1. What is the projected Compound Annual Growth Rate (CAGR) of the PC Webcams?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

PC Webcams

PC WebcamsPC Webcams by Type (Wireless Type, Wired Type, World PC Webcams Production ), by Application (Commercial, Individual, World PC Webcams Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

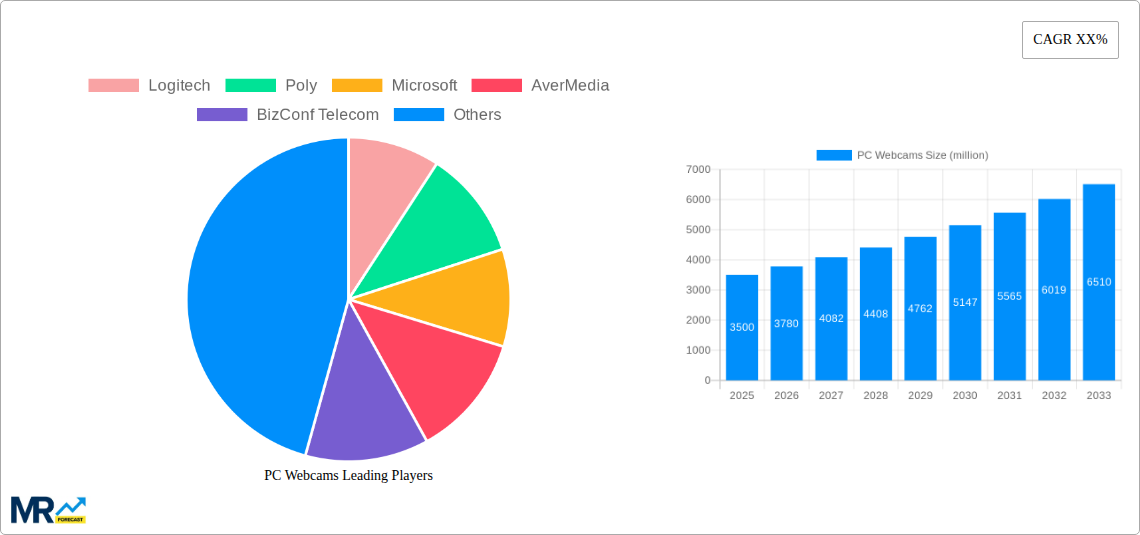

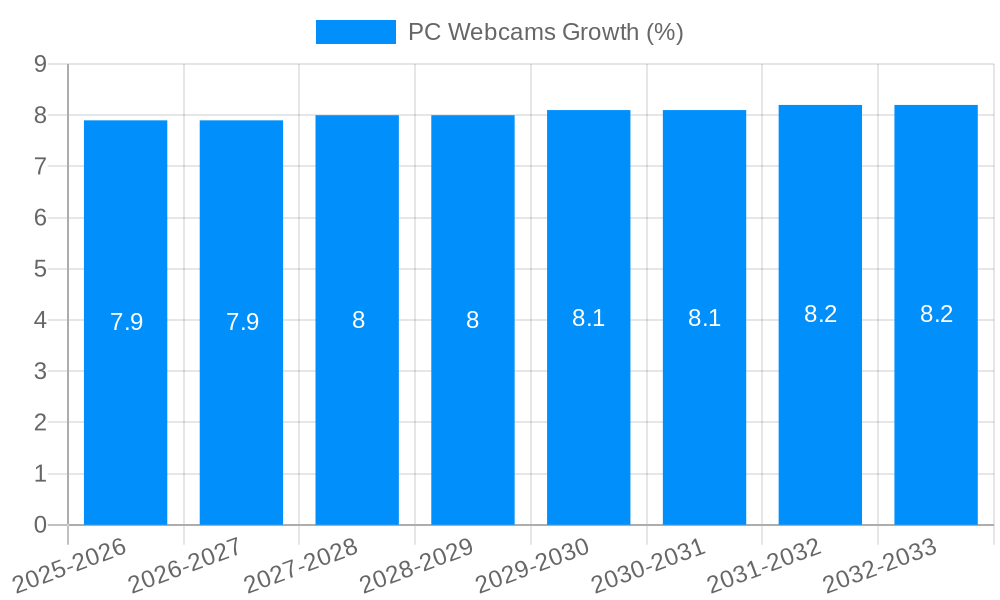

The global PC webcam market is experiencing robust growth, driven by the increasing prevalence of remote work, online education, and virtual collaboration. The market, estimated at $2.5 billion in 2025, is projected to witness a Compound Annual Growth Rate (CAGR) of 8% from 2025 to 2033, reaching approximately $4.2 billion by 2033. This expansion is fueled by several key factors: the sustained demand for high-quality video conferencing solutions, technological advancements leading to improved image quality and features (like 4K resolution and advanced autofocus), and the rising adoption of hybrid work models. The market is segmented by type (wireless and wired) and application (commercial and individual). Wireless webcams are gaining traction due to their convenience and portability, while the commercial segment is exhibiting stronger growth due to increased investments in workplace technology by businesses of all sizes. Key players like Logitech, Microsoft, and Poly dominate the market, leveraging strong brand recognition and a wide product portfolio. However, competition from emerging Asian manufacturers is intensifying, particularly from companies in China, leading to price pressures and innovation in the lower-cost segments. Geographic growth is largely spread, with North America and Europe holding significant market shares currently but substantial opportunities emerging in the Asia-Pacific region as adoption rates rise. Challenges include supply chain constraints and fluctuating component costs, which could impact profitability in the short term.

Despite these challenges, the long-term outlook for the PC webcam market remains positive. Continued technological advancements, the sustained growth of remote work, and the expanding adoption of video conferencing across various sectors will all contribute to sustained market expansion. The increasing integration of AI-powered features, such as advanced noise cancellation and facial recognition, will further enhance the user experience and drive demand for higher-end webcams. The shift towards hybrid working models necessitates a reliable and high-quality video conferencing solution, solidifying the place of PC webcams as an essential component of modern workplace and personal computing setups. Market players are strategically investing in R&D and strategic partnerships to navigate the competitive landscape and capitalize on emerging market trends. Focusing on enhanced user experience, superior image quality, and integrated software solutions will be crucial for success in this dynamic and growing market.

The global PC webcam market experienced significant growth during the historical period (2019-2024), driven primarily by the unprecedented surge in remote work and online communication spurred by the COVID-19 pandemic. Millions of units were sold annually, exceeding expectations and firmly establishing webcams as essential peripherals for both personal and professional use. While the initial boom saw a rapid increase in sales, the market has since settled into a more sustained, albeit still robust, growth trajectory. The estimated year 2025 shows a market stabilization, with production figures holding steady in the millions, suggesting a transition from pandemic-driven exceptional growth to a more normalized, yet consistently strong, demand. This stabilization reflects a shift from emergency purchases to more considered investments, with consumers and businesses alike evaluating features, quality, and price points more carefully. The forecast period (2025-2033) predicts continued growth, albeit at a more moderate pace, driven by evolving technological advancements and the sustained integration of video conferencing into various aspects of daily life. Market segmentation by type (wired versus wireless) and application (commercial versus individual) continues to be vital for understanding the nuances of market performance, with ongoing innovation and competition shaping the market landscape. Logitech, Microsoft, and other major players continue to hold significant market shares, but the presence of smaller, niche players points to the industry's dynamism and potential for disruption. The overall trend indicates a mature but continually evolving market with significant potential for expansion in emerging markets and through integration into increasingly sophisticated technologies such as AI-powered features and improved image quality. The ongoing growth reflects the increasing importance of visual communication in both professional and personal settings, solidifying the webcam's place as a vital component of the modern computing ecosystem. The study period (2019-2033) provides a comprehensive view of this evolution.

Several key factors are propelling the growth of the PC webcam market. Firstly, the widespread adoption of remote work and online learning continues to fuel demand. Businesses are increasingly investing in high-quality webcams for virtual meetings, while educational institutions rely on them for online classes and virtual tutoring. This demand extends beyond the enterprise and educational sectors, as individuals increasingly use webcams for personal communication, online gaming, and content creation. Secondly, technological advancements are enhancing webcam capabilities. Improvements in image sensors, resolution, and features such as autofocus and noise reduction are creating a more appealing user experience, driving adoption rates. The integration of artificial intelligence (AI) for features like auto-framing and background blurring is also boosting market appeal. Thirdly, the increasing affordability of high-quality webcams is broadening their accessibility to a wider range of consumers and businesses. This accessibility further drives market growth, particularly in developing economies. Finally, the integration of webcams into other devices, such as laptops and tablets, is contributing to market expansion. As these integrated cameras become more sophisticated, they drive demand for standalone, high-performance webcams to meet the needs of users demanding better quality and additional functionalities.

Despite the positive growth trajectory, the PC webcam market faces several challenges and restraints. One significant challenge is increasing competition, particularly from manufacturers offering low-cost, low-quality webcams. This price competition can pressure profit margins for established players. Another challenge stems from the cyclical nature of technological advancements. New devices and software regularly emerge, potentially impacting the lifespan and perceived value of existing webcam technology, requiring manufacturers to continuously innovate to remain competitive. Security concerns are another factor influencing the market. Data privacy and cybersecurity risks associated with webcam use are a growing concern for consumers and businesses alike, leading to demands for robust security features and heightened awareness among users. Furthermore, the increasing sophistication of integrated webcams in laptops and other devices presents a challenge to the standalone webcam market. The incorporation of advanced features directly into these integrated cameras decreases the immediate need for many consumers to invest in a separate, standalone device. Finally, fluctuating global economic conditions can impact consumer spending on non-essential electronics like webcams, particularly during periods of economic uncertainty.

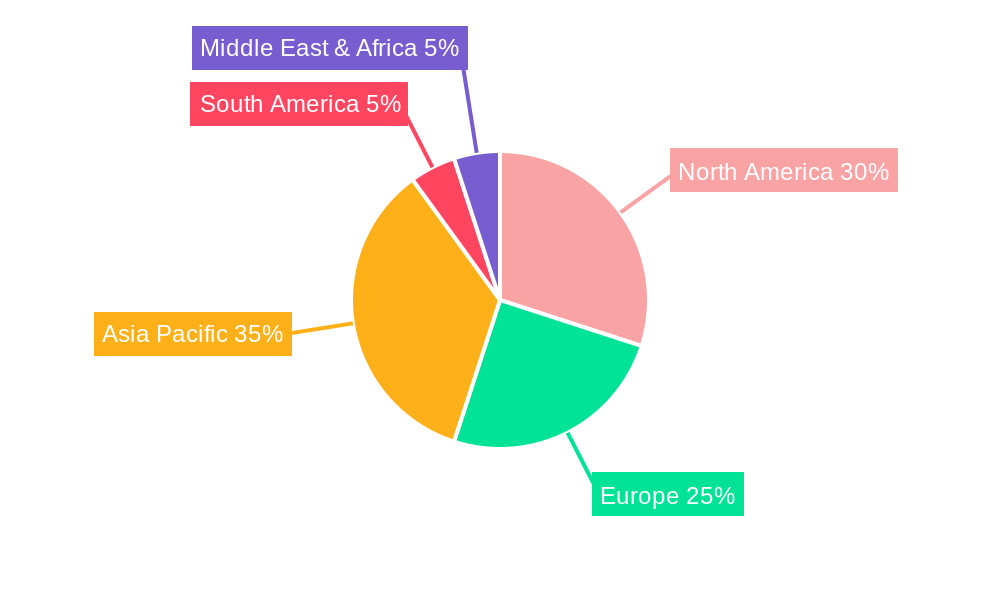

The North American and European markets are expected to continue dominating the PC webcam market due to high per capita income, extensive technological adoption, and well-established infrastructure supporting remote work and online communication. However, the Asia-Pacific region, particularly China and India, shows significant growth potential driven by rising internet penetration and increasing disposable incomes.

Segments Dominating the Market:

Wireless Type: The wireless segment is projected to experience faster growth compared to the wired segment due to increased convenience and flexibility. The ease of setup and portability offered by wireless webcams appeals to both individual and commercial users. Millions of units in this segment are predicted for the forecast period.

Commercial Application: The commercial segment is expected to remain a major driver of market growth due to the rising adoption of video conferencing solutions and the continued shift toward remote and hybrid work models. Businesses are increasingly investing in higher quality webcams to ensure clear and effective communication.

In detail:

The dominance of North America and Europe stems from a highly developed technological infrastructure and a culture of early adoption of new technologies. High disposable incomes enable consumers to readily invest in higher-quality webcams and associated technology. The commercial sector in these regions is exceptionally well-positioned for leveraging the enhanced capabilities of PC webcams for remote collaboration and improved communication efficiency. The expansion of the wireless segment is directly tied to consumer demand for convenient, easily deployable solutions in both commercial and residential settings. The shift towards remote and hybrid work models has accelerated this need, driving substantial growth in wireless webcam unit sales. The commercial sector's sustained growth is predicated upon the increasing importance of effective visual communication in business settings. Businesses recognize that clear and reliable video conferencing capabilities are vital for team cohesion, customer engagement, and overall operational efficiency. This demand for higher quality and greater functionality within commercial settings fuels higher sales volumes within this segment. The Asia-Pacific region's high potential hinges on the region's burgeoning digital economy, rising incomes, and increasing internet penetration. As more individuals and businesses gain access to high-speed internet, the demand for PC webcams is expected to soar. Further growth is facilitated by the cost-effectiveness of many PC webcams, making them accessible to a broad range of consumers in developing economies.

The PC webcam market's continued growth is fueled by several key catalysts. These include the sustained rise in remote work and hybrid work models, the increasing integration of webcams into online education, and the burgeoning demand for improved video conferencing and online communication tools across various sectors. Technological advancements, such as enhanced resolution, improved image processing, and the incorporation of AI features, also contribute significantly to expanding the market. Finally, the increasing affordability of high-quality webcams makes them accessible to a broader audience, fostering market expansion and penetration.

This report provides a comprehensive analysis of the PC webcam market, covering market trends, driving forces, challenges, key players, and significant developments across the study period (2019-2033). It offers in-depth insights into market segmentation by type (wired and wireless) and application (commercial and individual), providing valuable data and projections for market participants and investors seeking to understand this dynamic and rapidly evolving sector. The report highlights key regions and segments dominating the market, along with a detailed examination of growth catalysts and factors influencing market performance. The report's data-driven analysis empowers informed decision-making and strategic planning within the PC webcam industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Logitech, Poly, Microsoft, AverMedia, BizConf Telecom, Yealink Network Tech, Razer, Huddly, Sanwa Supply, Philips, Elecom, Suzhou Keda Technology, Shenzhen Aoni Electronic, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "PC Webcams," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the PC Webcams, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.