1. What is the projected Compound Annual Growth Rate (CAGR) of the Organic Bread Flour for Home Cooking?

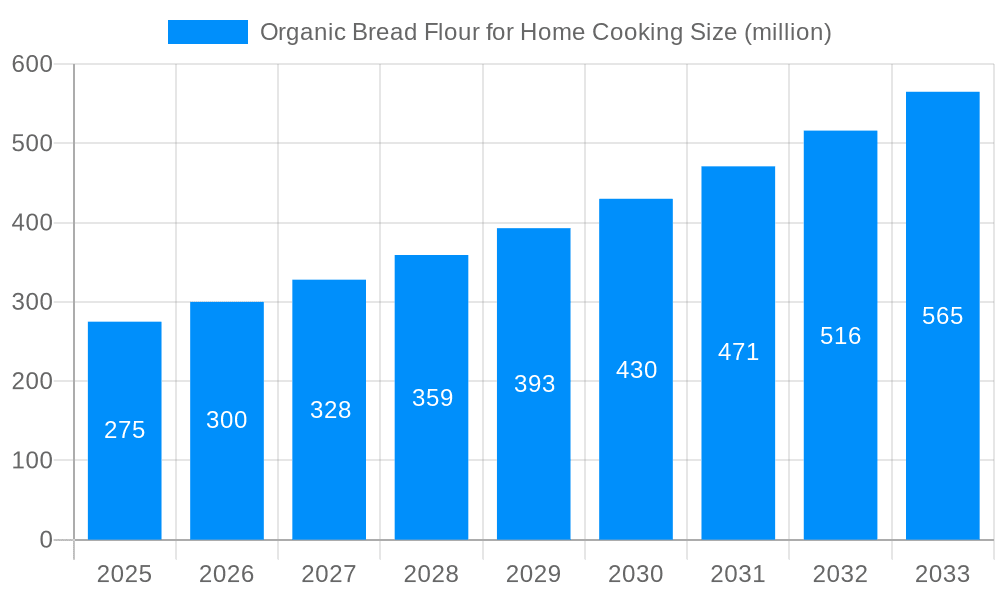

The projected CAGR is approximately 5.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Organic Bread Flour for Home Cooking

Organic Bread Flour for Home CookingOrganic Bread Flour for Home Cooking by Type (Machine Milled Flour, Stone Ground Flour), by Application (Online, Offline), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The organic bread flour market for home cooking exhibits significant growth, propelled by heightened consumer focus on health and wellness, a growing preference for natural and organic food options, and a substantial increase in home baking activities. Enhanced convenience and accessibility through online grocery platforms and broader retail availability in supermarkets and specialty stores further contribute to market expansion. Based on robust trends in the broader organic food sector and the expanding home baking segment, the 2025 market size is estimated at $325.23 million, with a projected Compound Annual Growth Rate (CAGR) of 5.9%. Key industry leaders such as General Mills, Bob's Red Mill, and King Arthur Flour are strategically positioned to leverage this growth via product innovation, targeted marketing initiatives, and collaborations with online retailers and home baking communities. Potential market challenges include premium pricing compared to conventional alternatives, which may impact price-sensitive consumers. However, rising disposable incomes and the increasing perception of organic products as a valuable health investment are mitigating these constraints.

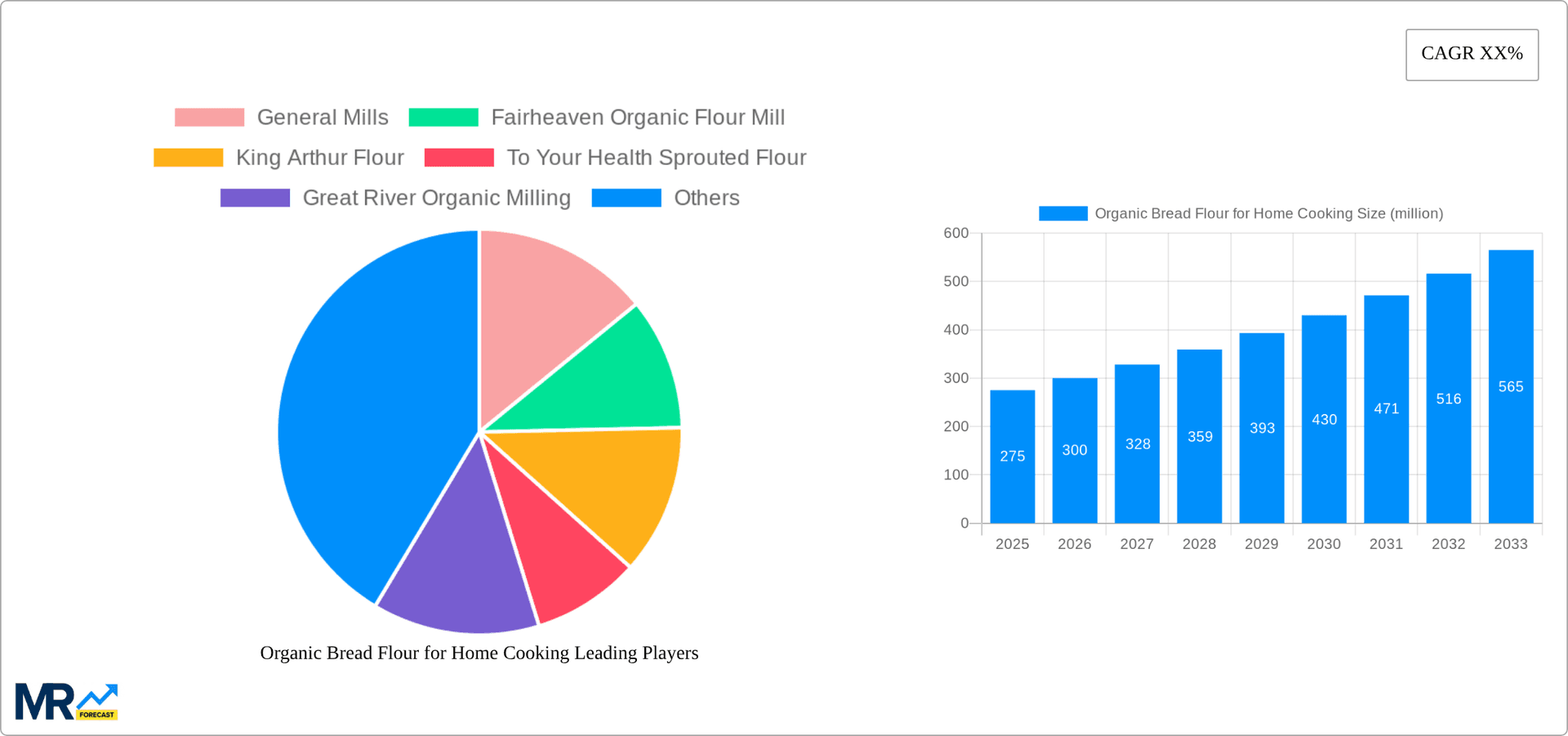

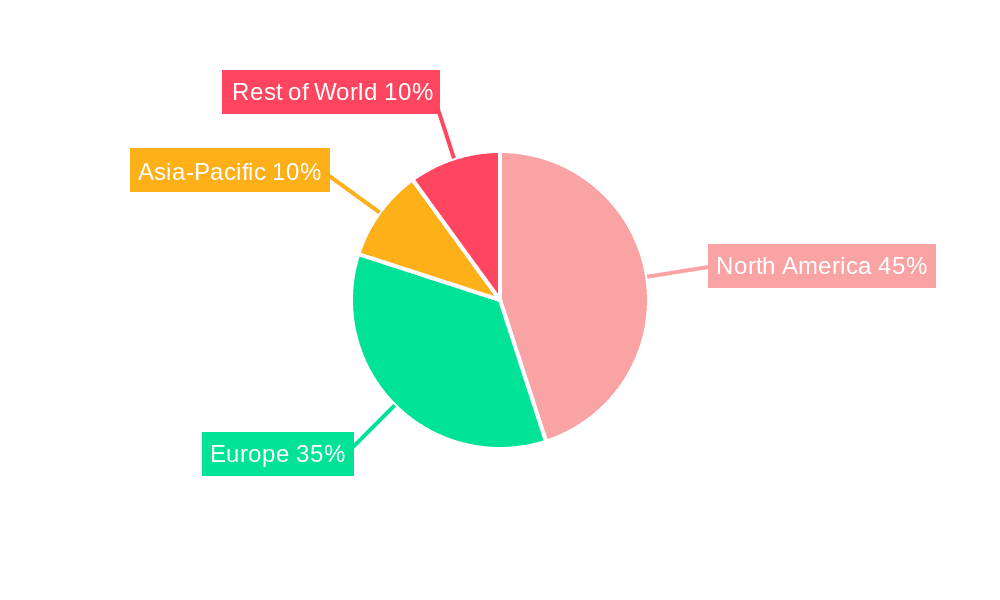

The competitive environment features a blend of established large corporations and smaller, niche organic flour producers. Brand success in this segment is contingent on effectively communicating the advantages of organic bread flour for home baking, highlighting superior quality, taste, and health benefits. Market segmentation is expected to center on product variations (e.g., whole wheat, white, sprouted), packaging dimensions, and distribution networks. Regional market dynamics will be influenced by consumer preferences and organic ingredient accessibility. North America and Europe are anticipated to lead market share, driven by established demand for organic products and a mature home baking culture. Sustained growth will depend on supply chain efficiency, continuous product development, and effective marketing campaigns targeting home bakers, especially those engaging with online recipes and digital baking communities.

The organic bread flour market for home cooking experienced robust growth during the historical period (2019-2024), exceeding several million units annually. This surge is projected to continue throughout the forecast period (2025-2033), driven by a confluence of factors. The estimated market size in 2025 is in the multi-million unit range, indicating significant consumer adoption. Key market insights reveal a strong correlation between rising consumer awareness of health and wellness and the increasing preference for organic and naturally sourced food products. The convenience factor, coupled with a growing interest in baking as a hobby and stress reliever during periods of uncertainty like the COVID-19 pandemic, has further amplified market demand. The increasing availability of organic bread flour through both online and brick-and-mortar channels has also played a vital role. Moreover, the expansion of the home baking segment and the rise of online baking tutorials and recipes have contributed significantly to the popularity of organic bread flour among home cooks. Premiumization is also a noticeable trend; consumers are increasingly willing to pay more for higher quality, organic ingredients. This trend is expected to fuel the growth of the premium segment within the market, further driving up the overall market value. Finally, a growing focus on sustainability and ethical sourcing of ingredients is fueling the demand for organic bread flour, aligning with the broader consumer shift towards environmentally conscious consumption patterns. The market is witnessing an influx of innovative product offerings such as sprouted flour and other specialty organic flours, catering to diverse consumer preferences and dietary needs.

Several key factors are driving the expansion of the organic bread flour market for home cooking. The escalating demand for healthier food options is a primary driver, with consumers actively seeking out organic ingredients to improve their diet and overall wellbeing. Increased disposable incomes, particularly in developed economies, allow consumers to afford premium, organic products, boosting market growth. The rise of the "clean label" movement, emphasizing transparency and the use of recognizable, natural ingredients, further contributes to the demand for organic bread flour. Simultaneously, the growing popularity of home baking as a leisure activity and the abundance of baking-related online content—from recipe blogs to instructional videos—encourage experimentation with different ingredients, including organic bread flour. Furthermore, the pandemic spurred a significant increase in home cooking and baking, accelerating the adoption of organic ingredients. Marketing efforts highlighting the nutritional and quality benefits of organic bread flour, compared to conventional alternatives, also play a crucial role in driving consumer preference. The broader trend towards health-conscious lifestyles and the growing awareness of the potential health hazards associated with conventionally grown wheat are also pivotal to this expansion.

Despite the positive growth trajectory, several challenges and restraints could potentially impact the market for organic bread flour. The higher cost of organic bread flour compared to conventional options remains a significant barrier for price-sensitive consumers. This price difference stems from the higher production costs associated with organic farming practices. Fluctuations in the price of raw materials, particularly organic wheat, can also affect the profitability and pricing of organic bread flour, potentially impacting market growth. Maintaining the consistent supply and quality of organic wheat is crucial; any disruptions in the supply chain could lead to shortages and price hikes. The limited availability of organic bread flour in certain regions may also restrict market expansion. Furthermore, educating consumers about the benefits of organic bread flour and dispelling misconceptions surrounding its quality or taste are ongoing challenges. The potential for inconsistencies in product quality across different brands also represents a significant hurdle that needs addressing to build strong consumer confidence in the category.

Segments: The premium segment, featuring specialized organic bread flours (e.g., sprouted flour, sourdough starters) is poised for significant growth, fueled by a consumer preference for higher quality and unique product offerings.

The paragraph further elaborates on the regional dominance: North America’s dominance stems from the high consumption of baked goods and the readily available information and resources for home bakers. Europe's strong performance is underpinned by the region's sophisticated culinary culture and focus on high-quality ingredients. Asia-Pacific, while still developing, demonstrates significant untapped potential, given its substantial population and evolving consumer preferences. The premium segment offers higher profit margins, attracting more investment and product innovation.

The organic bread flour market is experiencing accelerated growth due to several key factors: increased consumer demand for healthy and natural foods, the rising popularity of home baking as a hobby, improved access to organic ingredients through various retail channels, and the successful marketing efforts highlighting the benefits of organic bread flour. These factors collectively create a favorable environment for substantial market expansion in the coming years.

This report provides a comprehensive analysis of the organic bread flour market for home cooking, offering valuable insights into market trends, driving forces, challenges, key players, and future growth prospects. It provides detailed information on regional variations in consumer preferences and market size, segmented by product type and pricing. The report also analyzes the competitive landscape, highlighting key strategies employed by leading players to maintain their market share and capitalize on emerging growth opportunities. This information can help stakeholders make informed decisions related to product development, market entry, and investment strategies.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.9%.

Key companies in the market include General Mills, Fairheaven Organic Flour Mill, King Arthur Flour, To Your Health Sprouted Flour, Great River Organic Milling, Ardent Mills, Doves Farm Foods, Bay State Milling Company, Bob's red mill, Aryan International, Archer Daniels Midland (ADM), Dunany Flour, Shipton Mill Ltd, Beidahuang, WuGu-Kang Food, .

The market segments include Type, Application.

The market size is estimated to be USD 325.23 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Organic Bread Flour for Home Cooking," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Organic Bread Flour for Home Cooking, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.