1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Display Advertising Platforms?

The projected CAGR is approximately 13%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Display Advertising Platforms

Online Display Advertising PlatformsOnline Display Advertising Platforms by Type (/> Cloud based, On Premise), by Application (/> Retail, Recreation, Banking, Transportation, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

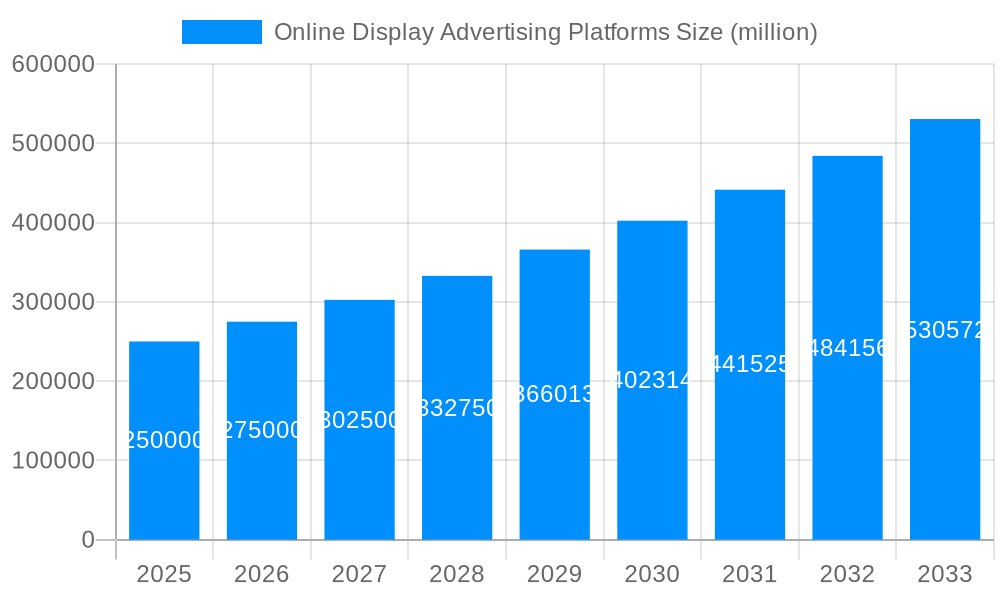

The online display advertising market is poised for significant expansion, projected to reach a substantial size. Driven by key factors such as the widespread adoption of programmatic advertising, the surge in mobile advertising, and the increasing efficacy of data analytics for precise campaign targeting, the market demonstrates robust growth potential. The continuous migration of consumers to digital media platforms, coupled with innovations in ad formats including video and interactive experiences, further accelerates this trend. The market is segmented across advertising platform types, ad formats (banner, video, native), industry verticals, and geographic regions. Intense competition is evident, with industry leaders continuously innovating and specialized platforms striving for market penetration. Key challenges include persistent concerns surrounding ad fraud and data privacy, dynamic regulatory environments, and the imperative to adapt to evolving consumer behaviors and technological advancements. The market is forecasted to grow at a Compound Annual Growth Rate (CAGR) of 13%, reaching a market size of 499.95 billion by 2025.

Looking forward, the online display advertising market will continue its upward trajectory, likely experiencing sustained growth fueled by advancements in artificial intelligence (AI) and machine learning (ML) for sophisticated ad optimization and targeting. The emphasis will increasingly be on delivering highly personalized and contextually relevant advertisements while proactively addressing privacy concerns. The competitive landscape will remain dynamic, shaped by strategic mergers, acquisitions, technological breakthroughs, and shifts in market leadership. Success in this evolving market will depend on the capacity of platforms to offer superior targeting capabilities, demonstrate measurable outcomes, and uphold transparency and ethical practices.

The online display advertising platforms market is experiencing robust growth, projected to reach tens of billions of dollars by 2033. The historical period (2019-2024) witnessed a significant increase in adoption driven by the rising popularity of programmatic advertising and the increasing sophistication of targeting capabilities. The estimated market value in 2025 is in the tens of billions, showcasing the sector's continued expansion. This growth is fueled by several factors, including the increasing penetration of the internet and mobile devices, the rise of e-commerce, and the evolution of advertising technologies. Programmatic buying, which automates the buying and selling of ad inventory, is transforming the industry, allowing for more efficient and targeted campaigns. The ability to precisely target specific demographics, interests, and behaviors is driving increased advertiser investment. Furthermore, the increasing use of data analytics and machine learning is enabling more effective campaign optimization and measurement, resulting in higher return on investment (ROI) for advertisers. While traditional display advertising still holds a significant share, the market is shifting towards video and interactive formats, leading to the development of more engaging and effective advertising experiences. The forecast period (2025-2033) anticipates continued growth, driven by innovation in areas such as augmented reality (AR) and virtual reality (VR) advertising, as well as the continued maturation of the programmatic ecosystem. Competition among platforms remains intense, with established players constantly innovating and new entrants seeking to carve out market share. The market is characterized by a complex ecosystem of publishers, advertisers, ad networks, and technology providers, all vying for a piece of the ever-expanding pie. The study period (2019-2033) encompasses this dynamic evolution and reveals a compelling narrative of sustained market growth and technological advancement.

Several key factors are propelling the growth of online display advertising platforms. Firstly, the continued expansion of the internet and mobile usage provides a vast and expanding audience for advertisers. With billions of people online globally, the reach of online display advertising is unparalleled. Secondly, the increasing sophistication of targeting technologies allows advertisers to reach highly specific demographics and interests with unprecedented accuracy. This precision targeting significantly improves the effectiveness and ROI of advertising campaigns. Thirdly, the rise of programmatic advertising streamlines the buying and selling process, making it more efficient and cost-effective for both advertisers and publishers. This automation also enables real-time optimization and data-driven decision-making. Fourthly, the proliferation of data analytics and machine learning capabilities helps advertisers better understand consumer behavior and optimize campaigns for maximum impact. This data-driven approach is transforming the industry, making it more precise and effective. Finally, the growing importance of video and interactive advertising formats enhances engagement and improves the overall user experience. These dynamic ad formats are capturing increased attention and leading to better campaign performance. The convergence of these factors is creating a positive feedback loop, driving further investment and innovation in the online display advertising platforms market.

Despite its significant growth, the online display advertising platforms market faces several challenges and restraints. Ad blocking software remains a significant obstacle, reducing the reach of online advertisements. Consumers increasingly employ ad blockers to mitigate intrusive ads, impacting the effectiveness of campaigns. The increasing prevalence of ad fraud poses another threat, with malicious actors seeking to generate fraudulent impressions and clicks, wasting advertisers' budgets. Furthermore, data privacy concerns and regulations like GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act) are impacting the way advertisers collect and use consumer data, limiting targeting capabilities and increasing compliance costs. The complexity of the ecosystem, with numerous platforms and technologies, can also create challenges for advertisers seeking to manage their campaigns effectively. The need to navigate multiple vendors and integrate different technologies can be resource-intensive. Finally, maintaining consumer trust and avoiding negative brand perception due to intrusive or irrelevant advertising remains a crucial concern for both advertisers and platform providers. Addressing these challenges will require ongoing innovation in areas such as ad format design, fraud detection, data privacy, and platform usability.

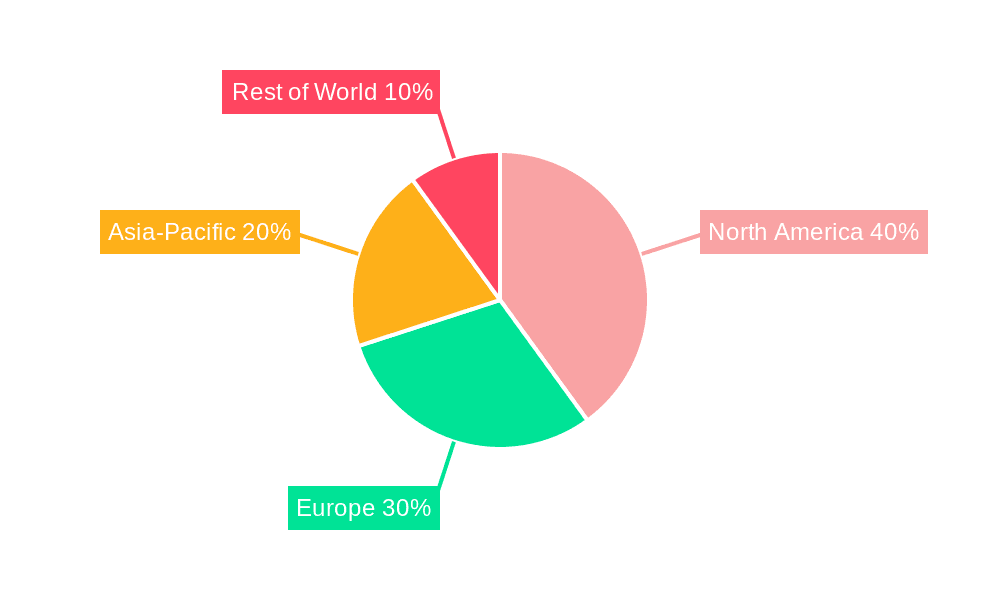

North America: The North American market, particularly the United States, is expected to maintain its dominant position, driven by high internet penetration, advanced advertising technologies, and significant advertiser spending. The region’s large and affluent consumer base, coupled with a mature digital advertising ecosystem, makes it a prime market for online display advertising.

Asia-Pacific: This region is experiencing rapid growth, fueled by the rising number of internet users and increasing smartphone penetration in countries like China and India. This represents a substantial opportunity for display advertising platforms, though regulatory landscapes and digital literacy levels vary significantly across the region.

Europe: While slightly slower than North America and parts of Asia-Pacific, Europe’s market is growing steadily. However, stringent data privacy regulations like GDPR continue to influence the market dynamics.

Programmatic Advertising: This segment is projected to hold the largest share of the market. The automation and efficiency offered by programmatic buying attract advertisers seeking streamlined campaign management and improved ROI. This technology makes it possible to reach highly specific audiences with targeted messaging.

Video Advertising: The increasing popularity of online video consumption fuels the growth of this segment. Video ads offer an engaging and visually rich format that resonates well with consumers, making it a highly sought-after advertising option. The emergence of technologies like in-stream and out-stream video advertising further propels this segment.

Mobile Advertising: With the widespread use of smartphones and tablets, mobile advertising has become a vital component of online display advertising. The ability to reach consumers on their mobile devices at any time, anywhere, makes mobile a powerful and highly effective medium.

In summary, North America will continue to lead in overall spending, but the Asia-Pacific region is poised for significant growth due to its expanding digital population and burgeoning e-commerce sector. Programmatic buying and video advertising segments will see the fastest growth rates due to increasing efficiency and audience engagement.

The online display advertising industry is experiencing significant growth catalyzed by several factors including increased internet penetration and mobile usage, the sophistication of targeting technologies enabling precision audience reach, and the adoption of programmatic advertising for streamlined efficiency and data-driven optimization. These advancements, coupled with the increasing use of video and interactive ad formats, further enhance user engagement and advertising effectiveness, resulting in substantial market expansion.

This report provides a comprehensive overview of the online display advertising platforms market, covering historical trends, current market dynamics, and future growth projections. It offers in-depth analysis of key market segments, leading players, and emerging technologies, providing valuable insights for businesses operating in or considering entry into this dynamic sector. The report's findings are based on extensive research, including data analysis and interviews with industry experts. It serves as a crucial resource for stakeholders seeking a comprehensive understanding of the market landscape and future growth opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 13%.

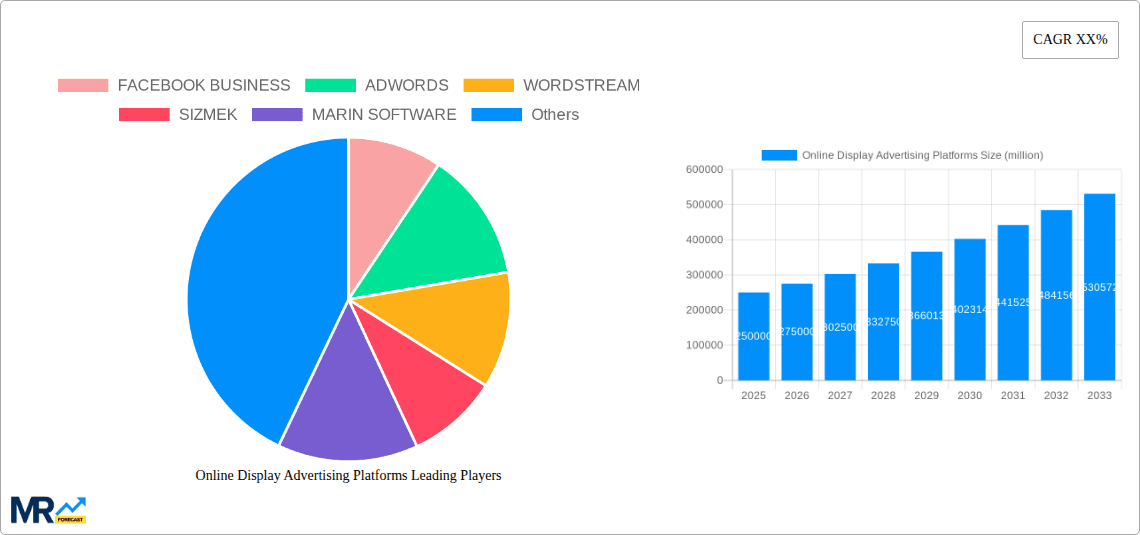

Key companies in the market include FACEBOOK BUSINESS, ADWORDS, WORDSTREAM, SIZMEK, MARIN SOFTWARE, DATAXU, Yahoo Gemini, MediaMath, Adobe Media Optimizer, Quantcast Advertise, Choozle, Acquisio, The Trade Desk, Flashtalking.

The market segments include Type, Application.

The market size is estimated to be USD 499.95 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Online Display Advertising Platforms," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Display Advertising Platforms, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.