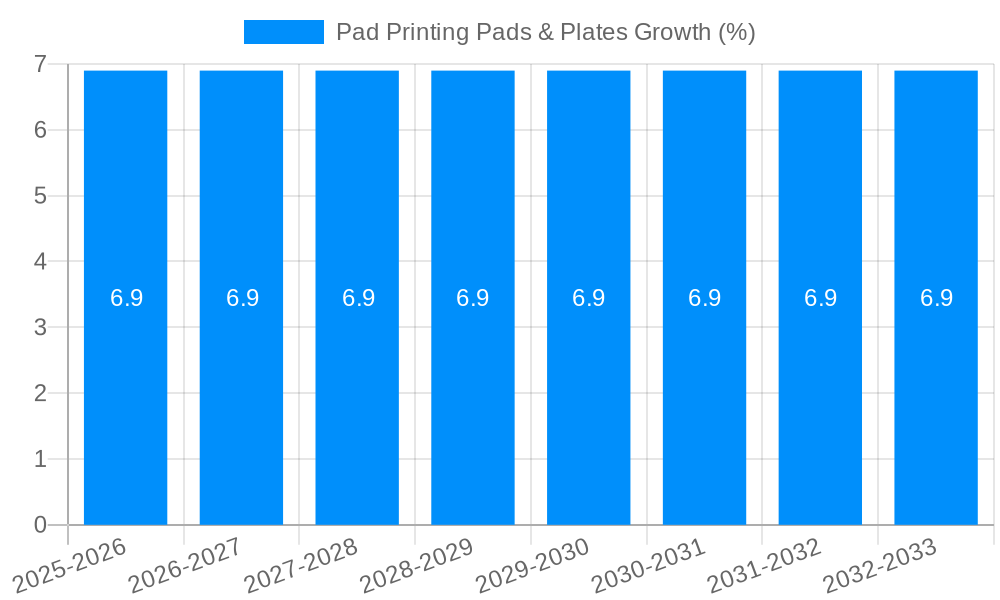

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pad Printing Pads & Plates?

The projected CAGR is approximately 6.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Pad Printing Pads & Plates

Pad Printing Pads & PlatesPad Printing Pads & Plates by Type (Pad Printing Pads, Pad Printing Plates), by Application (Consumer Goods, Electronics, Automotive, Medical, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

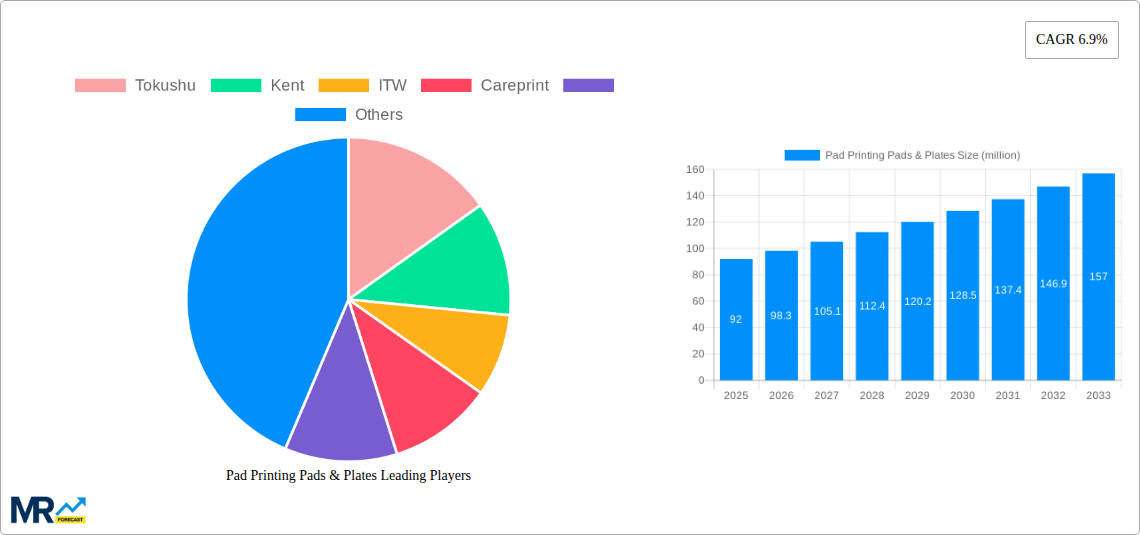

The global Pad Printing Pads & Plates market is projected to witness robust growth, driven by the increasing demand from diverse end-use industries. With an estimated market size of $92 million in 2025, the market is poised for significant expansion, fueled by a compound annual growth rate (CAGR) of 6.9% throughout the forecast period of 2025-2033. This upward trajectory is largely attributed to the escalating adoption of pad printing technology in the manufacturing of consumer goods, electronics, and automotive components, where precision and intricate designs are paramount. The automotive sector, in particular, is a key contributor, leveraging pad printing for branding, interior and exterior part decoration, and functional marking. Similarly, the burgeoning electronics industry relies on this method for marking and decorating small, complex components. Furthermore, the medical device industry is increasingly turning to pad printing for its ability to sterilize-resistant and biocompatible markings, adding another layer of growth potential.

The market segmentation reveals a strong demand for both Pad Printing Pads and Pad Printing Plates, with advancements in material science and manufacturing techniques leading to improved performance and longevity. While Pad Printing Pads are crucial for ink transfer, the Pad Printing Plates serve as the stencil for intricate designs, with innovations focusing on faster etching and higher resolution capabilities. Beyond consumer goods, electronics, and automotive, the "Others" segment, encompassing sectors like sporting goods, promotional items, and industrial labeling, also contributes to market expansion. Key industry players such as Tokushu, Kent, and ITW are at the forefront, investing in research and development to offer specialized solutions that cater to evolving industry needs, including sustainable printing options and advanced material formulations for enhanced durability and print quality.

This report provides an in-depth analysis of the global Pad Printing Pads & Plates market, examining trends, drivers, challenges, and future prospects. The study encompasses a Study Period of 2019-2033, with the Base Year and Estimated Year set at 2025. The Forecast Period spans 2025-2033, building upon the Historical Period of 2019-2024. The market is segmented by Type (Pad Printing Pads, Pad Printing Plates), Application (Consumer Goods, Electronics, Automotive, Medical, Others), and key industry developments.

The global Pad Printing Pads & Plates market is experiencing a dynamic evolution driven by a confluence of technological advancements, shifting industry demands, and a growing appreciation for the precision and versatility offered by pad printing technology. In the Historical Period (2019-2024), the market demonstrated steady growth, fueled by increasing adoption in sectors requiring intricate and durable marking solutions. The Estimated Year of 2025 is poised to witness a significant upswing, with projections indicating a market value in the tens of millions of units. Looking ahead into the Forecast Period (2025-2033), the market is expected to continue its upward trajectory, driven by innovations in material science for pad printing pads, leading to enhanced durability, chemical resistance, and transfer efficiency. For instance, advancements in silicone formulations have allowed for pads that can withstand harsher industrial environments and a wider range of inks, directly benefiting the Consumer Goods and Electronics segments where aesthetic appeal and product identification are paramount. The development of high-resolution, laser-etched plates has further propelled the Pad Printing Plates segment, enabling finer detail and sharper images, crucial for applications in the Automotive sector for component identification and branding, and in the Medical industry for marking sensitive equipment and devices with traceability information. The "Others" segment, encompassing niche applications like promotional items, toys, and decorative items, also contributes significantly, showcasing the broad applicability of pad printing. The trend towards miniaturization in electronics and the increasing complexity of automotive components are further stimulating demand for highly precise and adaptable pad printing solutions. Companies are investing heavily in R&D to develop pads with improved resilience to wear and tear, reducing downtime and replacement costs for end-users, a key consideration for manufacturers operating at high volumes. Furthermore, the growing emphasis on sustainability is influencing the development of eco-friendly inks and pad materials, aligning with global environmental regulations and consumer preferences. The integration of digital technologies with traditional pad printing processes, such as automated plate cleaning and ink dispensing systems, is also a burgeoning trend that promises to enhance efficiency and quality. The market is therefore characterized by a continuous pursuit of enhanced performance, cost-effectiveness, and environmental responsibility.

The robust growth trajectory of the Pad Printing Pads & Plates market is fundamentally propelled by an insatiable demand for precision marking and decoration across a diverse range of industries. The Consumer Goods sector, with its ever-evolving product designs and branding requirements, consistently relies on pad printing for its ability to apply intricate logos, serial numbers, and decorative elements onto irregularly shaped surfaces, from cosmetic packaging to household appliances. Similarly, the Electronics industry leverages pad printing for marking small components, circuit boards, and device casings with essential information like model numbers, safety certifications, and brand identifiers. The miniaturization trend in electronics further amplifies the need for the high-resolution capabilities that advanced pad printing plates and pads offer. In the Automotive sector, pad printing plays a crucial role in marking engine parts, interior components, and exterior trim with critical information such as part numbers, manufacturing dates, and warning labels, where durability and legibility under harsh conditions are non-negotiable. The Medical industry's stringent requirements for traceability and identification on surgical instruments, diagnostic devices, and pharmaceutical packaging are met by the accurate and sterile marking solutions provided by pad printing. Moreover, the inherent versatility of pad printing, allowing for the application of a wide array of ink types onto various substrates, including plastics, metals, glass, and ceramics, significantly broadens its applicability. The cost-effectiveness of pad printing, especially for high-volume production runs and complex designs, when compared to other marking methods, further solidifies its position as a preferred choice for manufacturers aiming to optimize their production processes and product aesthetics. The continuous innovation in pad materials, leading to increased lifespan and improved ink transfer, coupled with advancements in plate etching technologies for finer detail, are directly contributing to the market's expansion.

Despite its strong growth, the Pad Printing Pads & Plates market faces several challenges that can temper its expansion. A significant restraint is the increasing complexity of automation and integration. While automation is a driving force, the initial investment required for advanced pad printing machinery and integrated systems can be a hurdle for smaller manufacturers, particularly in emerging economies. The need for skilled labor to operate and maintain these sophisticated systems also presents a challenge, as specialized training is often required. Furthermore, the environmental impact and regulatory scrutiny associated with certain inks and solvents used in pad printing can lead to increased compliance costs and the need for reformulation. The shift towards more sustainable practices necessitates the development of eco-friendly alternatives, which can be a time-consuming and resource-intensive R&D process. Competition from alternative marking technologies, such as inkjet printing and laser engraving, which are continuously improving their capabilities and cost-effectiveness, also poses a competitive threat. While pad printing excels in certain applications, these competing technologies may offer advantages in terms of speed, automation, or material compatibility for specific use cases. Material degradation and wear and tear of pad printing pads, especially under high-volume and demanding industrial conditions, can lead to increased maintenance costs and production downtime, impacting overall operational efficiency. Developing pads with significantly enhanced longevity and resistance to abrasive environments remains a key area of focus for manufacturers. Finally, fluctuations in raw material prices, particularly for the specialized silicones used in pad production and the metals for plate etching, can impact the profitability of manufacturers and lead to price volatility in the market.

The global Pad Printing Pads & Plates market is characterized by a dynamic interplay of regional strengths and segment dominance. Examining the Application segment, Consumer Goods and Electronics are projected to be key pillars of market growth, with their combined market share expected to reach millions of units by 2025.

Consumer Goods: This segment's dominance is driven by the sheer volume of products manufactured globally, ranging from packaging for food and beverages to cosmetics, personal care items, and household appliances. The increasing emphasis on product differentiation, branding, and aesthetic appeal necessitates precise and vibrant marking solutions. Pad printing's ability to transfer detailed logos, expiration dates, batch codes, and decorative patterns onto a wide variety of irregular shapes and surfaces – from curved bottle caps to textured cosmetic containers – makes it indispensable. The growing disposable income in emerging economies is further fueling demand for packaged goods, directly translating into increased demand for pad printing consumables. Companies like ITW and Kent are heavily invested in this segment, offering a broad range of pads and plates tailored for high-volume, fast-paced consumer goods production. The demand for single-use packaging and promotional items, often decorated using pad printing, also contributes significantly to this segment's market share.

Electronics: The relentless pace of innovation in the electronics sector, characterized by shrinking device sizes and increasingly complex component layouts, positions this segment as a critical growth driver. Pad printing is essential for marking small electronic components, integrated circuits, printed circuit boards (PCBs), and finished products with vital information such as serial numbers, model identifiers, compliance marks, and logos. The need for high precision and fine detail resolution, which advanced laser-etched plates and specialized silicone pads can deliver, is paramount. The growth of wearable technology, smart home devices, and the Internet of Things (IoT) further expands the market for pad printing in electronics. Companies like Tokushu are at the forefront of developing specialized pads and plates that can withstand the chemical environments often encountered during electronic component manufacturing and assembly, ensuring the durability of markings. The demand for traceability in electronics, driven by concerns about counterfeit components and product recalls, also bolsters the importance of reliable marking solutions.

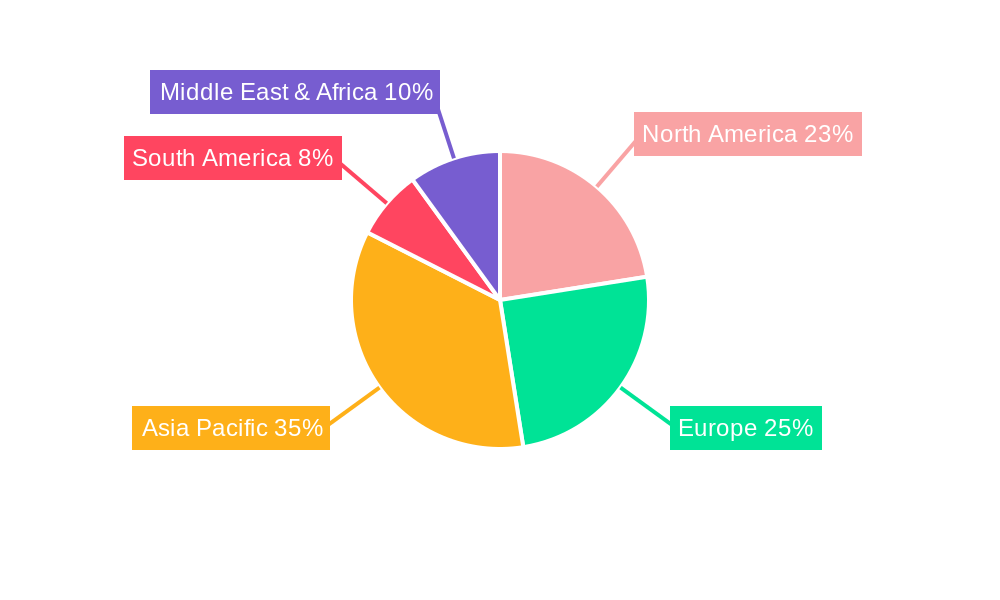

Geographically, Asia-Pacific is expected to continue its reign as the dominant region in the Pad Printing Pads & Plates market throughout the Forecast Period (2025-2033). This dominance is underpinned by several factors:

While Asia-Pacific leads, North America and Europe remain significant markets, driven by their strong presence in specialized applications within the automotive and medical sectors, and a continuous demand for high-quality, precision markings.

The Pad Printing Pads & Plates industry is propelled by several key growth catalysts. Continuous advancements in material science, leading to the development of more durable, chemical-resistant, and high-resolution pads and plates, are critical. The increasing adoption of automation and smart manufacturing technologies in various industries, which enhances the efficiency and precision of pad printing processes, acts as a significant catalyst. Furthermore, the growing demand for customization and intricate designs on products across consumer goods, electronics, and automotive sectors necessitates the capabilities offered by pad printing. The ongoing expansion of emerging economies and their increasing manufacturing output also fuels market growth.

This comprehensive report delves deep into the Pad Printing Pads & Plates market, providing invaluable insights for stakeholders. It offers detailed market sizing and forecasting from 2019-2033, with a granular analysis of the Base Year (2025) and Forecast Period (2025-2033). The report meticulously examines market segmentation by Type (Pad Printing Pads, Pad Printing Plates) and Application (Consumer Goods, Electronics, Automotive, Medical, Others), identifying key trends and growth drivers within each. Furthermore, it analyzes significant industry developments and profiles leading players like Tokushu, Kent, ITW, and Careprint, offering a complete picture of the market landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.9% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.9%.

Key companies in the market include Tokushu, Kent, ITW, Careprint, .

The market segments include Type, Application.

The market size is estimated to be USD 92 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Pad Printing Pads & Plates," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pad Printing Pads & Plates, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.