1. What is the projected Compound Annual Growth Rate (CAGR) of the Paper Product Packaging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Paper Product Packaging

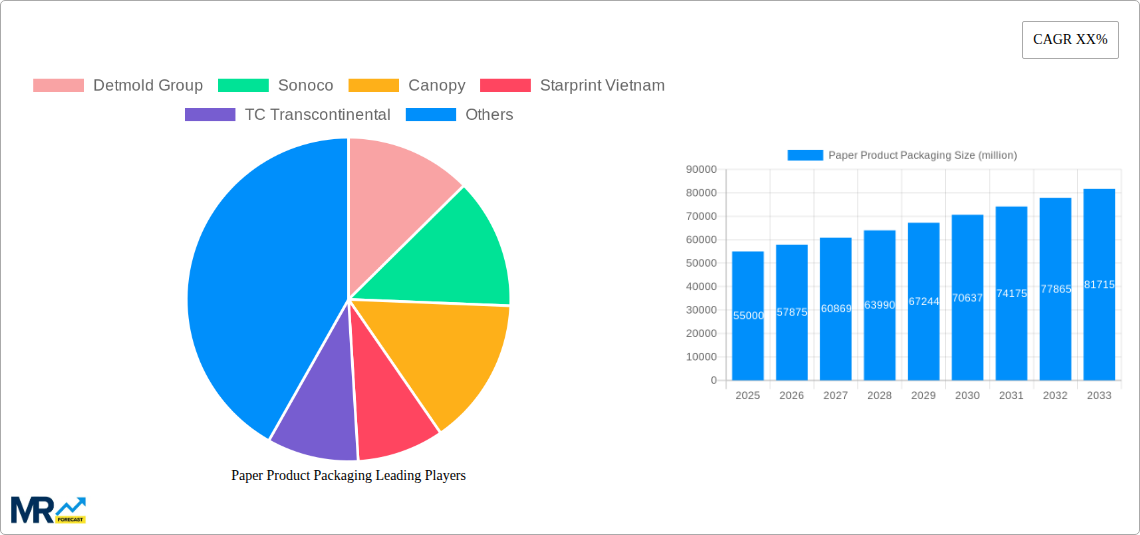

Paper Product PackagingPaper Product Packaging by Type (Carton, Paper Bag), by Application (Food, Clothing, Medicine, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

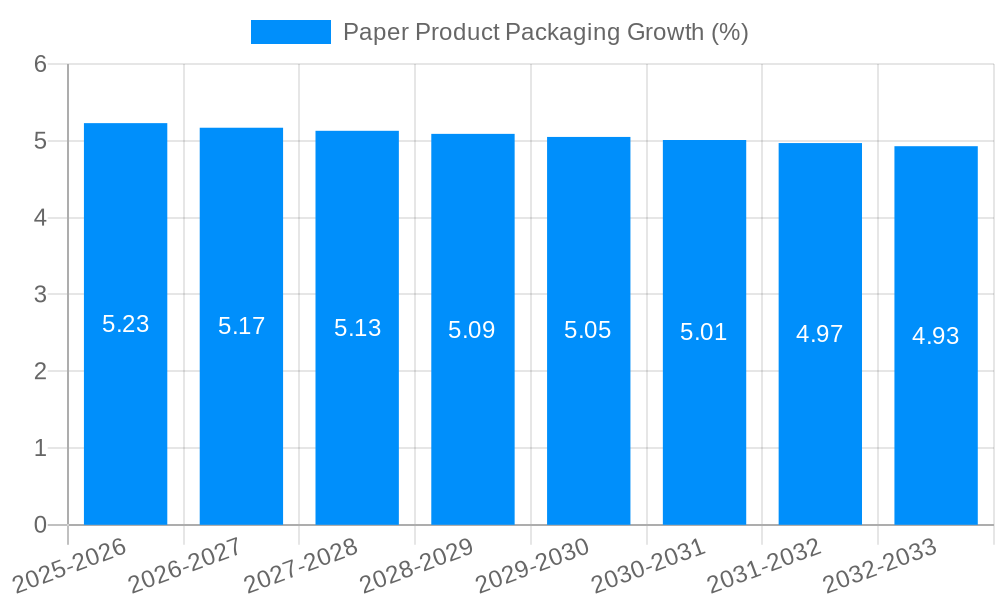

The global paper product packaging market is poised for significant expansion, driven by a burgeoning demand for sustainable and eco-friendly packaging solutions. With an estimated market size of approximately \$55 billion in 2025, the sector is projected to witness robust growth, expanding at a Compound Annual Growth Rate (CAGR) of around 5.5% through 2033. This upward trajectory is largely propelled by increasing consumer awareness regarding environmental issues, leading to a preference for recyclable and biodegradable materials over traditional plastics. Key drivers include the growing e-commerce industry, which relies heavily on durable yet lightweight paper-based packaging for shipping, and the food and beverage sector's shift towards more sustainable primary and secondary packaging. Furthermore, regulatory pressures worldwide are increasingly favoring paper-based alternatives, mandating reductions in plastic usage and incentivizing the adoption of greener packaging materials.

The market's dynamism is further shaped by evolving consumer preferences and innovative product development. The segmentation of the market reveals a strong demand for carton packaging, which dominates due to its versatility, cost-effectiveness, and suitability for a wide range of applications, including food, beverages, and consumer goods. Paper bags are also witnessing steady growth, particularly in retail and takeaway food services, as businesses seek to align with eco-conscious branding. While the convenience and cost-effectiveness of plastic packaging present some restraint, the overwhelming global push towards sustainability, coupled with advancements in paper technology offering improved barrier properties and printability, is expected to largely offset these challenges. Key players like Detmold Group, Sonoco, and TC Transcontinental are actively investing in research and development to offer innovative paper packaging solutions that meet the diverse needs of industries such as food, clothing, and medicine, thereby solidifying the market's growth trajectory.

This comprehensive report delves into the dynamic global Paper Product Packaging market, providing an in-depth analysis from its historical roots (2019-2024) through its projected trajectory until 2033. Leveraging the Base Year of 2025 for detailed estimations, the study offers unparalleled insights into market size, segmentation, key players, and prevailing trends. Utilizing robust data, the report quantifies market values in millions of units, offering a clear understanding of scale and volume.

The Paper Product Packaging market is currently undergoing a significant evolution, driven by a confluence of environmental consciousness, evolving consumer preferences, and technological advancements. A paramount trend is the unprecedented surge in demand for sustainable and eco-friendly packaging solutions. As regulatory pressures mount and consumer awareness regarding plastic waste intensifies, paper-based alternatives are witnessing substantial adoption across various applications. This shift is not merely a fleeting trend but a fundamental reorientation of the industry. Companies are heavily investing in developing innovative paper packaging that offers comparable performance to traditional plastic, including enhanced barrier properties, increased durability, and improved printability. The focus is on virgin and recycled paperboard, molded pulp, and paper-based films that can effectively replace single-use plastics in sectors like food and beverage, cosmetics, and e-commerce. Furthermore, the report observes a growing preference for minimalist and aesthetically pleasing packaging designs. Consumers are increasingly drawn to brands that demonstrate a commitment to environmental responsibility through their packaging. This translates to a demand for less material usage, easily recyclable components, and transparent labeling regarding the origin and recyclability of the packaging. The rise of e-commerce has also significantly impacted packaging trends, necessitating robust, protective, yet lightweight paper solutions that can withstand the rigors of shipping and handling while minimizing shipping costs. Customized and branded packaging is also gaining traction, as companies seek to differentiate themselves and enhance the unboxing experience for consumers. The integration of smart packaging technologies, such as QR codes for traceability and augmented reality features, is another emerging trend that enhances consumer engagement and provides valuable product information. The report will meticulously dissect these trends, quantifying their impact on market growth and regional demand, and providing actionable intelligence for stakeholders to navigate this rapidly transforming landscape. The continuous innovation in paper manufacturing processes, focusing on reducing water and energy consumption, further bolsters the market's sustainable narrative.

Several potent forces are propelling the growth of the Paper Product Packaging market. Foremost among these is the unwavering global drive towards sustainability and the circular economy. Growing environmental concerns and increasing awareness of the detrimental impact of plastic waste on ecosystems are compelling consumers and governments alike to seek viable alternatives. Paper packaging, with its inherent biodegradability and high recyclability rates, stands as a prime beneficiary of this paradigm shift. Regulatory bodies worldwide are implementing stringent policies aimed at reducing plastic consumption, thereby creating a favorable environment for paper-based solutions. This includes bans on certain single-use plastics and incentives for the adoption of sustainable packaging materials. The burgeoning e-commerce sector is another significant growth driver. As online retail continues its exponential expansion, the demand for robust, protective, and cost-effective shipping solutions escalates. Paperboard boxes, mailers, and protective inserts are ideally suited to meet these requirements, offering a balance of strength, light weight, and cost-efficiency. Furthermore, the increasing sophistication of paper packaging technology is expanding its applicability. Innovations in paper coatings and treatments are enhancing barrier properties, making paper packaging suitable for a wider range of products, including those with moisture or grease sensitivities, thereby directly impacting applications like food and medicine. The growing emphasis on brand differentiation and enhanced consumer experience is also contributing to market expansion. Companies are increasingly opting for aesthetically appealing and customizable paper packaging to strengthen their brand identity and create memorable unboxing experiences, further driving demand for innovative paper packaging designs and printing techniques.

Despite its promising growth trajectory, the Paper Product Packaging market is not without its challenges and restraints. A primary concern revolves around the inherent limitations of paper packaging when it comes to certain product functionalities. For applications requiring superior moisture, grease, or gas barriers, traditional paper packaging can fall short compared to its plastic counterparts. While advancements in coatings and laminations are addressing these limitations, they can sometimes increase the cost and complexity of recycling, creating a sustainability paradox. Fluctuations in the price and availability of raw materials, particularly virgin pulp, can also pose a significant restraint. Global supply chain disruptions, climate change impacts on forestry, and increased demand from other paper-consuming industries can lead to price volatility, affecting the profitability of packaging manufacturers. Competition from alternative sustainable packaging materials, such as bioplastics and reusable packaging systems, presents another challenge. While paper offers a strong sustainability profile, these emerging alternatives are also capturing market share, especially in niche applications. The cost competitiveness of paper packaging compared to conventional plastics remains a persistent concern, particularly in price-sensitive markets. While the long-term environmental benefits are clear, the initial capital investment for transitioning to paper-based solutions can be a barrier for some businesses. Furthermore, the infrastructure for effective recycling and waste management varies significantly across regions, which can impact the actual environmental benefit and consumer perception of paper packaging. In areas with underdeveloped recycling systems, paper waste can still end up in landfills, undermining its sustainable credentials. Lastly, consumer education and behavior play a crucial role. Misconceptions about the recyclability of certain paper products or the proper disposal methods can hinder the full realization of paper packaging's environmental potential.

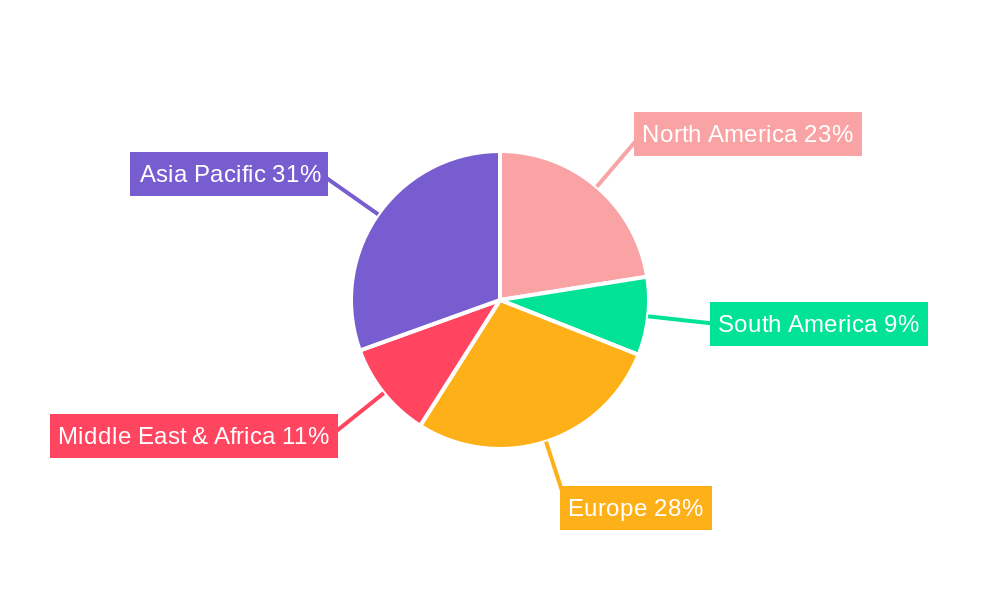

The global Paper Product Packaging market is characterized by dynamic regional contributions and segment dominance, with a clear indication that Asia Pacific is poised to be the leading region, primarily driven by its robust manufacturing base, burgeoning economies, and increasing environmental awareness. Within this region, China stands out as a powerhouse, fueled by its extensive industrial infrastructure, significant domestic consumption, and its role as a global manufacturing hub for various end-use industries that rely heavily on paper packaging. The country's proactive stance on environmental regulations, coupled with substantial investments in sustainable packaging technologies, further solidifies its dominance.

The Paper Bag segment, particularly within the Food application, is expected to be a key segment to dominate the market. This dominance is multi-faceted:

Food Application:

Paper Bag Segment:

While other regions like Europe will also witness significant growth due to stringent environmental regulations and a mature market for sustainable products, and North America due to its large consumer base and the booming e-commerce sector, Asia Pacific's sheer scale of manufacturing and consumption, coupled with the specific strengths of the paper bag segment in the food application, positions it for undeniable market dominance. The report will provide detailed quantitative data, including market share projections for these regions and segments throughout the forecast period (2025-2033), supported by an analysis of the underlying economic and consumer drivers.

The Paper Product Packaging industry is experiencing robust growth fueled by several key catalysts. The escalating global demand for sustainable and eco-friendly packaging solutions is undeniably the most significant driver. Growing environmental consciousness among consumers and increasingly stringent government regulations worldwide are compelling businesses to shift away from single-use plastics towards recyclable and biodegradable paper alternatives. The rapid expansion of the e-commerce sector presents another major growth catalyst. The need for sturdy, lightweight, and cost-effective packaging to facilitate online retail is driving substantial demand for paperboard boxes, mailers, and protective inserts. Furthermore, continuous innovation in paper manufacturing and converting technologies is enhancing the functionality and appeal of paper packaging. Developments in barrier coatings, printing techniques, and structural designs are expanding the applications for paper packaging into previously plastic-dominated segments, such as food and beverages.

This report offers an exhaustive examination of the Paper Product Packaging market, encompassing a granular analysis of its intricate dynamics. It provides a thorough understanding of market size and volume in millions of units across the Study Period: 2019-2033, with a specific focus on the Base Year: 2025 for detailed estimations. The report meticulously segments the market by Type (Carton, Paper Bag) and Application (Food, Clothing, Medicine, Other), and investigates crucial Industry Developments. Furthermore, it delves into the Driving Forces propelling market expansion, such as the sustainability imperative and the e-commerce boom, while also addressing significant Challenges and Restraints like raw material volatility and functional limitations. Crucially, the report identifies Key Regions or Countries and Dominant Segments, offering strategic insights into market leadership, particularly highlighting Asia Pacific and the Paper Bag segment for Food applications. Readers will gain a clear picture of the Growth Catalysts and a comprehensive list of Leading Players, along with a timeline of Significant Developments. This report is designed to equip stakeholders with the actionable intelligence needed to navigate this evolving and increasingly vital sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Detmold Group, Sonoco, Canopy, Starprint Vietnam, TC Transcontinental, Shanying International Holding Co., Ltd, Kunshan Jinhongkai Packaging Products Co., Ltd., Oji Packaging (Shanghai) Co., Ltd., Shanghai Haiyin Environmental Protection Technology Co., Ltd., Zijiang, Dalian Dongzheng Paper Bag Products Co., Ltd., Fujian Nanwang Environmental Protection Technology Co., Ltd., Shenzhen Jinjia Group Co., Ltd., Xiamen Hexing Packaging and Printing Co., Ltd., Xiamen Jihong Technology Co., Ltd., .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Paper Product Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Paper Product Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.