1. What is the projected Compound Annual Growth Rate (CAGR) of the Outdoor LED TV?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Outdoor LED TV

Outdoor LED TVOutdoor LED TV by Type (70+ Inch, 60-69 Inch, 55-59 Inch, 50-54 Inch, 45-49 Inch, 40-44 Inch, 35-39 Inch, 32-Inch, World Outdoor LED TV Production ), by Application (Consumer TV, Digital Signage, World Outdoor LED TV Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

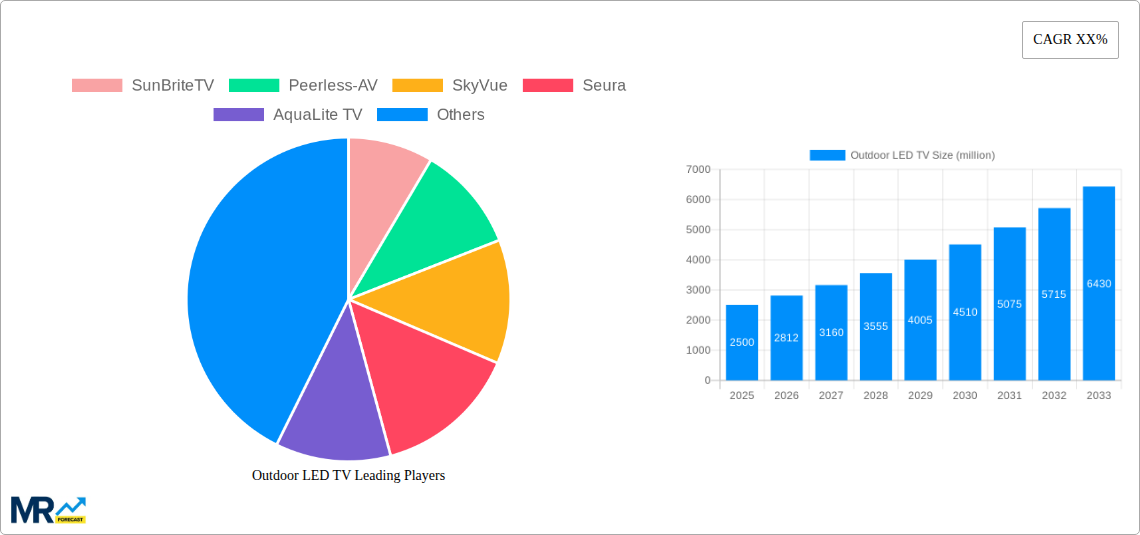

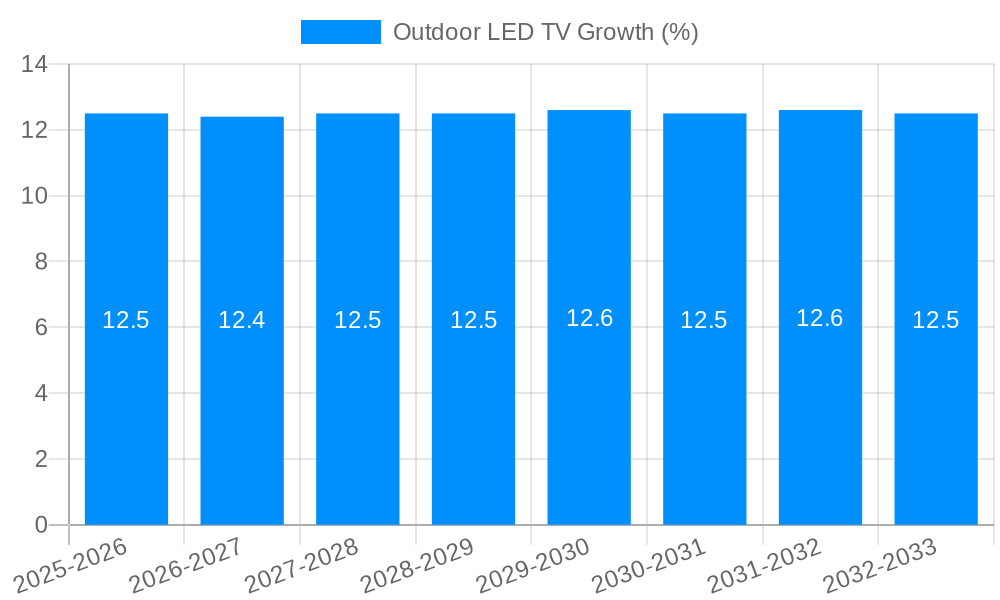

The global outdoor LED TV market is experiencing robust expansion, driven by increasing consumer demand for enhanced home entertainment experiences and the growing adoption of digital signage solutions in commercial spaces. With a projected market size estimated around $2,500 million in 2025, this sector is poised for substantial growth, forecasting a Compound Annual Growth Rate (CAGR) of approximately 12.5% through 2033. This significant upward trajectory is fueled by advancements in display technology, including improved brightness, weather resistance, and energy efficiency, making outdoor viewing increasingly viable and attractive. Furthermore, the expanding outdoor living trend, coupled with a rise in commercial establishments leveraging outdoor advertising and information displays, are key catalysts propelling market expansion. The 70+ Inch segment, in particular, is a dominant force, reflecting a desire for immersive viewing experiences, while the Digital Signage application is emerging as a powerful growth area, catering to the evolving needs of businesses.

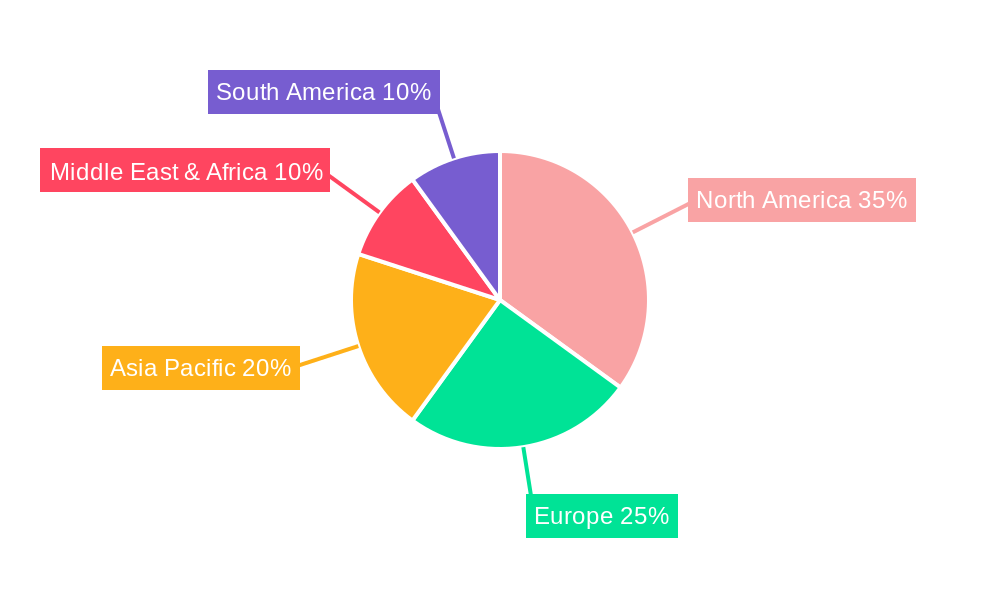

Geographically, North America is anticipated to lead the market, driven by a high disposable income and a strong culture of outdoor living and home entertainment. However, the Asia Pacific region, with its rapidly growing economies and increasing urbanization, presents a substantial growth opportunity, especially in consumer and digital signage applications. Despite the strong growth outlook, the market faces certain restraints, including the relatively high cost of premium outdoor LED TVs compared to their indoor counterparts, and potential challenges related to extreme weather conditions that could impact durability and performance. Nonetheless, ongoing technological innovations and decreasing manufacturing costs are expected to mitigate these challenges, ensuring sustained market penetration and continued strong performance in the coming years.

This report offers a deep dive into the dynamic Outdoor LED TV market, providing a detailed analysis of its trajectory from the historical period of 2019-2024 to a robust forecast extending through 2033. With 2025 serving as the base and estimated year, we meticulously dissect production volumes, application trends, and technological advancements. The global market is projected to witness significant expansion, with World Outdoor LED TV Production expected to reach multi-million unit figures annually. The report will delve into the intricate interplay of key industry players, emerging technologies, and evolving consumer demands that are shaping this burgeoning sector.

The Consumer TV segment, particularly in larger screen sizes, is anticipated to be a major driver of growth, while the Digital Signage application is poised for substantial expansion in commercial and public spaces. We will examine the intricate nuances of each screen size category, from the expansive 70+ Inch displays to the more accessible 32-Inch options, identifying their respective market shares and growth potentials. Furthermore, the report will highlight the critical industry developments and the strategic initiatives undertaken by leading manufacturers to capture market share in this increasingly competitive landscape.

The global outdoor LED TV market is experiencing a paradigm shift, characterized by a rapid escalation in demand driven by an increasing desire for enhanced outdoor entertainment and sophisticated commercial displays. XXX indicates a substantial evolution from niche products to mainstream solutions, with production volumes projected to soar into the millions of units annually by the forecast period. This surge is fueled by advancements in display technology, making these units more resilient to environmental factors like extreme temperatures, humidity, and direct sunlight, while simultaneously delivering superior picture quality. The proliferation of smart home ecosystems and the growing popularity of outdoor living spaces are directly contributing to the demand for larger, more immersive outdoor viewing experiences. Consumers are increasingly investing in patios, backyards, and outdoor kitchens, viewing outdoor LED TVs as an integral part of these modern living areas, akin to indoor entertainment systems. This trend is particularly pronounced in regions with favorable climates and a strong culture of outdoor social gatherings. Moreover, the commercial sector is increasingly recognizing the potent marketing capabilities of outdoor digital signage. Businesses across retail, hospitality, and public spaces are deploying these robust displays to engage audiences, convey dynamic information, and create impactful brand experiences. The ability to withstand harsh weather conditions and deliver high brightness for visibility in any lighting scenario makes outdoor LED TVs an ideal solution for areas like shopping malls, transportation hubs, and event venues. The market is witnessing a clear segmentation by screen size, with the 70+ Inch and 60-69 Inch categories leading the charge in consumer applications due to the desire for a cinematic experience, while smaller sizes are finding traction in more localized digital signage applications. The base year of 2025 is a pivotal point, with production already indicating strong momentum, set to accelerate through the forecast period of 2025-2033. The integration of advanced features such as high dynamic range (HDR) support, built-in sound systems, and sophisticated operating systems is further enhancing the appeal and functionality of these outdoor displays. The market is moving towards greater customization and integration with existing outdoor infrastructure, making these units not just screens, but integral components of an enhanced outdoor lifestyle and business strategy.

The remarkable growth of the outdoor LED TV market is propelled by a confluence of powerful economic, technological, and lifestyle factors. Foremost among these is the increasing disposable income and a growing inclination among consumers to invest in enhancing their outdoor living spaces. As backyards and patios are transformed into extensions of the home, the desire for integrated entertainment solutions, including high-quality audio-visual experiences, has surged. This lifestyle shift is further amplified by the continued evolution of display technology. Manufacturers have made significant strides in developing panels that offer superior brightness, contrast ratios, and color accuracy, enabling vibrant and clear visuals even in direct sunlight. Furthermore, the enhanced weatherproofing and durability of these units have addressed long-standing concerns about performance and longevity in outdoor environments. The robust nature of outdoor LED TVs, capable of withstanding a wide range of temperatures, humidity, and precipitation, has significantly broadened their applicability and appeal. The burgeoning digital signage industry also represents a significant growth engine. Businesses are increasingly leveraging the impact of large-format, weather-resistant displays for advertising, wayfinding, and information dissemination in public spaces, retail environments, and entertainment venues. The demand for dynamic, attention-grabbing content that can be viewed in any lighting condition makes outdoor LED TVs an indispensable tool for modern marketing strategies. The base year of 2025 marks a significant inflection point, with production trends indicating a sustained upward trajectory, and the forecast period of 2025-2033 is expected to witness this momentum accelerate as adoption rates continue to climb across both consumer and commercial sectors.

Despite the robust growth trajectory, the outdoor LED TV market faces several significant challenges and restraints that could potentially temper its expansion. A primary hurdle remains the cost of entry. Outdoor-grade LED TVs are inherently more expensive than their indoor counterparts due to the specialized components required for weatherproofing, enhanced brightness, and thermal management. This higher price point can be a deterrent for some price-sensitive consumers and smaller businesses. While prices have been declining, they still represent a considerable investment. Another significant challenge is the complexity of installation and maintenance. Mounting these larger, often heavier displays in outdoor settings can require specialized expertise and infrastructure, adding to the overall cost and logistical considerations. Furthermore, while weatherproofing has improved dramatically, the long-term durability and susceptibility to extreme weather events in certain regions still pose concerns for some potential buyers. Power consumption is also a factor to consider, as higher brightness levels required for outdoor visibility can translate to increased energy usage, which may be a concern for environmentally conscious consumers or businesses looking to manage operating costs. The availability of content and software integration can also be a bottleneck. Ensuring seamless integration with existing smart home systems or digital signage platforms, and providing content that is optimized for outdoor viewing conditions, requires ongoing development and compatibility. Finally, market fragmentation and the proliferation of regional players can lead to price wars and make it challenging for consumers and businesses to navigate the options and identify reliable, high-quality solutions, especially during the historical period of 2019-2024 as the market matured.

The global outdoor LED TV market is poised for significant regional and segment dominance, with North America expected to emerge as a leading force, primarily driven by strong consumer spending and a well-established culture of outdoor living and entertainment. The Consumer TV segment, particularly in the 70+ Inch and 60-69 Inch screen size categories, is anticipated to spearhead this dominance. This trend is fueled by the prevalence of spacious residential properties with dedicated outdoor entertainment areas, such as patios, decks, and backyards, which are increasingly being outfitted with high-end audiovisual equipment. The favorable climate in many parts of North America, conducive to year-round outdoor activities, further bolsters demand for durable and high-performance outdoor displays.

In parallel, the Digital Signage application segment is also set to witness substantial growth and contribution to the overall market, not only in North America but also in rapidly developing regions. The World Outdoor LED TV Production figures are intricately linked to the increasing adoption of these displays in commercial venues. This includes shopping malls, airports, public transportation hubs, stadiums, and restaurants, where dynamic and eye-catching advertising and information delivery are crucial. The ability of outdoor LED TVs to withstand various weather conditions and maintain high visibility in bright sunlight makes them an ideal solution for these demanding environments. As cities become more technologically integrated and businesses seek innovative ways to engage with their customers, the demand for outdoor digital signage is expected to skyrocket.

Beyond North America, Europe, particularly Western European countries with strong economies and a high standard of living, also presents a significant market for outdoor LED TVs, mirroring the consumer-driven trends observed in North America, albeit with a slightly more pronounced emphasis on energy efficiency and sophisticated design. Asia-Pacific, driven by rapidly urbanizing populations and a growing middle class, is expected to be a high-growth region, particularly in the digital signage segment as commercial infrastructure expands. The World Outdoor LED TV Production will be influenced by the manufacturing capabilities within these regions and the increasing demand from both domestic and export markets. The 55-59 Inch and 50-54 Inch segments are likely to gain significant traction in Asia-Pacific due to their versatility in various commercial and emerging residential applications, offering a balance between immersive viewing and cost-effectiveness. The study period from 2019-2033, with a base year of 2025, will clearly delineate these regional and segmental shifts in market dominance.

Several key growth catalysts are propelling the outdoor LED TV industry forward. The increasing consumer focus on enhancing outdoor living spaces as extensions of their homes, driven by a desire for integrated entertainment and social gathering areas, is a primary driver. Furthermore, continuous technological advancements in display brightness, weather resistance, and energy efficiency are making these products more appealing and practical. The burgeoning digital signage market, with businesses recognizing the impactful advertising and information dissemination capabilities of outdoor displays, represents another significant catalyst.

This comprehensive report meticulously analyzes the global outdoor LED TV market from 2019 to 2033, with 2025 serving as the critical base and estimated year. It provides in-depth insights into World Outdoor LED TV Production, projected to reach multi-million unit figures annually, and forecasts market dynamics through the forecast period of 2025-2033. The report scrutinizes the Consumer TV and Digital Signage application segments, detailing their respective market shares and growth potentials. It offers a granular breakdown of each screen size category, from 70+ Inch to 32-Inch, identifying key trends and their impact on overall market development. Furthermore, the report highlights significant industry developments and the strategic positioning of leading manufacturers.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include SunBriteTV, Peerless-AV, SkyVue, Seura, AquaLite TV, MirageVision, Luxurite, Cinios, Samsung, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Outdoor LED TV," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Outdoor LED TV, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.