1. What is the projected Compound Annual Growth Rate (CAGR) of the Passenger Vehicle Noise Reduction Material?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Passenger Vehicle Noise Reduction Material

Passenger Vehicle Noise Reduction MaterialPassenger Vehicle Noise Reduction Material by Type (Body Noise Reduction Material, Engine Noise Reduction Material, Other), by Application (Traditional Energy Passenger Car, New Energy Passenger Car), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

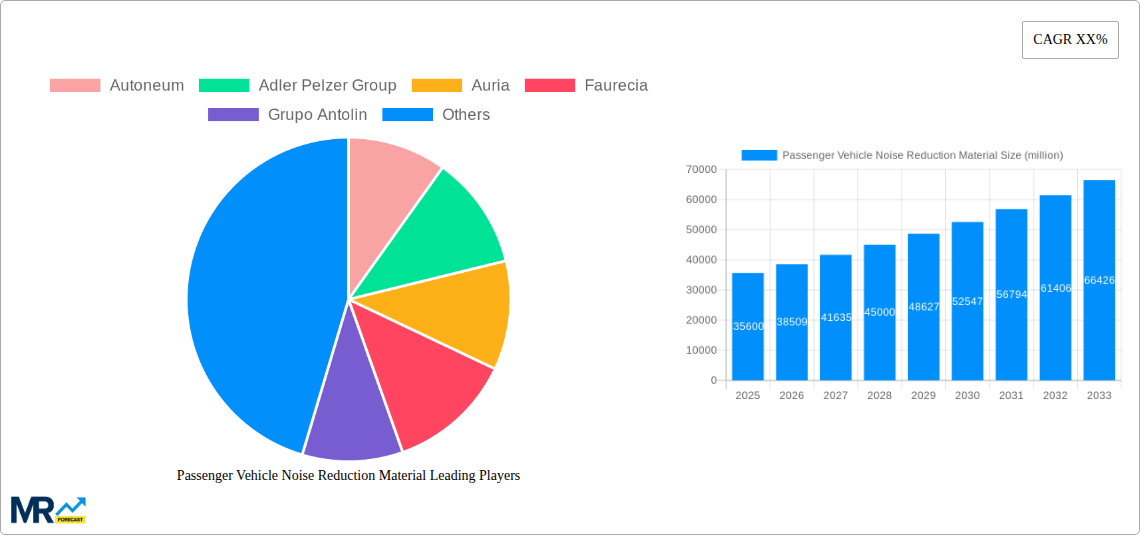

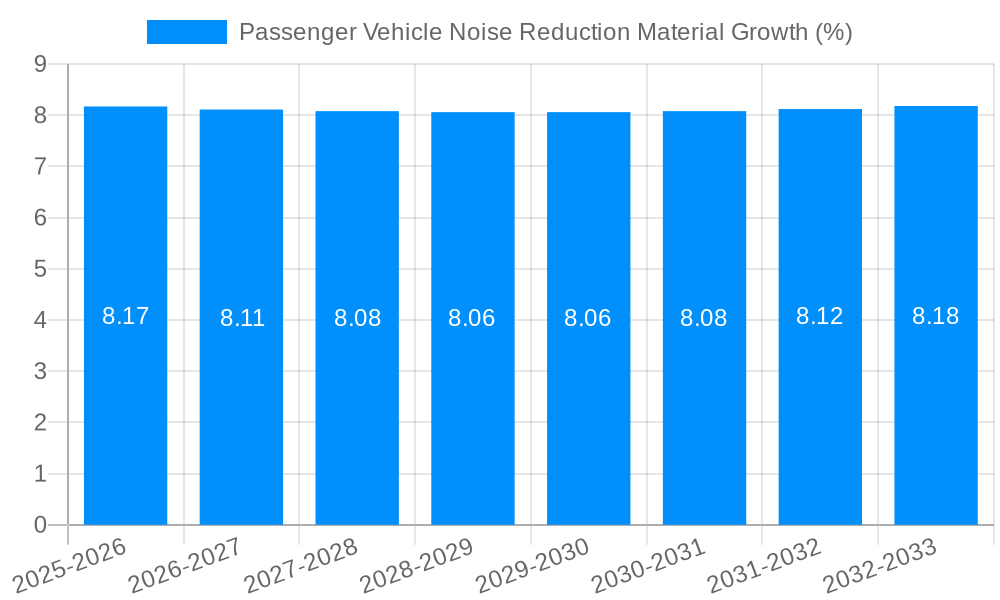

The Passenger Vehicle Noise Reduction Material market is poised for significant expansion, estimated to reach a substantial $35,600 million by 2025. This growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 8.2% throughout the forecast period of 2025-2033. The primary drivers behind this robust market performance include the escalating consumer demand for quieter and more comfortable in-cabin experiences, stringent government regulations concerning vehicle noise pollution, and the continuous innovation in material science leading to lighter, more effective noise reduction solutions. As automotive manufacturers prioritize NVH (Noise, Vibration, and Harshness) performance to differentiate their products and enhance customer satisfaction, the adoption of advanced noise reduction materials is becoming indispensable. The market is further stimulated by the increasing production of both traditional internal combustion engine (ICE) vehicles and the rapidly growing segment of new energy vehicles (NEVs), both of which present unique acoustic challenges and opportunities for specialized materials.

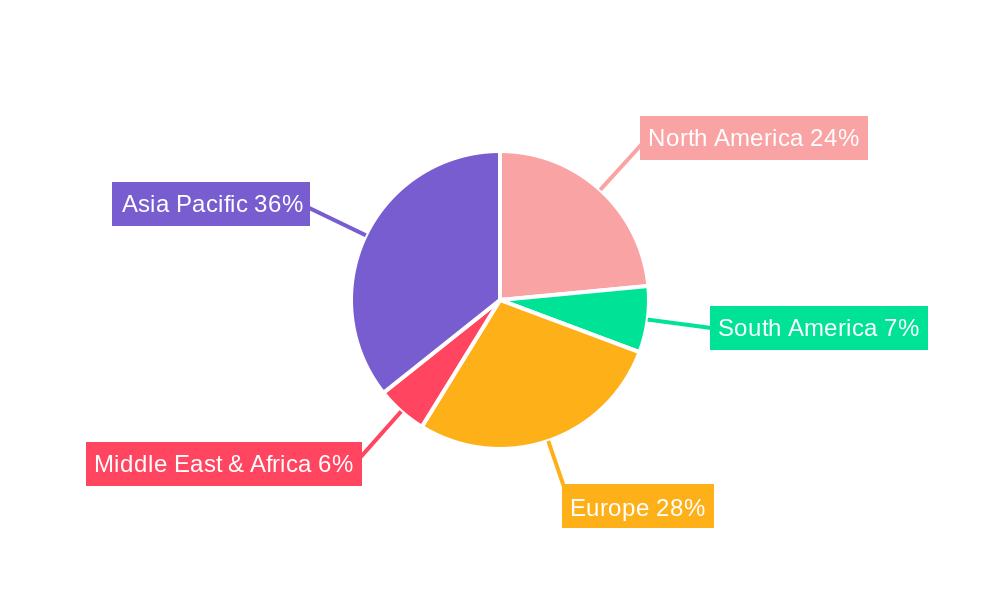

The market is segmented into Body Noise Reduction Materials and Engine Noise Reduction Materials, with both categories experiencing consistent demand. The "Other" segment likely encompasses specialized components and emerging applications. Geographically, Asia Pacific, particularly China and India, is emerging as a dominant force due to its massive vehicle production volumes and burgeoning automotive industry. North America and Europe, with their established automotive sectors and strong focus on regulatory compliance and premium vehicle features, also represent significant markets. Key players such as Autoneum, Adler Pelzer Group, and Faurecia are actively investing in research and development to offer innovative solutions that address evolving automotive acoustics needs, including materials that contribute to weight reduction and sustainability, thereby aligning with the industry's broader environmental goals. Restraints, such as the high cost of some advanced materials and the complexity of integration into existing manufacturing processes, are being steadily overcome through technological advancements and economies of scale.

This report offers an in-depth analysis of the global passenger vehicle noise reduction material market, providing a comprehensive overview of trends, growth drivers, challenges, and future projections. The study meticulously examines the market dynamics from 2019 to 2033, with a detailed focus on the Base Year of 2025 and the Forecast Period spanning from 2025 to 2033. Historical data from 2019-2024 is thoroughly reviewed to establish a robust understanding of past performance. The report quantifies key market insights using values in the million unit, ensuring a data-driven perspective.

The global passenger vehicle noise reduction material market is poised for significant expansion, driven by an increasing consumer demand for quieter and more comfortable driving experiences. As vehicle manufacturers continually strive to differentiate their offerings, the integration of advanced noise, vibration, and harshness (NVH) solutions has become a critical aspect of vehicle design and development. This trend is particularly pronounced in the premium segment, where enhanced cabin acoustics are a key selling proposition. However, the drive for improved NVH performance is gradually permeating into mass-market vehicles as well, reflecting a broader shift in consumer expectations. The market is witnessing a growing adoption of lightweight and sustainable materials, aligning with the automotive industry's broader push towards environmental responsibility. Innovations in material science are leading to the development of more effective and cost-efficient solutions, enabling a wider range of applications. The transition towards new energy vehicles (NEVs) presents a unique set of challenges and opportunities for noise reduction materials. While NEVs inherently produce less engine noise, they tend to amplify other noises, such as wind and road noise, necessitating sophisticated sound dampening solutions. This dynamic is shaping the product development strategies of key players, leading to the introduction of specialized materials tailored for the acoustic characteristics of electric powertrains and associated components. The overall market trajectory suggests a sustained period of growth, fueled by technological advancements, evolving consumer preferences, and regulatory pressures.

The market is segmented based on material type, including Body Noise Reduction Material, Engine Noise Reduction Material, and Other specialized categories. Applications are further categorized into Traditional Energy Passenger Cars and New Energy Passenger Cars, reflecting the evolving automotive landscape.

Key market insights include:

The passenger vehicle noise reduction material market is propelled by a confluence of compelling forces that are reshaping automotive design and consumer expectations. Foremost among these is the escalating consumer demand for a more refined and tranquil in-cabin experience. In today's competitive automotive landscape, a quiet and comfortable cabin has transcended from a luxury feature to a significant differentiating factor, influencing purchasing decisions across various vehicle segments. This heightened consumer awareness of NVH (Noise, Vibration, and Harshness) performance is compelling automakers to invest heavily in acoustic solutions. Furthermore, the rapid and relentless advancement in new energy vehicle (NEV) technology is acting as a powerful catalyst. While electric powertrains eliminate traditional engine roar, they amplify other ambient noises such as wind noise, tire noise, and component hum, creating new acoustic challenges that necessitate innovative noise reduction materials. This shift in acoustic profile for NEVs is driving the development of specialized materials designed to address these newly prominent noise sources. Concurrently, the automotive industry's unwavering commitment to weight reduction for improved fuel efficiency and extended EV range directly benefits advanced noise reduction materials. Many of these materials are inherently lightweight, offering a dual benefit of acoustic performance and mass optimization. Finally, increasing global regulations and industry standards focusing on occupant comfort and environmental noise pollution are indirectly incentivizing the adoption of more sophisticated noise reduction technologies.

Despite the robust growth trajectory, the passenger vehicle noise reduction material market is not without its hurdles. A significant challenge lies in the inherent cost implications associated with advanced acoustic materials and their integration. While consumers desire quieter vehicles, there's a limit to the premium they are willing to pay, especially in price-sensitive segments. This necessitates a delicate balance for manufacturers between achieving optimal NVH performance and maintaining competitive pricing. The complexity of integrating these materials into modern vehicle architectures also presents a challenge. As vehicle designs become more intricate and space becomes increasingly constrained, finding optimal locations and efficient methods for installing noise reduction materials requires significant engineering effort and investment. Furthermore, the evolving nature of the automotive industry, particularly the rapid shift towards electric vehicles, creates a dynamic environment where material requirements are constantly being re-evaluated. Developing and certifying new materials that meet the stringent performance, safety, and durability standards for NEVs can be a time-consuming and resource-intensive process. The supply chain for specialized acoustic materials can also be a point of vulnerability, susceptible to disruptions and fluctuations in raw material prices. Finally, educating and convincing consumers about the tangible benefits of investing in superior noise reduction technology, beyond basic sound dampening, remains an ongoing effort for both manufacturers and material suppliers.

The New Energy Passenger Car segment, coupled with the Asia-Pacific region, is projected to be a dominant force in the global passenger vehicle noise reduction material market during the forecast period. This dominance stems from a confluence of powerful drivers and strategic advantages that position these areas for significant growth and influence.

Asia-Pacific Region:

New Energy Passenger Car Segment:

In summary, the synergistic combination of the rapidly expanding New Energy Passenger Car segment and the dynamic, manufacturing-rich Asia-Pacific region creates a powerful nexus for the dominance of passenger vehicle noise reduction materials. The region's leadership in NEV production and adoption, coupled with growing consumer demand for comfort and technological innovation, makes it the epicenter for market growth and strategic development in this sector.

Several key factors are acting as significant growth catalysts for the passenger vehicle noise reduction material industry. The escalating consumer demand for enhanced cabin comfort and a superior driving experience is a primary driver, pushing automakers to prioritize NVH performance. The rapid evolution and adoption of new energy vehicles (NEVs) present a substantial opportunity, as the unique acoustic characteristics of electric powertrains necessitate specialized noise reduction solutions. Furthermore, continuous advancements in material science, leading to the development of lighter, more cost-effective, and highly efficient noise reduction materials, are fueling market expansion. The industry’s focus on sustainability is also a catalyst, with a growing demand for recyclable and eco-friendly acoustic materials.

This report provides an unparalleled level of detail and breadth in its examination of the passenger vehicle noise reduction material market. Beyond the core market analysis, it delves into the intricate interplay of technological advancements, evolving regulatory landscapes, and shifting consumer preferences that shape market dynamics. The report meticulously details the application of these materials across both traditional and new energy passenger vehicles, highlighting the specific acoustic challenges and solutions unique to each. Furthermore, it provides granular insights into industry developments, tracking significant innovations, strategic partnerships, and investment trends from the historical period through the forecast period. This comprehensive coverage ensures that stakeholders gain a holistic understanding of the market's present state and its promising future, equipping them with the data and analysis necessary for informed strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Autoneum, Adler Pelzer Group, Auria, Faurecia, Grupo Antolin, Toyota Boshoku, NVH KOREA, Tuopu Group, Sumitomoriko, Zhuzhou Times, Huanqiu Group, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Passenger Vehicle Noise Reduction Material," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Passenger Vehicle Noise Reduction Material, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.