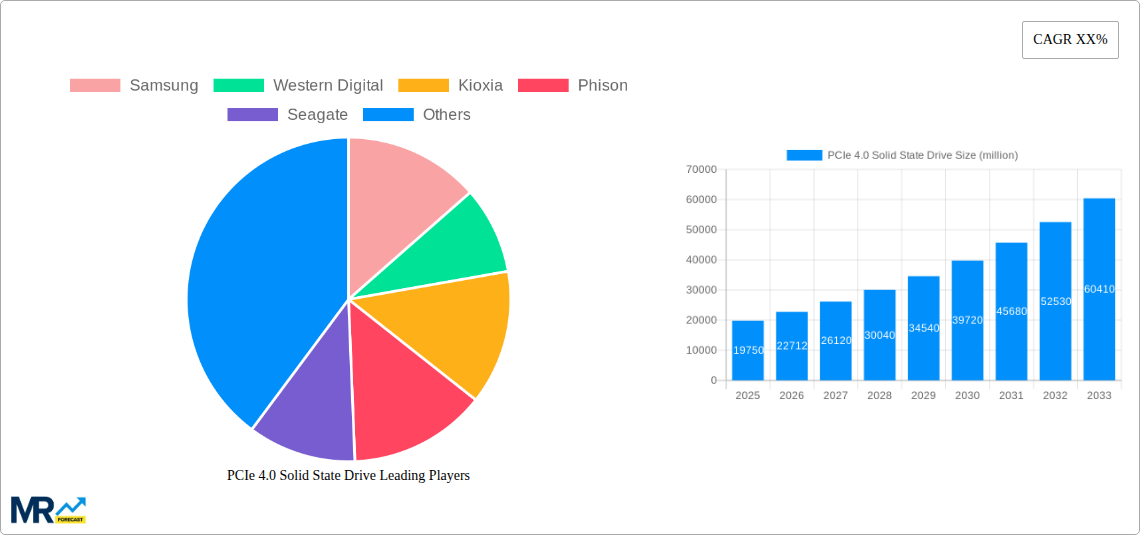

The global PCIe 4.0 Solid State Drive (SSD) market is poised for substantial growth, projected to reach an impressive market size of approximately $19,750 million by 2025. This surge is fueled by the increasing demand for higher storage speeds and improved performance across various applications, from demanding gaming environments to sophisticated scientific research. The adoption of PCIe 4.0 technology offers a significant leap in data transfer rates compared to its predecessors, making it an attractive upgrade for consumers and enterprises alike. Key drivers behind this expansion include the proliferation of high-resolution content, the growing complexity of software and data-intensive applications, and the continuous innovation by leading manufacturers like Samsung, Western Digital, and Kioxia. These companies are consistently pushing the boundaries of SSD technology, introducing drives with enhanced capacities and faster read/write speeds, which in turn stimulates market demand. The ongoing digital transformation across industries further underscores the critical need for robust and high-performing storage solutions, positioning PCIe 4.0 SSDs as a central component in modern computing infrastructure.

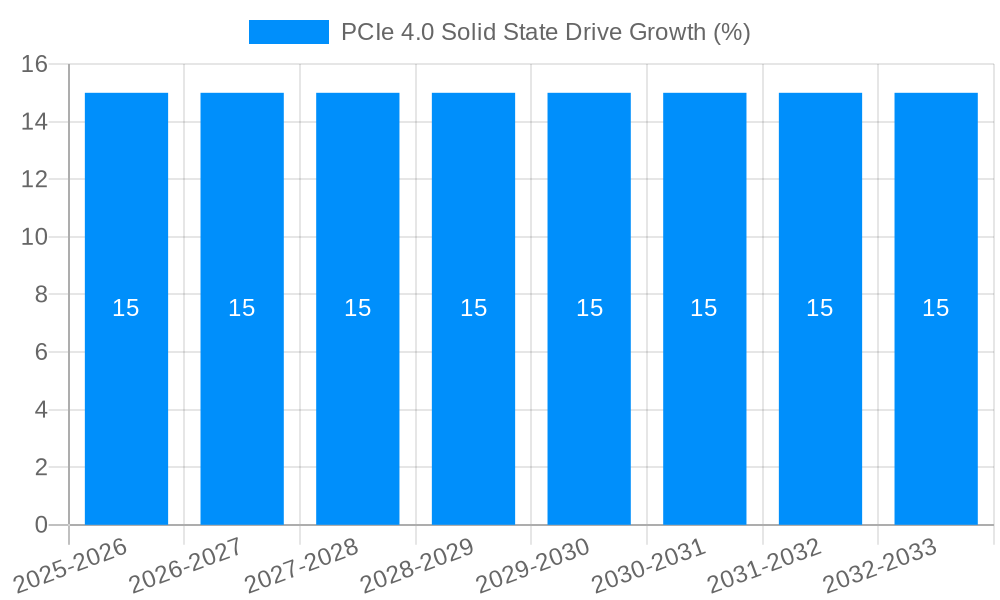

The market is expected to experience a Compound Annual Growth Rate (CAGR) of roughly 15% over the forecast period of 2025-2033. This robust growth trajectory is attributed to several key trends, including the expanding adoption of NVMe protocol, which is intrinsically linked with PCIe technology, and the increasing integration of PCIe 4.0 SSDs in next-generation gaming consoles and high-performance laptops. The "Others" segment in terms of drive types, encompassing capacities beyond 4TB, is likely to see accelerated growth as data storage needs escalate. Furthermore, the "Game Field" and "Scientific Research" applications are anticipated to remain dominant contributors to market revenue due to their inherent requirement for ultra-fast data access. While the market benefits from strong demand, potential restraints such as the initial higher cost of PCIe 4.0 drives compared to older technologies and supply chain complexities could present challenges. However, with ongoing technological advancements and economies of scale, these barriers are expected to diminish over time, ensuring sustained market expansion.

This comprehensive report delves into the dynamic World PCIe 4.0 Solid State Drive Production landscape, offering a granular analysis of market trends, driving forces, challenges, and future projections. Spanning a Study Period from 2019 to 2033, with a Base Year of 2025 and an Estimated Year also set at 2025, the report meticulously dissects the Historical Period (2019-2024) and provides robust insights for the Forecast Period (2025-2033). We will explore the intricate interplay of key players, technological advancements, and evolving application demands that are shaping this high-performance storage segment. The report provides an in-depth understanding of the market's trajectory, empowering stakeholders with actionable intelligence.

XXX The global World PCIe 4.0 Solid State Drive Production witnessed a significant surge in demand and adoption during the historical period (2019-2024), driven by the increasing need for faster data access across various computing platforms. By 2025, the market is projected to reach approximately $25,000 million in revenue, with an expected Compound Annual Growth Rate (CAGR) of around 15% from 2025 to 2033. This upward trajectory is largely attributed to the inherent performance advantages of the PCIe 4.0 interface, offering double the bandwidth of its predecessor. Consumers and enterprises alike are embracing these drives for their ability to dramatically reduce load times in demanding applications, accelerate data-intensive workflows, and enhance overall system responsiveness. The increasing availability of motherboards and chipsets supporting PCIe 4.0 has further democratized access to this technology, making it a mainstream choice for gaming rigs, professional workstations, and server environments. The evolution of NAND flash technology and controller innovation by leading manufacturers such as Samsung, Western Digital, and Kioxia has been instrumental in driving down costs per gigabyte, making higher capacity PCIe 4.0 SSDs more accessible. Furthermore, the emergence of specialized controllers from companies like Phison is enabling a wider array of performance optimizations, catering to specific application needs. The increasing adoption in nascent fields like AI/ML and edge computing also signals a broadening market base. By 2033, the market is anticipated to surpass $70,000 million, demonstrating sustained and robust growth fueled by continuous technological advancements and expanding application horizons. The ongoing development of PCIe 5.0 and subsequent generations will also indirectly fuel the PCIe 4.0 market by creating a tiered performance and pricing structure, making PCIe 4.0 an increasingly attractive value proposition.

Several potent forces are propelling the widespread adoption and growth of PCIe 4.0 Solid State Drives. Foremost among these is the insatiable demand for higher performance in computing, driven by increasingly sophisticated software and hardware. The gaming industry, in particular, has been a significant catalyst, with modern AAA titles leveraging the immense bandwidth of PCIe 4.0 SSDs to deliver faster loading screens, smoother in-game experiences, and richer visual detail. Beyond gaming, scientific research institutions are benefiting immensely, with researchers utilizing these drives to accelerate the processing of massive datasets in fields like genomics, astrophysics, and computational fluid dynamics. The rapid expansion of artificial intelligence and machine learning workloads, which are inherently data-intensive, also presents a substantial driving force. Furthermore, the professional content creation sector, encompassing video editing, 3D rendering, and graphic design, benefits from the expedited file transfer and rendering times offered by PCIe 4.0 SSDs. The increasing affordability of PCIe 4.0 technology, coupled with the growing availability of compatible motherboards and chipsets across various price points, is making these high-performance drives accessible to a broader consumer base and enterprise deployments. The continuous innovation in NAND flash memory and SSD controller technology from major players like Samsung, Western Digital, and Kioxia is further enhancing performance and capacity while driving down the cost per gigabyte, making the upgrade path more attractive.

Despite its impressive growth trajectory, the PCIe 4.0 Solid State Drive market faces certain challenges and restraints that could temper its expansion. One significant hurdle is the cost premium associated with PCIe 4.0 SSDs compared to their PCIe 3.0 counterparts. While prices have been declining, the performance gains may not always justify the higher initial investment for all user segments, particularly for general-purpose computing where the ultra-high speeds are not fully utilized. Another restraint is the ecosystem maturity. While PCIe 4.0 support is becoming more widespread, some older motherboards and systems still lack native compatibility, requiring users to upgrade their entire platform to fully leverage the technology. This can be a considerable expense for many. The availability of PCIe 5.0 and future interfaces also presents a potential long-term restraint. As newer, even faster standards emerge, some early adopters might hold out for the absolute latest technology, potentially impacting the mid-term demand for PCIe 4.0. Furthermore, the power consumption of high-performance PCIe 4.0 SSDs can be a concern for certain applications, especially in laptops and densely packed server environments where thermal management is critical. Finally, the manufacturing complexity and supply chain dependencies for advanced semiconductor components can lead to occasional shortages or price volatility, impacting market stability.

The World PCIe 4.0 Solid State Drive Production market is poised for dominance by specific regions and segments, driven by technological adoption, industrial development, and application demand.

North America (USA, Canada):

Asia Pacific (China, South Korea, Japan):

Europe (Germany, UK, France):

Dominant Segments:

The PCIe 4.0 Solid State Drive industry is experiencing robust growth propelled by several key catalysts. The ever-increasing demand for faster data access, particularly from the gaming sector and professional content creators, is a significant driver. Furthermore, the burgeoning field of artificial intelligence and machine learning, which requires rapid processing of massive datasets, is creating substantial demand. The ongoing digital transformation across enterprises, leading to greater reliance on cloud computing and data analytics, also necessitates high-performance storage solutions. The increasing affordability of PCIe 4.0 SSDs, coupled with the widespread adoption of compatible chipsets and motherboards, is making these drives more accessible to a wider user base, thereby accelerating market penetration.

This report offers unparalleled depth and breadth in its analysis of the World PCIe 4.0 Solid State Drive Production market. It provides a forward-looking perspective, meticulously forecasting market growth from 2025 to 2033, while thoroughly examining the historical trends from 2019 to 2024. The report dissects the intricate dynamics of market drivers, restraints, and emerging opportunities, offering strategic insights for stakeholders. It includes a detailed competitive landscape, highlighting the key players and their market positions, alongside an exhaustive list of significant technological developments and their impact. The comprehensive coverage extends to a granular segmentation analysis by type (500GB, 1TB, 2TB, 4TB, Others) and application (Game Field, Scientific Research, Others), providing a clear understanding of demand across different segments and geographical regions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Samsung, Western Digital, Kioxia, Phison, Seagate, Asgard, Crucial, Plextor, Corsair, Adata, Intel, .

The market segments include Type, Application.

The market size is estimated to be USD 19750 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "PCIe 4.0 Solid State Drive," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the PCIe 4.0 Solid State Drive, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.