1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Esports Betting?

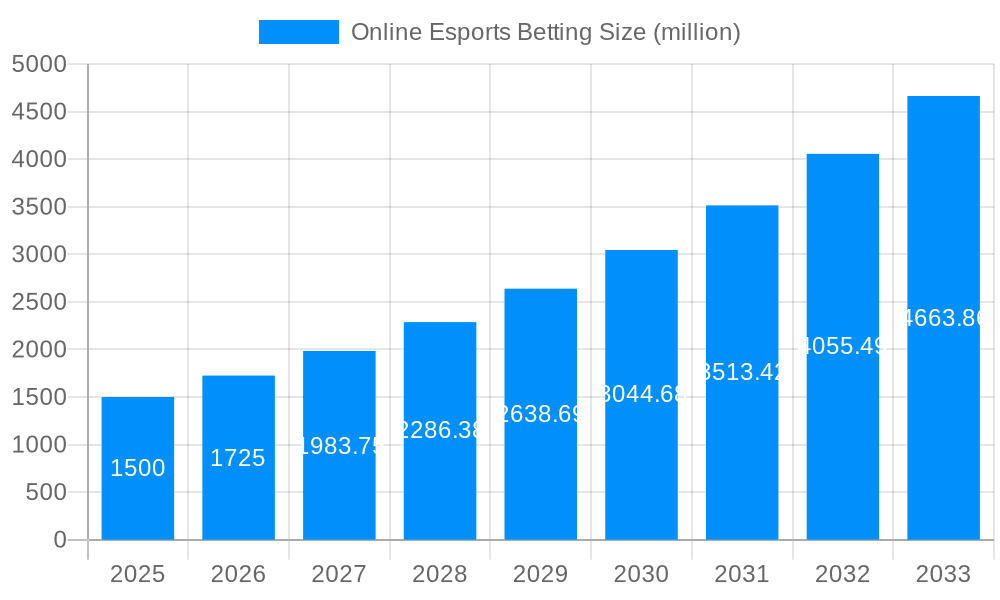

The projected CAGR is approximately 11.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Esports Betting

Online Esports BettingOnline Esports Betting by Type (League of Legends, Dota 2, CS: GO, Others), by Application (Ages 18-25, Ages 26-30, Ages 31 and Above), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global online esports betting market is experiencing rapid growth, fueled by the increasing popularity of esports tournaments and a surge in viewership. While precise figures for market size and CAGR aren't provided, considering the explosive growth of esports and the established online betting industry, a reasonable estimate for the 2025 market size could be $1.5 billion, with a CAGR of 15-20% projected through 2033. Key drivers include the rising popularity of games like League of Legends, Dota 2, and CS:GO, attracting a large and engaged audience ripe for betting. The 18-25 age demographic constitutes a significant portion of this market, mirroring the core esports fanbase. However, growth is not limited to this segment; expansion into the 26-30 and older age groups demonstrates the broadening appeal of competitive gaming and betting. Established betting companies like Entain and 888 Holdings are actively participating, alongside specialized esports betting platforms like GG.BET and Rivalry. North America and Europe currently represent the largest market segments, but significant growth is anticipated in Asia-Pacific regions like China and India as esports continues its global expansion. Regulatory hurdles and concerns around responsible gambling pose potential restraints on market growth, necessitating a balanced approach to regulation and player protection.

The competitive landscape is dynamic, with both established betting giants and dedicated esports betting operators vying for market share. Strategic partnerships between esports organizations and betting platforms are becoming increasingly common, furthering market penetration and brand visibility. The evolution of betting options beyond simple match winners to in-game events and player performance adds another layer of complexity and excitement, driving engagement. The market's success hinges on balancing the thrill of online betting with responsible gaming practices to maintain a sustainable and ethical ecosystem. Technological advancements, such as improved streaming and data analytics, will continue to enhance the overall betting experience and drive further market expansion. Future growth will depend on regulatory frameworks that strike a balance between promoting innovation and mitigating risks associated with gambling.

The online esports betting market is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. Driven by the increasing popularity of esports itself and the accessibility of online betting platforms, the market has shown consistent expansion throughout the historical period (2019-2024). Our study, covering the period 2019-2033, with a base and estimated year of 2025, reveals a significant upward trajectory. The forecast period (2025-2033) anticipates even more substantial growth, fueled by technological advancements, broader regulatory acceptance in key markets, and an expanding viewership base, particularly among younger demographics. Key market insights indicate a clear preference for established esports titles like League of Legends and Dota 2, yet the "Others" category is also demonstrating robust growth as new competitive games gain traction. The 18-25 age group remains the dominant demographic, representing a significant portion of both the viewership and betting market, although older age groups are increasingly participating, highlighting the market’s broadening appeal. The estimated market value in 2025 is projected to be in the hundreds of millions, with billions expected by the end of the forecast period. This growth is not uniform across all regions; specific geographical areas show significantly higher adoption rates than others, driven by factors including existing gambling regulations, internet penetration, and cultural acceptance of esports. The competitive landscape is intensely dynamic, with established betting operators alongside niche esports-focused platforms vying for market share. This report delves into the intricacies of this burgeoning market, providing a comprehensive analysis of its trends, drivers, challenges, and future prospects.

Several key factors are driving the remarkable growth of the online esports betting market. Firstly, the explosive popularity of esports itself provides a massive and engaged audience. Millions of viewers worldwide tune in to watch professional esports competitions, creating a fertile ground for betting activity. Secondly, the ease of access to online betting platforms, available on various devices and operating systems, contributes to the market's expansion. Thirdly, the increasing sophistication of betting options beyond simple match winners, including in-game prop bets and more complex scenarios, adds layers of engagement and attracts a wider range of bettors. Furthermore, the growing acceptance and legalization of online gambling in many jurisdictions are removing significant barriers to entry and fostering market growth. The introduction of innovative technologies, including virtual reality and augmented reality, further enhances the viewing experience and potentially increases betting engagement. Finally, the marketing and promotional activities of esports organizations and betting platforms are successfully attracting new audiences and encouraging participation in the betting ecosystem. The synergistic relationship between esports and online betting is a key catalyst, with each sector benefiting from the other's growth and popularity.

Despite its phenomenal growth, the online esports betting market faces several challenges. Regulatory uncertainty and varying legal frameworks across different countries present a significant hurdle. In some regions, online gambling remains heavily restricted or even illegal, limiting market expansion. Concerns about responsible gambling and the potential for addiction also require careful consideration and proactive measures from operators and regulators. The risk of match-fixing and other forms of fraud poses a substantial threat to the integrity of the market and necessitates robust monitoring and security protocols. Maintaining player trust and ensuring fair play are paramount to long-term market sustainability. Furthermore, the competitive landscape is intensely crowded, with numerous established and emerging operators vying for market share, leading to price wars and reduced profitability for some players. Finally, fluctuations in the popularity of specific esports titles and the potential emergence of competing entertainment forms could impact overall market demand. Addressing these challenges through responsible regulation, ethical practices, and innovative solutions is crucial for the continued healthy growth of the online esports betting industry.

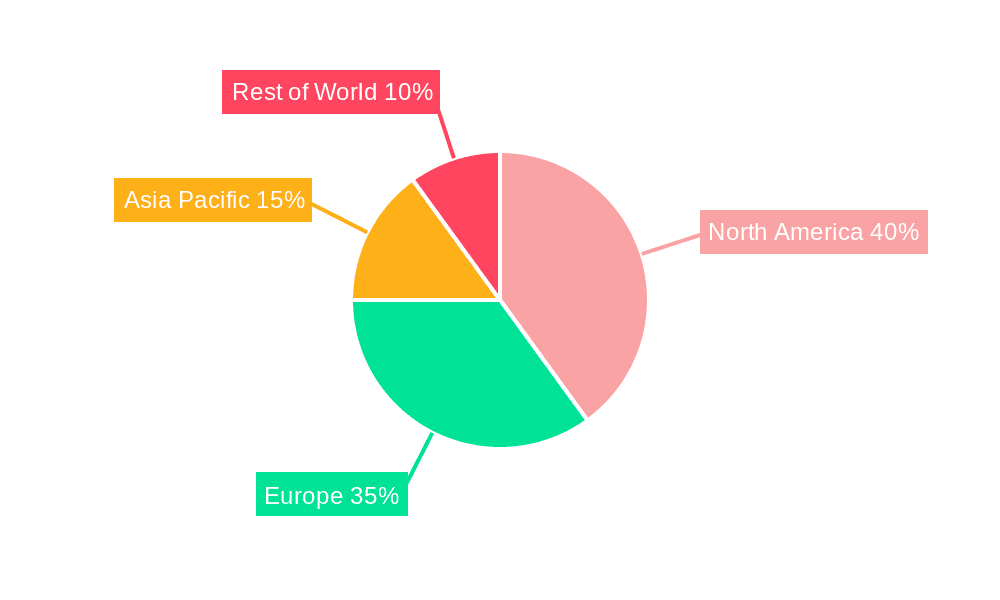

While the global online esports betting market is expanding rapidly, certain regions and segments are poised to dominate.

Key Regions: North America and Europe are expected to maintain their leading positions due to established esports ecosystems, high internet penetration, and relatively permissive gambling regulations. However, the Asia-Pacific region is experiencing rapid growth, with increasing esports viewership and a burgeoning betting market, presenting significant long-term potential.

Dominant Segment (Age): The 18-25 age demographic consistently demonstrates the highest engagement with online esports betting. This group's technological proficiency, disposable income, and inherent interest in esports create a substantial market segment.

Dominant Segment (Game): League of Legends and Dota 2 currently hold significant market share due to their established global following, lengthy competitive histories, and extensive tournament structures that provide abundant betting opportunities. However, other games, such as CS:GO and emerging titles, are also showing strong growth potential.

The dominance of these segments is largely due to a confluence of factors, including established viewership, ease of access to betting platforms, and cultural acceptance of both esports and online gambling. However, other segments, particularly those in emerging markets and involving newer esports titles, show remarkable potential for future growth. Understanding these dynamics is crucial for operators and investors looking to capitalize on the ongoing expansion of the online esports betting market.

The online esports betting market is experiencing phenomenal growth fueled by several key catalysts. The increasing popularity of esports competitions, coupled with technological advancements providing enhanced viewing experiences and diverse betting options, are significant drivers. Furthermore, the expanding regulatory landscape, with many jurisdictions beginning to embrace regulated online gambling, is removing significant market barriers. Finally, the marketing efforts of esports organizations and betting platforms continue to attract new audiences and bolster participation in this burgeoning sector. This synergistic relationship between esports, technology, and regulated gambling is creating a fertile environment for sustained and significant growth.

This report provides a comprehensive analysis of the online esports betting market, offering valuable insights into its current state, future trajectory, and key players. It examines market trends, driving forces, challenges, and growth catalysts, providing a detailed understanding of the industry's dynamics. The report's in-depth coverage includes projections and forecasts for the market's future growth, region-specific analyses, and an assessment of leading companies and their competitive strategies. This allows investors and industry stakeholders to make well-informed decisions.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.9% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 11.9%.

Key companies in the market include Entain, 888 Holdings, Kindred Group, Betsson AB, Betway, Pinnacle, Bet365, Bet-at-home.com, Betfred, BetWinner, Betvictor, GG.BET, Buff.bet, EveryGame, Betcris, Thunderpick, Rivalry, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Online Esports Betting," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Esports Betting, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.