1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Education Service Platform?

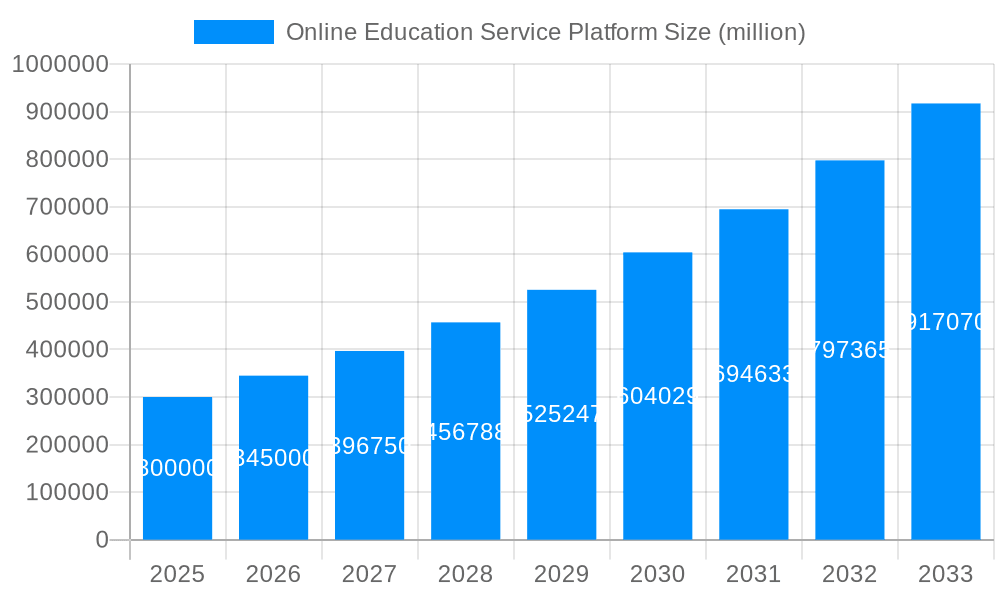

The projected CAGR is approximately 20.39%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Education Service Platform

Online Education Service PlatformOnline Education Service Platform by Type (/> Online Classes, Assessment Exams, Other), by Application (/> University Education, Non-university Education), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The Online Education Service Platform market is poised for significant expansion, driven by widespread internet adoption, the increasing integration of digital learning technologies, and a growing preference for flexible educational solutions. This dynamic market, projected to reach $356.66 billion by 2025, is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 20.39% from 2025 to 2033. Key growth drivers include the escalating demand for upskilling and reskilling to adapt to evolving job markets, the cost-effectiveness and accessibility of online courses, and continuous innovation in ed-tech, such as AI-driven platforms, VR/AR applications, and personalized learning pathways. The market is segmented across K-12 online learning, higher education programs, corporate training, and professional certifications, featuring a competitive landscape of established providers and innovative technology firms.

While the online education sector exhibits strong growth potential, it also faces challenges. These include ensuring digital equity for underserved populations, maintaining stringent quality control standards, and implementing robust cybersecurity measures to safeguard student data. Nevertheless, the market's positive trajectory is supported by the pervasive integration of technology in education and the increasing acceptance of online learning as a credible and effective means of knowledge acquisition. Furthermore, global government initiatives promoting digital literacy and online education are expected to accelerate market expansion. Leading companies are actively investing in advanced technologies and expanding their offerings to meet learner demands and maintain competitive advantage. Future growth will be influenced by technological advancements, improved internet infrastructure, and the continued widespread adoption of online learning solutions.

The online education service platform market experienced explosive growth during the historical period (2019-2024), fueled by the global pandemic and a growing preference for flexible learning options. This trend is projected to continue throughout the forecast period (2025-2033), with the market expected to reach multi-billion dollar valuations. Key market insights reveal a shift towards personalized learning experiences, driven by advanced technologies like AI and machine learning. These technologies are being integrated into platforms to provide customized learning paths, intelligent tutoring systems, and data-driven assessments. Furthermore, the increasing adoption of microlearning modules and gamified learning approaches caters to shorter attention spans and enhances engagement. The market is also witnessing a surge in demand for online certification and professional development courses, reflecting a growing emphasis on upskilling and reskilling in the rapidly evolving job market. The convergence of online learning platforms with corporate learning management systems (LMS) is another significant trend, facilitating seamless integration of professional development opportunities within the workplace. This convergence has led to large enterprises outsourcing a significant portion of their training needs to these platforms. The estimated market value for 2025 sits at several billion dollars, reflecting the significant investment and adoption across various educational sectors, from K-12 to higher education and corporate training. The market's future growth will be shaped by continuous technological advancements, evolving learning preferences, and the increasing recognition of the value of online education in achieving personal and professional goals. The competition is intensifying, with both established players and new entrants vying for market share by offering innovative features, enhanced user experiences, and specialized content.

Several factors are propelling the growth of the online education service platform market. The increasing accessibility and affordability of internet connectivity globally have significantly broadened the reach of online learning, making it accessible to a wider audience. The flexibility and convenience offered by online platforms are particularly attractive to working professionals, students with demanding schedules, and individuals in geographically remote areas. The pandemic served as a catalyst, accelerating the adoption of online learning across all educational levels. Simultaneously, the growing recognition of the importance of lifelong learning and upskilling is driving demand for online courses and certifications. Employers are increasingly valuing candidates with demonstrable online learning credentials, further fueling the market's expansion. Technological advancements, such as the development of immersive learning experiences through virtual reality (VR) and augmented reality (AR), are enhancing engagement and making online learning more interactive and effective. Finally, the expanding range of online courses and programs offered by various providers caters to diverse learning needs and preferences, further stimulating market growth. The cumulative impact of these factors is creating a robust and rapidly expanding market for online education service platforms.

Despite the rapid growth, the online education service platform market faces several challenges and restraints. One significant hurdle is ensuring the quality and credibility of online courses. Maintaining consistent quality control across a vast and diverse range of offerings is a complex task, especially given the emergence of numerous new providers. Concerns about academic integrity and the potential for plagiarism pose a significant challenge, requiring robust measures for authentication and assessment. The digital divide, particularly in developing countries with limited internet access, continues to restrict access to online education for a significant portion of the global population. Furthermore, the effectiveness of online learning is often questioned, particularly regarding the level of student engagement and interaction. Overcoming the challenges associated with online learning necessitates continuous investment in pedagogical research, the development of innovative teaching methods, and the creation of supportive learning environments. The competitive landscape also poses a challenge, with numerous providers vying for market share, requiring constant innovation and adaptation to maintain a competitive edge. Finally, addressing concerns about data privacy and security is crucial for building trust and ensuring responsible use of student data.

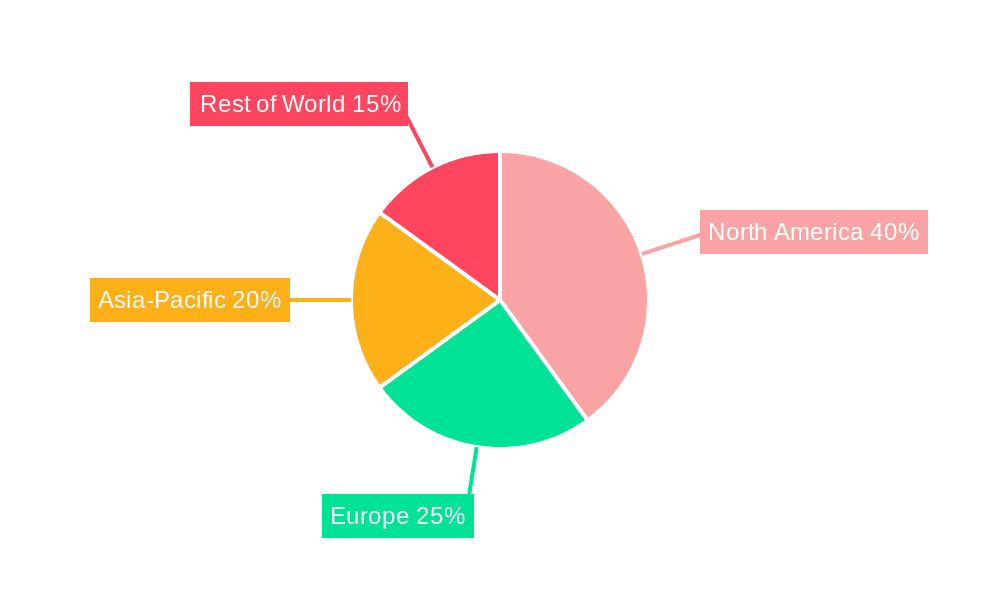

North America and Asia-Pacific: These regions are expected to dominate the market due to high internet penetration, a large tech-savvy population, and substantial investments in the edtech sector. North America holds a strong position owing to its advanced technology infrastructure and well-established online education ecosystem. The Asia-Pacific region exhibits exceptional growth potential, driven by a burgeoning young population, increasing disposable incomes, and rapid technological adoption.

Higher Education Segment: The higher education segment is projected to witness substantial growth due to the increasing adoption of online courses and degree programs, particularly among working professionals. Online learning provides flexibility and convenience, making it a suitable option for those juggling career and education. This segment is also benefiting from increased investment in online learning infrastructure and the development of innovative teaching methodologies.

Corporate Training Segment: The corporate training segment represents a significant driver of market growth. Organizations are increasingly adopting online learning platforms to deliver professional development programs, upskilling initiatives, and compliance training. This shift is being driven by cost-effectiveness, scalability, and the ability to provide training to employees across geographically dispersed locations. This segment offers a substantial and rapidly growing market opportunity for online education service platforms.

K-12 Segment: While this segment might show slower growth than higher education or corporate training, the increased use of online supplemental learning materials, virtual classrooms, and interactive platforms continues to impact the market. As the education system shifts towards the integration of technology, this segment will gradually show an increase in demand.

In summary, the combination of robust growth in North America and Asia-Pacific, alongside the strong demand for online learning across higher education and corporate training, creates a significant and expansive market for online education service platforms. While the K-12 segment shows slower growth, its future contribution cannot be overlooked in light of increased technology adoption within educational institutions.

The online education service platform industry is experiencing rapid growth, propelled by several key catalysts. The increasing demand for flexible and accessible learning options, coupled with technological advancements such as AI-powered personalization and immersive learning experiences, significantly contributes to this growth. Furthermore, the rising adoption of online learning by corporations for employee training and development presents an enormous market opportunity. The growing awareness of the importance of lifelong learning and upskilling among individuals further fuels the demand for online courses and certifications. These factors combined create a highly favorable environment for the continued expansion of the online education service platform market.

This report provides a comprehensive overview of the online education service platform market, encompassing market size estimations, growth forecasts, and key trends across various segments and regions. It analyses the driving forces and challenges impacting market dynamics, profiles leading players, and identifies significant industry developments. This detailed analysis provides valuable insights for stakeholders seeking to understand and navigate this rapidly evolving market. The report covers the historical period (2019-2024), with a base year of 2025 and a forecast period extending to 2033. The data presented offers a thorough understanding of current market conditions and future growth projections, allowing for informed strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.39% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 20.39%.

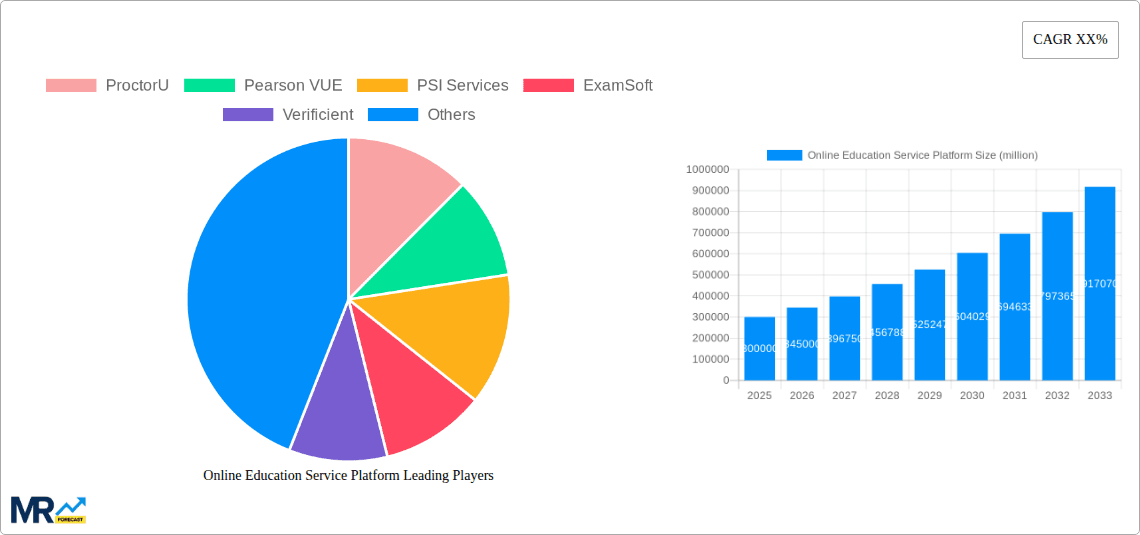

Key companies in the market include ProctorU, Pearson VUE, PSI Services, ExamSoft, Verificient, Respondus, Google Classroom, Udemy, WizIQ, BlackBoard Learn, Coursera, Skillshare, Thinkific, GoToTraining, Trainual, Koolearn Tech, Hujiang, Open Education, TAL Education Group, Gaotu Techedu.

The market segments include Type, Application.

The market size is estimated to be USD 356.66 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Online Education Service Platform," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Education Service Platform, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.