1. What is the projected Compound Annual Growth Rate (CAGR) of the Paper Packaging Box?

The projected CAGR is approximately 4.28%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Paper Packaging Box

Paper Packaging BoxPaper Packaging Box by Type (Gift Box, Color Box, Folding Carton, Others, World Paper Packaging Box Production ), by Application (Food & Beverage, Consumer Electronics, Medicine, Everyday Chemicals, Tobacco, Others, World Paper Packaging Box Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

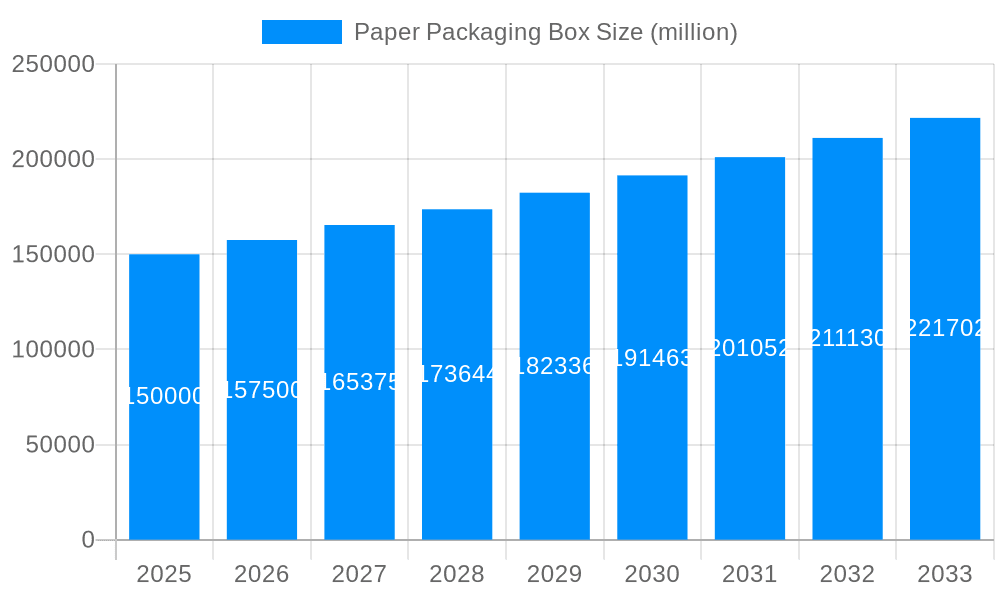

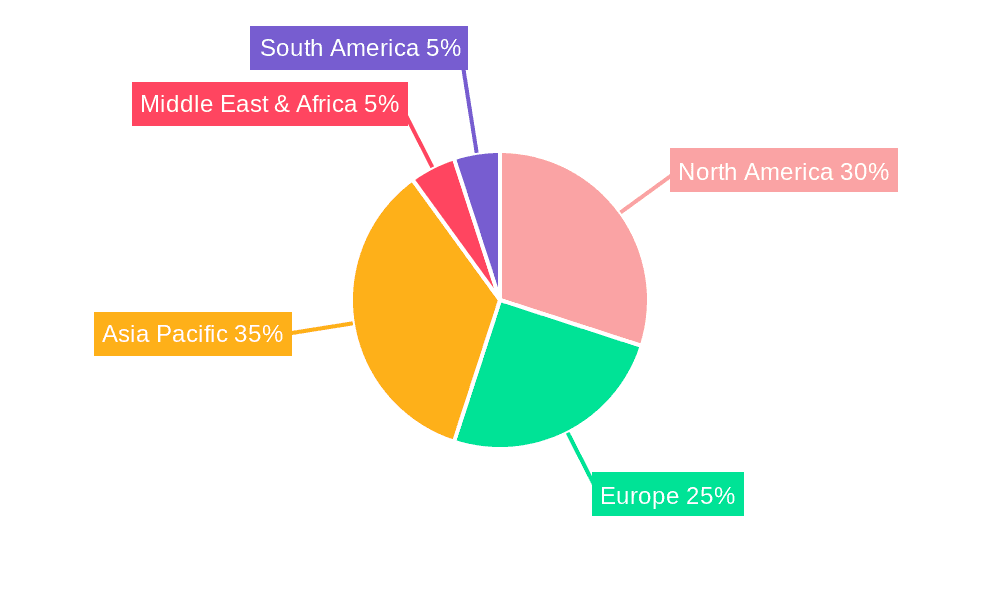

The global paper packaging box market is a significant and expanding sector, fueled by the rapid growth of e-commerce, demand for sustainable and convenient packaging, and the robust food and beverage industry. The market is projected to grow at a compound annual growth rate (CAGR) of 4.28%. Key market segments include gift boxes, color boxes, and folding cartons, serving diverse consumer and industrial requirements. Major application areas contributing to market demand are food & beverage, consumer electronics, and pharmaceuticals. Challenges such as fluctuating pulp and paper prices and competition from alternative packaging materials are being addressed through innovation in design, recycled content utilization, and advanced printing technologies. The market demonstrates strong presence in North America and Asia Pacific, with China and the United States as key contributors. Future expansion will be driven by sustainable packaging adoption, enhanced brand presentation, and global e-commerce growth.

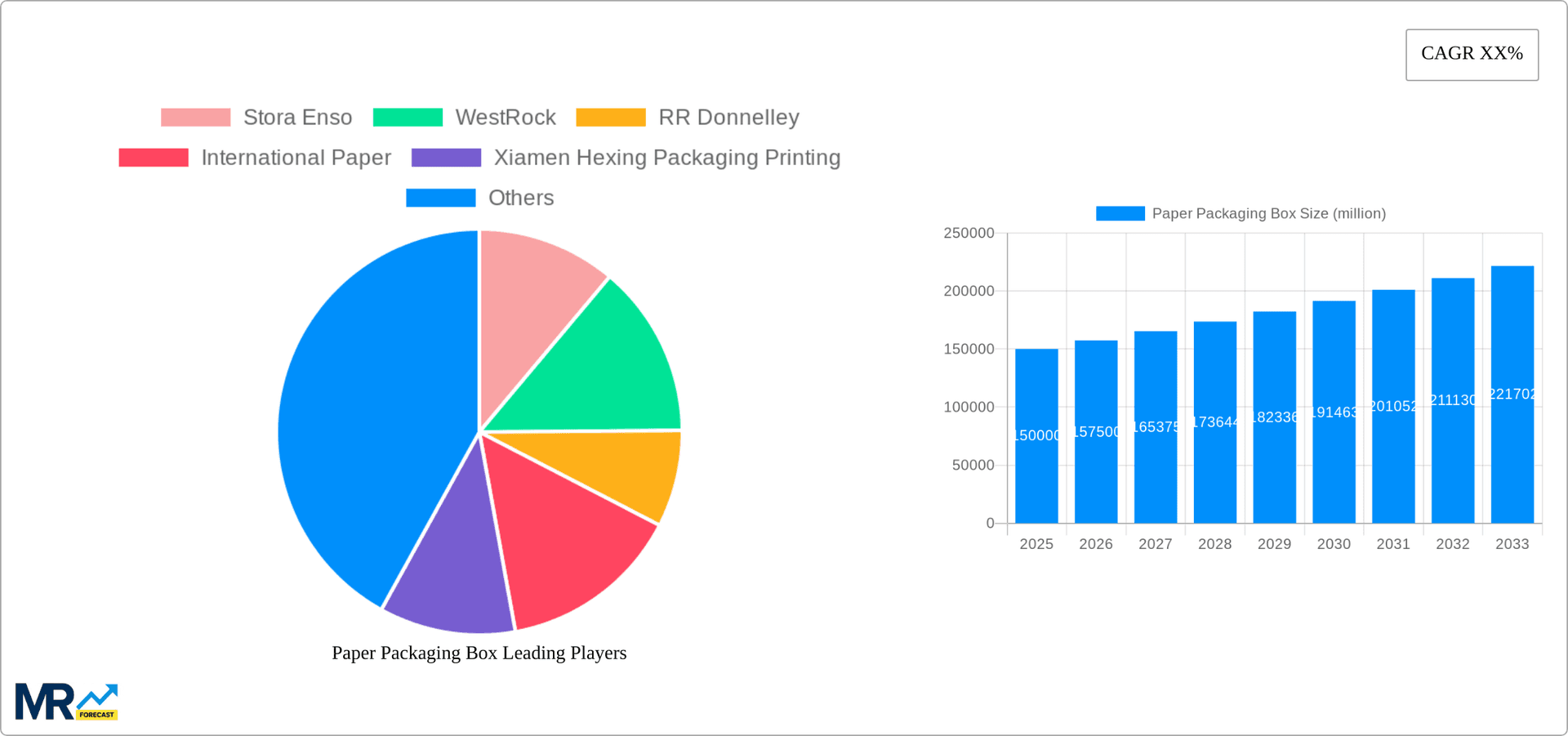

The competitive environment features major multinational corporations including Stora Enso, WestRock, and International Paper, alongside numerous regional players. Companies are prioritizing production efficiency, product portfolio expansion, and strategic collaborations to secure market position. While established entities hold substantial market share, smaller companies are innovating with niche solutions. The market anticipates further consolidation via mergers and acquisitions to broaden reach and access new technologies. The integration of digital printing is revolutionizing the sector with efficient, customized packaging. This trend, alongside a growing emphasis on eco-friendly solutions, will shape the paper packaging box market's future, with an estimated market size of 337.64 billion by the base year 2025.

The global paper packaging box market, valued at several billion units in 2024, is experiencing significant transformation driven by evolving consumer preferences and technological advancements. The shift towards sustainable and eco-friendly packaging solutions is a key trend, with brands increasingly prioritizing recyclable and biodegradable options to meet growing environmental concerns. This has fueled demand for innovative materials like recycled paperboard and sustainably sourced pulp, pushing manufacturers to adopt greener production processes. Furthermore, the market is seeing a rise in customized and personalized packaging, with brands utilizing unique designs and printing techniques to enhance product appeal and brand recognition. E-commerce growth continues to be a major driver, as the need for robust and protective packaging for online deliveries surges. This has led to increased demand for specialized boxes designed for efficient shipping and protection against damage during transit. Meanwhile, technological advancements are streamlining production processes, with automation and digital printing technologies improving efficiency and enabling faster turnaround times. The integration of smart packaging technologies, incorporating features like QR codes and RFID tags, is also gaining traction, allowing for enhanced product traceability and consumer engagement. This multifaceted evolution demonstrates the dynamism of the paper packaging box market, shaped by environmental considerations, technological innovation, and the dynamic landscape of e-commerce. The market's future is poised for continued growth, fueled by these interacting forces and the ongoing search for sustainable, efficient, and engaging packaging solutions. Over the forecast period (2025-2033), we project a continued increase in demand, potentially reaching tens of billions of units annually, reflecting the enduring relevance of paper packaging in a wide array of industries.

Several key factors are driving the expansion of the paper packaging box market. The escalating demand for eco-friendly packaging is a primary driver. Consumers and businesses alike are increasingly aware of the environmental impact of packaging, leading to a preference for sustainable alternatives such as recyclable and biodegradable paper-based solutions. This growing preference directly translates into increased demand for paper packaging boxes, pushing manufacturers to improve their sustainability practices and explore innovative eco-friendly materials. Another significant driver is the booming e-commerce sector. The rapid growth of online shopping necessitates robust and protective packaging for safe product delivery, significantly boosting the demand for various types of paper packaging boxes, from simple shipping cartons to customized retail packaging. Moreover, the rising disposable income in developing economies and the consequent increase in consumer spending on packaged goods are contributing to market expansion. Additionally, the adaptability of paper packaging boxes allows for diverse applications across various industries, further driving demand. From food and beverage to cosmetics and pharmaceuticals, the versatile nature of these boxes ensures their continued relevance and widespread usage. Finally, advancements in printing and packaging technologies provide greater opportunities for customization and branding, adding to the appeal and market value of paper packaging boxes.

Despite the significant growth potential, the paper packaging box market faces several challenges. Fluctuations in raw material prices, primarily pulp and paperboard, represent a major obstacle, impacting production costs and profitability. The availability and pricing of raw materials are susceptible to various factors including global economic conditions, environmental regulations, and transportation costs. Increased competition from alternative packaging materials like plastic and metal poses another significant challenge. While paper packaging enjoys significant environmental benefits, plastic offers advantages in terms of cost, durability, and barrier properties in certain applications. Stringent environmental regulations and compliance requirements can also increase operational costs for manufacturers, demanding investments in sustainable practices and technologies. Furthermore, maintaining consistency in quality and meeting the diverse requirements of different industries can be challenging. Manufacturers need to balance cost-effectiveness with high-quality production to meet the varying needs of clients across sectors. Finally, managing the complexities of global supply chains, logistics, and distribution networks can impact efficiency and cost management, presenting another key challenge for companies operating in this market.

The Asia-Pacific region is projected to dominate the paper packaging box market throughout the forecast period (2025-2033), driven by rapid economic growth, increasing consumer spending, and a burgeoning e-commerce sector. Within this region, countries like China and India are expected to lead, owing to their large populations, expanding middle classes, and significant manufacturing capabilities.

High Demand for Folding Cartons: The folding carton segment is anticipated to experience the highest growth rate within the type segment, driven by its versatility, cost-effectiveness, and suitability for a broad range of applications across diverse industries.

Food & Beverage Dominates Application: The food and beverage sector is expected to maintain its leading position in the application segment, due to the significant demand for packaging solutions that meet food safety and preservation standards.

Technological Advancements Fuel Growth: The integration of advanced printing and packaging technologies, such as digital printing and automated production lines, is significantly enhancing efficiency and enabling greater customization, fueling demand for premium products.

The North American and European markets are expected to maintain substantial market shares, albeit with slightly slower growth rates compared to the Asia-Pacific region. This is due to factors such as market maturity, already high levels of paper packaging usage, and stricter environmental regulations. However, these regions still represent significant markets for premium and specialized packaging solutions, particularly those emphasizing sustainability and customization. The market dynamics reflect a complex interplay of regional economic factors, consumption patterns, technological adoption, and environmental regulations. This leads to the dynamic distribution of market share across different regions and application segments, and emphasizes the importance of understanding regional specifics for successful market entry and competition.

The paper packaging box industry is poised for robust growth, primarily driven by the increasing demand for sustainable and eco-friendly packaging solutions. The rising consumer awareness of environmental issues is pushing brands to adopt more responsible packaging choices, directly impacting the demand for recyclable paper-based alternatives. Coupled with this is the e-commerce boom which necessitates efficient and protective packaging for product delivery, thereby fueling additional demand. This confluence of eco-consciousness and the surge in online retail is generating significant growth opportunities for the industry. Furthermore, innovation in printing and packaging technologies is allowing for greater product customization, enhanced brand visibility, and improved efficiency in the production process, further stimulating market expansion.

This report provides a comprehensive analysis of the paper packaging box market, encompassing market size, growth trends, key drivers, challenges, and leading players. The report covers detailed segmentations by type, application, and geography, offering insights into market dynamics and future projections. It also includes an in-depth competitive landscape analysis, highlighting the strategies of major players and their market positions. This extensive coverage provides valuable information for stakeholders across the value chain, including manufacturers, suppliers, distributors, and investors seeking to understand and navigate the evolving landscape of the paper packaging box market. The report utilizes data from the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033) to offer a robust and forward-looking perspective on market trends and opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.28% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.28%.

Key companies in the market include Stora Enso, WestRock, RR Donnelley, International Paper, Xiamen Hexing Packaging Printing, Shenzhen YUTO Packaging, ZRP Printing Group, Xiamen Jihong Technology, Shenzhen Jinjia Group, Shanghai Sunglow Packaging Technology, Lukka Pack, Hung Hing Printing, AMVIG Holdings, Litu Holdings Limited, Forest Packaging Group, Guangdong New Grand Long Packing, TianJin A&R Intelligent Packaging, Graphic Packaging, Shenzhen Mys Environmental Protection & Technology, Xi'an Global Printing, Topobal, Oliver Inc, Huhtamaki, Smurfit Kappa, Oji Holdings, Landa Digital Printing, Rohrer Corporation, RENGO CO.,LTD..

The market segments include Type, Application.

The market size is estimated to be USD 337.64 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Paper Packaging Box," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Paper Packaging Box, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.