1. What is the projected Compound Annual Growth Rate (CAGR) of the Oil Tanker Cargo Ships?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Oil Tanker Cargo Ships

Oil Tanker Cargo ShipsOil Tanker Cargo Ships by Type (VLCC, ULCC, World Oil Tanker Cargo Ships Production ), by Application (Deep Sea, Offshore, World Oil Tanker Cargo Ships Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

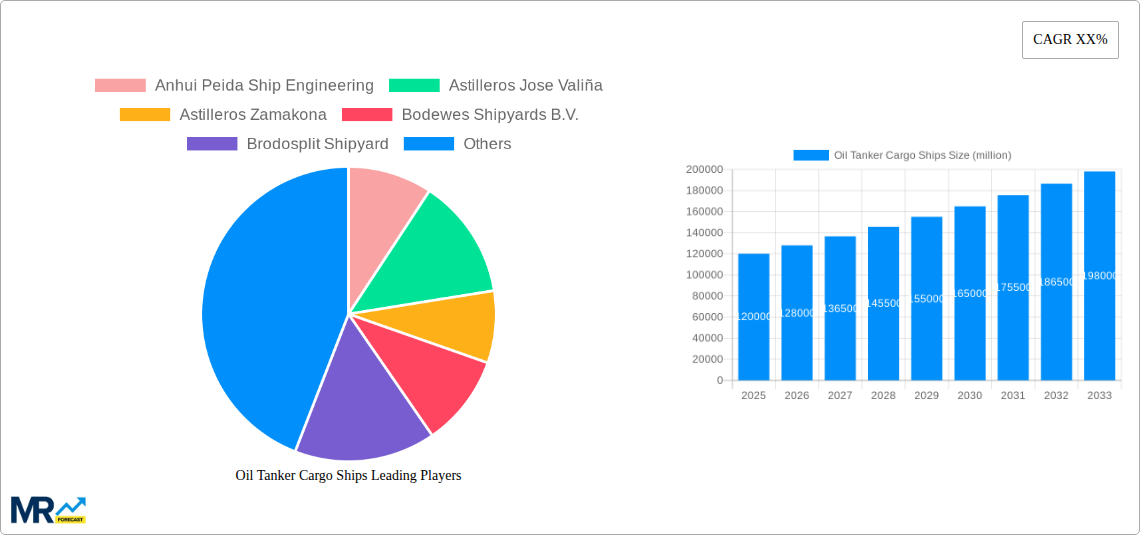

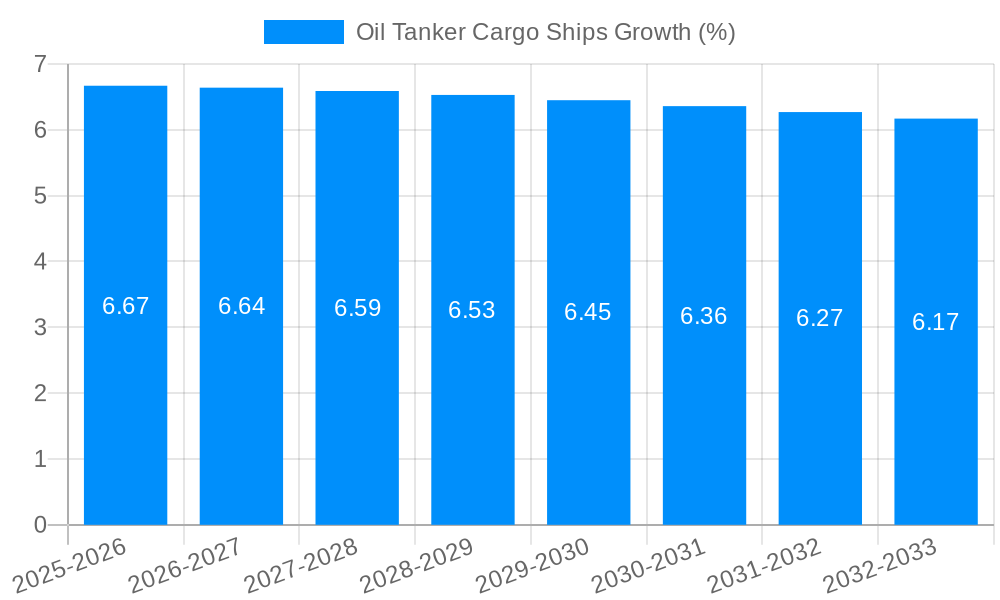

The global oil tanker cargo ships market is poised for significant growth, projected to reach an estimated $120 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 6.5% over the forecast period of 2025-2033. This expansion is primarily driven by the ever-increasing global demand for crude oil and refined petroleum products, fueled by industrialization, population growth, and developing economies. The dynamic geopolitical landscape and the strategic importance of secure energy supply chains further bolster the need for efficient and large-scale oil transportation. Key market players are investing in advanced shipbuilding technologies, focusing on enhancing fuel efficiency, environmental compliance, and safety standards to meet stringent international regulations and growing sustainability concerns. The market segmentation reveals a strong preference for Very Large Crude Carriers (VLCCs) due to their cost-effectiveness in transporting massive quantities of oil over long distances, alongside the continued relevance of Ultra Large Crude Carriers (ULCCs) for the largest shipments. Application-wise, deep-sea transportation remains the dominant segment, underscoring the global nature of oil trade.

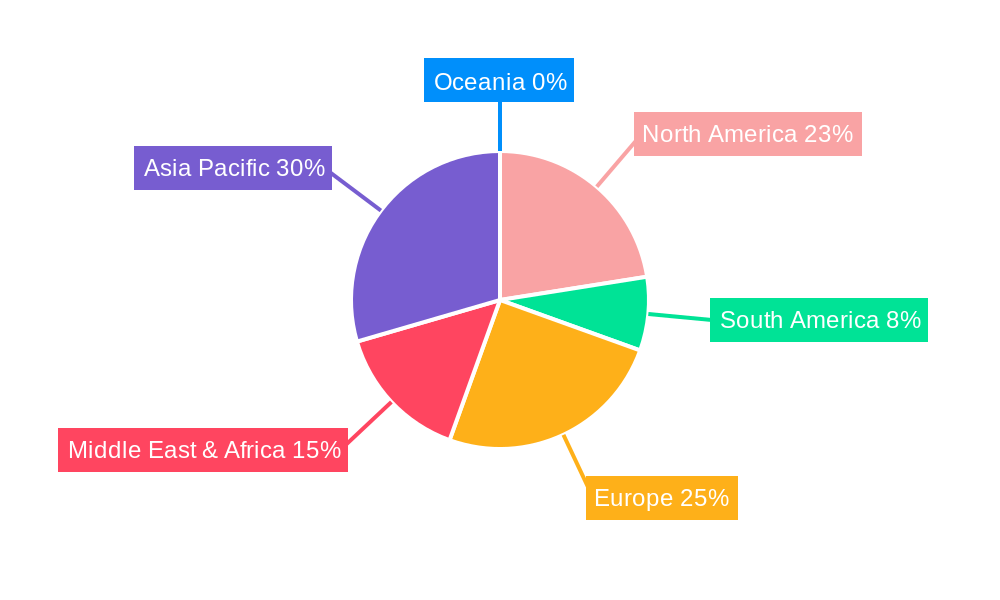

Emerging trends such as the development of dual-fuel or alternative fuel-powered tankers, the integration of smart technologies for fleet management and navigation, and the increasing complexity of offshore oil exploration and production activities are shaping the future of the oil tanker cargo ships industry. While the market benefits from strong demand, it faces restraints including the volatility of oil prices, which can impact shipping rates and investment decisions, and the increasing pressure for decarbonization within the maritime sector. Regulatory changes related to emissions and ballast water management also present ongoing challenges and opportunities for innovation. Geographically, the Asia Pacific region is expected to lead the market in terms of both production and demand, driven by rapid economic growth in countries like China and India. North America and Europe remain crucial markets, with significant fleet operations and shipbuilding capabilities, while the Middle East, as a major oil-producing region, plays a pivotal role in global tanker trade.

This report offers an in-depth analysis of the global Oil Tanker Cargo Ships market, spanning the historical period of 2019-2024 and extending through a projected forecast period of 2025-2033. Leveraging a base year of 2025 for estimations, the study meticulously examines market dynamics, growth drivers, and emerging trends. The report is built upon a robust data-driven methodology, incorporating insights from leading industry players and comprehensive market research to provide actionable intelligence for stakeholders. The estimated market size, valued in the millions, reflects the substantial global demand for these critical maritime assets.

The global Oil Tanker Cargo Ships market is poised for significant evolution over the study period (2019-2033), with a base year of 2025 serving as a crucial reference point for market assessments. During the historical period (2019-2024), the market witnessed fluctuations driven by geopolitical events, crude oil demand shifts, and the ongoing impact of the COVID-19 pandemic on global trade and shipping logistics. The year 2025 is expected to mark a period of stabilization and gradual recovery, setting the stage for sustained growth in the subsequent forecast period (2025-2033). Key market insights indicate a growing preference for larger and more efficient vessel types, particularly Very Large Crude Carriers (VLCCs) and Ultra Large Crude Carriers (ULCCs), driven by economies of scale and the need to transport increasing volumes of crude oil. This trend is further amplified by advancements in shipbuilding technology, leading to the development of tankers with enhanced safety features, improved fuel efficiency, and reduced environmental impact. The report highlights the increasing emphasis on environmental regulations, such as the International Maritime Organization's (IMO) 2020 sulfur cap and the ongoing discussions around decarbonization in the shipping industry. This regulatory push is compelling shipbuilders and owners to invest in greener technologies, including the exploration and adoption of alternative fuels like LNG, methanol, and eventually, ammonia and hydrogen. The application of these vessels primarily spans Deep Sea and Offshore operations, facilitating the global movement of crude oil from production centers to refining hubs. The World Oil Tanker Cargo Ships Production segment is a critical indicator of the industry's capacity and future supply, and its trends are closely monitored for market health. Emerging markets, particularly in Asia, are expected to continue their dominance in both shipbuilding and consumption, influencing global tanker trade routes and demand for new builds. The geopolitical landscape, energy security concerns, and the evolving energy transition will collectively shape the trajectory of the Oil Tanker Cargo Ships market, making it a dynamic and strategically important sector of the global maritime industry. The report delves into the intricate interplay of these factors, providing a comprehensive outlook for stakeholders.

The global Oil Tanker Cargo Ships market is propelled by a confluence of robust economic forces and evolving energy demands. The fundamental driver remains the insatiable global appetite for crude oil, which underpins the vast majority of energy production and industrial activity worldwide. As economies grow and populations expand, the need for energy, and consequently crude oil, continues to rise, directly translating into a sustained demand for tanker capacity. Furthermore, shifts in global crude oil production and refining capacities are creating new trade flows and increasing the reliance on long-haul transportation, thus necessitating larger and more specialized vessels like VLCCs and ULCCs. Technological advancements in shipbuilding are also playing a pivotal role. Innovations in hull design, propulsion systems, and cargo handling equipment are leading to the construction of more efficient, safer, and environmentally compliant tankers. These advancements not only improve operational economics for shipping companies but also help them meet increasingly stringent international regulations. The ongoing energy transition, while introducing new fuel sources, does not diminish the immediate need for oil transportation. In fact, the logistical challenges associated with transporting crude oil to meet current energy needs while simultaneously developing and integrating alternative fuel infrastructure create a complex but ultimately supportive environment for the existing tanker fleet and new builds designed for efficiency and flexibility.

Despite the prevailing demand, the Oil Tanker Cargo Ships market grapples with several significant challenges and restraints. The inherent volatility of crude oil prices, influenced by geopolitical tensions, OPEC+ decisions, and global economic sentiment, directly impacts the profitability of oil transportation. Such volatility can lead to unpredictable freight rates, making long-term investment decisions for new builds or fleet modernization more uncertain for shipping companies. Furthermore, the increasing global focus on environmental sustainability and the drive towards decarbonization pose a substantial challenge. Stricter regulations concerning emissions, ballast water management, and the potential for future carbon taxes on shipping emissions necessitate significant investments in new technologies and retrofitting existing vessels. This can lead to higher operational costs and the risk of stranded assets if older, less environmentally friendly ships become obsolete. The fluctuating nature of global trade, subject to geopolitical conflicts, trade wars, and protectionist policies, can disrupt established shipping routes and affect the overall demand for tanker services. Geopolitical instability in key oil-producing or transit regions can also create operational risks and impact the security of supply chains. Finally, the capital-intensive nature of shipbuilding, coupled with the cyclicality of the shipping industry, can make financing for new builds and fleet upgrades challenging, especially during periods of economic downturn or uncertainty, thereby restraining market expansion.

The global Oil Tanker Cargo Ships market is characterized by distinct regional strengths and segment preferences, with specific areas poised for significant dominance in the coming years.

Dominant Regions/Countries:

Asia-Pacific: This region is a powerhouse for both the production and consumption of crude oil, as well as a leading hub for shipbuilding.

Middle East: This region is the epicenter of global crude oil production and a critical trading hub.

Dominant Segments:

Type: VLCC (Very Large Crude Carrier) and ULCC (Ultra Large Crude Carrier)

Application: Deep Sea

The interplay between these regions and segments creates a dynamic market where shipbuilding capabilities in Asia, coupled with the substantial oil production in the Middle East and the massive consumption patterns across the globe, drive the demand and production of VLCCs and ULCCs primarily for Deep Sea applications.

The Oil Tanker Cargo Ships industry is poised for growth driven by several key factors. Sustained global demand for crude oil, particularly from developing economies, ensures a consistent need for efficient transportation. Furthermore, the ongoing energy transition, while shifting fuel sources, will still necessitate the movement of traditional fuels for a considerable period, especially during the infrastructure development phase of alternative energy. Technological advancements in shipbuilding, leading to more fuel-efficient and environmentally compliant vessels, are also encouraging fleet modernization and new builds. Regulatory mandates pushing for cleaner shipping practices are stimulating investment in advanced technologies and potentially creating demand for specialized tankers. Finally, the cyclical nature of fleet replacement and the need to adhere to international safety standards will continue to drive demand for new vessel construction.

This report provides a comprehensive overview of the global Oil Tanker Cargo Ships market, meticulously analyzing trends, drivers, challenges, and future prospects. It delves into the intricate details of market segmentation, regional dominance, and the competitive landscape, offering valuable insights for stakeholders across the value chain. The study employs a robust analytical framework, incorporating historical data from 2019-2024 and extending projections through 2033, with 2025 serving as a pivotal base year for estimations. The report’s exhaustive coverage ensures that readers gain a deep understanding of the market’s complexities and its strategic importance in the global energy infrastructure.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Anhui Peida Ship Engineering, Astilleros Jose Valiña, Astilleros Zamakona, Bodewes Shipyards B.V., Brodosplit Shipyard, Construcciones Navales Del Norte, CSBC Corporation, DAEWOO SHIPBUILDING, Damen, General Dynamics NASSCO, Greenbay marine, HANJIN HEAVY INDUSTRIES AND CONSTRUCTION, Hijos de J. Barreras, Hitzler Werft, HYUNDAI HEAVY INDUSTRIES, Imabari Shipbuilding, MITSUBISHI HEAVY INDUSTRIES - Ship & Ocean, Mitsui Engineering & Shipbuilding, Namura Shipbuilding, Nuovi Cantieri Apuania, SAMSUNG HEAVY INDUSTRIES, SembCorp Marine, STX SHIPBUILDING, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Oil Tanker Cargo Ships," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Oil Tanker Cargo Ships, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.