1. What is the projected Compound Annual Growth Rate (CAGR) of the Oleyl Lactate?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Oleyl Lactate

Oleyl LactateOleyl Lactate by Type (>99% Purity, ≤99% Purity, World Oleyl Lactate Production ), by Application (Hair Care, Skin Care, Others, World Oleyl Lactate Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

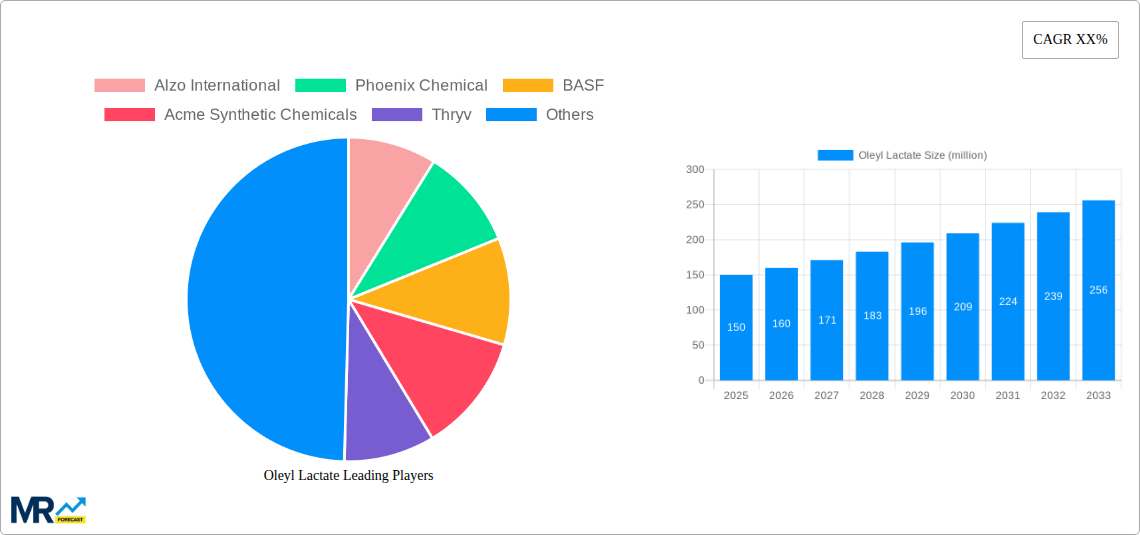

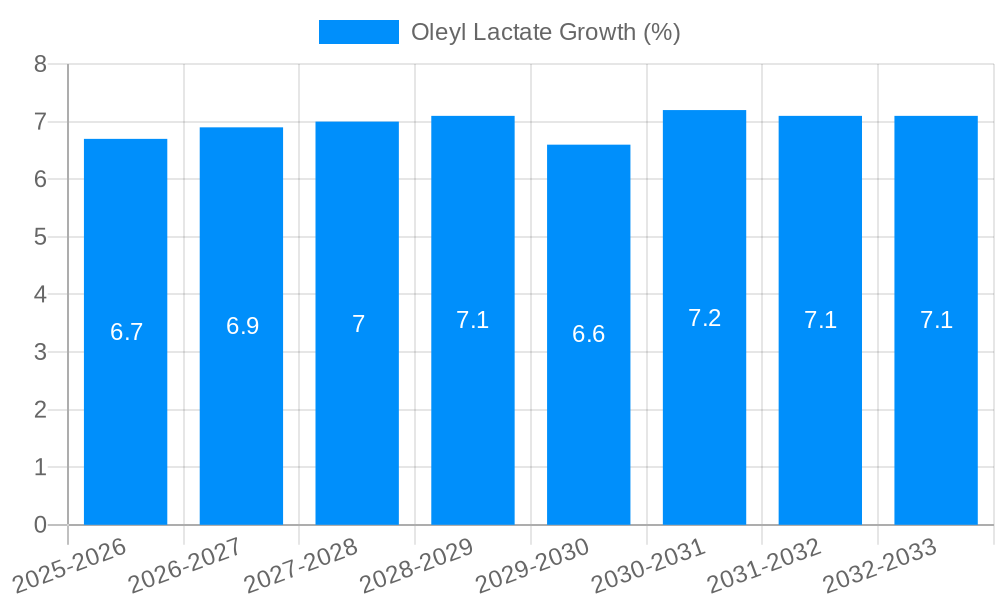

The global Oleyl Lactate market is poised for significant expansion, projected to reach an estimated USD 150 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.5% anticipated between 2025 and 2033. This growth trajectory is primarily propelled by the escalating demand for natural and sustainable ingredients in the personal care industry. Oleyl lactate's emollient, moisturizing, and skin-conditioning properties make it a highly sought-after component in cosmetic formulations, particularly in hair care and skin care products. The increasing consumer preference for gentle, biodegradable, and effective cosmetic ingredients is a key driver, pushing manufacturers to incorporate oleyl lactate into their product lines. Furthermore, advancements in production technologies that enhance purity and reduce manufacturing costs are contributing to its wider adoption across various applications. The market's value is expected to climb steadily, driven by innovation and a growing awareness of oleyl lactate's benefits among both consumers and formulators.

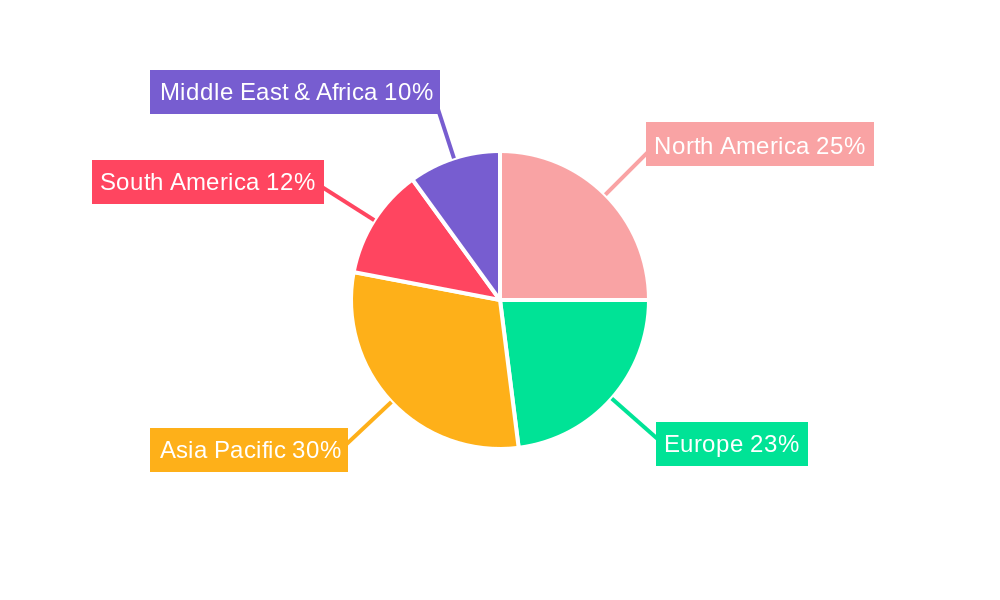

Despite the promising outlook, certain factors could moderate the market's growth. The availability and price fluctuations of raw materials, oleyl alcohol and lactic acid, could present challenges. Additionally, stringent regulatory landscapes in different regions, while ensuring product safety, can sometimes slow down the introduction of new formulations or ingredients. However, the overarching trend towards clean beauty and the inherent biodegradability of oleyl lactate are expected to outweigh these restraints. The market is segmented by purity levels, with >99% purity catering to premium applications and ≤99% purity serving broader cosmetic needs. Geographically, the Asia Pacific region, particularly China and India, is emerging as a significant growth hub due to its rapidly expanding middle class and increasing disposable incomes, fueling demand for high-quality personal care products. North America and Europe continue to be mature yet stable markets with a strong emphasis on advanced formulations and sustainable ingredients.

This report provides a comprehensive analysis of the global Oleyl Lactate market, encompassing market trends, driving forces, challenges, regional dominance, growth catalysts, key players, significant developments, and an in-depth overview of the market's future trajectory. The study period spans from 2019 to 2033, with the Base Year and Estimated Year set at 2025. The Forecast Period extends from 2025 to 2033, building upon the Historical Period of 2019-2024. We project World Oleyl Lactate Production to reach significant figures within this timeframe, estimated in the million unit.

The Oleyl Lactate market is exhibiting dynamic trends shaped by evolving consumer preferences and technological advancements within the cosmetics and personal care industries. A key insight is the growing demand for high-purity Oleyl Lactate, particularly the >99% Purity segment. This is driven by formulators seeking premium ingredients that offer superior performance, stability, and a more refined sensory experience in their final products. Consumers are increasingly scrutinizing ingredient lists, and the prevalence of naturally derived and high-quality components like Oleyl Lactate is becoming a significant purchasing factor. The ≤99% Purity segment, while still relevant for certain cost-sensitive applications, is experiencing a relative slowdown in growth as manufacturers pivot towards higher-grade alternatives.

Geographically, the Asia-Pacific region is emerging as a significant hub for both production and consumption, fueled by a burgeoning middle class with increasing disposable incomes and a heightened awareness of skincare and haircare. North America and Europe, however, continue to hold substantial market share due to the presence of established cosmetic brands and a mature market that readily adopts innovative ingredients. The Application segment of Skin Care is experiencing robust growth, with Oleyl Lactate being lauded for its emollient, moisturizing, and skin-conditioning properties, making it a sought-after ingredient in anti-aging creams, lotions, and serums. The Hair Care segment is also a strong contributor, with Oleyl Lactate enhancing hair manageability, shine, and providing conditioning benefits. The "Others" application segment, which includes niche industrial uses and emerging applications, is also demonstrating steady expansion. Market intelligence suggests that strategic partnerships and acquisitions between ingredient manufacturers and formulators will become more prevalent, aiming to secure supply chains and co-develop innovative product formulations. The overall World Oleyl Lactate Production is projected to see a consistent upward trend throughout the forecast period, driven by these interwoven factors.

The Oleyl Lactate market is propelled by a confluence of powerful drivers, with the escalating demand for natural and bio-based ingredients standing at the forefront. Consumers are increasingly seeking personal care products that align with their values of sustainability and health consciousness, and Oleyl Lactate, derived from oleyl alcohol and lactic acid, fits this paradigm perfectly. Its emollient and skin-conditioning properties are highly valued in the Skin Care and Hair Care industries, leading to its incorporation in a wide array of premium formulations. The growing emphasis on "clean beauty" and ingredient transparency further bolsters its appeal, as formulators and consumers alike are drawn to its perceived safety and efficacy. Furthermore, ongoing research and development are uncovering new applications and benefits of Oleyl Lactate, expanding its utility beyond its traditional roles. This continuous innovation, coupled with the expanding global cosmetics market, particularly in emerging economies, creates a fertile ground for the sustained growth of Oleyl Lactate. The increasing awareness of its biodegradability and reduced environmental impact compared to synthetic alternatives also contributes significantly to its market penetration.

Despite its promising growth trajectory, the Oleyl Lactate market faces several challenges and restraints that could temper its expansion. One significant challenge is the volatility in the pricing and availability of its raw materials, particularly oleyl alcohol, which is often derived from natural sources and can be subject to agricultural yields and supply chain disruptions. Fluctuations in these raw material costs can impact the overall production cost of Oleyl Lactate, potentially affecting its affordability and market competitiveness. Another restraint is the presence of established and cost-effective alternative emollients and conditioning agents in the market. While Oleyl Lactate offers unique benefits, competitors with lower price points or longer-standing market presence can pose a challenge, especially in price-sensitive segments of the personal care industry. Regulatory scrutiny regarding ingredient safety and efficacy, although generally favorable for Oleyl Lactate, can also introduce complexities and require ongoing compliance efforts from manufacturers. Furthermore, the development of new, cutting-edge ingredients that offer comparable or superior performance could dilute the market share of Oleyl Lactate if it fails to innovate and differentiate itself. Limited awareness of its full spectrum of benefits in certain niche applications might also act as a restraint, hindering broader adoption.

Several regions and segments are poised to dominate the Oleyl Lactate market, exhibiting distinct growth patterns and contributing significantly to the World Oleyl Lactate Production.

Asia-Pacific: This region is projected to be a key growth engine, driven by a rapidly expanding middle class with increasing disposable incomes and a growing adoption of Western beauty standards. Countries like China, India, South Korea, and Southeast Asian nations are witnessing a surge in demand for premium skincare and haircare products, where Oleyl Lactate finds extensive application. The presence of a vast population and a growing awareness of anti-aging and personal grooming further fuels this demand. Local manufacturing capabilities are also on the rise, potentially reducing import dependency and contributing to regional market dominance. The Skin Care segment within Asia-Pacific is particularly strong, with consumers actively seeking products that offer moisturization, skin softening, and a smooth feel.

North America: This established market continues to be a significant player, characterized by high consumer spending on beauty and personal care products, a strong emphasis on innovation, and the presence of leading global cosmetic brands. The demand for high-quality, naturally derived ingredients like Oleyl Lactate is robust, supported by a well-informed consumer base. The Hair Care segment in North America is also a substantial contributor, with Oleyl Lactate being used in conditioners, styling products, and treatments for its enhancing and protective properties. The >99% Purity segment is particularly dominant here, catering to the premium product segment.

Europe: Similar to North America, Europe boasts a mature market with discerning consumers who prioritize product efficacy, safety, and sustainability. The region has a strong tradition of using specialized cosmetic ingredients, and Oleyl Lactate's emollient and sensory benefits align well with European skincare and haircare formulations. Stringent regulations in Europe often lead to a preference for well-researched and high-purity ingredients, benefiting the >99% Purity Oleyl Lactate segment.

Dominant Segments:

The Oleyl Lactate industry is poised for significant growth, fueled by several key catalysts. The escalating consumer preference for natural and bio-derived ingredients in personal care products is a primary driver. As awareness of environmental sustainability and ingredient safety grows, Oleyl Lactate's derivation from renewable resources makes it an attractive alternative to synthetic emollients. Furthermore, ongoing research and development into the enhanced properties of Oleyl Lactate, particularly its superior skin conditioning and emollient benefits, are expanding its application scope across various skincare and haircare formulations. The growth of the global cosmetics market, especially in emerging economies with increasing disposable incomes, also acts as a significant catalyst for increased Oleyl Lactate consumption.

This report offers a comprehensive analysis of the Oleyl Lactate market, delving into its intricate dynamics and future potential. It provides granular insights into market trends, meticulously analyzing the impact of evolving consumer preferences for natural and high-purity ingredients. The report dissects the driving forces, highlighting the critical role of sustainability and the expanding applications in skincare and haircare. It also addresses the challenges, such as raw material price volatility and competitive pressures, offering a balanced perspective on market constraints. Furthermore, the report identifies key regions and segments poised for dominance, with a detailed examination of the Asia-Pacific's ascendancy and the significant contributions of the >99% Purity and Skin Care segments to the overall World Oleyl Lactate Production. This in-depth coverage ensures stakeholders possess the knowledge to navigate the market effectively and capitalize on emerging opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Alzo International, Phoenix Chemical, BASF, Acme Synthetic Chemicals, Thryv, Triveni Chemicals, Knowde, Ashland Care Specialties, USITC, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Oleyl Lactate," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Oleyl Lactate, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.