1. What is the projected Compound Annual Growth Rate (CAGR) of the Patient Lifting Equipment ?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Patient Lifting Equipment

Patient Lifting Equipment Patient Lifting Equipment by Type (Ceiling Lifts, Stair and Wheelchair Lifts, Mobile Lifts, Sit-To-Stand Lifts, Bath and Pool Lifts, Lifting Slings, World Patient Lifting Equipment Production ), by Application (Hospitals, Home Care Settings, Elderly Care Facilities, Others, World Patient Lifting Equipment Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global patient lifting equipment market is projected to reach a substantial $7,246.6 million by 2025, indicating a robust and expanding industry dedicated to enhancing patient mobility and caregiver safety. This growth is fueled by a confluence of factors, including the increasing prevalence of chronic diseases and age-related mobility issues, the aging global population, and a growing emphasis on reducing workplace injuries among healthcare professionals. The market's expansion is further propelled by technological advancements leading to the development of more sophisticated, user-friendly, and versatile lifting solutions, such as advanced mobile lifts and integrated sit-to-stand systems. Hospitals and home care settings are the primary application segments, driven by the need for efficient patient transfer and the desire to promote independent living for individuals with disabilities. The rising demand for patient lifting equipment is directly correlated with the growing awareness of the ergonomic benefits it offers to caregivers, thereby mitigating the risk of musculoskeletal disorders and improving the overall quality of care.

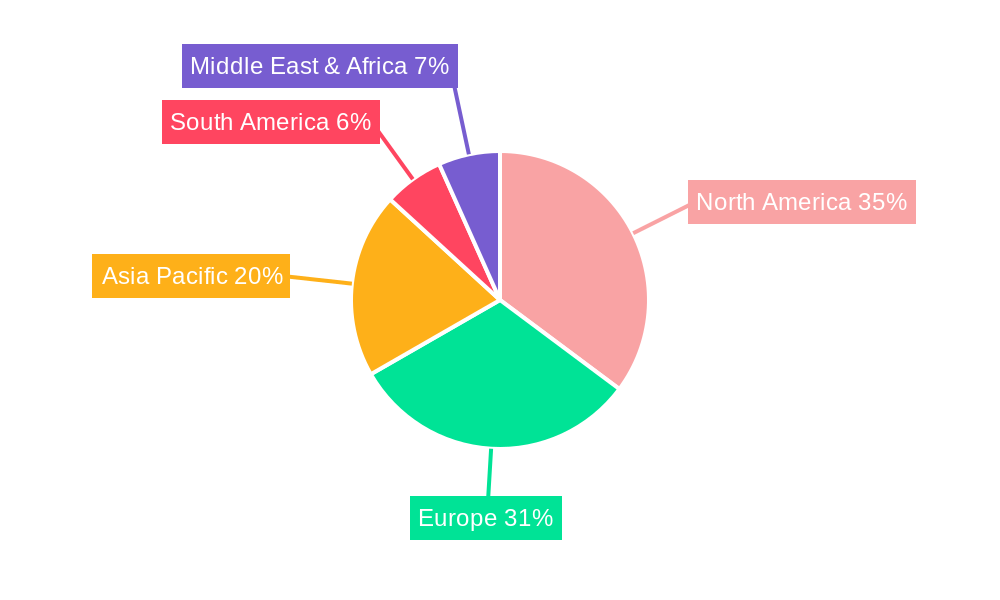

The patient lifting equipment market is characterized by a diverse range of product segments, including ceiling lifts, stair and wheelchair lifts, mobile lifts, sit-to-stand lifts, bath and pool lifts, and lifting slings, each catering to specific patient needs and environments. North America and Europe currently dominate the market due to advanced healthcare infrastructure, high healthcare spending, and a higher incidence of age-related conditions. However, the Asia Pacific region is anticipated to witness the fastest growth, spurred by increasing healthcare investments, a burgeoning elderly population, and rising disposable incomes in countries like China and India. Key market restraints include the high initial cost of advanced equipment and the need for proper training for effective operation. Despite these challenges, the strategic initiatives undertaken by leading players, such as mergers, acquisitions, and new product launches, are expected to further shape the competitive landscape and drive market penetration across various geographies.

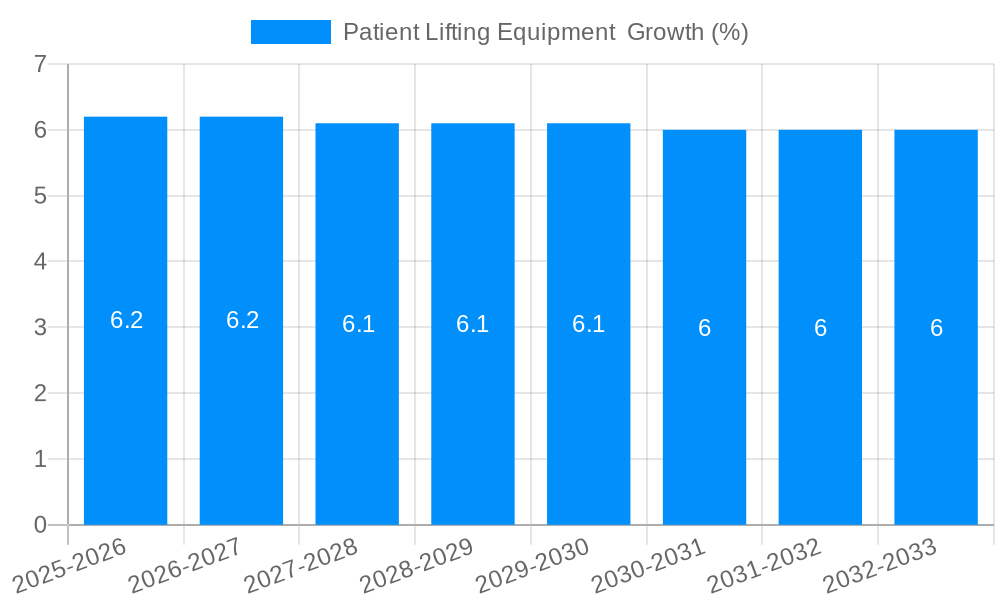

This report offers a comprehensive analysis of the global Patient Lifting Equipment market, providing in-depth insights into market dynamics, growth trajectories, and competitive landscapes. Leveraging a robust methodology, the study meticulously examines the market from the historical period of 2019-2024, with the base year set at 2025 for precise estimations. The forecast period extends from 2025 to 2033, enabling stakeholders to anticipate future market evolutions and strategic opportunities. The report utilizes a unit of millions for all quantitative values, reflecting the substantial scale of the global patient lifting equipment industry.

The patient lifting equipment market is experiencing a significant transformative phase, driven by a confluence of technological advancements, evolving healthcare needs, and a growing emphasis on patient and caregiver safety. XXX insights reveal a pronounced shift towards intelligent and user-friendly lifting solutions designed to minimize physical strain on caregivers and enhance the dignity and comfort of patients. The increasing prevalence of chronic diseases, coupled with an aging global population, is creating a sustained demand for reliable and efficient patient handling devices. This demographic shift is particularly evident in developed nations, where the number of individuals requiring assistance with mobility is steadily rising. Consequently, the market is witnessing a surge in demand for advanced ceiling lift systems, which offer unobtrusive and permanent lifting solutions within healthcare facilities and home care environments. These systems are lauded for their ability to facilitate a wide range of patient transfers, from bed to chair and for hygiene-related tasks, thereby reducing the risk of musculoskeletal injuries for healthcare professionals. Furthermore, the integration of smart technologies, such as sensor-based controls and connectivity features, is enhancing the functionality and safety of patient lifting equipment. These innovations not only improve the precision and ease of operation but also enable data logging for patient care monitoring and workflow optimization. The market is also observing a growing interest in portable and adaptable lifting solutions, catering to the increasing demand for home healthcare services and enabling patients to maintain independence in familiar surroundings. The emphasis on infection control is also influencing product design, with manufacturers increasingly incorporating antimicrobial materials and easy-to-clean surfaces into their offerings. The overarching trend is a move towards holistic patient care, where lifting equipment plays a crucial role in promoting mobility, preventing injuries, and improving the overall quality of life for individuals with limited mobility. The market size, as projected for 2025, is expected to be in the billions of dollars, with a steady growth rate anticipated throughout the forecast period. The strategic importance of patient lifting equipment is underscored by its vital role in modern healthcare settings, where it contributes significantly to patient safety, staff well-being, and operational efficiency.

Several key factors are propelling the patient lifting equipment market forward at an impressive pace. The most significant driver is the global demographic shift towards an aging population. As individuals live longer, the incidence of age-related mobility impairments and chronic conditions requiring assistive devices increases exponentially. This demographic trend directly translates into a higher demand for patient lifting solutions across various care settings. Secondly, there is a growing awareness and stringent regulatory focus on reducing workplace injuries among healthcare professionals. Manual patient handling has historically been a leading cause of musculoskeletal disorders for nurses and caregivers. The implementation of ergonomic lifting equipment significantly mitigates these risks, leading to lower compensation claims and improved staff retention. Thirdly, the increasing adoption of home healthcare services is a major growth catalyst. As healthcare systems aim to reduce hospitalizations and provide more comfortable, patient-centric care, the demand for accessible and user-friendly lifting equipment for domestic use is soaring. This includes mobile lifts and sit-to-stand aids that empower individuals to maintain independence within their homes. Moreover, technological advancements are continually enhancing the functionality, safety, and user-friendliness of patient lifting devices. Innovations such as integrated sensors, automated controls, and lightweight, durable materials are making these devices more appealing and effective. Finally, the rising healthcare expenditure globally, particularly in emerging economies, is contributing to increased investment in healthcare infrastructure and equipment, including patient lifting solutions.

Despite the robust growth prospects, the patient lifting equipment market faces several challenges and restraints that could potentially hinder its expansion. A primary concern is the significant initial cost associated with advanced patient lifting systems, particularly ceiling lifts and sophisticated mobile units. This high upfront investment can be a barrier for smaller healthcare facilities, individual users, and those in resource-constrained regions, limiting their access to these essential technologies. The need for proper training and ongoing maintenance also adds to the total cost of ownership and operational complexity, which can deter potential adopters. Furthermore, the perceived complexity of installation and operation for some advanced systems can create hesitation among end-users, particularly in less technologically inclined environments. The lack of standardized regulations and guidelines in certain developing countries regarding the use and installation of patient lifting equipment can lead to inconsistent adoption and potential safety concerns. Cybersecurity threats, although nascent in this sector, could become a restraint as more connected and smart lifting devices enter the market, necessitating robust data protection measures. Reimbursement policies and insurance coverage for patient lifting equipment can also vary significantly across different regions and healthcare systems, impacting affordability and accessibility for patients and providers. The stigma associated with requiring lifting assistance can also contribute to delayed adoption for some individuals, though this is gradually diminishing with increased awareness. Finally, the availability of skilled technicians for installation, maintenance, and repair can be limited in certain geographical areas, posing a logistical challenge for widespread deployment and ongoing support of sophisticated lifting equipment.

The global Patient Lifting Equipment market is characterized by the dominance of specific regions and product segments, driven by a combination of demographic, economic, and technological factors.

Dominant Segments:

Dominant Region/Country:

While North America leads, Europe, particularly Western European countries with similar demographic trends and high healthcare standards, also represents a significant and growing market. Asia-Pacific is emerging as a key growth region, driven by increasing healthcare investments, improving living standards, and a burgeoning elderly population, although adoption rates may still be lower compared to developed regions. The combined market share of North America and Europe is estimated to represent a substantial portion, potentially exceeding 60%, of the global patient lifting equipment market in 2025, with a projected combined value in the billions of millions.

The patient lifting equipment industry is experiencing robust growth catalyzed by several key factors. The relentless global aging demographic, with its attendant increase in mobility impairments, is a fundamental driver. Simultaneously, a heightened awareness of the risks associated with manual patient handling is compelling healthcare facilities to invest in ergonomic solutions, thus protecting their workforce. The burgeoning home healthcare sector, driven by patient preference and cost-effectiveness, also fuels demand for user-friendly, portable lifting devices. Technological innovations, leading to smarter, safer, and more intuitive equipment, further stimulate adoption.

This report provides an exhaustive exploration of the patient lifting equipment market, offering a deep dive into its current state and future trajectory. It meticulously details the market size, segmentation by type and application, and regional dynamics, providing quantitative projections in millions of units. The analysis delves into key trends, such as the integration of smart technologies and the growing emphasis on user-centric design. Furthermore, the report identifies and elaborates on the primary drivers propelling market growth, including the aging global population and the increasing adoption of home healthcare. Crucially, it also addresses the significant challenges and restraints that may impede market expansion, such as high initial costs and the need for extensive training. The comprehensive coverage extends to an in-depth examination of leading market players, their strategic initiatives, and significant recent developments that are shaping the industry landscape. Stakeholders can leverage this report to gain a nuanced understanding of the opportunities and risks within the patient lifting equipment sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Arjo, DJO global, Drive DeVilbiss healthcare, ETAC, GF Health Products, Guldmann, Handicare, Hill-Rom Holdings, Inc., Invacare, Joerns Healthcare, Medline Industries, Prism Medical.

The market segments include Type, Application.

The market size is estimated to be USD 7246.6 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Patient Lifting Equipment ," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Patient Lifting Equipment , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.