1. What is the projected Compound Annual Growth Rate (CAGR) of the Packaging Film?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Packaging Film

Packaging FilmPackaging Film by Type (PE Films, BOPET Films, BOPP Films, CPP Films, Others, World Packaging Film Production ), by Application (Food Packaging, Drug Packaging, Textile Packaging, Others, World Packaging Film Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

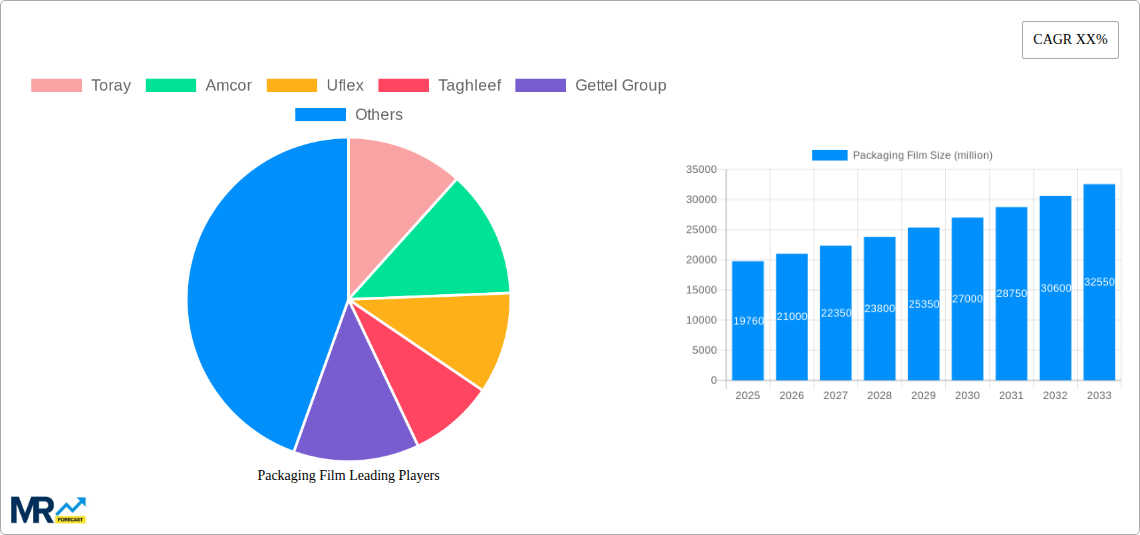

The global packaging film market is poised for robust expansion, projected to reach a substantial $19,760 million by 2025. This growth is fueled by an escalating demand for sophisticated and protective packaging solutions across a myriad of industries. Key drivers include the burgeoning e-commerce sector, which necessitates durable and visually appealing packaging to withstand transit; the increasing global consumption of processed foods and beverages, requiring advanced barrier properties to ensure freshness and shelf-life; and the pharmaceutical industry's stringent requirements for tamper-evident and sterile packaging for medications. Furthermore, the growing emphasis on sustainable packaging alternatives, such as recyclable and biodegradable films, is also a significant catalyst, pushing innovation and market diversification. Emerging economies, particularly in Asia Pacific, are expected to lead this growth trajectory due to rapid industrialization, increasing disposable incomes, and a rising consumer preference for packaged goods. The market is characterized by a dynamic landscape, with continuous investment in research and development aimed at enhancing film performance, reducing environmental impact, and catering to evolving consumer preferences for convenience and safety.

The packaging film market is witnessing significant trends that are shaping its future trajectory. A dominant trend is the innovation in material science, leading to the development of high-performance films with superior barrier properties, enhanced strength, and improved aesthetics. This includes the expansion of specialized films like BOPET (Biaxially Oriented Polyethylene Terephthalate) and BOPP (Biaxially Oriented Polypropylene), which offer excellent clarity, printability, and mechanical strength, making them ideal for a wide range of applications from food and beverage to consumer electronics. The growing imperative for sustainability is driving the adoption of flexible packaging formats, which reduce material usage and waste compared to rigid alternatives. The integration of advanced printing and lamination technologies is also a key trend, enabling manufacturers to create visually striking packaging that enhances brand visibility and consumer engagement. Despite the positive outlook, the market faces restraints such as volatile raw material prices, particularly for petroleum-based polymers, and increasing regulatory scrutiny regarding plastic waste and its environmental impact. However, the industry's proactive approach to developing eco-friendly solutions and the consistent demand from essential sectors like food and pharmaceuticals are expected to outweigh these challenges, ensuring sustained market growth and innovation.

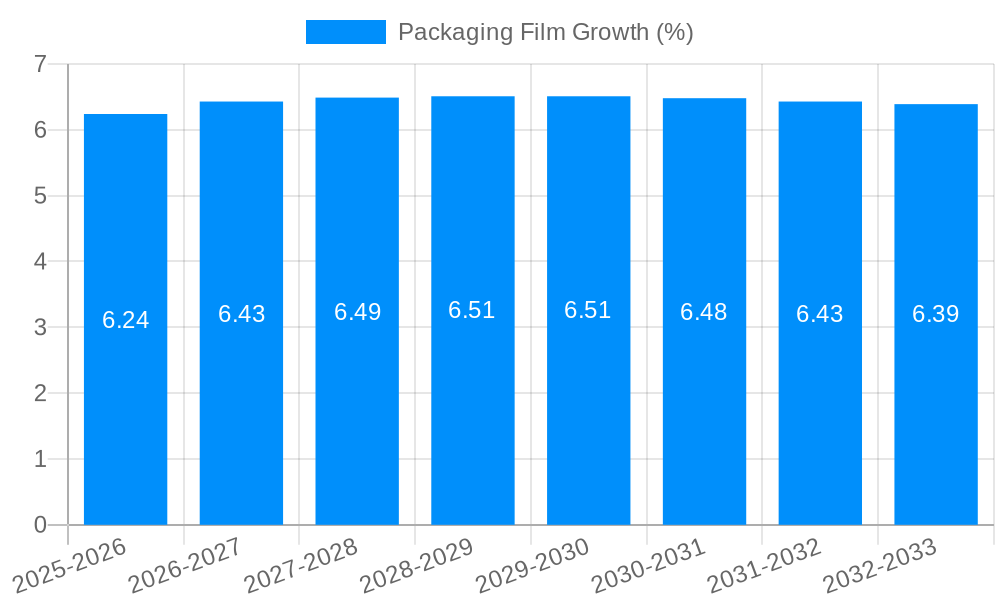

This comprehensive report delves into the dynamic global Packaging Film market, offering an in-depth analysis of its current landscape and future trajectory. Spanning the Study Period of 2019-2033, with a keen focus on the Base Year of 2025, this report provides actionable insights derived from extensive market research. The Estimated Year of 2025 is thoroughly examined, alongside the critical Forecast Period of 2025-2033, building upon robust data from the Historical Period of 2019-2024.

The report meticulously dissects the market by Type, including the production volumes in millions of units for PE Films, BOPET Films, BOPP Films, CPP Films, and Others. Furthermore, it analyzes the Application segments, detailing the market share and projected growth for Food Packaging, Drug Packaging, Textile Packaging, and Other applications. This holistic approach ensures a granular understanding of market segmentation and demand drivers.

The global packaging film market is experiencing a transformative phase, marked by an escalating demand for innovative, sustainable, and high-performance solutions. A significant trend is the increasing adoption of advanced barrier films, driven by the need for extended shelf life and product protection, particularly in the food and pharmaceutical sectors. These films, often multi-layered and incorporating specialized materials, are crucial in preventing spoilage, contamination, and degradation, thereby reducing food waste and ensuring product integrity. The growing consumer consciousness regarding environmental impact is also a major catalyst, pushing manufacturers towards recyclable, compostable, and biodegradable packaging film options. This shift is not merely regulatory; it's a proactive response to market demand and a commitment to corporate social responsibility. Consequently, significant investments are being channeled into research and development of novel bio-based polymers and advanced recycling technologies for plastic films.

Furthermore, the market is witnessing a surge in demand for smart and active packaging films. These advanced films incorporate technologies that monitor product freshness, indicate temperature fluctuations, or even release antimicrobial agents, thereby enhancing safety and convenience. The digital integration into packaging, including features like QR codes for traceability and authentication, is also gaining traction, especially within the pharmaceutical and premium food segments. The trend towards lightweighting and material reduction continues to be a priority, with manufacturers optimizing film structures to achieve desired performance with less material, leading to cost savings and reduced environmental footprint. This is particularly relevant in the context of rising raw material costs and increasing logistics expenses. The expansion of e-commerce is also creating new avenues for packaging film, necessitating robust, protective, and aesthetically pleasing solutions for online retail. From a production perspective, the market is characterized by consolidation and strategic partnerships, as companies seek to enhance their product portfolios, expand their geographical reach, and leverage economies of scale. Automation and advanced manufacturing techniques are also being widely adopted to improve efficiency and product quality.

Several potent forces are collectively propelling the global packaging film market towards sustained growth. Foremost among these is the ever-increasing global population and the consequent rise in demand for packaged goods, particularly in emerging economies. As urbanization continues and disposable incomes rise, so does the consumption of convenience foods, processed goods, and pharmaceutical products, all of which heavily rely on packaging films for preservation and distribution. The stringent regulatory landscape promoting food safety and extending product shelf life is another significant driver. Governments worldwide are implementing stricter regulations concerning food spoilage and contamination, thereby mandating the use of high-barrier packaging films that offer superior protection. Similarly, the pharmaceutical industry's demand for sterile, tamper-evident, and precisely controlled packaging solutions for sensitive drugs and medical devices further bolsters the market.

The growing consumer preference for convenience and on-the-go consumption is directly translating into a higher demand for single-serving and easily resealable packaging, a segment where flexible films excel. This trend is amplified by the expansion of the e-commerce sector, which necessitates robust yet lightweight packaging to withstand the rigors of shipping and handling while ensuring product integrity upon arrival. The continuous innovation in material science and polymer technology is a fundamental catalyst, leading to the development of advanced films with enhanced properties such as improved barrier resistance, higher tensile strength, better printability, and increased recyclability or biodegradability. These advancements not only meet evolving market needs but also open up new application areas. Finally, the increasing focus on sustainability and the circular economy is pushing the development and adoption of eco-friendly packaging films, including those made from recycled content or bio-based materials, creating a significant growth avenue for environmentally conscious solutions.

Despite the robust growth trajectory, the packaging film market is not without its significant challenges and restraints. The most prominent among these is the mounting environmental concern and the ensuing regulatory pressure to reduce plastic waste. Public outcry and governmental policies aimed at curbing single-use plastics, coupled with the slow pace of developing widely accessible and economically viable recycling infrastructure, pose a substantial hurdle. The perceived negative environmental impact of plastic films can also lead to consumer backlash, influencing purchasing decisions and forcing brands to seek alternatives, even if they are less functional or more expensive. Volatility in raw material prices, particularly for petrochemical-based polymers like polyethylene and polypropylene, presents a persistent challenge. Fluctuations in crude oil prices directly impact the cost of these essential raw materials, leading to unpredictable production costs and affecting profit margins for manufacturers.

The capital-intensive nature of advanced packaging film production and the high cost of R&D for sustainable alternatives can be a barrier to entry for smaller players and slow down the widespread adoption of new technologies. Developing and scaling up the production of compostable or biodegradable films, or implementing sophisticated recycling processes, requires significant financial investment. Furthermore, performance trade-offs associated with sustainable materials can sometimes limit their application. While efforts are being made to match the performance of conventional films, some eco-friendly alternatives may still fall short in terms of barrier properties, durability, or heat resistance, restricting their use in certain demanding applications. The complex global supply chain and geopolitical uncertainties can also disrupt the availability of raw materials and finished products, leading to production delays and increased logistical costs. Lastly, consumer perception and the need for effective consumer education regarding the recyclability and proper disposal of different types of packaging films remain a challenge in achieving true circularity.

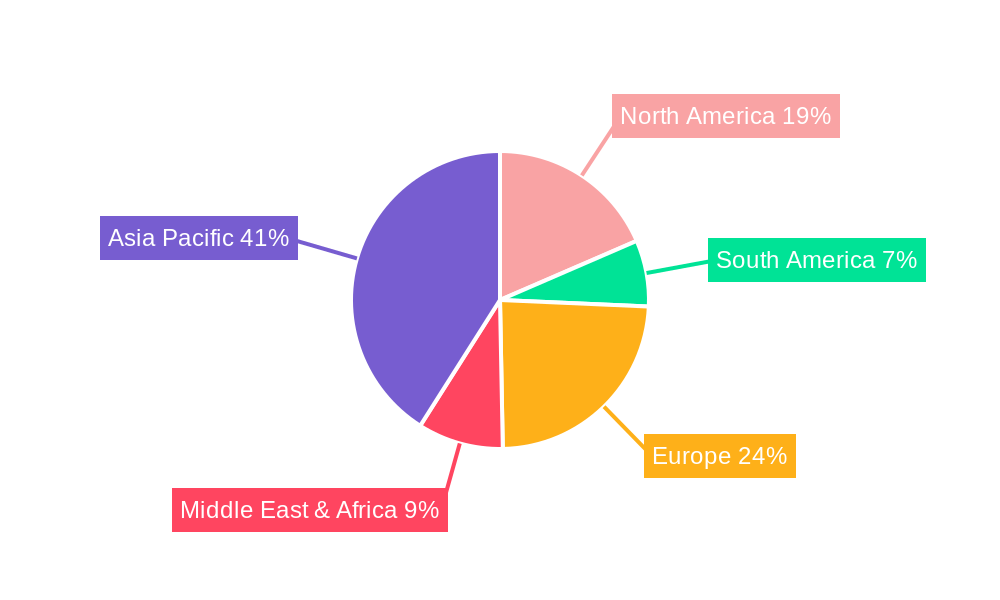

The global packaging film market is characterized by significant regional variations in production, consumption, and innovation, with certain regions and segments demonstrating a clear dominance.

Dominant Segments:

Type: PE Films (Polyethylene Films): PE films, owing to their versatility, cost-effectiveness, and wide range of applications, consistently hold a dominant position in the packaging film market. Their adaptability to various processing techniques like extrusion and blown film, coupled with their excellent moisture barrier properties, makes them indispensable for a vast array of products. In the World Packaging Film Production figures, PE films often constitute a substantial portion, exceeding 15,000 million units in recent years. Their prevalence in food packaging, particularly for snacks, frozen foods, and general-purpose bags, along with their use in agricultural films and industrial packaging, underpins their market leadership. The continuous development of specialized PE grades, such as linear low-density polyethylene (LLDPE) and high-density polyethylene (HDPE), further expands their application scope and reinforces their market share.

Application: Food Packaging: This segment is the undisputed leader, driven by the fundamental human need for food and the increasing global population. The demand for extended shelf life, enhanced food safety, and visually appealing packaging makes food packaging a cornerstone of the packaging film industry. It accounts for a significant majority of the total packaging film consumption, often estimated to be over 60% of the global market. Within this segment, the use of PE films for flexible pouches and bags, BOPET films for retort packaging, and BOPP films for lamination and overwraps is particularly noteworthy. The drive towards convenience foods, ready-to-eat meals, and the burgeoning e-commerce of groceries further amplifies the importance of this segment.

Dominant Region/Country:

Asia-Pacific: This region stands out as the most dominant and rapidly growing market for packaging films. Its dominance is fueled by several interconnected factors.

Therefore, the Asia-Pacific region, driven by its immense consumer market and robust manufacturing capabilities, coupled with the dominance of PE Films and Food Packaging segments globally, collectively presents the most significant and influential force in the world packaging film market.

The packaging film industry's growth is significantly catalyzed by several key factors. The burgeoning demand from the food and beverage sector, driven by population growth and changing dietary habits, remains a primary catalyst. Furthermore, the increasing healthcare awareness and the expansion of the pharmaceutical industry necessitate high-quality, safe, and tamper-evident packaging films. The e-commerce boom is another major growth engine, creating a demand for durable, lightweight, and protective packaging solutions for online deliveries. Continuous innovation in material science, leading to the development of sustainable, high-barrier, and functional films, opens new application avenues and caters to evolving consumer preferences and regulatory demands.

This report provides an exhaustive analysis of the global packaging film market, offering critical insights for stakeholders seeking to navigate this complex landscape. It meticulously details market size, growth rates, and future projections across key segments like PE Films, BOPET Films, BOPP Films, and CPP Films, with production volumes stated in the millions of units. The report's deep dive into application sectors, including Food Packaging, Drug Packaging, and Textile Packaging, highlights critical demand drivers and opportunities. It also thoroughly examines the impact of industry developments, such as the growing emphasis on sustainability, the rise of smart packaging, and technological advancements in material science. Furthermore, the report provides an in-depth regional analysis, identifying key dominant markets and their underlying growth factors. With a robust methodology encompassing historical data from 2019-2024, base year analysis for 2025, and forecasts up to 2033, this report equips businesses with the essential intelligence needed for strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Toray, Amcor, Uflex, Taghleef, Gettel Group, Innovia, Forop Group, Oben Group, Kanghui New Material Technology, YONGSHENG, BaiHong Industrial, Zhejiang Great Southeast Corp, Shaoxing Xiangyu Green Packing, Changsu Industrial, Zijiang, Cangzhou Mingzhu, Zhe Jiang Yuan Da Plastic, SDK, Hubei Huishi Plastic, Huangshan Novel, Prince New Material, Zhengyi Packaging.

The market segments include Type, Application.

The market size is estimated to be USD 199760 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Packaging Film," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Packaging Film, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.