1. What is the projected Compound Annual Growth Rate (CAGR) of the Organic Cocoa Products?

The projected CAGR is approximately 6.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Organic Cocoa Products

Organic Cocoa ProductsOrganic Cocoa Products by Type (Cocoa Beans, Cocoa Powder, Cocoa Butter, Others), by Application (Online Sales, Offline Sales), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

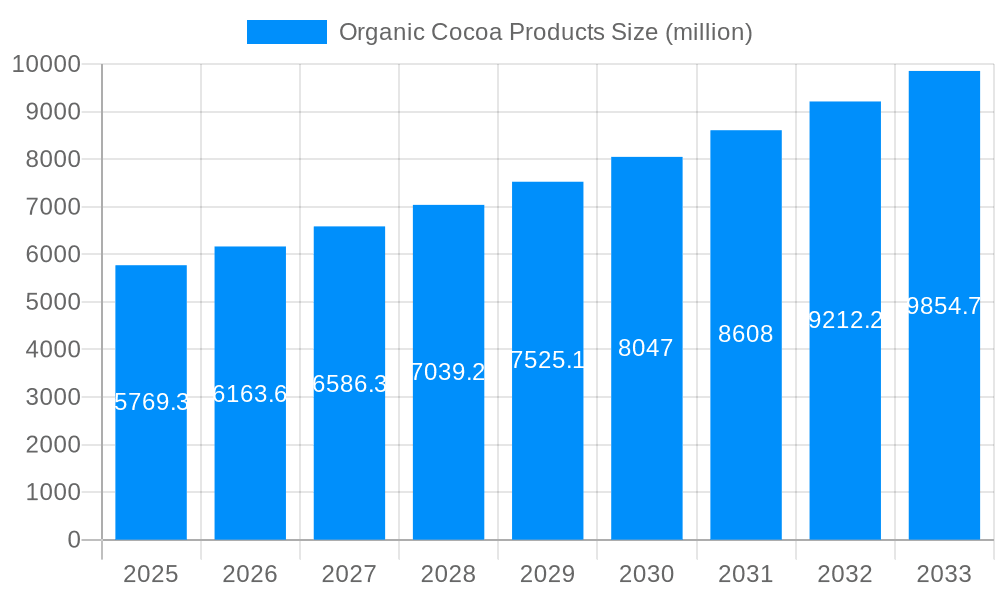

The organic cocoa products market, valued at $5769.3 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.7% from 2025 to 2033. This surge is driven by increasing consumer awareness of health and wellness, a growing preference for natural and sustainably sourced ingredients, and a rising demand for ethically produced chocolate. The market is witnessing significant trends such as the increasing popularity of dark chocolate with high cocoa content due to its purported health benefits, the emergence of innovative product formats like cocoa nibs and cocoa powder blends in various food and beverage applications, and the expansion of organic cocoa farming practices to meet the escalating demand. However, challenges remain, including the relatively higher price point of organic cocoa products compared to conventional options and the limited availability of certified organic cocoa beans in certain regions. This necessitates a focus on sustainable farming practices and supply chain transparency to address these constraints. Key players in this dynamic market include established chocolate manufacturers like Hershey's and Barry Callebaut, along with smaller, specialized brands focusing on ethically sourced and high-quality organic cocoa. Geographical distribution likely mirrors existing chocolate consumption patterns, with North America and Europe holding significant market shares.

The forecast period (2025-2033) anticipates continued expansion, driven by sustained consumer interest in clean-label products and a heightened emphasis on sustainability within the food and beverage industry. The market segmentation is likely diverse, encompassing various product forms (bars, powder, nibs, etc.), and distribution channels (direct-to-consumer, retail, foodservice). Companies are actively innovating to cater to the growing demand for organic cocoa products, with a focus on new product development, strategic partnerships, and sustainable sourcing initiatives. The success of individual companies will depend on their ability to balance consumer demand for quality, affordability, and ethical sourcing practices. This market's future is promising but hinges on a balanced approach between growth and sustainability.

The global organic cocoa products market is experiencing robust growth, driven by a confluence of factors including increasing consumer awareness of health and wellness, a rising preference for natural and sustainable products, and the expanding availability of organic cocoa beans. The market, valued at approximately $XX billion in 2024, is projected to reach $YY billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of X%. This growth is fueled by the increasing demand for organic chocolate, cocoa powder, and other cocoa-derived products across various consumer segments. The shift towards clean-label products and the growing popularity of ethically sourced ingredients are further bolstering market expansion. Consumers are increasingly scrutinizing ingredient lists, seeking out products free from artificial additives and preservatives, contributing significantly to the demand for organic alternatives. Moreover, the rise of veganism and the growing interest in plant-based diets are propelling the demand for organic cocoa products as a versatile and ethically sound ingredient in various food and beverage applications. This trend is particularly pronounced in developed economies like North America and Europe, where consumers have greater purchasing power and awareness of sustainable practices. However, emerging economies are also witnessing increasing adoption, albeit at a slower pace, reflecting the growing middle class and their increased disposable incomes. The market also shows segmentation based on product type (chocolate bars, cocoa powder, etc.), distribution channels (online, retail), and geographic location, all presenting unique growth opportunities for market players. The competitive landscape is dynamic, with both established players and new entrants vying for market share through product innovation and strategic partnerships.

Several key factors are driving the remarkable growth trajectory of the organic cocoa products market. Firstly, the heightened consumer consciousness regarding health and wellness is undeniable. People are increasingly prioritizing healthier dietary choices, seeking out products with natural ingredients and minimal processing. Organic cocoa, perceived as a healthier alternative to conventionally produced cocoa, aligns perfectly with this trend. Secondly, the growing awareness of sustainability and ethical sourcing is significantly impacting consumer purchasing decisions. Consumers are more likely to choose products from companies committed to environmentally friendly and socially responsible practices. Organic cocoa farming often employs sustainable agricultural techniques, appealing to environmentally conscious consumers. Thirdly, the burgeoning vegan and plant-based food movement is further boosting demand. Organic cocoa products serve as a key ingredient in a wide range of vegan confectionery, beverages, and other food products, satisfying the growing demand within this segment. Finally, the rising disposable incomes in emerging economies are gradually increasing the affordability and accessibility of organic cocoa products, broadening the market's potential reach. This combination of factors points towards a sustained period of substantial growth for the organic cocoa products market in the coming years.

Despite the impressive growth potential, the organic cocoa products market faces several challenges. Firstly, the higher cost of organic cocoa beans compared to conventionally grown beans presents a significant obstacle. This increased cost often translates to higher prices for finished products, potentially limiting consumer accessibility, especially in price-sensitive markets. Secondly, the limited availability of certified organic cocoa beans can constrain supply, potentially hindering market expansion. The conversion of conventional cocoa farms to organic practices is a time-consuming process, and the yield per hectare may initially be lower. Thirdly, maintaining consistent quality and traceability throughout the entire supply chain is crucial for preserving consumer trust. Ensuring that organic certifications are rigorously upheld and that practices align with sustainability standards necessitates significant effort and investment from producers. Finally, stringent regulations and certification standards associated with organic products can create complexities and increase compliance costs for producers. Addressing these challenges effectively is critical to unlocking the full potential of the organic cocoa products market.

North America: The region boasts a high level of consumer awareness regarding health and sustainability, driving strong demand for organic cocoa products. The established culture of premium chocolate consumption also contributes to market growth. Furthermore, the significant presence of key players in the chocolate industry within North America further strengthens the market dominance.

Europe: Similar to North America, Europe has a well-established market for organic food products, with consumers increasingly seeking out organic and ethically sourced chocolate and cocoa-derived items. Stringent regulations surrounding organic food production also contribute to the market's growth and consumer confidence.

Premium Chocolate Segment: The premium chocolate segment demonstrates higher growth rates due to a willingness to pay a premium for high-quality, ethically sourced, and organic cocoa products. This segment caters to a consumer base that prioritizes taste and experience beyond price.

Direct-to-Consumer (DTC) Sales: The rise of e-commerce and online retail platforms allows smaller organic cocoa producers to reach a wider customer base, bypassing traditional retail channels and achieving greater market penetration.

In summary, North America and Europe are leading the charge in organic cocoa product consumption, driven by consumer preferences for healthier and more sustainably produced options. The premium chocolate segment holds significant promise, while a growing DTC sales channels significantly impacts the market dynamics.

The organic cocoa products market is poised for continued expansion due to a convergence of factors including the increasing health consciousness among consumers, the rising demand for sustainable and ethically sourced products, and the rapid growth of the vegan and plant-based food sectors. Furthermore, ongoing innovations in product formulations and technological advancements in cocoa processing are creating new opportunities and expanding market applications. The growing popularity of organic cocoa in various culinary applications, from baked goods to beverages, further fuels the market's growth.

This report provides a comprehensive analysis of the organic cocoa products market, covering market size, growth trends, driving forces, challenges, and key players. It provides valuable insights into the market dynamics, including regional variations and segment-specific growth opportunities, enabling informed decision-making for businesses operating in or intending to enter this rapidly growing market. The report incorporates extensive market data from the historical period (2019-2024), the base year (2025), the estimated year (2025), and the forecast period (2025-2033), providing a comprehensive overview of past performance and future projections. The report includes detailed company profiles, focusing on strategies, market share, and competitive landscape analysis.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.7% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.7%.

Key companies in the market include Hershey's, Guittard Chocolate Company, Taza Chocolate, Lake Champlain Chocolates, Scharffen Berger Chocolate Maker, Barry Callebaut AG, Cemoi Chocolatier, Haigh's Chocolates, Lotte Confectionery, CasaLuker, Casa Bosques, Puratos, Theobroma Chocolat, Agostoni Chocolate, Chocolaterie Robert, .

The market segments include Type, Application.

The market size is estimated to be USD 5769.3 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Organic Cocoa Products," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Organic Cocoa Products, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.