1. What is the projected Compound Annual Growth Rate (CAGR) of the Out-of-home Advertising?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Out-of-home Advertising

Out-of-home AdvertisingOut-of-home Advertising by Type (/> Transit Advertising, Billboard, Street Furniture Advertising, Others), by Application (/> BFSI, IT and Telecom, Automotive and Transportation, Education, Entertainment, Healthcare, Consumer Goods and Retail, Government and Utilities, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The Out-of-Home (OOH) advertising market is experiencing robust growth, driven by increasing urbanization, rising disposable incomes, and the resurgence of offline engagement after the pandemic. Technological advancements, such as digital billboards and programmatic buying, are transforming the industry, enabling targeted advertising and improved measurement capabilities. The market is segmented by advertising type (Transit, Billboard, Street Furniture, Others) and application (BFSI, IT & Telecom, Automotive, etc.), with digital formats showing significant traction across various segments. While traditional billboard advertising remains prevalent, transit advertising, especially in densely populated areas, and innovative street furniture displays are witnessing rapid expansion. The competitive landscape is dynamic, featuring both large multinational companies and regional players vying for market share. North America and Europe currently hold significant market share, but Asia-Pacific is projected to exhibit strong growth due to its expanding urban populations and rising advertising spend. Challenges include the increasing cost of prime locations and the need for continuous innovation to maintain audience engagement in a fragmented media landscape.

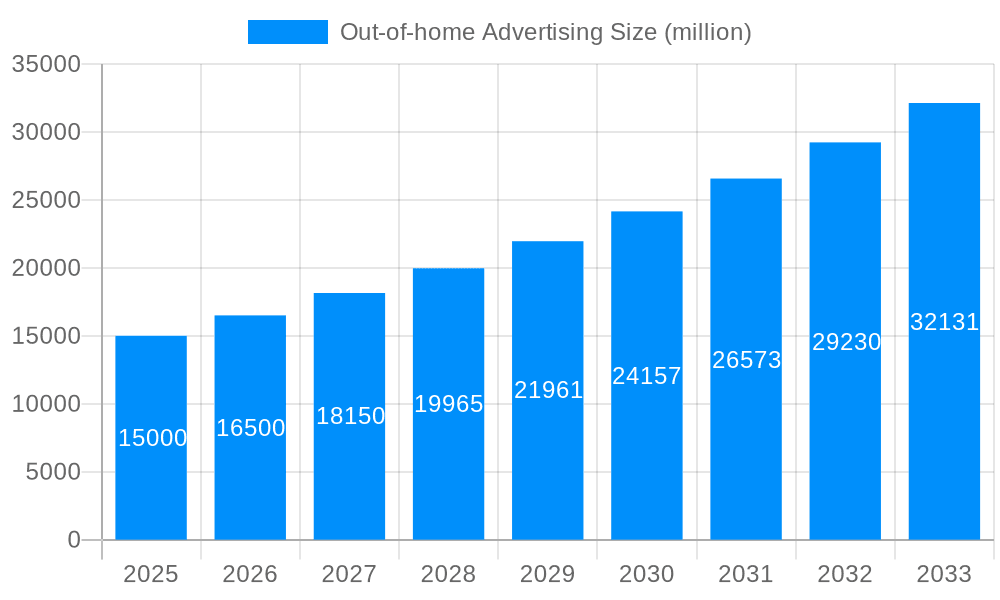

The forecast period (2025-2033) anticipates sustained growth, although the exact CAGR will depend on various factors like economic conditions and technological disruption. Key restraints include regulatory hurdles in certain regions, competition from digital advertising channels, and the need for continuous investment in infrastructure upgrades. However, the overall outlook remains positive, propelled by the inherent advantages of OOH advertising, including its high visibility, impactful visual presentation, and ability to reach broad, diverse audiences. The ongoing shift towards data-driven OOH strategies and the integration of advanced analytics will play a crucial role in shaping future growth trajectories and improving the effectiveness of OOH campaigns. This will lead to a more efficient allocation of resources and a greater return on investment for advertisers.

The out-of-home (OOH) advertising market, valued at approximately $35 billion in 2025, is experiencing a dynamic transformation driven by technological advancements and evolving consumer behavior. The historical period (2019-2024) saw steady growth, largely fueled by digital OOH formats and programmatic buying. The forecast period (2025-2033) projects even more significant expansion, with estimates exceeding $60 billion by 2033. This growth is attributed to several factors, including the increasing integration of data-driven strategies, the rise of innovative digital formats like interactive billboards and video screens, and a renewed focus on location-based targeting. Traditional formats, such as billboards and transit advertising, continue to hold relevance, particularly in high-traffic areas and for broad reach campaigns. However, the integration of digital technologies is making these traditional formats smarter and more effective. Furthermore, the increasing prevalence of mobile devices allows for seamless integration of OOH campaigns with digital marketing strategies, enhancing engagement and measurement capabilities. This convergence creates a powerful synergy, allowing advertisers to reach consumers across multiple touchpoints with cohesive messaging. The market is also witnessing the emergence of niche OOH formats, catering to specific demographics and locations. This trend contributes to the overall growth and diversification of the market, offering advertisers a wide range of options to achieve their marketing objectives. Competition among major players is fierce, leading to continuous innovation and improvement in services and technologies. Overall, the OOH advertising landscape is evolving into a more sophisticated, data-driven, and engaging medium.

Several key factors are propelling the growth of the OOH advertising market. Firstly, the increasing urbanization and concentration of populations in major cities create a large, readily accessible audience for OOH campaigns. Secondly, the rising adoption of digital OOH formats allows for greater targeting precision and campaign optimization. Programmatic buying, the automated purchasing of ad space, significantly enhances efficiency and reach. Thirdly, the integration of data analytics provides advertisers with valuable insights into campaign performance, facilitating data-driven decision-making and maximizing ROI. The ability to measure impressions, dwell times, and even conversion rates is revolutionizing OOH’s effectiveness. Furthermore, the increasing use of mobile devices and location-based technologies creates opportunities for personalized and contextually relevant advertising experiences. Consumers are increasingly receptive to creative and impactful OOH campaigns that integrate seamlessly into their daily routines. Lastly, the rise of experiential marketing and the desire for brands to create memorable interactions with consumers contribute to the increased adoption of innovative OOH formats like interactive billboards and augmented reality experiences. This shift emphasizes engagement and memorable brand experiences beyond simple visual exposure.

Despite its growth potential, the OOH advertising market faces several challenges. Firstly, the high cost of production and placement, particularly for premium locations and digital formats, can be a significant barrier to entry for smaller advertisers. Secondly, measurement and attribution of OOH campaigns remain comparatively more complex than other digital channels, requiring sophisticated analytics and technology. Thirdly, environmental concerns, particularly related to the aesthetic impact of billboards and the energy consumption of digital displays, pose a challenge to the industry's sustainability. The industry is increasingly focusing on more sustainable practices and eco-friendly solutions to address this concern. Furthermore, competition from other advertising channels, including digital and social media, demands a continuous innovation and adaptation to remain relevant and attract advertisers. Finally, regulatory hurdles and permitting processes in various jurisdictions can create complexities and delays in campaign implementation. Addressing these issues through technological advancements, better measurement solutions, and environmentally conscious initiatives is crucial for the continued and sustainable growth of the OOH advertising industry.

The global OOH advertising market is experiencing robust growth across various regions, with North America and Asia-Pacific emerging as key drivers. Within these regions, specific countries like the United States, China, and Japan contribute significantly to the overall market size.

Regarding segments:

Billboard Advertising: Billboards remain a dominant force, providing wide reach and high visibility, particularly in high-traffic areas. Digital billboards, with their capacity for dynamic content and targeted messaging, are significantly boosting the segment's growth. The market for digital billboards is expected to grow at a compound annual growth rate (CAGR) of over 10% during the forecast period. Technological advancements, such as programmatic buying and improved data analytics, are enhancing the effectiveness and efficiency of billboard advertising.

Transit Advertising: Transit advertising, encompassing advertising on buses, trains, and subways, benefits from captive audiences and high frequency of exposure. The continued expansion of public transportation systems in major cities worldwide further contributes to the segment's growth. The increasing use of mobile devices by commuters also provides opportunities for integrated digital campaigns.

Street Furniture Advertising: Street furniture advertising, including bus shelters, kiosks, and benches, presents opportunities for targeted advertising in specific locations. The integration of digital displays into street furniture is enhancing its effectiveness and attracting greater advertiser interest.

Application Segments: The Consumer Goods and Retail, and Automotive and Transportation sectors are major drivers in OOH advertising spending. Their emphasis on brand building and reaching broad consumer segments makes OOH an attractive channel. The BFSI (Banking, Financial Services, and Insurance) sector is also increasingly embracing OOH, particularly for financial awareness campaigns and reaching wider consumer groups.

In summary, the combination of strong growth in North America and Asia-Pacific, and the continued dominance of billboards, alongside strong growth in digital formats and transit advertising, ensures significant opportunities for growth throughout the forecast period.

The OOH advertising industry is experiencing robust growth fueled by several key catalysts. The integration of digital technologies, including programmatic buying, data analytics, and interactive displays, significantly enhances targeting and measurement capabilities. This allows for more effective campaigns and better ROI for advertisers. Furthermore, the increasing urbanization and population density in major cities create readily available and significant audiences for OOH advertising. Finally, the creative use of OOH formats within integrated marketing strategies allows for broader consumer engagement and increases the effectiveness of overall campaigns.

This report provides a comprehensive overview of the OOH advertising market, encompassing market size, trends, growth drivers, challenges, key players, and future outlook. It analyzes historical data (2019-2024), provides estimates for the base year (2025), and offers detailed forecasts for the period 2025-2033. The report also delves into various segments and applications, providing valuable insights for businesses operating within or considering entry into this dynamic market. The analysis of key players and significant developments provides a detailed view of the market's evolution and its anticipated trajectory.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include JCDecaux, Clear Channel Outdoor, Focus Media, Lamar Advertising, Global (Exterion Media), oOh! Media, Outfront Media, Stroer Media, Times OOH Media, Primedia Outdoor, APG | SGA, Adams Outdoor Advertising, Fairway Outdoor Advertising, Lightbox OOH Video Network, AllOver Media, BroadSign International, QMS Media, EPAMEDIA, Bell Media, AirMedia, White Horse Group, Phoenix Metropolis Media, Balintimes Hong Kong Media.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Out-of-home Advertising," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Out-of-home Advertising, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.