1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Household Furniture?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Household Furniture

Online Household FurnitureOnline Household Furniture by Type (Solid Wood Type, Metal Type, Jade Type, Glass Type, Others), by Application (Household Application, Office Application, Hospital Application, Outdoor Application, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

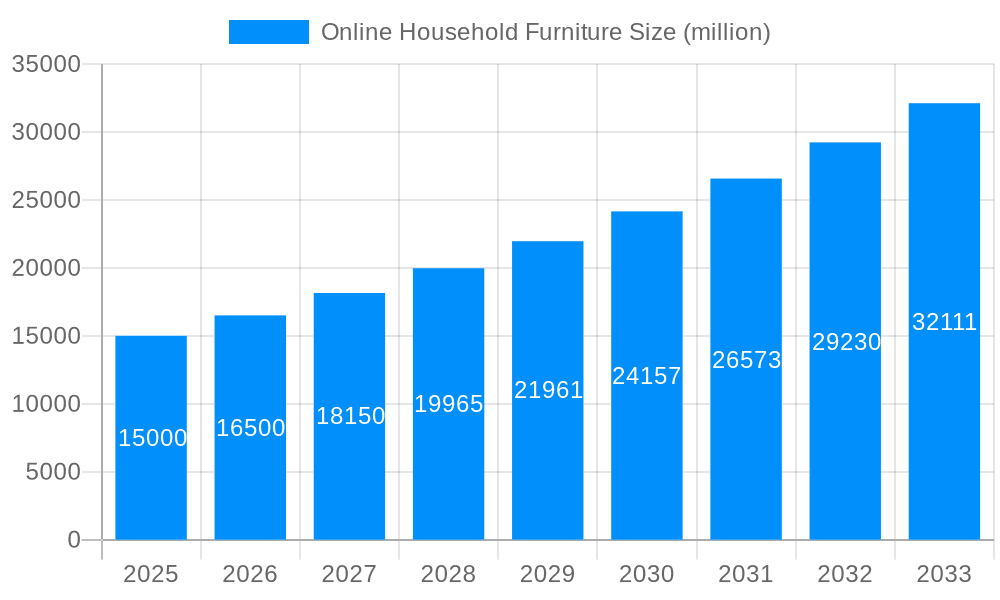

The online household furniture market is experiencing robust growth, driven by the increasing preference for convenient online shopping, the rising adoption of e-commerce platforms, and the expanding reach of high-speed internet. This market is projected to reach a substantial size, with a Compound Annual Growth Rate (CAGR) fueling significant expansion over the forecast period of 2025-2033. Key players such as Wayfair, IKEA, and Ashley Furniture are leveraging their established online presence and extensive product catalogs to capture significant market share. The market is segmented by product type (e.g., sofas, beds, dining tables, etc.), price point, and style, catering to diverse consumer preferences and budgets. Furthermore, innovative marketing strategies, including virtual reality showrooms and personalized recommendations, are enhancing the online shopping experience and driving sales.

Several factors contribute to the market's continued growth. Consumers appreciate the ease of browsing a wide selection from the comfort of their homes, comparing prices and features easily, and benefiting from often competitive online pricing. The rising popularity of home renovation and improvement projects is further fueling demand. However, challenges such as concerns about product quality and delivery, difficulties in assessing furniture size and fit without physical inspection, and the potential for longer delivery times compared to brick-and-mortar stores remain. To mitigate these, companies are investing in enhanced customer service, clearer product descriptions, improved logistics, and convenient return policies. The competitive landscape is characterized by both established furniture brands expanding their online presence and specialized online furniture retailers vying for market share, leading to innovation and continuous improvement in the customer experience.

The online household furniture market experienced explosive growth during the 2019-2024 historical period, driven primarily by the shift towards e-commerce and changing consumer preferences. The convenience and accessibility of online shopping, coupled with the vast selection and competitive pricing offered by online retailers, significantly impacted the traditional brick-and-mortar furniture market. This trend is expected to continue throughout the forecast period (2025-2033), albeit at a potentially moderated pace compared to the initial surge. The market witnessed a significant increase in sales volume, reaching an estimated XXX million units in 2025. This growth is not solely attributable to increased online sales but also reflects a general increase in household formation and renovation projects. However, challenges remain, particularly concerning logistical complexities in delivering bulky furniture items, the limitations of online visual representation (e.g., accurate color and texture depiction), and the increasing importance of customer experience, including returns and assembly. The market has also seen a rise in specialized online furniture retailers focusing on specific styles, materials, or price points, leading to increased competition and consumer choice. Furthermore, the integration of augmented reality (AR) and virtual reality (VR) technologies within online platforms is enhancing the online shopping experience, allowing customers to virtually place furniture in their homes before purchasing. This innovation is contributing to higher conversion rates and reduced return rates. The increasing adoption of omnichannel strategies by furniture retailers further blurs the lines between online and offline shopping, offering consumers greater flexibility and choice in how they interact with brands. This trend, combined with continued technological advancements and evolving consumer expectations, will shape the future landscape of the online household furniture market. The estimated year 2025 marks a significant milestone, representing a culmination of past trends and a launchpad for future market evolution. The next decade will see further diversification of product offerings, enhanced online shopping experiences, and the rise of new business models and technologies within this dynamic sector.

Several key factors are driving the growth of the online household furniture market. The most prominent is the unparalleled convenience offered by online shopping. Consumers can browse a vast selection of furniture from the comfort of their homes, compare prices across different retailers, and make purchases at their convenience, eliminating the need for time-consuming trips to physical stores. Secondly, the increased penetration of the internet and mobile devices has significantly broadened the reach of online furniture retailers, enabling access to a much larger customer base. The rising disposable incomes in many parts of the world are fueling increased spending on home furnishings, further contributing to market expansion. Moreover, the affordability and diverse range of products offered online, catering to various budgets and styles, attract a wider customer demographic. Aggressive marketing strategies and promotional offers employed by online retailers are also driving sales. The growth of social media platforms has provided new avenues for brand awareness and engagement, influencing purchasing decisions. Finally, technological advancements, such as AR and VR technology, that enhance the online shopping experience, contribute significantly to driving sales growth. These factors, collectively, are responsible for the significant expansion observed in the online household furniture market and are projected to continue fueling its growth in the coming years.

Despite the significant growth potential, the online household furniture market faces considerable challenges. The primary hurdle is the logistical complexity of delivering bulky and fragile items. Shipping costs can be substantial, and damage during transit remains a significant concern, impacting customer satisfaction and leading to returns. The inability to physically inspect furniture before purchase is another limitation. Accurate color and texture representation online can be difficult, leading to discrepancies between customer expectations and the actual product received. This issue often results in higher return rates, increasing operational costs for retailers. The increasing competition among online retailers necessitates aggressive pricing strategies, potentially impacting profitability. Furthermore, building and maintaining trust with online customers requires a robust customer service infrastructure capable of handling inquiries, resolving issues, and managing returns efficiently. Finally, security concerns related to online transactions and data privacy remain vital factors impacting consumer confidence and purchasing decisions. Overcoming these challenges requires innovative solutions, improved logistics, enhanced online presentation technologies, and a strong commitment to customer satisfaction.

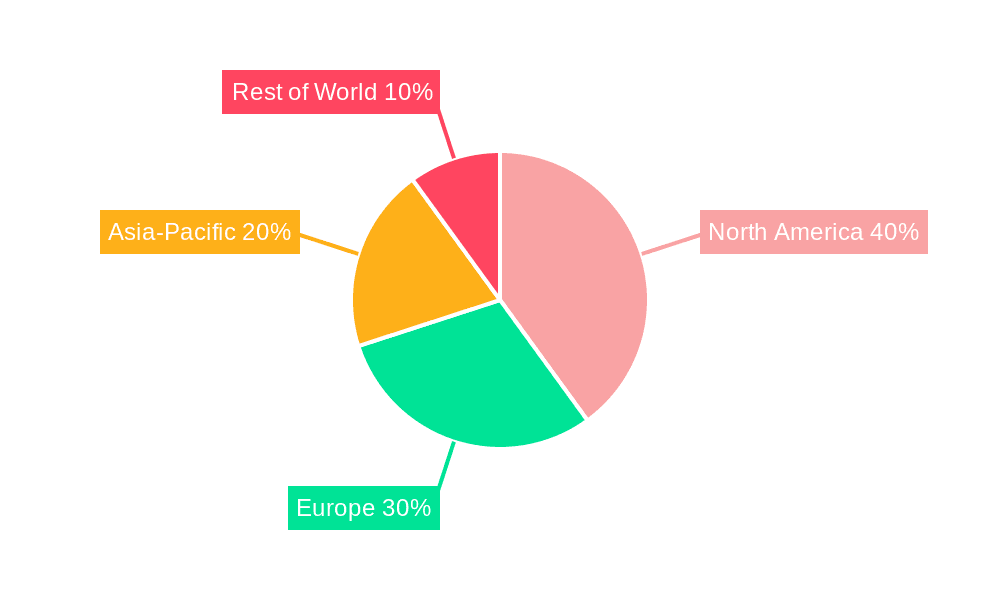

The online household furniture market is geographically diverse, with growth varying across different regions. However, several key regions and segments are expected to dominate the market:

North America (USA & Canada): This region boasts a large and mature e-commerce market, high internet penetration, and substantial disposable incomes, making it a key driver of online furniture sales. The region's established logistics infrastructure further supports this dominance. The prevalence of large online retailers targeting this region is also significant.

Europe (Western Europe especially): Similar to North America, Western European countries exhibit high levels of internet penetration and e-commerce adoption, resulting in a strong online furniture market. Germany, the UK, and France are expected to be leading contributors.

Asia-Pacific (China & India): While still developing in comparison, the Asia-Pacific region exhibits high growth potential, driven by rapidly rising disposable incomes and increasing internet penetration in major markets like China and India. This expansion is heavily influenced by the growth of the middle class and changing lifestyle preferences.

Segment Dominance: The segments showing strong growth include:

The convergence of these regional and segmental factors significantly shapes the overall landscape of the online household furniture market.

Several factors are catalyzing growth in the online household furniture industry. Firstly, the increasing sophistication of online shopping experiences, with features like virtual reality and augmented reality, is dramatically improving the consumer experience and increasing confidence in online purchases. Secondly, the expansion of logistics infrastructure and fulfillment networks is reducing delivery times and costs, making online furniture purchasing more appealing. Thirdly, the rising popularity of home renovation and improvement projects is creating significant demand for furniture upgrades. Finally, the continued growth of e-commerce platforms and their focus on personalized marketing and targeted advertising further fuel sales growth in this sector.

This report provides a comprehensive analysis of the online household furniture market, covering key trends, driving forces, challenges, and growth opportunities. It offers insights into the competitive landscape, profiles key players, and provides detailed regional and segmental analyses, enabling readers to make informed business decisions in this dynamic and rapidly evolving market. The report spans the historical period (2019-2024), the base year (2025), and provides forecasts up to 2033, providing a long-term perspective on market evolution. It utilizes data analysis to highlight key trends and provide quantitative insights into the sector’s size and growth trajectory.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

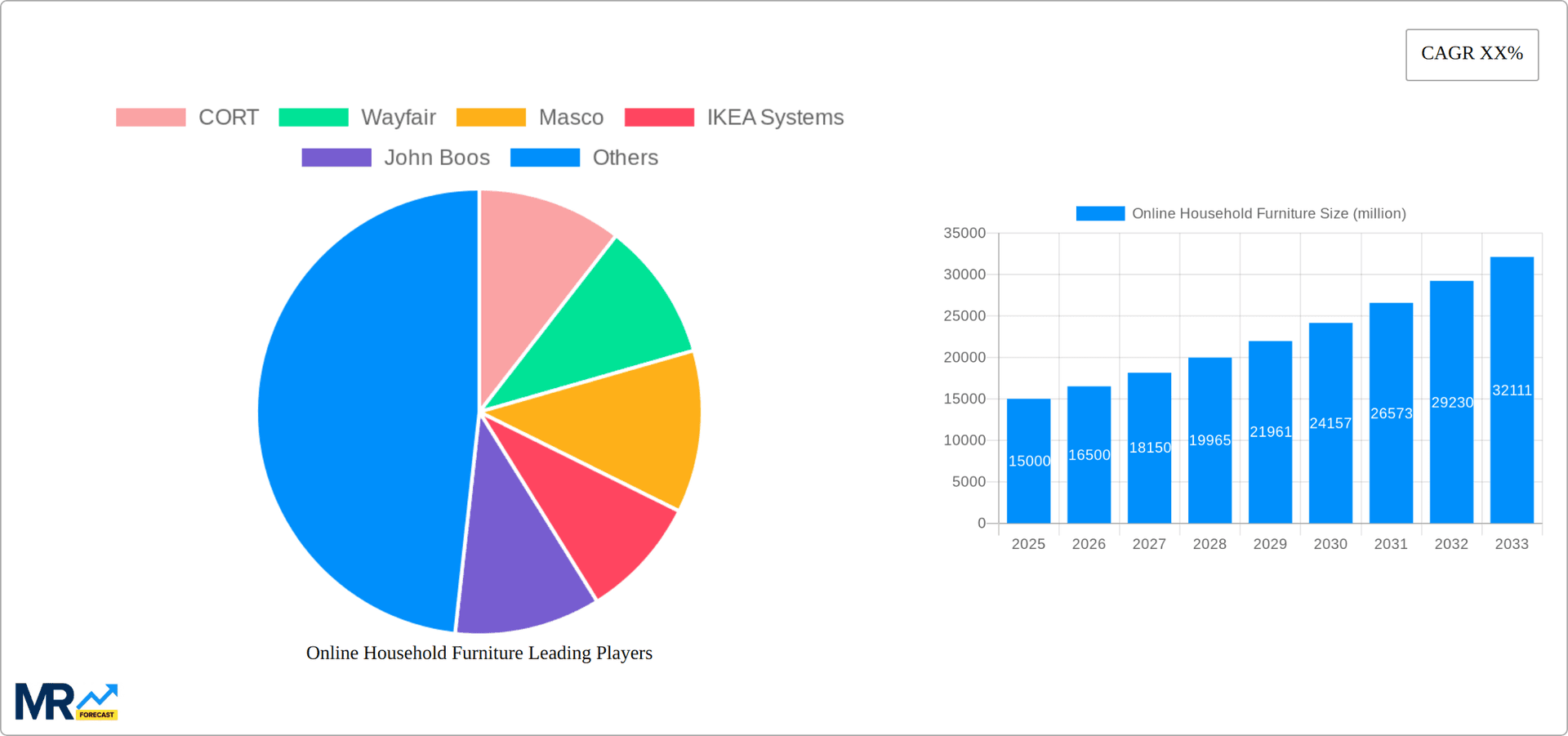

Key companies in the market include CORT, Wayfair, Masco, IKEA Systems, John Boos, MasterBrand Cabinets, Kimball, La-Z-Boy, FurnitureDealer, Steelcase, Rooms To Go, Ashley, Roche Bobois, SICIS, Armstrong Cabinets, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Online Household Furniture," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Household Furniture, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.