1. What is the projected Compound Annual Growth Rate (CAGR) of the Organolithium Compound?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Organolithium Compound

Organolithium CompoundOrganolithium Compound by Application (Petrochemical, Pharmaceutical, Other), by Type (Butyl Lithium, Phenyl Lithium, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

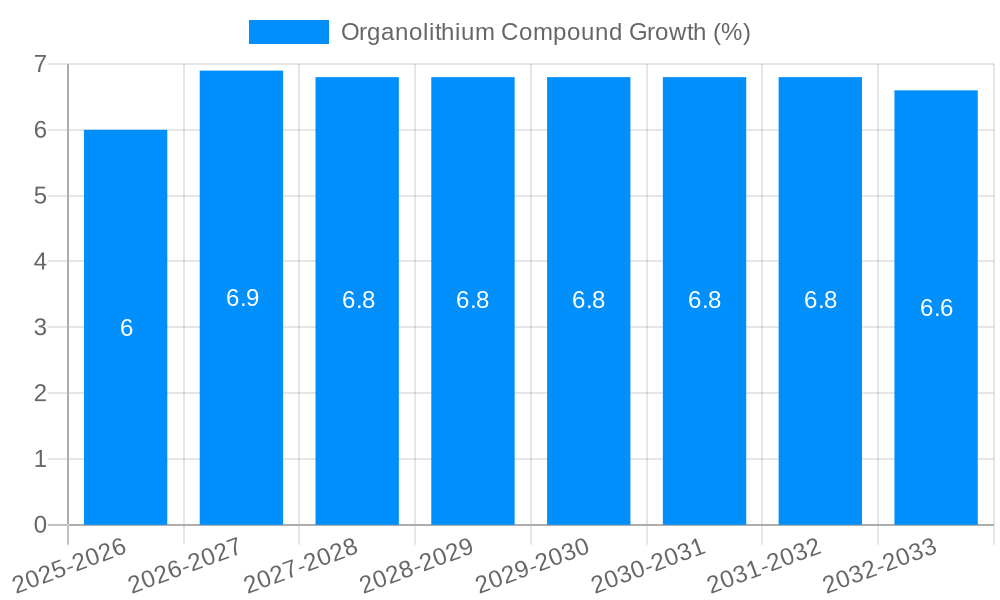

The global Organolithium Compound market is poised for significant expansion, projected to reach approximately $7.5 billion by 2033, with a robust Compound Annual Growth Rate (CAGR) of around 7%. This growth is fueled by escalating demand from critical sectors such as the petrochemical industry, where organolithium compounds serve as essential catalysts in polymerization processes for producing plastics and synthetic rubbers. Furthermore, the pharmaceutical sector is a substantial contributor, utilizing these compounds in the synthesis of complex active pharmaceutical ingredients (APIs) and intermediates. The "Other" application segment, encompassing areas like advanced materials and battery technology, is also witnessing burgeoning interest, indicating a diversified demand base. The market is characterized by the dominance of Butyl Lithium and Phenyl Lithium types, driven by their widespread application in organic synthesis. Key players like Livent, Albemarle, and Jiangsu Ganfeng Lithium Co. Ltd. are actively investing in research and development to enhance product offerings and expand production capacities, anticipating continued market buoyancy.

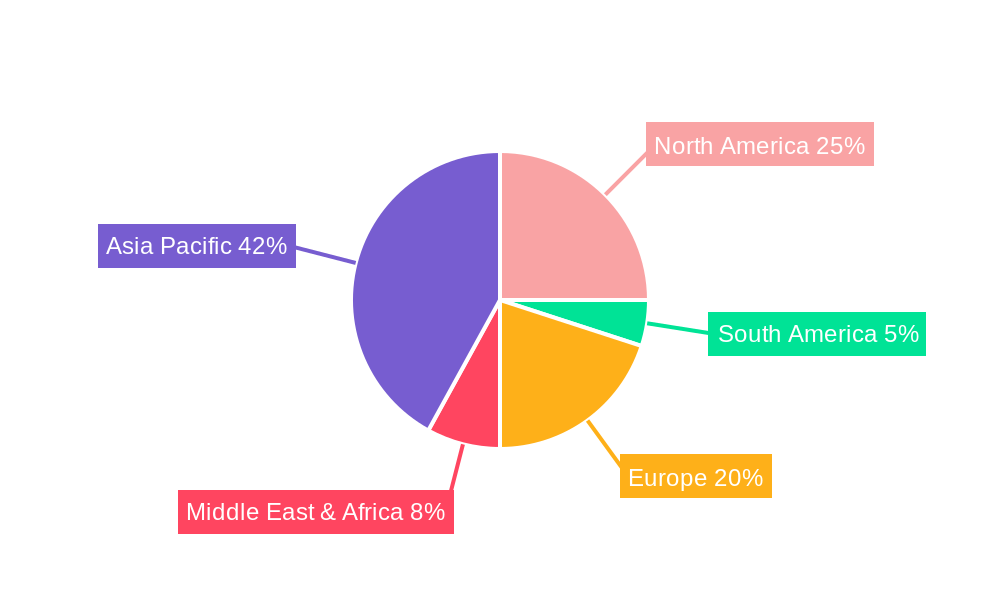

The market trajectory for organolithium compounds is shaped by several interconnected drivers and trends. A primary driver is the increasing global consumption of polymers and advanced plastics, directly correlating with organolithium compound demand. The pharmaceutical industry's continuous innovation and the growing pipeline of complex drug molecules further necessitate the use of these highly reactive reagents. Emerging applications in areas like solid-state batteries and advanced semiconductor manufacturing also present promising avenues for market growth. However, the market faces certain restraints, including the inherent hazardous nature of organolithium compounds, requiring stringent safety protocols during handling, storage, and transportation, which can escalate operational costs. Fluctuations in the prices of lithium and other raw materials also pose a challenge. Geographically, Asia Pacific, particularly China, is emerging as a dominant region due to its strong manufacturing base in petrochemicals and pharmaceuticals, coupled with significant investments in advanced materials. North America and Europe remain crucial markets owing to their established chemical and pharmaceutical industries and ongoing technological advancements.

Here's a unique report description on Organolithium Compounds, incorporating your specified elements:

The global organolithium compound market is poised for substantial expansion, projected to reach several million units by 2033. This growth is underpinned by a confluence of factors, with the petrochemical and pharmaceutical industries serving as primary demand drivers. Within the petrochemical sector, organolithium compounds, particularly n-butyllithium, are indispensable in the production of specialty polymers and synthetic rubber, leveraging their potent anionic polymerization capabilities. The demand for advanced materials with tailored properties in automotive, construction, and consumer goods manufacturing directly fuels this segment. Simultaneously, the pharmaceutical industry's increasing reliance on complex organic synthesis for novel drug development and the production of active pharmaceutical ingredients (APIs) is a significant contributor. Organolithium reagents facilitate highly selective and efficient bond formations, critical for intricate molecular architectures. Looking at the historical period (2019-2024), the market has witnessed steady progress, influenced by advancements in synthetic methodologies and increasing R&D investments. The base year of 2025 sets a pivotal point for forecasting, with the estimated year aligning with this to capture immediate post-base year trends. The forecast period (2025-2033) anticipates a CAGR that reflects the burgeoning applications and technological innovations. The study period (2019-2033) offers a comprehensive temporal scope, encompassing historical performance and future projections. The market's trajectory is also shaped by geographic shifts in production and consumption, with Asia-Pacific emerging as a key manufacturing hub. The evolving regulatory landscape, particularly concerning environmental sustainability and chemical safety, will also play a crucial role in shaping market dynamics. Innovations in handling and application technologies, aimed at mitigating the inherent reactivity of organolithium compounds, are also contributing to their broader adoption. The increasing complexity of chemical synthesis across various sectors is creating a sustained demand for these highly reactive and versatile reagents, solidifying their importance in modern chemical industries. The market's overall value is expected to ascend into the millions of units, reflecting both increased volume and the high-value nature of these specialized chemicals.

The organolithium compound market's impressive upward trajectory is fundamentally driven by the insatiable demand from its core application sectors. The petrochemical industry, in particular, is a voracious consumer, utilizing these compounds as initiators for anionic polymerization in the production of styrene-butadiene rubber (SBR) and polybutadiene rubber (PBR), essential components for tires and other rubber products. The burgeoning automotive sector, with its focus on lightweight materials and high-performance tires, directly translates to increased organolithium consumption. Furthermore, advancements in polymer science, leading to the development of novel polymers with superior thermal and mechanical properties, are expanding the application scope for organolithiums beyond traditional uses. In parallel, the pharmaceutical industry's constant pursuit of new drug molecules and increasingly complex APIs necessitates precise and efficient synthetic routes. Organolithium reagents, with their ability to form carbon-carbon bonds with exceptional selectivity and under mild conditions, are invaluable tools in this endeavor. The growing global healthcare expenditure and the continuous pipeline of new drug discoveries further bolster this demand. The increasing emphasis on green chemistry and sustainable manufacturing processes is also indirectly driving the demand for organolithium compounds, as researchers explore more efficient and atom-economical synthetic pathways where these reagents can play a pivotal role. The continuous innovation in catalyst development and process optimization further enhances the attractiveness and utility of organolithium compounds across a wider array of chemical transformations.

Despite the robust growth, the organolithium compound market is not without its hurdles. The primary challenge stems from the inherent reactivity and pyrophoric nature of many organolithium compounds, necessitating stringent safety protocols for handling, storage, and transportation. This adds significant operational costs and requires specialized infrastructure, limiting entry for smaller players and impacting overall cost-effectiveness, especially for less developed regions. Furthermore, the synthesis of organolithium compounds often involves hazardous reagents and can generate byproducts that require careful disposal, posing environmental concerns and driving up compliance costs. The reliance on specific raw materials, such as lithium metal, can also introduce supply chain vulnerabilities and price volatility, impacting the predictability of production costs. The development of alternative, less hazardous reagents or synthetic pathways, while still nascent, represents a potential long-term restraint. Stringent regulatory frameworks governing the production, use, and disposal of these highly reactive chemicals, particularly in developed economies, add another layer of complexity and can slow down market penetration in certain applications. The specialized expertise required for effective utilization also presents a barrier to widespread adoption in industries less familiar with organolithium chemistry. Overcoming these challenges will be crucial for unlocking the full market potential.

The organolithium compound market's dominance is largely dictated by the confluence of robust industrial demand and advanced manufacturing capabilities. Asia-Pacific is emerging as a formidable force, driven by its significant manufacturing base in both petrochemicals and pharmaceuticals, coupled with increasing investments in R&D and production facilities. Countries like China and India are not only major consumers but are rapidly expanding their production capacities, leveraging cost advantages and growing domestic demand. The sheer volume of polymer production for automotive, construction, and consumer goods in this region, coupled with the escalating pharmaceutical manufacturing sector, positions Asia-Pacific as a critical market. Within this expansive region, China stands out due to its extensive chemical industry infrastructure, government support for advanced materials, and its role as a global manufacturing hub. The country's active participation in the automotive supply chain and its rapidly growing generic and novel drug development pipeline directly translate to substantial organolithium consumption.

Focusing on the Application Segment, the Petrochemical industry is projected to remain a dominant force. Organolithium compounds, especially butyl lithium variants, are crucial as initiators for anionic polymerization in the production of specialty elastomers like styrene-butadiene-styrene (SBS) block copolymers, which are used in adhesives, sealants, and footwear. The demand for high-performance tires in the automotive sector, driven by fuel efficiency standards and the need for durable materials, is a significant contributor to this dominance. Furthermore, the expansion of infrastructure projects globally necessitates increased production of advanced polymers for construction materials, further bolstering the petrochemical application. The continuous innovation in polymer science, leading to the development of novel materials with tailored properties for niche applications, also contributes to the sustained demand for organolithium compounds. The ability of organolithiums to precisely control polymer architecture, molecular weight, and tacticity is a key enabler for these advanced material developments.

Within the Type Segment, Butyl Lithium is expected to maintain its leading position. n-Butyllithium and sec-butyllithium are widely employed as anionic polymerization initiators in the production of synthetic rubbers and thermoplastic elastomers, aligning perfectly with the petrochemical industry's demand. Their affordability, availability, and well-established handling procedures make them the preferred choice for large-scale industrial applications. The versatility of butyl lithium in facilitating various organometallic transformations, including metal-halogen exchange and deprotonation reactions, further solidifies its market significance across diverse chemical synthesis processes. The continuous optimization of butyl lithium production processes to enhance efficiency and reduce environmental impact will ensure its continued dominance in the forecast period.

The organolithium compound industry is propelled by several key growth catalysts. The ever-increasing demand for advanced polymers with superior properties in industries like automotive and electronics is a primary driver. The pharmaceutical sector's reliance on complex organic synthesis for novel drug development creates sustained demand for these versatile reagents. Technological advancements in handling and application technologies are improving safety and efficiency, encouraging broader adoption. Furthermore, government initiatives promoting domestic manufacturing and R&D in specialty chemicals, particularly in emerging economies, are fostering market expansion.

This comprehensive report delves deep into the global organolithium compound market, providing an in-depth analysis of trends, drivers, and challenges from the historical period of 2019-2024 through to the forecast period of 2025-2033, with 2025 serving as the base and estimated year. It meticulously examines the market's trajectory, projected to reach several million units, driven by robust demand from the petrochemical and pharmaceutical sectors. The report further explores the critical role of key regions, particularly Asia-Pacific, and dominant segments like petrochemical applications and butyl lithium types, in shaping market dynamics. It also highlights significant developments and leading players, offering a holistic view of this vital segment of the chemical industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Livent, Albemarle, Jiangsu Changjili New Energy Technology Co., Ltd., Jiangxi Ganfeng Lithium Co. Ltd, Shaoxing Shangyu Hualun Chemical Co., Ltd, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Organolithium Compound," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Organolithium Compound, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.