1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Course for Corporate?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Course for Corporate

Online Course for CorporateOnline Course for Corporate by Type (Academic Subjects, Career Development, It Operations, Computer Programming, Others), by Application (Small Businesses, Mid-size Business, Large Enterprises), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

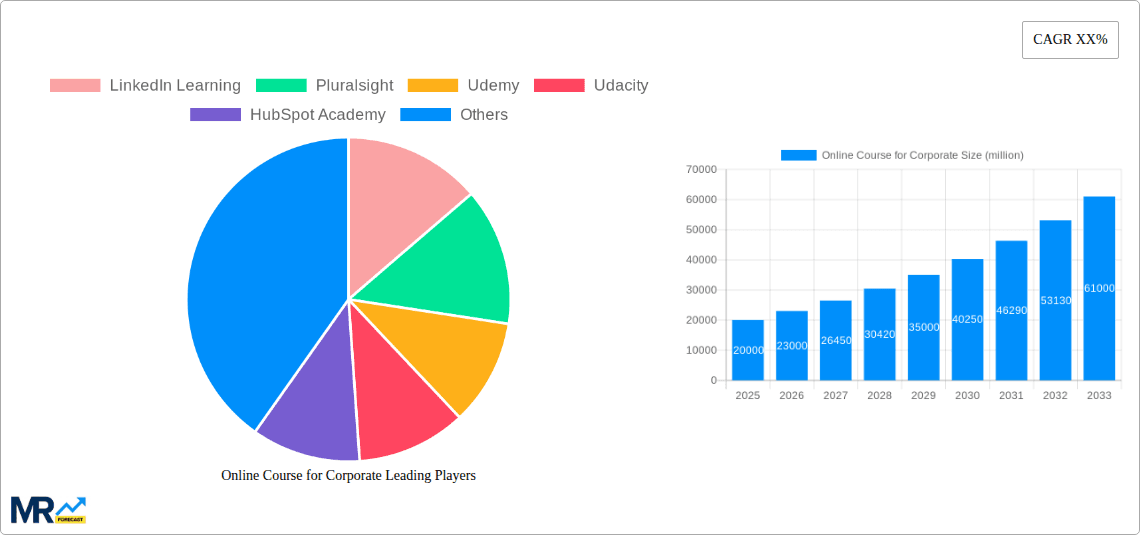

The online corporate training market is experiencing robust growth, driven by the increasing need for upskilling and reskilling initiatives within organizations of all sizes. The market, estimated at $25 billion in 2025, is projected to experience a Compound Annual Growth Rate (CAGR) of 15% from 2025 to 2033, reaching approximately $80 billion by 2033. This expansion is fueled by several key factors. Firstly, the rise of remote work and hybrid work models necessitates accessible and flexible training solutions. Secondly, the rapid technological advancements across industries demand continuous employee development to maintain competitiveness. Thirdly, organizations are increasingly recognizing the return on investment (ROI) associated with well-trained employees, leading to increased budgetary allocations for online corporate training programs. The market segments are diverse, catering to academic subjects, career development, IT operations, computer programming, and other specialized areas, serving small businesses, mid-sized enterprises, and large corporations alike. Leading players like LinkedIn Learning, Pluralsight, and Coursera are capitalizing on this growth through innovative course offerings and strategic partnerships.

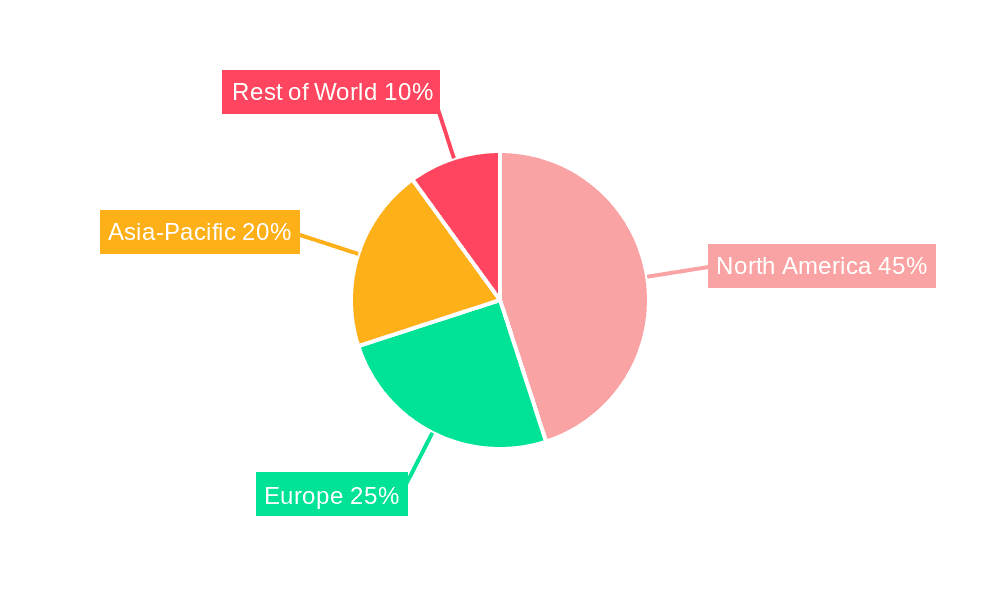

Geographic distribution shows a strong concentration in North America and Europe, driven by higher adoption rates and a well-established technology infrastructure. However, emerging markets in Asia-Pacific and the Middle East & Africa are exhibiting significant growth potential, presenting opportunities for expansion and market penetration. While challenges exist, such as ensuring effective learning outcomes and addressing the digital literacy gap in some regions, the overall market outlook remains positive. The industry is expected to consolidate further, with larger players acquiring smaller companies to enhance their offerings and expand their market reach. This consolidation will likely lead to increased competition and innovation within the online corporate training landscape. Furthermore, the integration of artificial intelligence and personalized learning experiences will further enhance the effectiveness and appeal of these programs.

The online corporate training market is experiencing explosive growth, projected to reach multi-million dollar valuations by 2033. From 2019 to 2024 (historical period), the market witnessed significant adoption driven by increasing digitalization and the need for upskilling and reskilling initiatives within organizations. The estimated market value in 2025 (base and estimated year) is already substantial, with projections indicating a compound annual growth rate (CAGR) that will propel the market into the billions by the end of the forecast period (2025-2033). This growth is fueled by several key factors: the increasing availability of high-quality online learning platforms, a shift towards remote and hybrid work models demanding flexible training solutions, and a growing recognition of the return on investment (ROI) associated with upskilling employees. Key market insights reveal a strong preference for platforms offering specialized courses aligned with specific industry needs, and a rising demand for personalized learning experiences tailored to individual employee skill gaps. The integration of advanced technologies like AI and gamification further enhances the appeal of online corporate training, improving engagement and knowledge retention. This trend is expected to continue, with businesses of all sizes – from small businesses to large enterprises – increasingly incorporating online learning into their employee development strategies. Competition among providers is fierce, encouraging innovation and the development of more sophisticated and effective learning methodologies. The market shows a clear trend towards a blended learning approach, combining online modules with in-person training or mentorship to maximize effectiveness. Data analytics are also playing a significant role, enabling companies to track training outcomes and measure the impact of online learning programs on employee performance and overall business results. This data-driven approach is further driving investment in and adoption of online corporate training solutions.

Several powerful forces are driving the expansion of the online corporate training market. The most significant is the need for continuous upskilling and reskilling. In today's rapidly evolving technological landscape, employees must constantly adapt to new tools, technologies, and methodologies to remain competitive. Online courses provide a flexible and cost-effective solution for organizations to meet this need, offering a wide range of subjects and training modalities to cater to diverse employee skill requirements. The rise of remote and hybrid work models has also significantly contributed to the market's growth. With employees working remotely or in hybrid settings, access to traditional in-person training becomes limited. Online courses offer a convenient and accessible alternative, allowing employees to learn at their own pace and time, regardless of location. Furthermore, the cost-effectiveness of online training compared to traditional methods is a major advantage. Online courses often eliminate the expenses associated with travel, venue rental, and instructor fees, making them an attractive option for organizations of all sizes, especially smaller businesses with limited budgets. Finally, the increasing focus on data-driven decision-making in HR and training departments is bolstering the adoption of online learning platforms. Many platforms offer robust analytics dashboards, enabling businesses to track learner progress, assess the effectiveness of training programs, and measure ROI, providing a clear demonstration of the value of online training investments.

Despite the significant growth, challenges and restraints exist within the online corporate training market. One major challenge is ensuring learner engagement and knowledge retention. Unlike traditional in-person training, online courses require learners to be self-motivated and disciplined to complete the training effectively. Maintaining high levels of engagement requires innovative teaching methodologies, interactive content, and gamified elements. Another significant hurdle is the issue of digital literacy and access to technology. Not all employees possess the same level of digital proficiency, and access to reliable internet connectivity can be a barrier for some. Organizations need to address these issues by providing appropriate technical support and ensuring equitable access to technology and training resources for all employees. Furthermore, the sheer volume of online courses available can be overwhelming, making it difficult for companies to select the most appropriate and effective programs for their employees. Careful evaluation of course quality, relevance, and alignment with specific business needs is crucial. The security and confidentiality of sensitive company data used in online training programs also pose a concern. Robust cybersecurity measures are essential to protect against data breaches and ensure compliance with relevant regulations. Finally, effectively integrating online training into existing learning and development strategies can be challenging. Successful implementation requires careful planning, communication, and ongoing support from management and HR departments.

The North American market, specifically the United States, is currently a dominant player in the online corporate training sector, driven by high technology adoption rates, a robust economy, and a strong focus on continuous employee development. However, other regions such as Europe and Asia-Pacific are showing significant growth potential, particularly in countries with large and rapidly expanding tech sectors.

Large Enterprises: This segment is expected to be a key driver of market growth due to their larger budgets and increased need for continuous employee upskilling and reskilling across multiple departments and skillsets. Large enterprises can leverage the scale and efficiency of online learning platforms to train a large workforce effectively and cost-efficiently. Their significant resources allow for investment in high-quality, specialized training programs and sophisticated learning management systems (LMS).

IT Operations: The rapid advancement of technology and the increasing reliance on digital systems within organizations have fueled the demand for specialized IT training. This segment benefits from online training due to the ever-changing nature of IT technologies. The dynamic nature of IT mandates continuous learning for employees to stay abreast of current and upcoming technologies. Online courses allow for just-in-time training and readily available updates on evolving techniques.

The growth of cloud computing has further propelled the demand for IT Operations training, with companies needing employees proficient in cloud-based infrastructure management, cybersecurity, and data analytics.

Paragraph: The convergence of a technologically advanced workforce in North America, particularly within large enterprises, and the burgeoning demand for IT operations expertise positions this combination as the key segment dominating the market. The agility and cost-effectiveness of online training solutions perfectly align with the needs of large organizations striving to maintain a competitive edge in the rapidly evolving IT landscape. The scalability and accessibility of online platforms allow for the efficient training of large teams, addressing the immediate and long-term skill gaps within IT departments. The clear return on investment (ROI) from improved employee proficiency and reduced operational inefficiencies further solidifies the position of this sector as a significant driver of market growth.

Several factors are catalyzing growth in the online corporate training industry. The rising adoption of cloud-based learning management systems (LMS) is streamlining training delivery and administration. The integration of artificial intelligence (AI) is personalizing the learning experience, improving engagement, and optimizing training outcomes. Government initiatives promoting digital literacy and workforce development are also significantly contributing to market expansion. The increasing emphasis on data-driven decision-making in HR and training departments underscores the value of online training platforms that offer robust analytics dashboards and reporting capabilities. Finally, the ongoing need for continuous upskilling and reskilling in a rapidly changing technological environment ensures a consistently high demand for online corporate training solutions.

The online corporate training market is poised for continued significant growth throughout the forecast period, driven by several factors including the need for continuous employee upskilling, the rise of remote work, and the cost-effectiveness of online training solutions. The market's expansion is further fueled by technological advancements such as AI-powered personalized learning and the adoption of cloud-based LMS, improving learning efficacy and ROI measurement. The continued expansion into diverse industry sectors and geographic regions, along with an increasing focus on measuring training impact, ensures the sustained growth of this dynamic market segment.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include LinkedIn Learning, Pluralsight, Udemy, Udacity, HubSpot Academy, Coursera, A Cloud Guru, CBT Nuggets, Infosec Skills, ITProTV, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Online Course for Corporate," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Course for Corporate, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.