1. What is the projected Compound Annual Growth Rate (CAGR) of the Online First-person Shooter Game?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online First-person Shooter Game

Online First-person Shooter GameOnline First-person Shooter Game by Type (Closed Type, Sandbox Type), by Application (Under 18 Years Old, 18-35 Years Old, 35+ Years Old), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

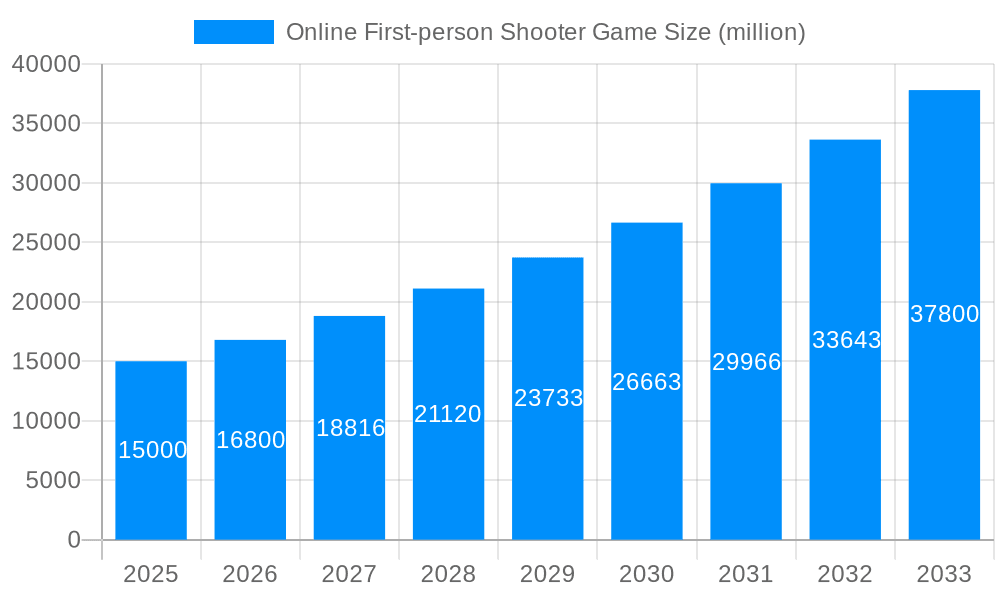

The online first-person shooter (FPS) game market is a dynamic and rapidly evolving sector within the broader gaming industry. Driven by technological advancements such as improved graphics, enhanced online connectivity, and the rise of esports, the market is experiencing significant growth. The increasing popularity of battle royale and competitive FPS titles, coupled with the expanding accessibility of high-speed internet, fuels this expansion. While precise figures are unavailable from the provided data, a reasonable estimation, considering the global gaming market's overall growth and the FPS genre's prominence, suggests a 2025 market size of approximately $15 billion USD. A conservative Compound Annual Growth Rate (CAGR) of 12% from 2025-2033, reflecting market maturation and potential saturation, projects a market value exceeding $45 billion by 2033. Key market segments include closed-type games emphasizing competitive play and sandbox-type games providing greater player freedom, with significant revenue contributions from the 18-35 age demographic. However, the market faces challenges like increasing game development costs, the need for constant content updates to maintain player engagement, and concerns regarding game addiction and violence.

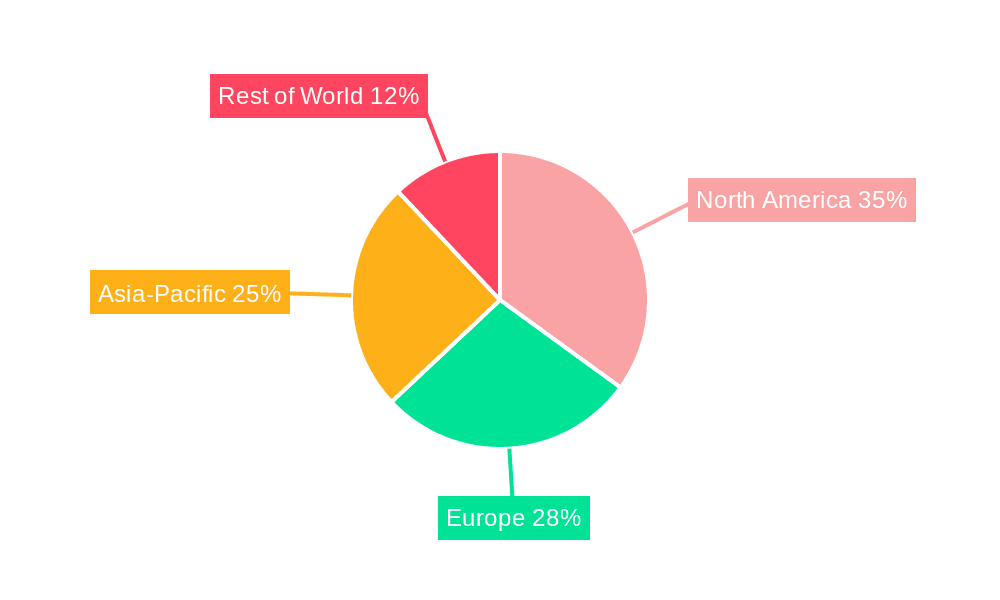

The competitive landscape is dominated by established players like Tencent, EA, Activision Blizzard (implied through presence of similar titles), and Epic Games, each leveraging vast resources and established franchises. However, the market also presents opportunities for smaller, innovative studios focusing on niche genres or unique game mechanics. Geographical distribution shows a strong concentration in North America and Europe, driven by high internet penetration and established gaming cultures. Asia-Pacific, particularly China and India, represent significant growth potential due to the expanding gaming audience and increasing smartphone penetration. The market's future hinges on continued technological innovation, the evolution of game design, and effective management of potential regulatory hurdles related to content and player safety. Strategic partnerships and mergers and acquisitions are likely to reshape the market landscape in the coming years.

The online first-person shooter (FPS) game market experienced explosive growth during the historical period (2019-2024), exceeding several million units sold annually. This surge is attributed to several converging factors, including the increasing affordability and accessibility of high-speed internet, the evolution of gaming hardware (making graphically intensive games more playable), and the rise of esports. The market demonstrates a clear preference for digital distribution, bypassing traditional retail channels, and showcasing the power of online platforms like Steam and various mobile app stores. The period saw a significant shift towards free-to-play (F2P) models, monetized through in-app purchases, battle passes, and cosmetic items. This approach broadened the player base considerably, attracting casual gamers alongside hardcore enthusiasts. While established franchises like Call of Duty and Battlefield maintained their dominance, the emergence of new competitive titles and battle royale games like Fortnite and Apex Legends redefined market dynamics. The estimated year (2025) projects continued strong performance, with a total market value in the hundreds of millions, driven by ongoing technological advancements and the expansion of the global gaming audience. The forecast period (2025-2033) anticipates sustained growth, potentially reaching billions of units sold depending on market saturation and the introduction of revolutionary game mechanics and technologies, such as advancements in VR/AR integration. This report analyzes the market's evolution during the study period (2019-2033), focusing on key trends, driving forces, challenges, and dominant players. This information provides valuable insights for investors, developers, and industry stakeholders seeking to navigate this dynamic and competitive market.

Several key factors are propelling the growth of the online FPS game market. Firstly, the ever-increasing popularity of esports has significantly boosted the visibility and appeal of FPS games, creating a lucrative professional scene that attracts both players and spectators. This competitive aspect further fuels game development and innovation, leading to improved graphics, enhanced gameplay, and more immersive experiences. Secondly, the continuous evolution of gaming technology, including more powerful consoles and PCs, as well as advancements in mobile gaming technology, enables developers to create increasingly realistic and visually stunning games. Thirdly, the free-to-play (F2P) model's widespread adoption has democratized access to these games, allowing a much broader audience to participate, regardless of their financial constraints. This model, combined with the lucrative potential of in-app purchases and microtransactions, has proven remarkably successful in generating substantial revenue. Finally, the rise of social media and streaming platforms has facilitated the organic spread of awareness and excitement around FPS games, with influencers and streamers playing a crucial role in driving engagement and player acquisition. The constant influx of new players, combined with the loyalty of veteran players, guarantees a continually expanding market.

Despite its remarkable growth, the online FPS game market faces several challenges and restraints. Intense competition among established and emerging developers creates a highly competitive environment, necessitating continuous innovation to maintain market share. The need for constant updates and content releases to keep players engaged presents a significant development burden and cost for studios. Maintaining a healthy game balance and preventing exploits is crucial, especially in competitive games, and requires ongoing vigilance and resources. Furthermore, concerns about the potential negative impacts of gaming, such as addiction and violence, lead to regulatory scrutiny and societal pressure, necessitating responsible game design and player engagement strategies. Monetization strategies, while crucial for revenue generation, must be carefully calibrated to avoid alienating players with excessive or unfair in-app purchases. Finally, technological advancements, while beneficial, also create an ongoing need for developers to adapt to evolving platforms and hardware, increasing development complexity and expense. Overcoming these challenges is paramount for sustainable success in the online FPS market.

The online FPS game market is a global phenomenon, but certain regions and segments demonstrate particularly strong growth potential.

Key Regions/Countries:

Dominant Segment: 18-35 Years Old

The online FPS game industry's growth is fueled by several key catalysts, including technological advancements that continuously enhance game graphics and immersive experiences, the expansion of esports, which attracts new players and enhances the overall competitive landscape, and the increasing accessibility of high-speed internet, which connects a global player base. Furthermore, innovative monetization models, such as the free-to-play model, make the games accessible to a broader audience, further boosting growth.

This report provides a comprehensive overview of the online first-person shooter game market, encompassing key trends, growth drivers, challenges, and leading players. It offers detailed market segmentation, focusing on key regions, player demographics, and game types, alongside projections for the future growth of the industry. The report's detailed insights provide valuable information for businesses in the gaming industry, investors, and anyone interested in the future of online gaming.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Tencent Games, Valve, Microsoft, Neowiz, Electronic Arts, Ubisoft Montréal, Nintendo, SQUARE ENIX, Sony Group, EPIC Games, Bandai Namco Holdings Inc, NetEase, Sea Limited, Sohu Changyou, NetDragon, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Online First-person Shooter Game," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online First-person Shooter Game, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.