1. What is the projected Compound Annual Growth Rate (CAGR) of the Pad Printing Ink for Medical Products?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Pad Printing Ink for Medical Products

Pad Printing Ink for Medical ProductsPad Printing Ink for Medical Products by Type (Solvent-based, UV Curing, World Pad Printing Ink for Medical Products Production ), by Application (PPE, Medical Device, World Pad Printing Ink for Medical Products Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

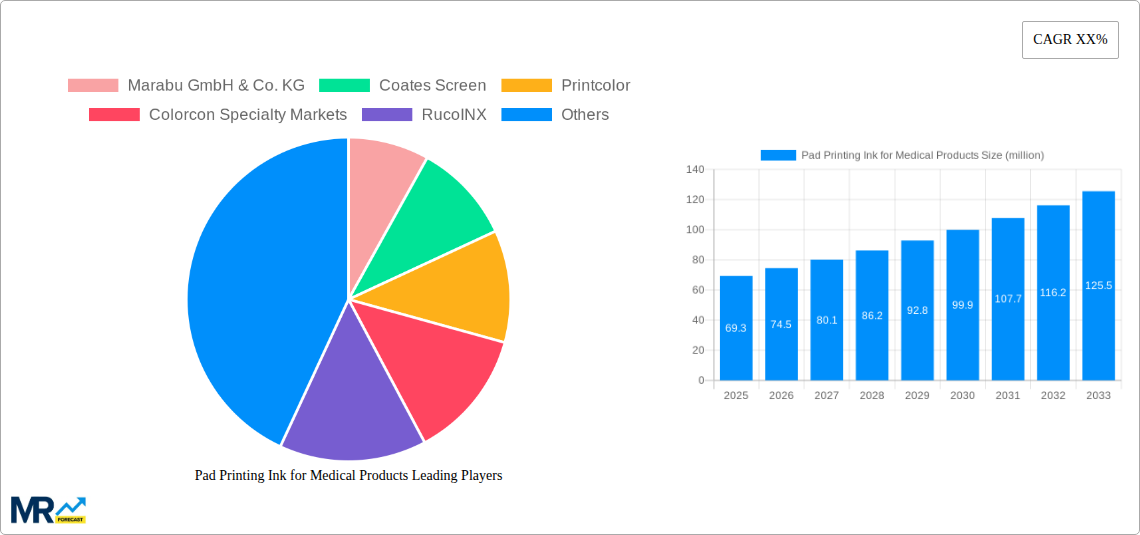

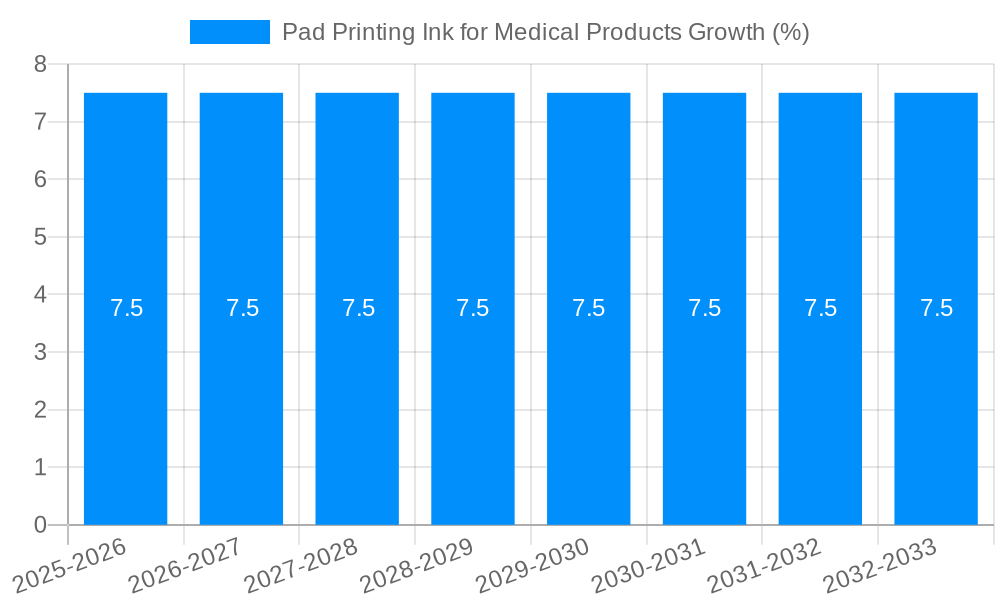

The global Pad Printing Ink for Medical Products market is poised for significant expansion, projected to reach an estimated USD 69.3 million in 2025. This growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of approximately 7.5% anticipated over the forecast period of 2025-2033. This upward trend is primarily driven by the escalating demand for sophisticated and reliable medical devices, coupled with a heightened focus on patient safety and product traceability within the healthcare industry. The increasing prevalence of chronic diseases and an aging global population further bolster the need for advanced medical equipment, directly translating into a greater requirement for specialized pad printing inks. These inks are crucial for marking and branding medical products with essential information such as lot numbers, expiry dates, and regulatory symbols, ensuring compliance and facilitating effective inventory management.

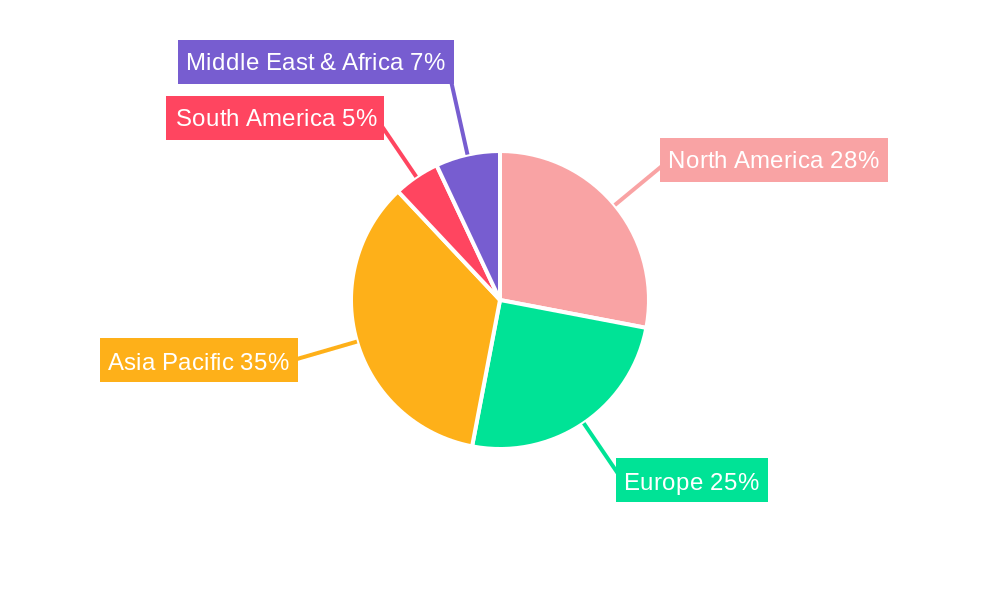

The market landscape is characterized by distinct segments, with Solvent-based inks currently holding a significant share due to their cost-effectiveness and established performance. However, the UV Curing ink segment is witnessing rapid adoption, driven by its environmental advantages, faster drying times, and superior durability, aligning with stricter environmental regulations and the industry's move towards sustainable practices. Geographically, Asia Pacific is emerging as a dominant region, fueled by its expanding healthcare infrastructure, a burgeoning medical manufacturing base, and increasing investments in research and development. North America and Europe remain crucial markets, with a strong emphasis on high-quality medical devices and stringent regulatory frameworks. Key restraints include the fluctuating raw material costs for ink production and the complex regulatory landscape for medical device components, which necessitate rigorous testing and validation processes for printing inks.

Here is a unique report description on Pad Printing Ink for Medical Products, incorporating your specified elements:

This in-depth market intelligence report offers a granular analysis of the global Pad Printing Ink for Medical Products market, providing actionable insights and strategic foresight for stakeholders. The study meticulously examines market dynamics across the Study Period: 2019-2033, with a focus on the Base Year: 2025 and an extensive Forecast Period: 2025-2033, building upon a robust Historical Period: 2019-2024. Our research quantifies the market size in millions of units, offering a clear picture of current and future market potential. The report delves into critical aspects, including technological advancements, regulatory landscapes, and evolving application demands within the healthcare sector. We explore the intricate interplay of different ink types, from traditional solvent-based formulations to high-performance UV curing inks, and their suitability for a diverse range of medical applications. Furthermore, the analysis provides a detailed breakdown of market segmentation by application, highlighting the burgeoning demand within PPE and Medical Devices. Our comprehensive approach ensures that manufacturers, suppliers, and end-users are equipped with the knowledge to navigate this dynamic and increasingly vital market.

The global Pad Printing Ink for Medical Products market is experiencing a significant upward trajectory, driven by an escalating demand for specialized inks that meet stringent healthcare regulations and performance requirements. The market is characterized by a clear shift towards innovative ink formulations that offer enhanced biocompatibility, durability, and adherence to a wider array of medical substrates. A prominent trend is the increasing adoption of UV-curable inks, a segment projected to witness substantial growth due to their rapid curing times, reduced VOC emissions, and superior print quality, making them ideal for sensitive medical device applications where minimal contamination is paramount. The growth of the PPE segment, amplified by recent global health events, continues to be a significant market influencer, necessitating high-volume production of durable and easily identifiable marking solutions. Medical device manufacturers are increasingly seeking inks that can withstand sterilization processes, such as gamma irradiation and EtO sterilization, without compromising the integrity of the print or the device itself. This demand is spurring research and development into novel ink chemistries. The trend towards miniaturization in medical devices also presents an opportunity for finer print resolution and specialized ink formulations capable of precise application on smaller components. Furthermore, the regulatory landscape, with its emphasis on patient safety and traceability, is pushing for inks with verifiable compositions and compliance with standards like ISO 10993. The development of inks with enhanced chemical resistance to bodily fluids and cleaning agents is also a key trend, ensuring the long-term legibility and functionality of printed information on medical products. The market is also witnessing a growing interest in sustainable ink solutions, with manufacturers exploring bio-based or recycled content options, although this remains a nascent trend in the highly regulated medical sector. Overall, the Pad Printing Ink for Medical Products market is poised for continued expansion, fueled by technological innovation, evolving application needs, and a steadfast commitment to patient safety and product integrity. The market size in millions of units is expected to reflect this robust growth throughout the forecast period.

The Pad Printing Ink for Medical Products market is being propelled by a confluence of powerful forces, primarily rooted in the ever-expanding global healthcare industry. The relentless growth in the aging population worldwide, coupled with an increasing prevalence of chronic diseases, directly translates into a higher demand for a diverse range of medical devices, from sophisticated diagnostic equipment to essential consumables. Each of these products often requires precise and durable marking for identification, branding, and regulatory compliance, creating a sustained need for high-quality pad printing inks. Furthermore, the ongoing advancements in medical technology, leading to the development of smaller, more complex, and innovative devices, necessitate inks capable of exceptional precision, adhesion, and resistance to various sterilization methods. The global emphasis on patient safety and the need for product traceability are also significant drivers. Regulatory bodies worldwide are imposing stricter guidelines on the marking and labeling of medical products, requiring inks that are biocompatible, non-toxic, and can withstand harsh environmental conditions, ensuring that critical information remains legible throughout the product's lifecycle. The expanding healthcare infrastructure in emerging economies, coupled with increased government spending on healthcare, is also opening up new avenues for market growth. The recent global health crises have further underscored the importance of readily available and clearly marked medical supplies, particularly in the PPE segment, leading to a surge in demand for robust and efficient printing solutions. The pursuit of cost-effectiveness and operational efficiency in medical manufacturing also encourages the adoption of pad printing technologies, which offer a balance of speed, precision, and affordability for high-volume production runs.

Despite the robust growth trajectory, the Pad Printing Ink for Medical Products market faces several significant challenges and restraints that can impede its full potential. A primary concern is the stringent and evolving regulatory landscape governing medical products and their components. Obtaining certifications and approvals for new ink formulations, particularly those intended for direct patient contact or critical applications, can be a time-consuming and costly process. Compliance with biocompatibility standards, such as ISO 10993, requires extensive testing and documentation, creating a barrier to entry for smaller ink manufacturers. The specialized nature of medical applications also demands high levels of purity and consistency in ink formulations, making any deviation from established standards a potential risk. Furthermore, the diverse range of substrates used in medical devices, including various plastics, metals, and composites, presents a challenge in developing universal ink solutions that offer optimal adhesion and durability across all materials. The need for inks to withstand multiple sterilization processes – including autoclaving, gamma irradiation, and EtO sterilization – without degradation adds another layer of complexity to formulation and testing. Fluctuations in raw material prices, especially for specialized pigments and resins required for medical-grade inks, can impact manufacturing costs and profit margins. Moreover, the inherent limitations of pad printing technology itself, such as the potential for ink pooling or uneven laydown on highly textured surfaces, can necessitate more advanced and costly printing methods for certain applications. The awareness and adoption of newer, more advanced printing technologies within the medical sector, while an opportunity for innovation, can also pose a competitive challenge to traditional pad printing inks.

The UV Curing segment, within the broader Medical Device application, is poised to dominate the Pad Printing Ink for Medical Products market in the coming years, with a particularly strong presence anticipated in North America and Europe. These regions, driven by their advanced healthcare infrastructures, high disposable incomes, and robust regulatory frameworks, have consistently been at the forefront of adopting innovative medical technologies. The UV Curing segment's dominance is attributable to several key factors. Firstly, UV-curable inks offer unparalleled advantages for medical device printing. Their rapid curing times significantly enhance production efficiency, a crucial aspect in high-volume manufacturing environments. This speed translates into reduced energy consumption and increased throughput, directly impacting profitability. Secondly, UV inks are known for their superior adhesion to a wide variety of medical-grade plastics and metals, which are common materials in advanced medical devices such as surgical instruments, diagnostic equipment components, and implantable devices. This enhanced adhesion ensures the longevity of printed markings, even when subjected to rigorous sterilization processes.

Moreover, UV inks typically contain fewer volatile organic compounds (VOCs) compared to traditional solvent-based inks, making them more environmentally friendly and safer for use in cleanroom environments prevalent in medical device manufacturing. This aligns with the growing global emphasis on sustainability and occupational health. The ability of UV inks to achieve high print resolution and fine detail is also critical for the increasingly miniaturized and complex components found in modern medical devices. Applications requiring precise alphanumeric coding, logos, or intricate schematics benefit immensely from the sharp and consistent output of UV pad printing.

In terms of applications, the Medical Device segment's dominance is underpinned by the sheer breadth and depth of its demand. From sophisticated imaging systems and robotic surgery equipment to essential diagnostic tools and patient monitoring devices, almost every medical device necessitates durable and compliant markings. This includes serial numbers for traceability, regulatory symbols (e.g., CE marking, FDA approval), branding, and operational instructions. The continuous innovation in the medical device sector, with a constant stream of new product launches and upgrades, ensures a perpetual demand for marking solutions.

North America, particularly the United States, and Europe, with countries like Germany, France, and the UK, represent the leading regions due to:

While other regions like Asia-Pacific are showing rapid growth, especially in the PPE segment, North America and Europe are expected to maintain their leadership in the higher-value Medical Device segment with UV Curing inks due to their established technological ecosystems and demand for cutting-edge solutions.

The Pad Printing Ink for Medical Products industry is experiencing significant growth driven by an escalating global demand for medical devices and personal protective equipment (PPE). Advancements in material science have led to the development of novel substrates for medical applications, requiring specialized inks with enhanced adhesion and durability. The increasing stringency of regulatory requirements for product traceability and patient safety is compelling manufacturers to adopt high-quality, compliant inks that can withstand sterilization processes and chemical exposure. Furthermore, the ongoing miniaturization of medical devices necessitates inks capable of precise application and high-resolution printing, a capability where UV-curable inks excel. The expanding healthcare infrastructure in emerging economies, coupled with rising healthcare expenditure, is also creating new market opportunities for pad printing ink manufacturers.

This comprehensive report delves deeply into the global Pad Printing Ink for Medical Products market, providing an exhaustive analysis of its current state and future potential. Spanning the Study Period: 2019-2033, with a keen focus on the Base Year: 2025, the report offers detailed market sizing in millions of units and forecasts for the Forecast Period: 2025-2033, building on a robust Historical Period: 2019-2024. It dissects market dynamics by ink type, including Solvent-based and UV Curing technologies, and by application segments such as PPE and Medical Devices. The report offers critical insights into market trends, driving forces, challenges, and identifies dominant regions and segments. Furthermore, it highlights key growth catalysts and provides a comprehensive overview of leading players and significant industry developments, equipping stakeholders with invaluable strategic intelligence for informed decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Marabu GmbH & Co. KG, Coates Screen, Printcolor, Colorcon Specialty Markets, RucoINX, Inkcups, ITW, Encres DUBUIT, Proell, Tampoprint.

The market segments include Type, Application.

The market size is estimated to be USD 69.3 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Pad Printing Ink for Medical Products," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pad Printing Ink for Medical Products, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.