1. What is the projected Compound Annual Growth Rate (CAGR) of the Organic and Natural Dog Foods?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Organic and Natural Dog Foods

Organic and Natural Dog FoodsOrganic and Natural Dog Foods by Type (Dry Pet Food, Wet and Canned Pet Food, Snacks and Treats, World Organic and Natural Dog Foods Production ), by Application (Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others, World Organic and Natural Dog Foods Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

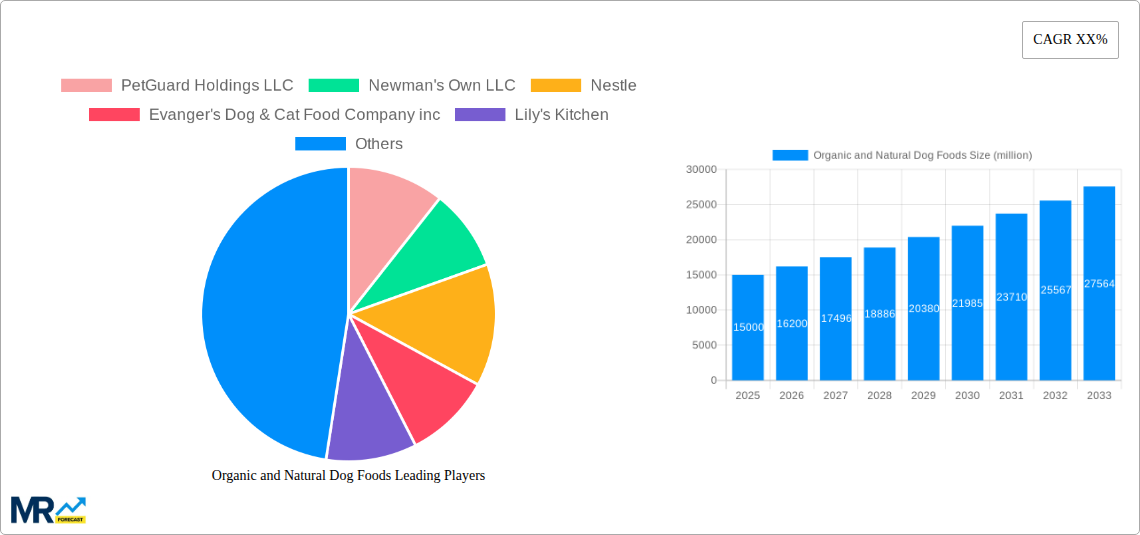

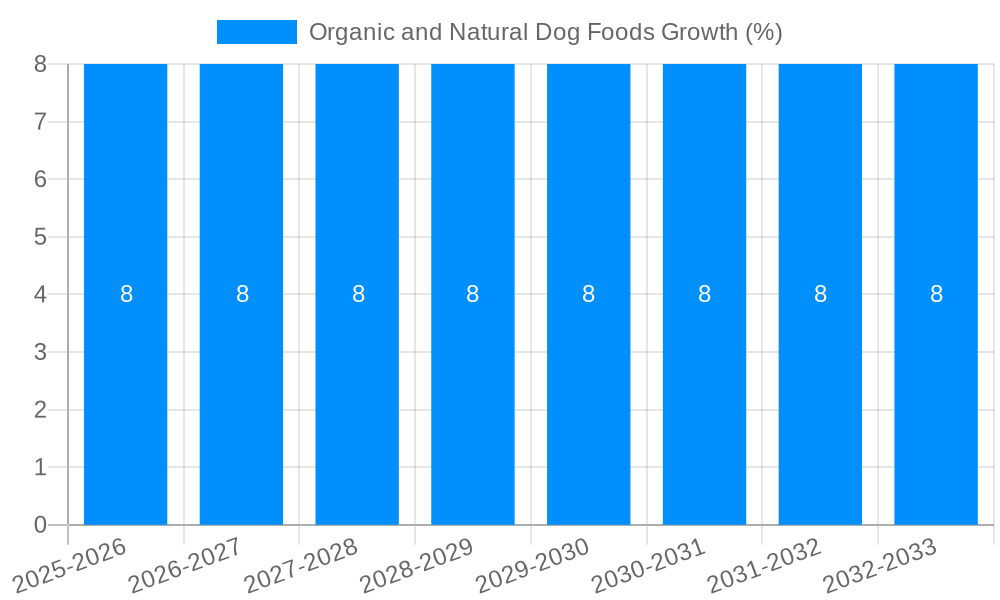

The global organic and natural dog food market is experiencing robust growth, driven by increasing pet humanization, rising consumer awareness of pet health and nutrition, and a growing preference for premium pet food products. The market is segmented by product type (dry, wet/canned, snacks & treats) and distribution channel (supermarkets, specialty stores, online). While precise market size figures are unavailable, considering typical growth rates in the pet food sector and the expanding interest in organic and natural products, a reasonable estimation for the 2025 market size could be around $15 billion USD. This assumes a moderate CAGR of 7-8% over the past few years, aligning with trends in the broader premium pet food segment. The market's future trajectory is projected to be equally positive, potentially reaching $25 billion by 2033, based on a sustained CAGR of approximately 5-6%. This reflects a slower growth rate than in previous years, potentially due to market saturation in some regions and higher base values.

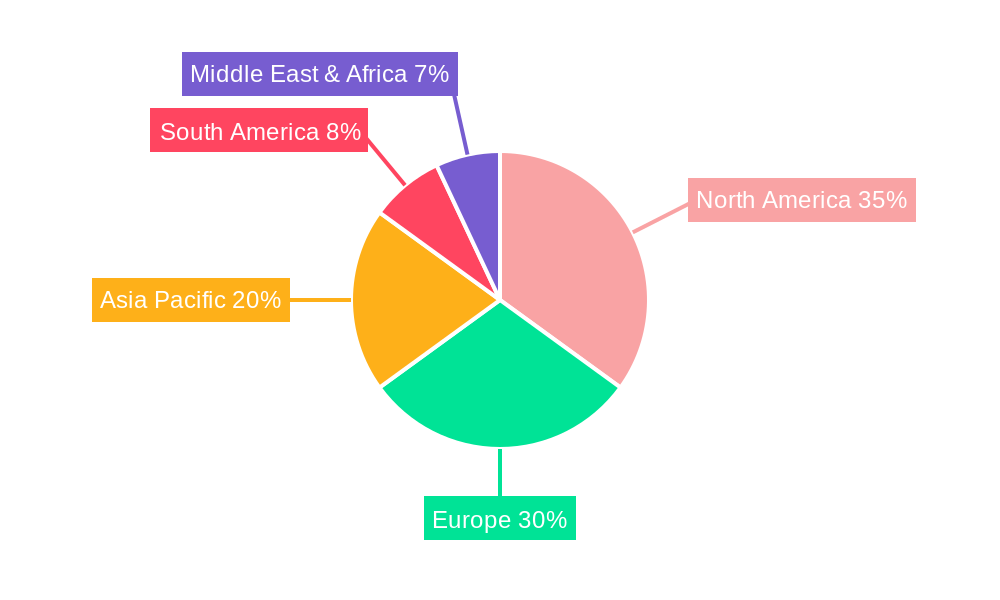

Key drivers include the increasing disposable incomes of pet owners, particularly in emerging markets like Asia-Pacific and parts of South America, fueling demand for higher-quality pet foods. Furthermore, the growing prevalence of pet allergies and intolerances is pushing consumers towards organic and natural alternatives, perceived as safer and less likely to trigger adverse reactions. However, the market faces constraints such as higher production costs associated with organic ingredients, potentially leading to premium pricing that could limit accessibility for some consumers. The presence of numerous established and emerging players, including both large multinational corporations and smaller niche brands, creates a competitive landscape. Regionally, North America and Europe are currently the largest markets, but Asia-Pacific is expected to witness significant growth in the coming years due to rapid economic development and an evolving pet ownership culture. The online channel is gaining traction, offering convenience and wider product selection to consumers.

The global organic and natural dog food market is experiencing robust growth, driven by a confluence of factors. Increasing pet humanization, where pets are treated as family members, is a significant driver. This trend translates into a willingness to spend more on premium, high-quality food perceived as healthier and more nutritious. Consumers are increasingly aware of the ingredients in their pet's food, leading to a demand for transparency and traceability. This has fueled the popularity of organic and natural options, as consumers seek to avoid artificial preservatives, colors, and flavors. The market also benefits from the growing awareness of the link between diet and pet health. Conditions like obesity and allergies are prompting owners to seek out foods that support their dog's well-being. This shift is particularly evident in developed regions with higher disposable incomes and a greater emphasis on pet health and wellness. The market size, currently in the hundreds of millions of units, is projected to experience substantial growth in the forecast period (2025-2033), driven by these evolving consumer preferences and a broadening product range, encompassing specialized diets for various breeds and life stages. Furthermore, the increasing availability of organic and natural dog food through various retail channels, from supermarkets and hypermarkets to specialized pet stores and online platforms, has significantly contributed to the market's expansion. However, the higher price point of organic and natural dog food compared to conventional options presents a challenge, particularly during economic downturns. Nonetheless, the sustained growth in consumer spending on premium pet products suggests a resilient market outlook for the coming years.

The organic and natural dog food market's expansion is fueled by several key drivers. Firstly, the growing awareness of the detrimental effects of artificial ingredients on canine health significantly influences consumer choices. Concerns about artificial preservatives, colors, and flavors have led pet owners to seek out natural alternatives perceived as safer and healthier for their beloved companions. This heightened awareness is fueled by readily accessible information online and through pet health advocacy groups. Secondly, the trend towards pet humanization plays a crucial role. Owners increasingly view their pets as family members, leading to a higher willingness to invest in premium products that enhance their pet's well-being. This translates into a willingness to pay a premium for organic and natural foods. Thirdly, increased disposable incomes in many parts of the world, particularly in developed nations, allow pet owners to afford higher-priced premium pet foods. Finally, the increasing availability of organic and natural dog food options through diverse retail channels, encompassing supermarkets, specialized stores, and online platforms, broadens market access and contributes to increased sales. These factors collectively propel the continuous expansion of this market segment, driving the hundreds of millions of units sold annually.

Despite significant growth, the organic and natural dog food market faces several challenges. The primary restraint is the higher price point compared to conventional dog food options. This price differential can be a significant barrier for budget-conscious consumers, particularly in emerging markets with lower disposable incomes. Moreover, concerns about the authenticity and certification of "organic" and "natural" claims pose a significant challenge. Consumers need assurance that the products they purchase genuinely meet the standards they expect. The market's susceptibility to economic downturns presents another challenge; during periods of economic uncertainty, consumers may reduce spending on premium pet products, impacting sales. Furthermore, ensuring consistent supply chain management and maintaining high-quality standards across production can be complex and costly. Competition from established players in the conventional pet food industry also presents a challenge, as these brands increasingly introduce their own lines of organic or natural products. Finally, clearly defining and regulating the terms "organic" and "natural" is critical to maintain consumer trust and prevent misleading marketing practices. Addressing these challenges is essential for sustaining the long-term growth of the organic and natural dog food market.

The North American market currently holds a significant share of the global organic and natural dog food market, followed closely by Europe. This dominance is attributable to several factors, including higher disposable incomes, increased pet ownership, and a growing awareness of pet health and nutrition. Within these regions, the dry pet food segment dominates, driven by its convenience, longer shelf life, and cost-effectiveness compared to wet or canned options. Online stores are also experiencing substantial growth, facilitating increased accessibility and consumer convenience. Specialty pet stores cater to a niche market seeking premium products and expert advice, driving sales of higher-priced, specialized organic and natural dog foods. The following points further illustrate market dominance:

The projected growth in Asia-Pacific, driven by rising disposable incomes and increasing pet ownership, presents significant future opportunities. The market's dynamic nature suggests consistent shifts and adjustments in regional and segmental dominance over the forecast period.

Several factors are catalyzing the growth of the organic and natural dog food industry. The increasing awareness of the link between diet and pet health, coupled with rising consumer disposable incomes, is a major driver. The continuous improvement in the quality and range of products available is another crucial element. Finally, innovative marketing and branding strategies that highlight the health benefits and superior ingredients of these foods are attracting a broader consumer base, fueling market expansion and contributing to the overall impressive growth trajectory.

This report provides a comprehensive overview of the organic and natural dog food market, offering insights into its growth trajectory, key players, market trends, and challenges. It encompasses a detailed analysis of the market across key regions and segments, providing valuable data for businesses and stakeholders involved in the industry. The report's forecasts, based on thorough research and analysis, offer valuable guidance for strategic decision-making and future planning. The study period covers the historical period (2019-2024), the base year (2025), the estimated year (2025), and the forecast period (2025-2033). The report also identifies key market trends and growth catalysts, including pet humanization, increasing health consciousness, and the evolving retail landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include PetGuard Holdings LLC, Newman's Own LLC, Nestle, Evanger's Dog & Cat Food Company inc, Lily's Kitchen, Avian Organics, Castor & Pollux Natural Petworks, Yarrah, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Organic and Natural Dog Foods," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Organic and Natural Dog Foods, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.