1. What is the projected Compound Annual Growth Rate (CAGR) of the Packaged Broth?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Packaged Broth

Packaged BrothPackaged Broth by Type (Chicken Broth, Beef Broth, Vegetable Broth, Others, World Packaged Broth Production ), by Application (Food Service, Supermarkets/Hypermarkets, Departmental Stores, Speciality Stores, Online Retail, World Packaged Broth Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

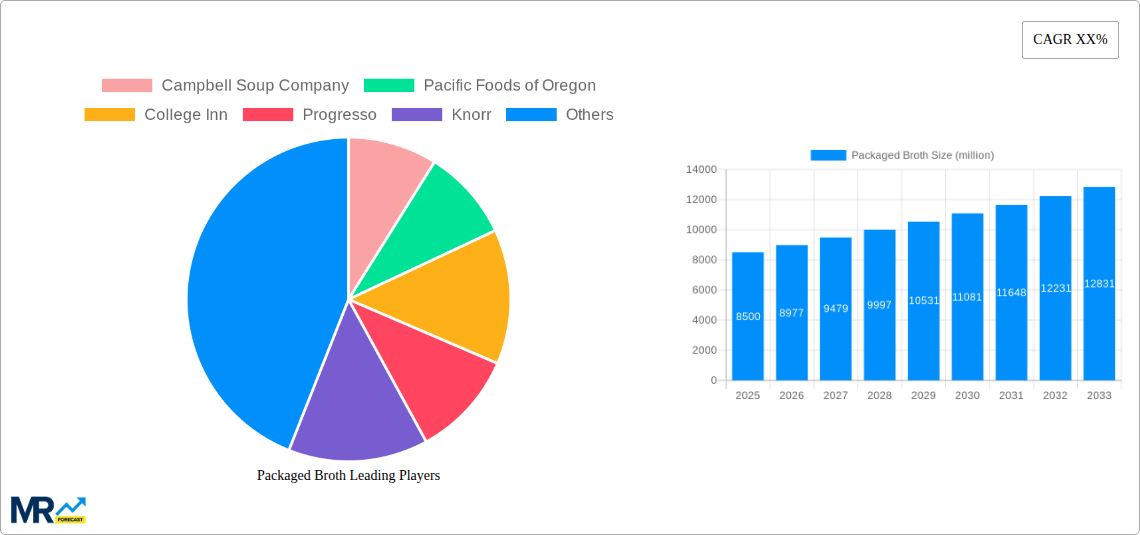

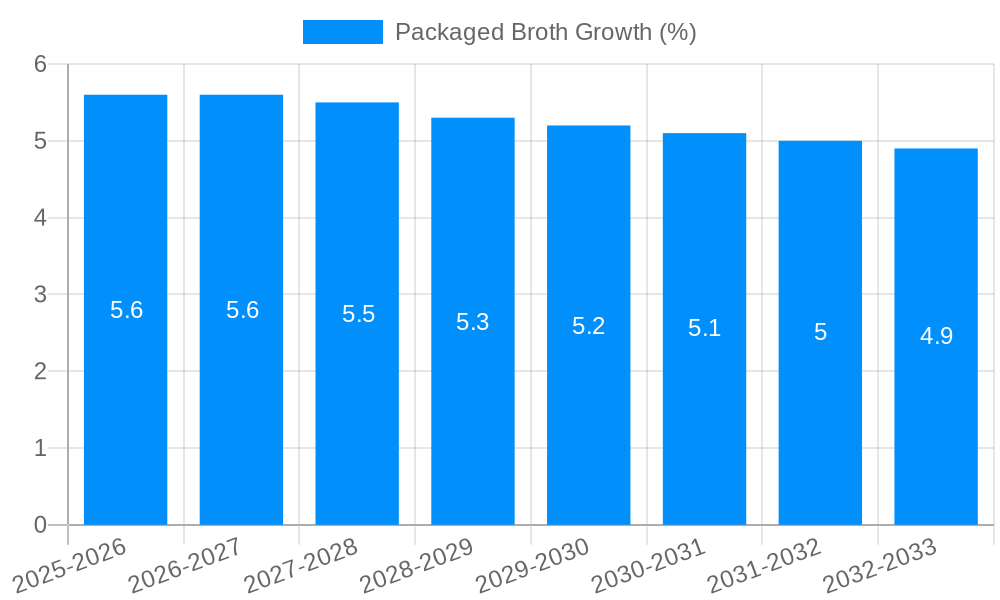

The global packaged broth market is poised for significant expansion, projected to reach an estimated $8,500 million by 2025, driven by a robust CAGR of 5.5% from 2019-2033. This growth is fueled by a confluence of factors, including the increasing demand for convenient and healthy food options, a rising awareness of the nutritional benefits of broth, and the growing popularity of culinary exploration at home. Consumers are actively seeking versatile ingredients that can enhance the flavor and nutritional profile of their meals, and packaged broth fits this need perfectly. The market's expansion is further propelled by innovations in product formulations, such as low-sodium and organic options, catering to health-conscious consumers. Additionally, the expansion of online retail channels and the increasing disposable income in emerging economies are creating new avenues for market penetration and sustained growth. The "on-the-go" lifestyle and busy schedules further contribute to the demand for ready-to-use broth products, solidifying its position as a staple in modern kitchens worldwide.

The packaged broth market is segmented by type, application, and distribution channel, offering a diverse range of product offerings and consumer touchpoints. Chicken broth currently dominates the market due to its widespread use in various cuisines, followed by beef and vegetable broths. The application landscape is also varied, with food service establishments being major consumers, while supermarkets/hypermarkets and online retail channels are experiencing rapid growth in consumer adoption. Trends like the rising popularity of bone broth for its perceived health benefits and the demand for ethically sourced and natural ingredients are shaping product development and marketing strategies. However, the market faces certain restraints, including fluctuating raw material prices and intense competition from private label brands. Despite these challenges, strategic collaborations, product diversification, and a focus on sustainable sourcing will be crucial for companies to maintain a competitive edge and capitalize on the burgeoning opportunities within this dynamic market.

Here's a unique report description for Packaged Broth, incorporating your specific requirements:

XXX The global packaged broth market is poised for significant expansion, driven by evolving consumer preferences and a heightened awareness of health and wellness. During the Study Period of 2019-2033, the market has witnessed a discernible shift from traditional, often less convenient, homemade broths to readily available, high-quality packaged alternatives. The Base Year of 2025 serves as a critical benchmark, with the Estimated Year also 2025 providing immediate insights into current market dynamics. The Forecast Period of 2025-2033 anticipates a robust growth trajectory, building upon the foundational trends observed during the Historical Period of 2019-2024. A key trend is the increasing demand for premium and organic broth options. Consumers are actively seeking out products with minimal artificial ingredients, low sodium content, and ethically sourced components. This has led to a surge in offerings from brands emphasizing natural preparation methods and the use of high-quality ingredients like grass-fed beef bones and organic vegetables. The World Packaged Broth Production is projected to reach $XX million in 2025, with substantial growth anticipated over the forecast horizon. Furthermore, the convenience factor remains paramount, with busy lifestyles fueling the demand for quick and easy meal solutions. Packaged broths, available in various formats such as liquid, powder, and cubes, cater effectively to this need, serving as versatile ingredients for soups, stews, sauces, and even beverages. The rise of specialized dietary trends, including paleo and keto diets, has also opened new avenues for packaged broth manufacturers. Products specifically formulated to align with these nutritional guidelines are gaining traction, further segmenting and diversifying the market. The growing adoption of online retail channels is also playing a pivotal role, offering consumers broader access to a wider array of brands and product types, contributing to market accessibility and growth. The overall market is characterized by innovation in flavor profiles, packaging sustainability, and a focus on functional benefits.

Several potent forces are actively propelling the global packaged broth market forward, creating a dynamic and expanding landscape. Foremost among these is the escalating consumer interest in health and wellness. As individuals become more health-conscious, they are actively seeking food products that offer nutritional benefits. Packaged broths, especially those positioned as wholesome and natural, are capitalizing on this trend. They are increasingly viewed not just as culinary ingredients but as sources of essential nutrients, hydration, and even gut health support, particularly bone broth varieties. The convenience offered by packaged broths is another significant driver. In today's fast-paced world, consumers are constantly looking for time-saving solutions in the kitchen. Packaged broths, available in a variety of ready-to-use formats, significantly reduce preparation time for meals, making them an indispensable pantry staple for many households. This convenience, coupled with the growing popularity of home cooking, creates a strong demand for such products. Furthermore, the expanding reach of e-commerce platforms has made packaged broths more accessible than ever before. Consumers can easily browse, compare, and purchase a wide range of products from the comfort of their homes, breaking down geographical barriers and expanding the market reach for manufacturers. The increasing diversity of dietary preferences and lifestyles, such as the rise of plant-based diets and specialized dietary approaches like keto and paleo, has also created new market opportunities, encouraging the development of a wider array of broth types and formulations to cater to these specific needs.

Despite the promising growth trajectory, the packaged broth market is not without its hurdles and constraints. A primary challenge stems from the perception of packaged broths as being less natural or healthy compared to homemade alternatives. Many consumers still associate homemade broths with superior taste and nutritional integrity, often holding concerns about the presence of artificial ingredients, preservatives, and high sodium levels in commercially produced options. This perception can act as a significant restraint, particularly for brands that struggle to effectively communicate their commitment to natural ingredients and transparent labeling. The intense competition within the market also presents a considerable challenge. With a multitude of established players and emerging brands, differentiation and market penetration can be difficult. Companies must invest heavily in marketing, product innovation, and brand building to stand out in a crowded space. Price sensitivity among a segment of consumers can also be a limiting factor. While premium and organic options are gaining traction, a significant portion of the market remains price-conscious, making it challenging for manufacturers to command higher prices for their products, especially when competing with lower-cost alternatives. Supply chain disruptions and the volatility of raw material prices, such as the cost of bones and vegetables, can also impact profit margins and the overall cost-effectiveness of production, posing a consistent challenge for manufacturers aiming for stable pricing and reliable product availability.

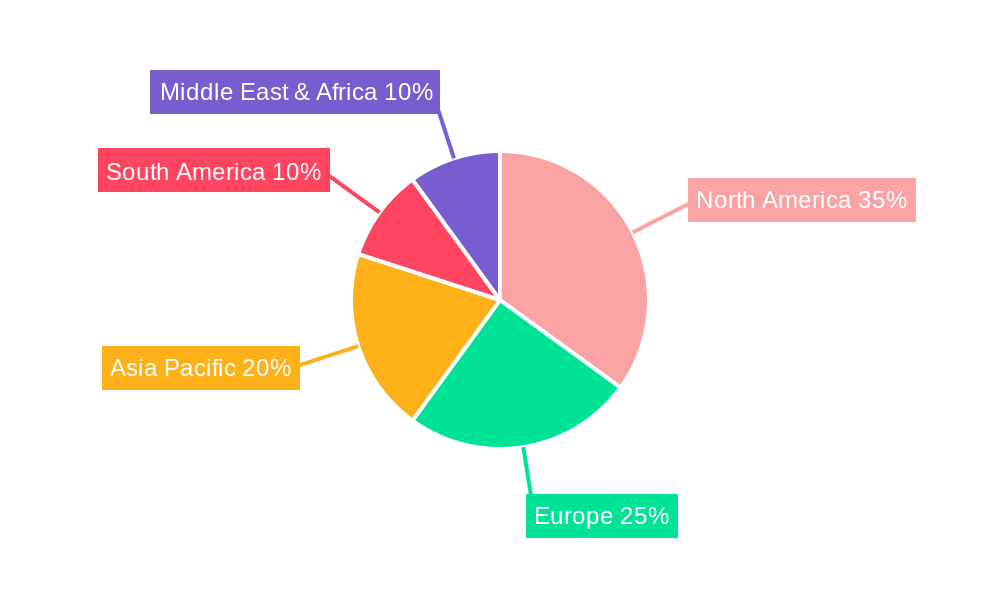

The global packaged broth market is characterized by distinct regional strengths and segment dominance, with certain areas and product categories exhibiting particularly robust performance.

North America: This region, encompassing the United States and Canada, is consistently a dominant force in the packaged broth market.

Europe: The European market presents a diverse landscape for packaged broths, with Western European countries like the United Kingdom, Germany, and France showing substantial consumption.

Asia-Pacific: This region, while historically less dominant in packaged broth consumption compared to Western markets, is exhibiting the fastest growth rate.

Dominant Segments:

Type: Chicken Broth: This segment consistently holds the largest market share globally.

Application: Supermarkets/Hypermarkets: This distribution channel is the primary avenue for packaged broth sales.

Application: Online Retail: This segment is experiencing the most rapid growth and is increasingly becoming a critical channel for market penetration.

The synergy between strong regional demand, particularly in North America, and the widespread popularity of chicken broth through accessible channels like supermarkets, forms the bedrock of the current market. However, the burgeoning growth in Asia-Pacific and the rapid expansion of online retail indicate future shifts and emerging dominance. The World Packaged Broth Production is expected to reach substantial figures, with these key regions and segments driving the lion's share of the market value.

Several key factors are acting as powerful growth catalysts for the packaged broth industry. The escalating consumer demand for convenient and healthy food options is a primary driver, as packaged broths offer a quick and nutritious base for a wide array of dishes. The growing popularity of specialized diets, such as paleo and keto, has spurred innovation in product formulation, leading to the development of specific broth types that cater to these dietary needs. Furthermore, the increasing adoption of online retail channels has significantly expanded market accessibility, allowing consumers to easily purchase a wider selection of products. The continuous innovation in flavor profiles and the focus on premium, natural, and organic ingredients are also attracting a broader consumer base, enhancing the perceived value and appeal of packaged broths.

This comprehensive report delves into the intricate dynamics of the global packaged broth market. It provides an in-depth analysis of current trends, historical performance, and future projections, with a strong focus on the Study Period of 2019-2033. The report meticulously examines the key driving forces, such as the growing demand for convenience and health-conscious products, and the challenges faced by the industry, including intense competition and consumer perception. It further pinpoints dominant regions and segments, offering valuable insights into which areas and product types are leading the market's expansion. The report also highlights significant developments and innovations, along with a thorough overview of leading companies. This detailed exploration ensures a holistic understanding of the packaged broth sector for strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Campbell Soup Company, Pacific Foods of Oregon, College Inn, Progresso, Knorr, Manischewitz, Bonafide Provisions, Bare Bones Broth, Paleo Broth Company, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Packaged Broth," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Packaged Broth, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.