1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Course Providers?

The projected CAGR is approximately 18.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Course Providers

Online Course ProvidersOnline Course Providers by Type (Cloud Based, Web Based), by Application (Large Enterprises, SMEs), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The online course market is demonstrating substantial growth, propelled by a rising demand for adaptable and accessible educational solutions. Projected to reach $30.92 billion by 2025, the market is expected to expand at a Compound Annual Growth Rate (CAGR) of 18.4%. This expansion is attributed to the increasing adoption of online learning for professional development and corporate upskilling, the growing availability of diverse course content, and technological advancements that enhance user experience through interactive and personalized learning platforms. The market is segmented by delivery mode, including cloud-based and web-based solutions, and by target audience, encompassing large enterprises and Small and Medium-sized Enterprises (SMEs). Cloud-based platforms are increasingly favored for their scalability and accessibility, with large enterprises being key consumers for talent management and organizational development.

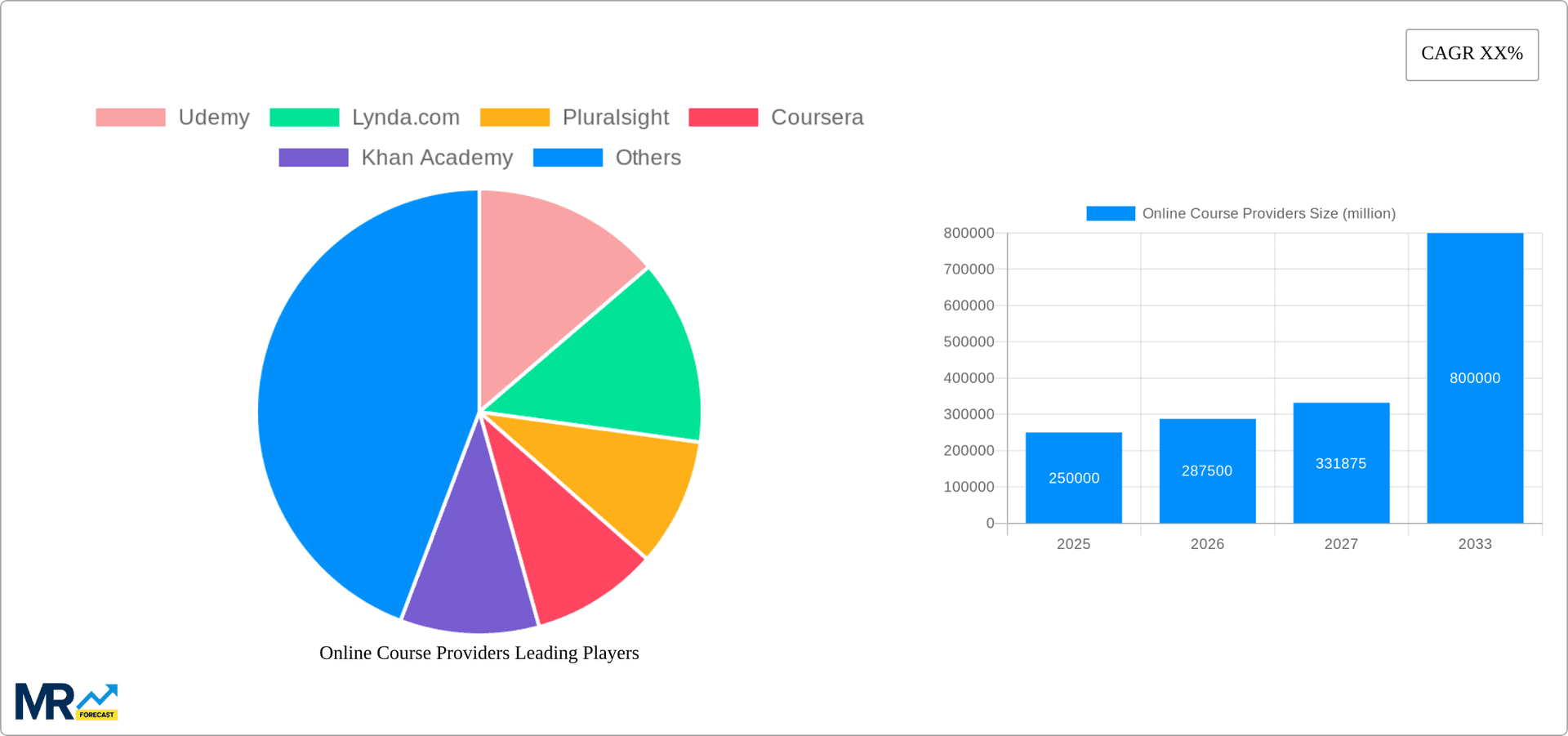

Key market trends include the rising popularity of microlearning, personalized learning journeys, gamified educational approaches, and the integration of artificial intelligence for adaptive learning and tailored feedback. Although potential restraints include concerns regarding online certification credibility and the digital divide, the market's outlook remains highly optimistic. Leading players such as Udemy, Coursera, and Pluralsight are driving innovation and market expansion, while specialized platforms cater to niche skill requirements. Geographic growth is anticipated globally, with North America and Europe currently holding substantial market shares, and the Asia-Pacific region expected to experience significant expansion due to increased internet penetration and a growing young demographic.

The online course provider market experienced explosive growth between 2019 and 2024, driven by the increasing demand for flexible and accessible learning solutions. This trend is projected to continue throughout the forecast period (2025-2033), with the market expected to reach multi-billion dollar valuations. The historical period (2019-2024) saw a significant shift towards online learning, accelerated by the COVID-19 pandemic, which forced educational institutions and businesses to adopt remote learning strategies. This led to a surge in user adoption across various segments, including large enterprises, SMEs, and individual learners. Key market insights reveal a growing preference for cloud-based and web-based platforms offering a wide range of courses, from professional development to hobbyist interests. The market is becoming increasingly competitive, with established players facing challenges from new entrants offering innovative features and specialized content. Furthermore, the integration of artificial intelligence (AI) and personalized learning technologies is transforming the learning experience, leading to improved engagement and knowledge retention. The demand for upskilling and reskilling initiatives across industries fuels this growth, with businesses investing heavily in employee training and development through online platforms. This trend is particularly pronounced in the technology sector, where the demand for specialized skills like data science and software development drives the adoption of online courses. The rise of micro-learning, offering bite-sized learning modules, further enhances accessibility and caters to busy professionals. Finally, the increasing adoption of subscription-based models provides a predictable revenue stream for providers and affordable access for learners. The base year for this analysis is 2025, with estimations and projections extending to 2033, providing a comprehensive view of the market's trajectory.

Several factors are fueling the rapid expansion of the online course provider market. The accessibility and flexibility offered by online courses are primary drivers, catering to learners with diverse schedules and geographical locations. Unlike traditional classroom settings, online learning allows individuals to learn at their own pace, revisiting materials as needed and focusing on areas requiring more attention. The affordability of many online courses compared to traditional educational programs is another significant factor, making them accessible to a wider audience, including those in developing economies. The diverse range of courses available, covering numerous subjects and skill levels, contributes to the market's expansion, meeting the diverse needs of learners. The increasing demand for upskilling and reskilling, driven by rapid technological advancements and evolving job market demands, is a crucial driver, with individuals and organizations actively seeking online platforms to enhance their skills and remain competitive. The integration of innovative technologies, such as AI-powered personalized learning platforms and gamification techniques, enhances the learning experience and increases learner engagement, further contributing to market growth. Finally, the robust marketing and distribution channels employed by many online course providers, leveraging social media and search engine optimization, have broadened their reach and increased brand visibility, leading to greater market penetration.

Despite its rapid growth, the online course provider market faces several challenges. Maintaining the quality and relevance of course content is crucial, as outdated or inaccurate information can detract from the learning experience and damage the provider's reputation. Ensuring effective assessment and certification mechanisms is critical to validating the skills and knowledge gained through online courses, addressing concerns about credibility compared to traditional education. The high competition within the market requires continuous innovation and adaptation to retain existing users and attract new ones. The issue of digital literacy and access to technology remains a barrier for some potential learners, particularly in developing regions with limited internet connectivity or digital skills. Protecting intellectual property rights and preventing piracy are ongoing concerns for course providers, requiring robust measures to safeguard their content. Finally, managing learner expectations and providing adequate support and interaction are essential to ensure a positive learning experience. Addressing these challenges requires a multifaceted approach, incorporating technological advancements, rigorous quality control mechanisms, and strategic marketing strategies to enhance the overall value proposition and expand market reach.

The online course provider market demonstrates significant regional variations, with North America and Europe currently holding leading positions, driven by high internet penetration, strong digital literacy rates, and a robust culture of lifelong learning. However, the Asia-Pacific region is poised for substantial growth, fueled by increasing internet access, a large young population eager to upskill, and a booming tech industry. Within market segments, the SME (Small and Medium-sized Enterprises) segment is projected to experience significant growth due to the increasing need for employee training and development, especially in areas such as digital marketing, software development, and customer service. SMEs often have limited budgets and resources for traditional training programs, making cost-effective online courses a highly attractive option. The affordability and flexibility of online courses allow SMEs to easily adapt training programs to their changing needs and budget constraints, providing a scalable and efficient way to upskill their workforce. The cloud-based delivery model is also proving highly popular within the SME segment, offering flexibility, accessibility, and scalability, eliminating the need for expensive on-site infrastructure. Additionally, the ability to track employee progress and learning outcomes through online platforms provides invaluable insights into training effectiveness. The combination of these factors points to the SME segment's continued dominance in the online course provider market in the coming years.

The online course provider industry is propelled by several key growth catalysts. These include the increasing demand for upskilling and reskilling, driven by technological advancements and a rapidly evolving job market. Affordability and accessibility of online courses compared to traditional education are significant factors. The flexibility and convenience of online learning cater to diverse learners with varying schedules and locations. Furthermore, the integration of innovative technologies, such as AI-powered personalized learning and gamification, enhances the learning experience. The expanding range of course offerings, encompassing diverse subjects and skill levels, caters to a wide audience, increasing market penetration.

This report provides a comprehensive analysis of the online course provider market, covering historical data (2019-2024), current estimations (2025), and future projections (2025-2033). It delves into market trends, driving forces, challenges, and key players, providing valuable insights for businesses and stakeholders operating within this dynamic industry. The report also identifies key regions and segments poised for significant growth, offering strategic recommendations for success in this competitive landscape.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.4% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 18.4%.

Key companies in the market include Udemy, Lynda.com, Pluralsight, Coursera, Khan Academy, HubSpot, Codecademy, ITProTV, iHASCO, General Assembly, EdX, Envato Tuts+, Code School, DataCamp, Dataquest, .

The market segments include Type, Application.

The market size is estimated to be USD 30.92 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Online Course Providers," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Course Providers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.